Overview

This strategy is a trading system based on divergence relationships between the Parabolic SAR indicator and price movement. By monitoring divergence phenomena between SAR indicator and price trends, it identifies potential trend reversal points to capture market turning opportunities. The strategy employs the classic Parabolic SAR indicator as its core technical indicator, combined with divergence analysis methods to construct a complete trend-following trading system.

Strategy Principles

The core logic includes several key elements: 1. Uses Parabolic SAR indicator to track price trends, featuring dynamic adjustment of acceleration factors 2. Detects divergence between price and SAR indicator through a set lookback period 3. Triggers long signals when bullish divergence occurs (price makes new lows while SAR doesn’t) 4. Triggers short signals when bearish divergence occurs (price makes new highs while SAR doesn’t) 5. Marks trading signals on charts using shape.triangleup and shape.triangledown 6. Integrates alert functionality to notify traders of trading signals promptly

Strategy Advantages

- Scientific Indicator Selection

- Parabolic SAR is a market-tested mature indicator

- Indicator parameters can be flexibly adjusted for different market characteristics

- Reliable Signal Mechanism

- Divergence signals have strong trend prediction capability

- Combines price and indicator trends to reduce false signals

- Complete System Design

- Includes comprehensive signal generation, execution, and monitoring mechanisms

- Integrates graphical interface and alert functions for easy operation

Strategy Risks

- Parameter Sensitivity

- Improper SAR parameter settings may lead to overtrading

- Divergence detection period selection affects signal quality

- Market Adaptability

- May generate false signals in volatile markets

- Frequent invalid signals may occur in ranging markets

- Insufficient Risk Control

- Lacks stop-loss mechanism

- No position management system

Strategy Optimization Directions

- Enhanced Signal Filtering

- Add trend filters to trade only in main trend direction

- Incorporate volume indicators to verify signal validity

- Improved Risk Control

- Add dynamic stop-loss mechanism

- Design position management system

- Optimized Parameter Adjustment

- Develop adaptive parameter system

- Dynamically adjust parameters based on market conditions

Summary

This is a trend-following strategy based on classic technical indicators, capturing market turning points through divergence analysis. The strategy design is clear, implementation methods are concise, and it has good operability. However, in practical application, it still needs optimization according to specific market characteristics, especially in risk control aspects. Through adding filtering mechanisms and improving the risk control system, this strategy has the potential to achieve more stable trading performance.

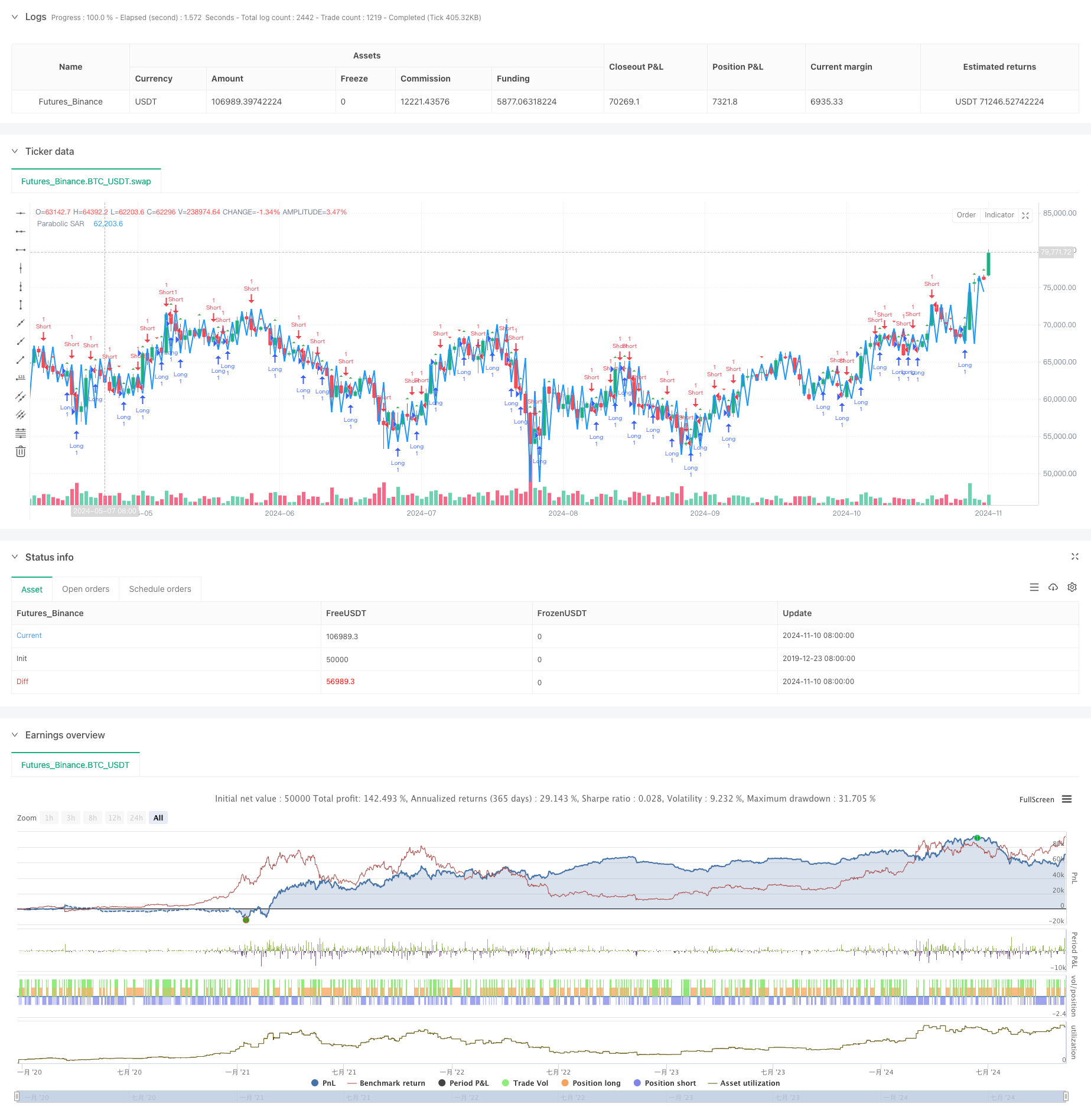

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SAR Divergence Strategy", overlay=true)

// --- Inputs ---

length = input.int(14, title="SAR Length", minval=1)

accelerationFactor = input.float(0.02, title="Acceleration Factor", minval=0.01)

maximumFactor = input.float(0.2, title="Maximum Factor", minval=0.01)

// --- SAR Calculation ---

sar = ta.sar(length, accelerationFactor, maximumFactor)

// --- Divergence Detection ---

lookback = 5

// Bullish Divergence

bullCond = close[lookback] < close[lookback + 1] and sar[lookback] > sar[lookback + 1]

// Bearish Divergence

bearCond = close[lookback] > close[lookback + 1] and sar[lookback] < sar[lookback + 1]

// --- Strategy Logic ---

if (bullCond)

strategy.entry("Long", strategy.long)

if (bearCond)

strategy.entry("Short", strategy.short)

// --- Plotting ---

plot(sar, color=color.blue, linewidth=2, title="Parabolic SAR")

plotshape(bullCond, style=shape.triangleup, color=color.green, size=size.small, title="Bullish Divergence")

plotshape(bearCond, style=shape.triangledown, color=color.red, size=size.small, title="Bearish Divergence")

// --- Alerts ---

alertcondition(bullCond, title="Bullish SAR Divergence", message="Bullish Divergence detected")

alertcondition(bearCond, title="Bearish SAR Divergence", message="Bearish Divergence detected")