Overview

This strategy utilizes Simple Moving Averages (SMAs) on multiple timeframes to capture market trends. By comparing the relative positions of short-term and long-term SMAs, it generates buy and sell signals. The strategy also employs trend confirmation conditions to filter out false signals and improve trading accuracy. Additionally, it incorporates take profit and stop loss features for risk management.

Strategy Principles

- Calculate short-term and long-term SMAs to determine the direction of the market trend.

- Generate a buy signal when the short-term SMA crosses above the long-term SMA, and a sell signal when the short-term SMA crosses below the long-term SMA.

- Use trend confirmation conditions to filter out false signals. Only execute buys when the main trend is bullish, and only execute sells when the main trend is bearish.

- Implement take profit and stop loss features to control trading risk. Close positions when the price reaches the predefined take profit or stop loss levels.

- Dynamically adjust positions based on trend confirmation conditions. Promptly close positions when the main trend changes to avoid losses from trend reversals.

Strategy Advantages

- Trend Following: By utilizing SMAs on different timeframes, the strategy effectively captures the main market trends and adapts to various market conditions.

- Trend Confirmation: The introduction of trend confirmation conditions filters out false signals, improving the reliability of trading signals and reducing invalid trades.

- Risk Management: The built-in take profit and stop loss features help control trading risk and protect investors’ capital.

- Dynamic Adjustment: Positions are dynamically adjusted based on trend confirmation conditions, allowing the strategy to respond to market changes in a timely manner and mitigate losses from trend reversals.

Strategy Risks

- Parameter Optimization Risk: The performance of the strategy depends on the selection of parameters such as SMA periods and take profit/stop loss levels. Inappropriate parameter settings may lead to suboptimal strategy performance.

- Choppy Market Risk: In choppy market conditions, frequent trading signals may result in overtrading, increasing trading costs and risks.

- Unexpected Event Risk: In the face of unexpected major events, the market may experience severe volatility, and the strategy may not be able to respond promptly, leading to significant losses.

Strategy Optimization Directions

- Incorporate Additional Technical Indicators: Combine other technical indicators, such as MACD and RSI, to improve the accuracy and robustness of trend identification.

- Optimize Parameter Selection: Through historical data backtesting and parameter optimization, find the optimal combination of SMA periods, take profit/stop loss levels, and other parameters to enhance strategy performance.

- Improve Risk Management: Introduce more advanced risk management techniques, such as dynamic stop loss and position sizing, to further control risk exposure.

- Adapt to Different Market Conditions: Dynamically adjust strategy parameters based on market volatility and trend strength, enabling the strategy to adapt to different market conditions.

Conclusion

This multi-timeframe SMA trend following strategy with dynamic stop loss utilizes SMAs on different timeframes to capture market trends, filters out false signals using trend confirmation conditions, and incorporates take profit/stop loss and dynamic position adjustment features to achieve trend following and risk management objectives. Although the strategy has certain advantages, it still faces risks such as parameter optimization, choppy markets, and unexpected events. Future optimizations can focus on incorporating additional technical indicators, optimizing parameter selection, improving risk management, and adapting to different market conditions to enhance the robustness and profitability of the strategy.

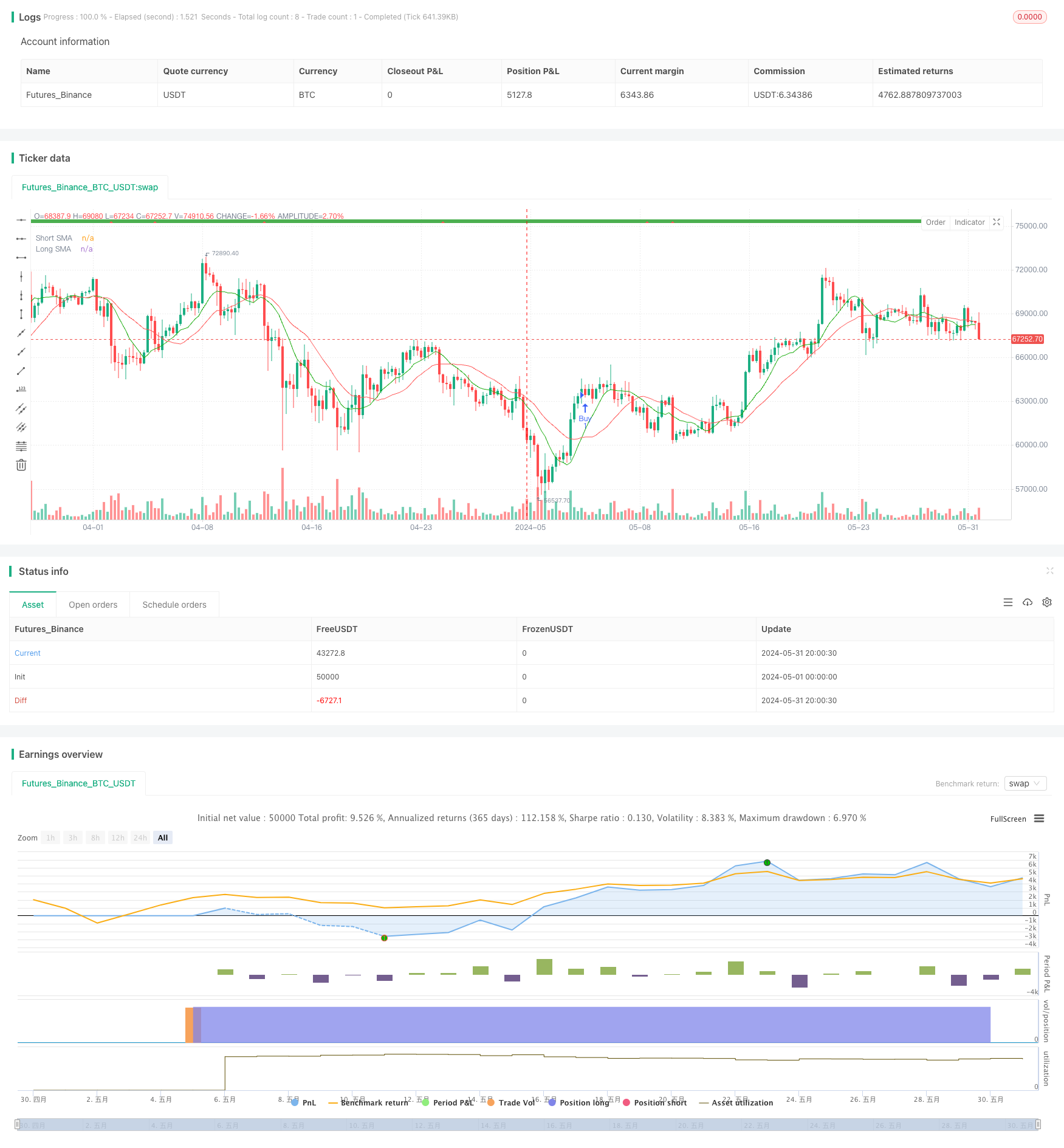

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("market slayer v3", overlay=true)

// Input parameters

showConfirmationTrend = input(title='Show Trend', defval=true)

confirmationTrendTimeframe = input.timeframe(title='Main Trend', defval='240')

confirmationTrendValue = input(title='Main Trend Value', defval=2)

showConfirmationBars = input(title='Show Confirmation Bars', defval=true)

topCbarValue = input(title='Top Confirmation Value', defval=60)

short_length = input.int(10, minval=1, title="Short SMA Length")

long_length = input.int(20, minval=1, title="Long SMA Length")

takeProfitEnabled = input(title="Take Profit Enabled", defval=false)

takeProfitValue = input.float(title="Take Profit (points)", defval=20, minval=1)

stopLossEnabled = input(title="Stop Loss Enabled", defval=false)

stopLossValue = input.float(title="Stop Loss (points)", defval=50, minval=1)

// Calculate SMAs

short_sma = ta.sma(close, short_length)

long_sma = ta.sma(close, long_length)

// Generate buy and sell signals based on SMAs

buy_signal = ta.crossover(short_sma, long_sma)

sell_signal = ta.crossunder(short_sma, long_sma)

// Plot SMAs

plot(short_sma, color=color.rgb(24, 170, 11), title="Short SMA")

plot(long_sma, color=color.red, title="Long SMA")

// Confirmation Bars

f_confirmationBarBullish(cbValue) =>

cBarClose = close

slowConfirmationBarSmaHigh = ta.sma(high, cbValue)

slowConfirmationBarSmaLow = ta.sma(low, cbValue)

slowConfirmationBarHlv = int(na)

slowConfirmationBarHlv := cBarClose > slowConfirmationBarSmaHigh ? 1 : cBarClose < slowConfirmationBarSmaLow ? -1 : slowConfirmationBarHlv[1]

slowConfirmationBarSslDown = slowConfirmationBarHlv < 0 ? slowConfirmationBarSmaHigh : slowConfirmationBarSmaLow

slowConfirmationBarSslUp = slowConfirmationBarHlv < 0 ? slowConfirmationBarSmaLow : slowConfirmationBarSmaHigh

slowConfirmationBarSslUp > slowConfirmationBarSslDown

fastConfirmationBarBullish = f_confirmationBarBullish(topCbarValue)

fastConfirmationBarBearish = not fastConfirmationBarBullish

fastConfirmationBarClr = fastConfirmationBarBullish ? color.green : color.red

fastConfirmationChangeBullish = fastConfirmationBarBullish and fastConfirmationBarBearish[1]

fastConfirmationChangeBearish = fastConfirmationBarBearish and fastConfirmationBarBullish[1]

confirmationTrendBullish = request.security(syminfo.tickerid, confirmationTrendTimeframe, f_confirmationBarBullish(confirmationTrendValue), lookahead=barmerge.lookahead_on)

confirmationTrendBearish = not confirmationTrendBullish

confirmationTrendClr = confirmationTrendBullish ? color.green : color.red

// Plot trend labels

plotshape(showConfirmationTrend, style=shape.square, location=location.top, color=confirmationTrendClr, title='Trend Confirmation Bars')

plotshape(showConfirmationBars and (fastConfirmationChangeBullish or fastConfirmationChangeBearish), style=shape.triangleup, location=location.top, color=fastConfirmationChangeBullish ? color.green : color.red, title='Fast Confirmation Bars')

plotshape(showConfirmationBars and buy_signal and confirmationTrendBullish, style=shape.triangleup, location=location.top, color=color.green, title='Buy Signal')

plotshape(showConfirmationBars and sell_signal and confirmationTrendBearish, style=shape.triangledown, location=location.top, color=color.red, title='Sell Signal')

// Generate trade signals

buy_condition = buy_signal and confirmationTrendBullish and not (strategy.opentrades > 0)

sell_condition = sell_signal and confirmationTrendBearish and not (strategy.opentrades > 0)

strategy.entry("Buy", strategy.long, when=buy_condition, comment ="BUY CALLS")

strategy.entry("Sell", strategy.short, when=sell_condition, comment ="BUY PUTS")

// Take Profit

if (takeProfitEnabled)

strategy.exit("Take Profit Buy", from_entry="Buy", profit=takeProfitValue)

strategy.exit("Take Profit Sell", from_entry="Sell", profit=takeProfitValue)

// Stop Loss

if (stopLossEnabled)

strategy.exit("Stop Loss Buy", from_entry="Buy", loss=stopLossValue)

strategy.exit("Stop Loss Sell", from_entry="Sell", loss=stopLossValue)

// Close trades based on trend confirmation bars

if strategy.opentrades > 0

if strategy.position_size > 0

if not confirmationTrendBullish

strategy.close("Buy", comment ="CLOSE CALLS")

else

if not confirmationTrendBearish

strategy.close("Sell", comment ="CLOSE PUTS")

// Define alert conditions as booleans

buy_open_alert = buy_condition

sell_open_alert = sell_condition

buy_closed_alert = strategy.opentrades < 0

sell_closed_alert = strategy.opentrades > 0

// Alerts

alertcondition(buy_open_alert, title='Buy calls', message='Buy calls Opened')

alertcondition(sell_open_alert, title='buy puts', message='buy Puts Opened')

alertcondition(buy_closed_alert, title='exit calls', message='exit calls ')

alertcondition(sell_closed_alert, title='exit puts', message='exit puts Closed')