Overview

This is an intelligent rotation strategy based on time periods that seeks to generate returns through long-short rotation trading within specified time periods. The strategy employs a flexible position management mechanism that can automatically adjust trading direction according to market conditions while incorporating risk control functions. It supports bi-directional trading and optional swing trading mode, demonstrating strong adaptability.

Strategy Principle

The strategy primarily controls trading through time periods and position status. First, the inActivePeriod() function determines whether trading is within the effective trading interval of the last 500 bars. Within the effective interval, the strategy decides trading actions based on variables such as position status (positionHeld), holding time (barsHeld), and pause time (barsPaused). When swing trading mode is enabled, the strategy rotates quickly between long and short directions; when disabled, positions are closed after 3 periods and wait for new trading opportunities.

Strategy Advantages

- High Flexibility: Supports pure long, pure short, or bi-directional trading modes

- Controlled Risk: Limits position holding time through time periods to avoid long-term position risks

- Good Adaptability: Automatically adjusts trading direction based on market conditions

- Simple Operation: Clear trading logic, easy to understand and execute

- High Capital Efficiency: Improves capital utilization through frequent rotation

- Adjustable Parameters: Key parameters can be flexibly adjusted according to actual needs

Strategy Risks

- Frequent trading may lead to high commission costs

- May generate frequent false signals in oscillating markets

- Fixed holding periods might miss important market opportunities

- Market trends not considered, may trade against primary trends

- Lack of stop-loss mechanism may cause significant losses in extreme market conditions

Strategy Optimization Directions

- Introduce volatility indicators (like ATR) to dynamically adjust holding periods

- Add trend judgment indicators to improve trading direction accuracy

- Include stop-loss and take-profit mechanisms to enhance risk control

- Optimize entry timing to avoid unfavorable trading periods

- Introduce money management system to optimize position sizing

- Add market sentiment indicators to improve trading accuracy

Summary

This strategy achieves market returns through time period control and long-short rotation, demonstrating strong flexibility and adaptability. While certain risks exist, the strategy’s stability and profitability can be significantly improved through reasonable optimization and risk control measures. The core advantage lies in its simple yet effective trading logic, making it suitable as a foundation strategy for further optimization and expansion.

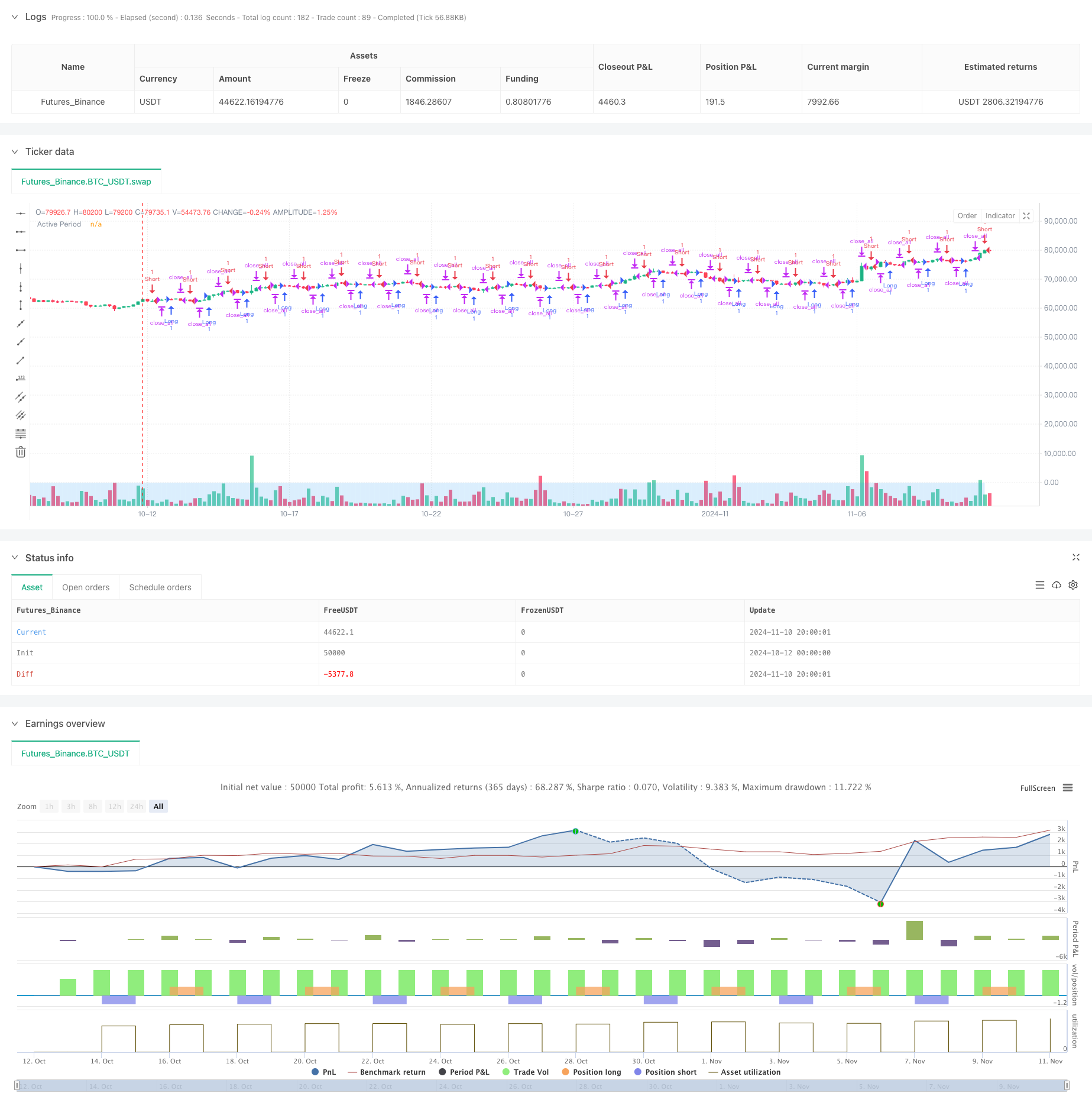

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Tickerly Test Strategy", overlay=true)

// Inputs

longEnabled = input.bool(true, "Enable Long Trades")

shortEnabled = input.bool(true, "Enable Short Trades")

swingEnabled = input.bool(false, "Enable Swing Trading")

// Variables

var positionHeld = 0

var barsHeld = 0

var barsPaused = 0

var lastAction = "none"

// Function to determine if we're in the last 500 bars

inActivePeriod() =>

barIndex = bar_index

lastBarIndex = last_bar_index

barIndex >= (lastBarIndex - 499)

// Main strategy logic

if inActivePeriod()

if swingEnabled

if positionHeld == 0 and barstate.isconfirmed

if lastAction != "long"

strategy.entry("Long", strategy.long)

positionHeld := 1

barsHeld := 0

lastAction := "long"

else

strategy.entry("Short", strategy.short)

positionHeld := -1

barsHeld := 0

lastAction := "short"

if positionHeld != 0

barsHeld += 1

if barsHeld >= 2

if positionHeld == 1

strategy.entry("Short", strategy.short)

positionHeld := -1

barsHeld := 0

lastAction := "short"

else

strategy.entry("Long", strategy.long)

positionHeld := 1

barsHeld := 0

lastAction := "long"

else

if positionHeld == 0 and barsPaused >= 1 and barstate.isconfirmed

if longEnabled and shortEnabled

if lastAction != "long"

strategy.entry("Long", strategy.long)

positionHeld := 1

barsHeld := 0

barsPaused := 0

lastAction := "long"

else

strategy.entry("Short", strategy.short)

positionHeld := -1

barsHeld := 0

barsPaused := 0

lastAction := "short"

else if longEnabled

strategy.entry("Long", strategy.long)

positionHeld := 1

barsHeld := 0

barsPaused := 0

lastAction := "long"

else if shortEnabled

strategy.entry("Short", strategy.short)

positionHeld := -1

barsHeld := 0

barsPaused := 0

lastAction := "short"

if positionHeld != 0

barsHeld += 1

if barsHeld >= 3

strategy.close_all()

positionHeld := 0

barsHeld := 0

barsPaused := 0 // Reset pause counter when exiting a position

else

barsPaused += 1

// Plotting active period for visual confirmation

plot(inActivePeriod() ? 1 : 0, "Active Period", color=color.new(color.blue, 80), style=plot.style_areabr)