Overview

This strategy combines multiple indicators such as EMA, MACD, VWAP, and RSI to capture high-probability trading opportunities. It uses EMA to determine the trend direction, MACD for momentum, VWAP for volume, and RSI for overbought and oversold conditions. The strategy generates buy and sell signals based on a combination of these indicators while using a trailing stop loss to protect profits.

Strategy Principles

- EMA is used to determine the trend direction. When the price is above the EMA, it is considered an uptrend, and when below, it is considered a downtrend.

- MACD is used to gauge momentum. When the MACD fast line crosses above the slow line, momentum is considered to be turning bullish, and when it crosses below, momentum is considered to be turning bearish.

- VWAP is used to assess volume. When the price is above VWAP, buying pressure is considered to be stronger than selling pressure, and when below, selling pressure is considered to be stronger.

- RSI is used to determine overbought and oversold conditions. When RSI is above 70, it is considered overbought, and when below 30, it is considered oversold.

- A buy signal is generated when the price is above the EMA, the MACD fast line crosses above the slow line, the price is above VWAP, and RSI is below the overbought level.

- A sell signal is generated when the price is below the EMA, the MACD fast line crosses below the slow line, the price is below VWAP, and RSI is above the oversold level.

- Position size is calculated based on account equity and risk percentage.

- A trailing stop loss is used to protect profits, with the stop loss price moving along with the price.

Strategy Advantages

- The combination of multiple indicators provides a more comprehensive assessment of market conditions, improving the accuracy of trading signals.

- The use of a trailing stop loss helps protect profits during trend continuation and reduces drawdowns.

- Calculating position size based on account equity and risk percentage allows for control over the risk of each trade.

- Parameters can be adjusted according to user preferences, enhancing the flexibility of the strategy.

Strategy Risks

- In choppy markets, frequent trading signals may lead to overtrading and commission losses.

- During trend reversals, the trailing stop loss may not exit positions quickly enough, leading to larger drawdowns.

- Parameter selection needs to be optimized for different markets and instruments, and inappropriate parameters may lead to poor strategy performance.

Strategy Optimization Directions

- Consider adding more filtering conditions, such as volume and volatility, to further improve signal accuracy.

- Consider using more dynamic stop loss methods, such as ATR stop loss, to better adapt to different market conditions.

- Consider optimizing parameters using methods like genetic algorithms to find the optimal parameter combination.

- Consider incorporating position sizing and money management strategies to better control risk and enhance returns.

Summary

This strategy combines multiple indicators to assess market conditions and generate trading signals while using a trailing stop loss to protect profits. Strategy parameters can be adjusted according to user preferences, enhancing the flexibility of the strategy. However, the strategy may perform poorly in choppy markets and face larger drawdowns during trend reversals, so it needs to be optimized and improved for different markets and instruments. Future optimizations can consider adding more filtering conditions, dynamic stop loss methods, parameter optimization, and position sizing to improve the stability and profitability of the strategy.

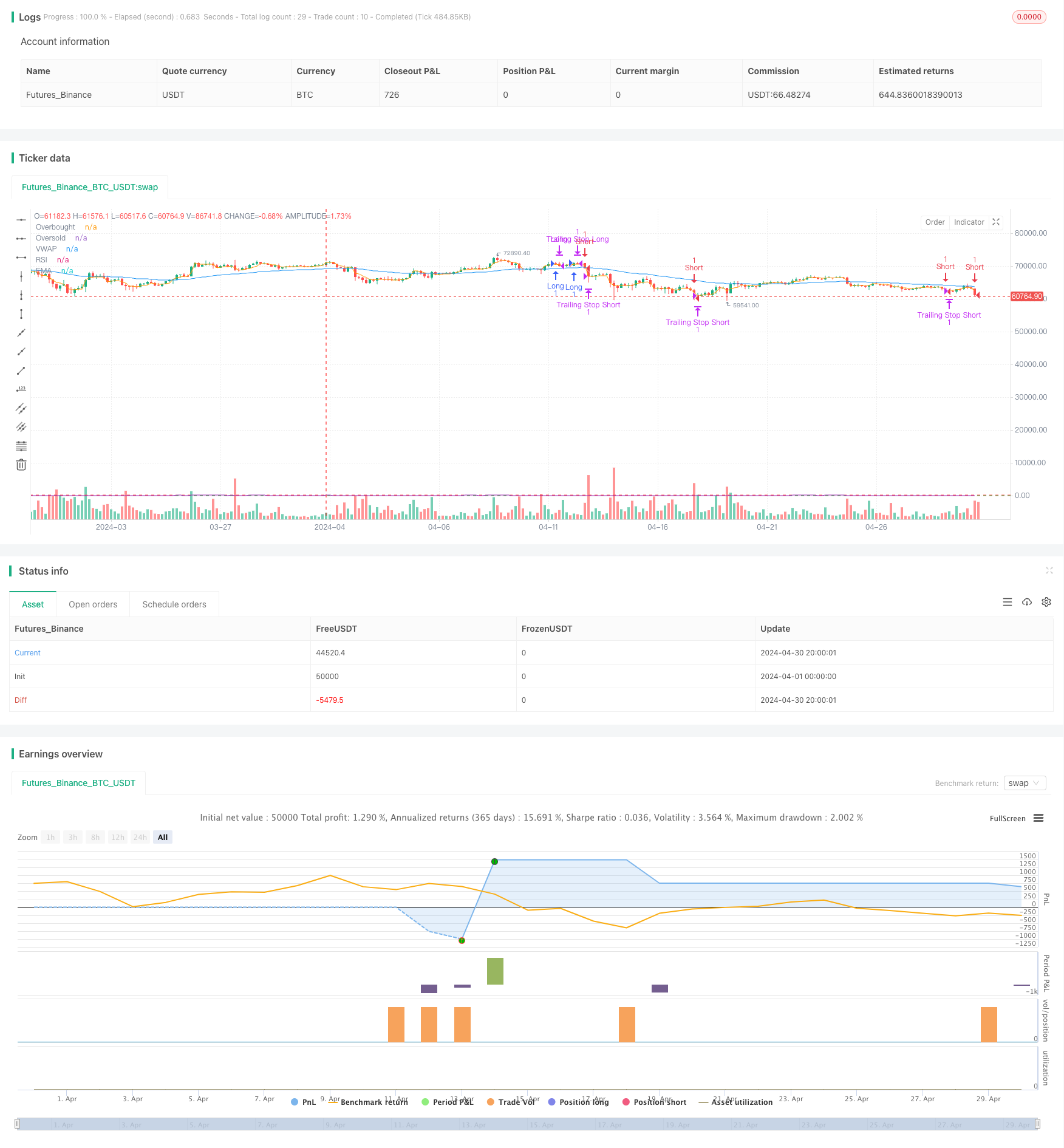

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Intraday Strategy", overlay=true)

// Input parameters

emaLength = input.int(50, title="EMA Length")

macdShort = input.int(12, title="MACD Short Period")

macdLong = input.int(26, title="MACD Long Period")

macdSignal = input.int(9, title="MACD Signal Period")

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

risk = input.float(1, title="Risk Percentage", minval=0.1, step=0.1)

trailOffset = input.float(0.5, title="Trailing Stop Offset", minval=0.1, step=0.1)

// Calculating indicators

ema = ta.ema(close, emaLength)

[macdLine, signalLine, _] = ta.macd(close, macdShort, macdLong, macdSignal)

rsi = ta.rsi(close, rsiLength)

vwap = ta.vwap(close)

// Entry conditions

longCondition = ta.crossover(macdLine, signalLine) and close > ema and rsi < rsiOverbought and close > vwap

shortCondition = ta.crossunder(macdLine, signalLine) and close < ema and rsi > rsiOversold and close < vwap

// Exit conditions

longExitCondition = ta.crossunder(macdLine, signalLine) or close < ema

shortExitCondition = ta.crossover(macdLine, signalLine) or close > ema

// Position sizing based on risk percentage

capital = strategy.equity

positionSize = (capital * (risk / 100)) / close

// Executing trades

if (longCondition)

strategy.entry("Long", strategy.long, qty=1)

if (shortCondition)

strategy.entry("Short", strategy.short, qty=1)

if (longExitCondition)

strategy.close("Long")

if (shortExitCondition)

strategy.close("Short")

// Trailing stop loss

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Long", from_entry="Long", trail_price=close, trail_offset=trailOffset)

if (strategy.position_size < 0)

strategy.exit("Trailing Stop Short", from_entry="Short", trail_price=close, trail_offset=trailOffset)

// Plotting indicators

plot(ema, title="EMA", color=color.blue)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

plot(vwap, title="VWAP", color=color.orange)