In the field of quantitative trading, trend following strategies have always been one of the most popular trading methods. This article introduces a trend following strategy based on a dual moving average system, which improves trading efficiency through optimized risk-reward ratios.

Strategy Overview

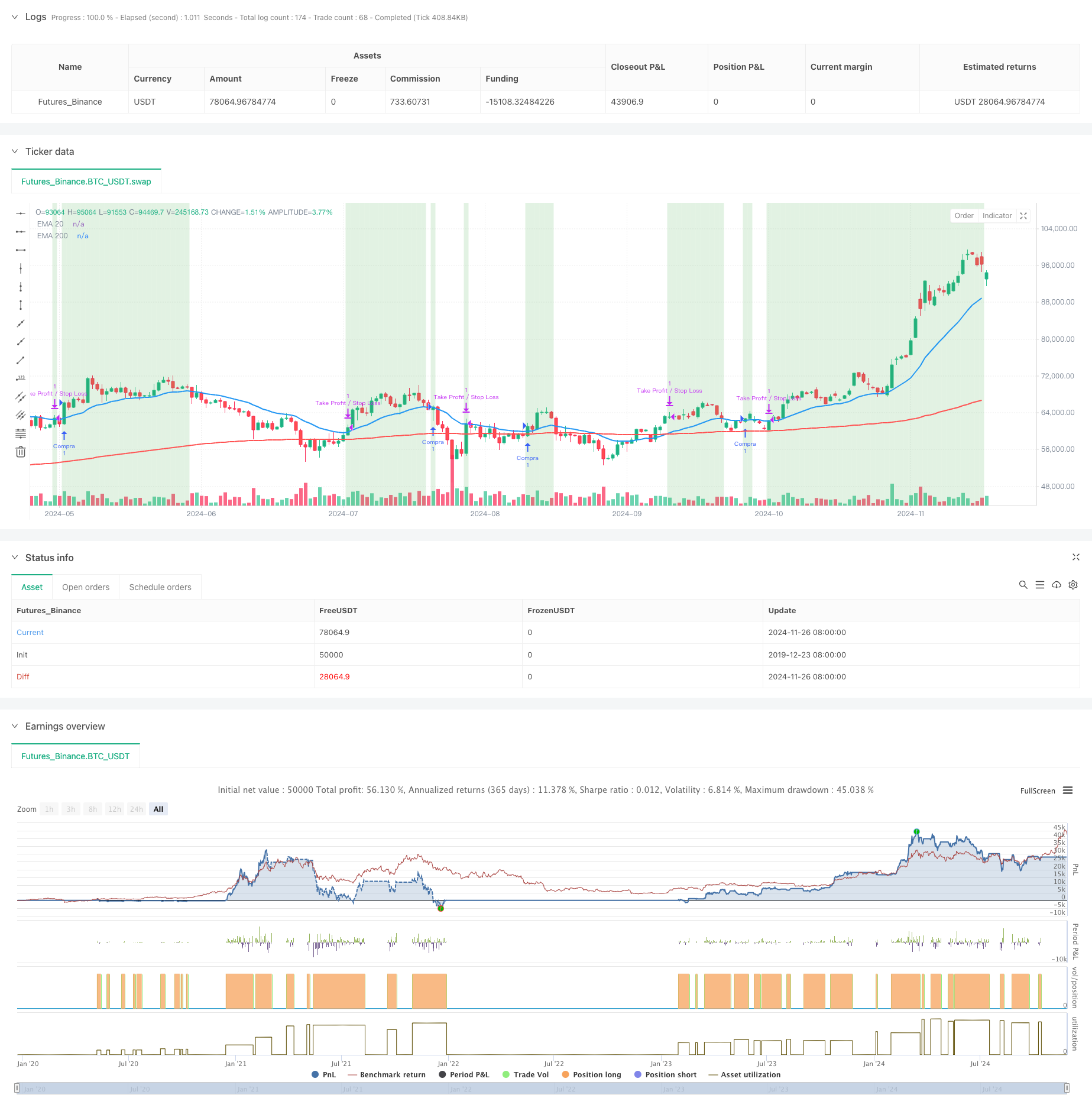

This strategy uses 20-day and 200-day exponential moving averages (EMA) as primary indicators, combined with a 3:1 risk-reward ratio for trading decisions. Buy signals are generated when the price breaks above the 20-day EMA and the 20-day EMA is above the 200-day EMA. Each trade has fixed stop-loss (-0.5%) and take-profit (1.5%) levels to ensure controlled risk.

Strategy Principles

The core logic includes several key elements: 1. Uses 20-day and 200-day EMAs to judge market trends, with the 200-day EMA representing long-term trend and 20-day EMA reflecting short-term movements 2. A buy signal is generated when price breaks above the 20-day EMA and the 20-day EMA is above the 200-day EMA, indicating an upward trend 3. Employs a 3:1 risk-reward ratio, with take-profit level (1.5%) being three times the stop-loss level (0.5%) 4. Uses variables to track trade status and avoid duplicate entries 5. Resets trade status when price falls below 20-day EMA, preparing for the next trade

Strategy Advantages

- Dual moving average system effectively filters market noise and improves signal reliability

- Fixed risk-reward ratio supports long-term profitable trading

- Clear entry and exit rules reduce subjective judgment

- High degree of automation, easy to implement and backtest

- Comprehensive risk control mechanism with clear stop-loss levels for each trade

Strategy Risks

- May generate frequent false signals in ranging markets

- Fixed stop-loss and take-profit levels may not suit all market conditions

- Trading costs not considered may affect actual returns

- Stop-loss placement may be too close to entry in high-volatility markets

- Market liquidity factors not considered

Optimization Directions

- Introduce volume indicators to improve trend judgment accuracy

- Dynamically adjust stop-loss and take-profit levels based on market volatility

- Add trend strength filters to reduce false signals

- Consider incorporating market sentiment indicators

- Optimize position management system for better money management

Summary

This is a well-structured trend following strategy with clear logic. By combining a dual moving average system with fixed risk-reward ratios, the strategy achieves good returns while maintaining risk control. Though there are areas for optimization, it’s overall a trading system worthy of further research and improvement.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Compra con Ratio 3:1", overlay=true)

// Parámetros de la temporalidad diaria y las EMAs

ema20 = ta.ema(close, 20)

ema200 = ta.ema(close, 200)

// Condiciones para la entrada en largo

cierre_por_encima_ema20 = close > ema20

ema20_mayor_ema200 = ema20 > ema200

// Variable para registrar si ya se realizó una compra

var bool compra_realizada = false

// Condición para registrar una compra: primera vez que cierra por encima de EMA 20 con EMA 20 > EMA 200

if (cierre_por_encima_ema20 and ema20_mayor_ema200 and not compra_realizada)

// Abrir una operación de compra

strategy.entry("Compra", strategy.long)

compra_realizada := true // Registrar que se realizó una compra

// Definir los niveles de stop loss y take profit basados en el ratio 3:1

stop_loss = strategy.position_avg_price * 0.995 // -0.50% (rendimiento)

take_profit = strategy.position_avg_price * 1.015 // +1.50% (3:1 ratio)

// Establecer el stop loss y take profit

strategy.exit("Take Profit / Stop Loss", from_entry="Compra", stop=stop_loss, limit=take_profit)

// Condición para resetear la compra: cuando el precio cierra por debajo de la EMA de 20

if (close < ema20)

compra_realizada := false // Permitir una nueva operación

// Ploteo de las EMAs

plot(ema20, title="EMA 20", color=color.blue, linewidth=2)

plot(ema200, title="EMA 200", color=color.red, linewidth=2)

// Colorear el fondo cuando el precio está por encima de ambas EMAs

bgcolor(cierre_por_encima_ema20 and ema20_mayor_ema200 ? color.new(color.green, 80) : na)