Overview

This strategy is a composite trading system that combines Stochastic Relative Strength Index (Stochastic RSI) with candlestick pattern confirmation. The system generates automated trading signals by analyzing SRSI indicator’s overbought and oversold levels along with price action confirmation through candlestick patterns. The strategy employs advanced technical indicator combinations, incorporating both trend-following and reversal trading characteristics, demonstrating strong market adaptability.

Strategy Principles

The core logic of the strategy is built on several key elements: 1. Uses 14-period RSI as the foundation to calculate Stochastic RSI values as the primary signal source 2. Applies 3-period simple moving averages to Stochastic RSI’s K and D lines for signal smoothing 3. Sets 80 and 20 as overbought and oversold thresholds for market condition assessment 4. Incorporates current candlestick’s open and close price relationship for trend confirmation 5. Generates long signals when K line crosses above oversold level with bullish candlestick 6. Triggers short signals when K line crosses below overbought level with bearish candlestick 7. Implements corresponding stop-loss when K line crosses overbought/oversold levels

Strategy Advantages

- High Signal Reliability: Dual confirmation mechanism through Stochastic RSI and candlestick patterns significantly improves trading signal accuracy

- Comprehensive Risk Control: Clear stop-loss conditions effectively control risk for each trade

- Strong Parameter Adaptability: Key parameters can be optimized for different market characteristics

- Clear Visual Feedback: Uses background colors and shape markers for intuitive signal display

- High Automation Level: Full automation from signal generation to order execution minimizes human intervention

Strategy Risks

- Choppy Market Risk: May generate frequent false breakout signals in sideways markets

- Lag Risk: Moving average calculations have inherent lag, potentially missing optimal entry points

- Parameter Sensitivity: Different parameter settings significantly affect strategy performance

- Market Environment Dependency: Signals may become unstable in highly volatile market conditions

- Systemic Risk: Stop-loss settings may fail during major market events

Strategy Optimization Directions

- Incorporate Volume Indicators: Add trading volume as additional signal confirmation

- Optimize Stop-Loss Mechanism: Consider implementing trailing stops or ATR-based dynamic stops

- Add Trend Filters: Implement long-period moving averages as trend filters

- Improve Signal Filtering: Consider market volatility and adjust parameters in high volatility periods

- Dynamic Parameter Adjustment: Dynamically adjust overbought/oversold thresholds based on market conditions

Summary

This strategy constructs a robust trading system by combining Stochastic RSI indicators with candlestick patterns. While maintaining operational simplicity, the system achieves effective risk control. Through appropriate parameter optimization and signal filtering, the strategy can adapt to various market environments. Traders are advised to conduct thorough historical data backtesting and adjust parameters according to specific market characteristics before live implementation.

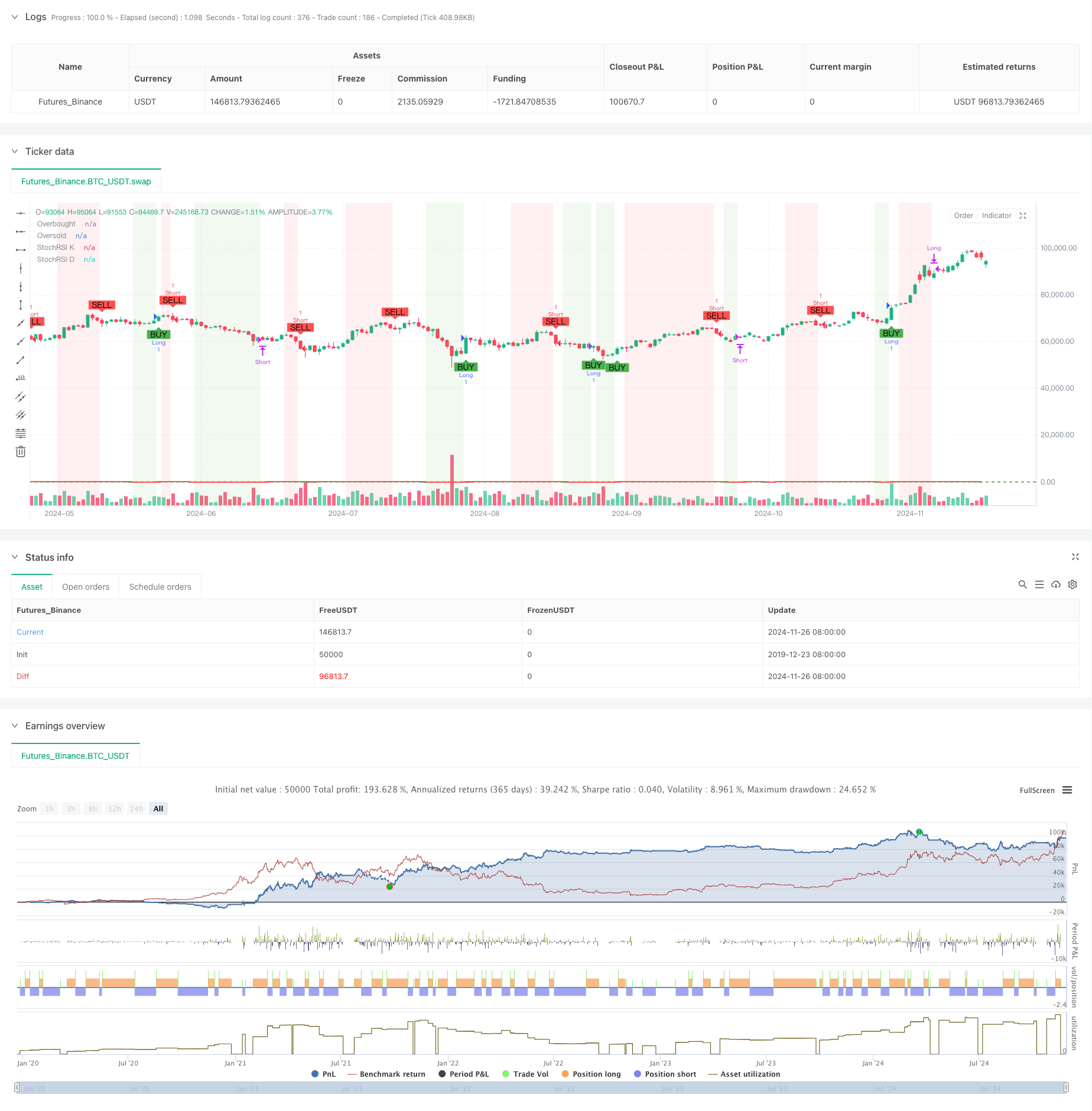

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Stochastic RSI Strategy with Candlestick Confirmation", overlay=true)

// Input parameters for Stochastic RSI

rsiPeriod = input.int(14, title="RSI Period")

stochRsiPeriod = input.int(14, title="Stochastic RSI Period")

kPeriod = input.int(3, title="K Period")

dPeriod = input.int(3, title="D Period")

// Overbought and Oversold levels

overboughtLevel = input.int(80, title="Overbought Level", minval=50, maxval=100)

oversoldLevel = input.int(20, title="Oversold Level", minval=0, maxval=50)

// Calculate RSI

rsi = ta.rsi(close, rsiPeriod)

// Calculate Stochastic RSI

stochRSI = ta.stoch(rsi, rsi, rsi, stochRsiPeriod) // Stochastic RSI calculation using the RSI values

// Apply smoothing to StochRSI K and D lines

k = ta.sma(stochRSI, kPeriod)

d = ta.sma(k, dPeriod)

// Plot Stochastic RSI on separate panel

plot(k, title="StochRSI K", color=color.green, linewidth=2)

plot(d, title="StochRSI D", color=color.red, linewidth=2)

hline(overboughtLevel, "Overbought", color=color.red, linestyle=hline.style_dashed)

hline(oversoldLevel, "Oversold", color=color.green, linestyle=hline.style_dashed)

// Buy and Sell Signals based on both Stochastic RSI and Candlestick patterns

buySignal = ta.crossover(k, oversoldLevel) and close > open // Buy when K crosses above oversold level and close > open (bullish candle)

sellSignal = ta.crossunder(k, overboughtLevel) and close < open // Sell when K crosses below overbought level and close < open (bearish candle)

// Plot Buy/Sell signals as shapes on the chart

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

// Background color shading for overbought/oversold conditions

bgcolor(k > overboughtLevel ? color.new(color.red, 90) : na)

bgcolor(k < oversoldLevel ? color.new(color.green, 90) : na)

// Place actual orders with Stochastic RSI + candlestick pattern confirmation

if (buySignal)

strategy.entry("Long", strategy.long)

if (sellSignal)

strategy.entry("Short", strategy.short)

// Optionally, you can add exit conditions for closing long/short positions

// Close long if K crosses above the overbought level

if (ta.crossunder(k, overboughtLevel))

strategy.close("Long")

// Close short if K crosses below the oversold level

if (ta.crossover(k, oversoldLevel))

strategy.close("Short")