Overview

This strategy combines Bollinger Bands and the 5-day Exponential Moving Average (EMA) to generate trading signals. When the price breaks above the upper Bollinger Band and closes below the 5-day EMA, a short position is opened. Conversely, when the price breaks below the lower Bollinger Band and closes above the 5-day EMA, a long position is opened. Additionally, when a reverse signal appears, the strategy closes the current position and opens a new position in the opposite direction. The strategy aims to capture market volatility and trend changes by using Bollinger Bands to gauge relative price levels and the EMA as a trend filter to generate trading signals.

Strategy Principles

- Calculate the upper, middle, and lower Bollinger Bands. The upper band is the middle band plus two standard deviations, the lower band is the middle band minus two standard deviations, and the middle band is the simple moving average of the closing prices.

- Calculate the 5-day EMA as a trend reference.

- When the opening price is above the upper Bollinger Band and the closing price is below the 5-day EMA, open a short position.

- When the opening price is below the lower Bollinger Band and the closing price is above the 5-day EMA, open a long position.

- If a short position is already open and a long signal is triggered, close the short position and open a long position.

- If a long position is already open and a short signal is triggered, close the long position and open a short position.

- If holding a long position and a short closing signal is triggered, close the long position.

- If holding a short position and a long closing signal is triggered, close the short position.

Strategy Advantages

- Utilizes both price volatility and trend characteristics to generate signals, allowing opportunities to be seized in both trending and oscillating markets.

- Bollinger Bands can be flexibly adjusted to adapt to different market conditions and instrument characteristics.

- The 5-day EMA acts as a trend filter, effectively reducing noise and frequent trades.

- The mechanism of timely stop-loss and reverse position opening allows for better risk control and actively seizing new trend opportunities.

- Clear logic, easy to understand and implement, and convenient for further optimization.

Strategy Risks

- Improper parameter selection may lead to signal distortion or excessive trading. Optimization and testing based on the instrument and timeframe are necessary.

- In oscillating markets, frequent trading signals may occur, resulting in overtrading and increased costs.

- There may be a lag in capturing trend turning points, potentially missing the best entry opportunities.

- The risk of failure exists with a single technical indicator combination, requiring validation with other signals.

- In extreme market conditions, there may be a risk of losing control, requiring strict risk control measures.

Strategy Optimization Directions

- Optimize the parameters of the Bollinger Bands, such as length and multiplier, to find the best parameter combination.

- Optimize and test the EMA period to select the best trend period.

- Incorporate other trend indicators such as MACD as auxiliary judgment to improve the accuracy of trend capture.

- Introduce volatility indicators such as ATR as a basis for stop-loss and position management to control single-trade risk.

- Restrict trading to specific time periods to avoid ineffective fluctuations at certain times.

- Set appropriate take-profit and stop-loss strategies based on market characteristics.

Summary

By combining Bollinger Bands and EMA, this strategy can effectively capture trending and volatility opportunities, suitable for medium to long-term trading strategies. However, attention should be paid to parameter optimization, position control, and risk management. It should also be combined with other technical indicators and fundamental analysis for better performance. The strategy’s performance may be influenced by market conditions and require adjustments and optimizations based on actual situations.

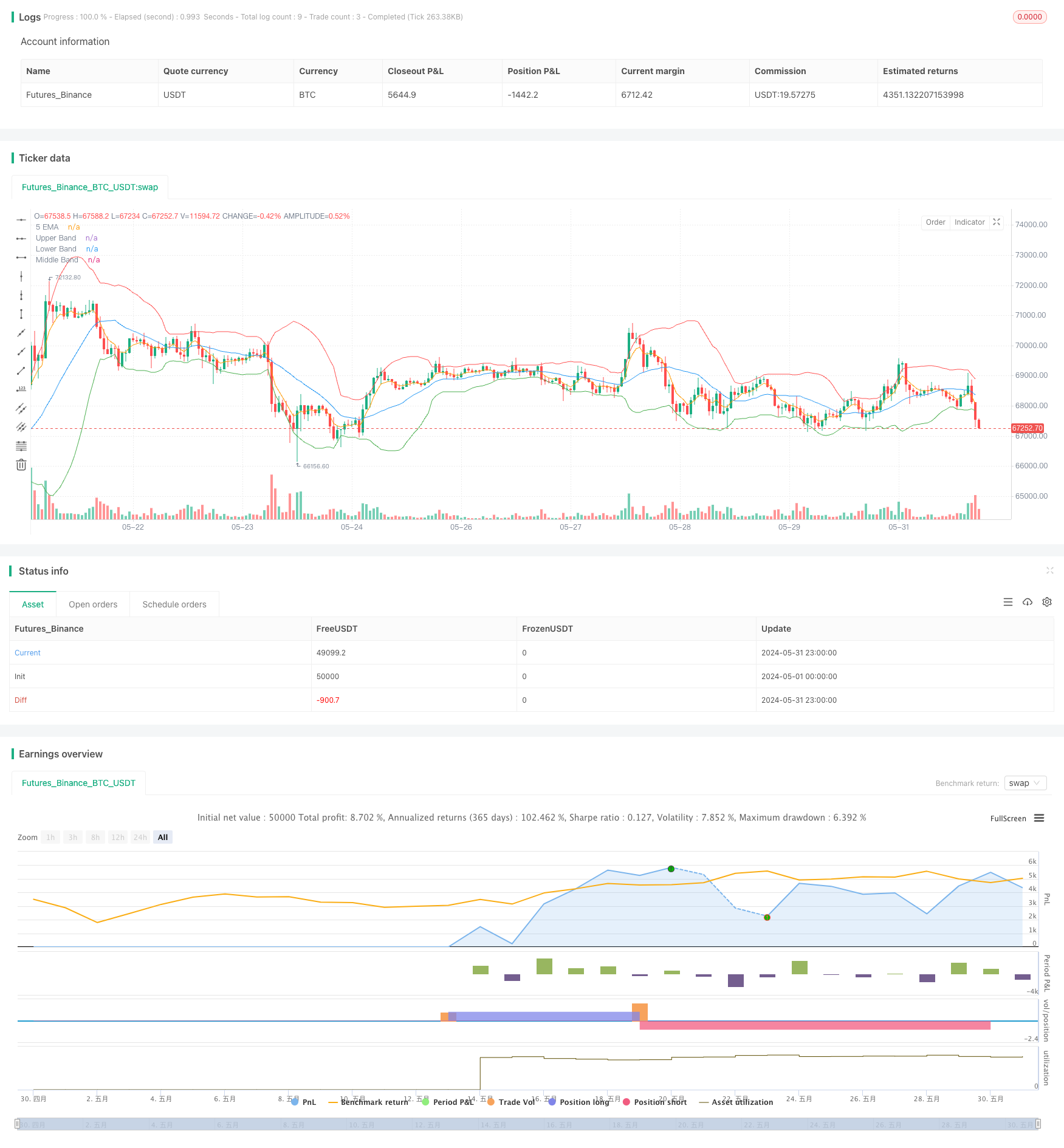

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands and EMA Strategy", overlay=true)

// Define the Bollinger Bands

length = input.int(20, title="BB Length")

src = input(close, title="BB Source")

mult = input.float(2.0, title="BB Multiplier")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(upper, "Upper Band", color=color.red)

plot(lower, "Lower Band", color=color.green)

plot(basis, "Middle Band", color=color.blue) // Use plot instead of hline for basis

// Define the 5-period EMA

ema5 = ta.ema(close, 5)

// Plot the 5 EMA

plot(ema5, "5 EMA", color=color.orange)

// Generate signals

var float entry_price = na

var string trade_direction = "none"

if (na(close[1]))

trade_direction := "none"

// Condition for entering a short trade

if (open > upper and close < ema5)

if (trade_direction != "short")

strategy.entry("Short", strategy.short)

entry_price := close

trade_direction := "short"

// Condition for entering a long trade

if (open < lower and close > ema5)

if (trade_direction != "long")

strategy.entry("Long", strategy.long)

entry_price := close

trade_direction := "long"

// Close short trade on a long signal

if (trade_direction == "short" and open < lower and close > ema5)

strategy.close("Short")

strategy.entry("Long", strategy.long)

entry_price := close

trade_direction := "long"

// Close long trade on a short signal

if (trade_direction == "long" and open > upper and close < ema5)

strategy.close("Long")

strategy.entry("Short", strategy.short)

entry_price := close

trade_direction := "short"

// Close trades when opposite signal is generated

if (trade_direction == "long" and open > upper and close < ema5)

strategy.close("Long")

trade_direction := "none"

if (trade_direction == "short" and open < lower and close > ema5)

strategy.close("Short")

trade_direction := "none"