Overview

This strategy is a multi-wave trend following system that identifies market trends by analyzing price changes across three consecutive trading periods through their highs and lows. The strategy employs dynamic stop-loss and take-profit mechanisms to protect capital while pursuing stable returns. This approach is particularly suitable for markets with clear trends, effectively capturing medium to long-term price movements.

Strategy Principles

The core logic is built on the principles of price movement continuity and trend continuation. Specifically, the strategy operates through the following steps: 1. Trend Identification Mechanism: Continuously monitors highs and lows over three periods, identifying an uptrend when three consecutive higher lows appear, and a downtrend when three consecutive lower highs occur. 2. Signal Generation System: Automatically generates corresponding buy or sell signals once a trend is confirmed. 3. Risk Management System: Each trade is equipped with dynamic stop-loss and take-profit points, with a stop-loss distance of 2 units and a profit target of 6 units.

Strategy Advantages

- Trend Following Reliability: Confirmation across three periods significantly reduces the possibility of false breakouts.

- Reasonable Risk-Reward Ratio: The set 1:3 risk-reward ratio (2 units stop-loss vs 6 units take-profit) adheres to professional trading principles.

- High Automation Level: The system automatically identifies signals and executes trades, reducing emotional interference.

- Good Visualization: Clear graphical markers for buy and sell points facilitate understanding and review.

Strategy Risks

- Ranging Market Risk: May generate frequent false signals in sideways markets, leading to consecutive stops.

- Slippage Risk: Actual execution prices may significantly deviate from expected prices during high volatility.

- Money Management Risk: Fixed stop-loss and take-profit distances may not suit all market conditions.

Optimization Directions

- Add Volatility Filter: Consider incorporating ATR indicator for dynamic adjustment of stop-loss and take-profit distances.

- Include Trend Confirmation Indicators: Combine with moving averages or MACD to filter false signals.

- Implement Position Sizing System: Dynamically adjust position sizes based on market volatility and account risk tolerance.

- Optimize Signal Confirmation: Consider adding volume confirmation or other technical indicators.

Summary

This is a well-designed trend following strategy that enhances trading reliability through multiple confirmation mechanisms. While there are areas for optimization, the overall approach is clear and suitable as a basic strategy framework for further refinement and customization. The strategy’s core strength lies in its simple yet effective trend identification mechanism, coupled with a reasonable risk management system, capable of achieving good results in trending markets.

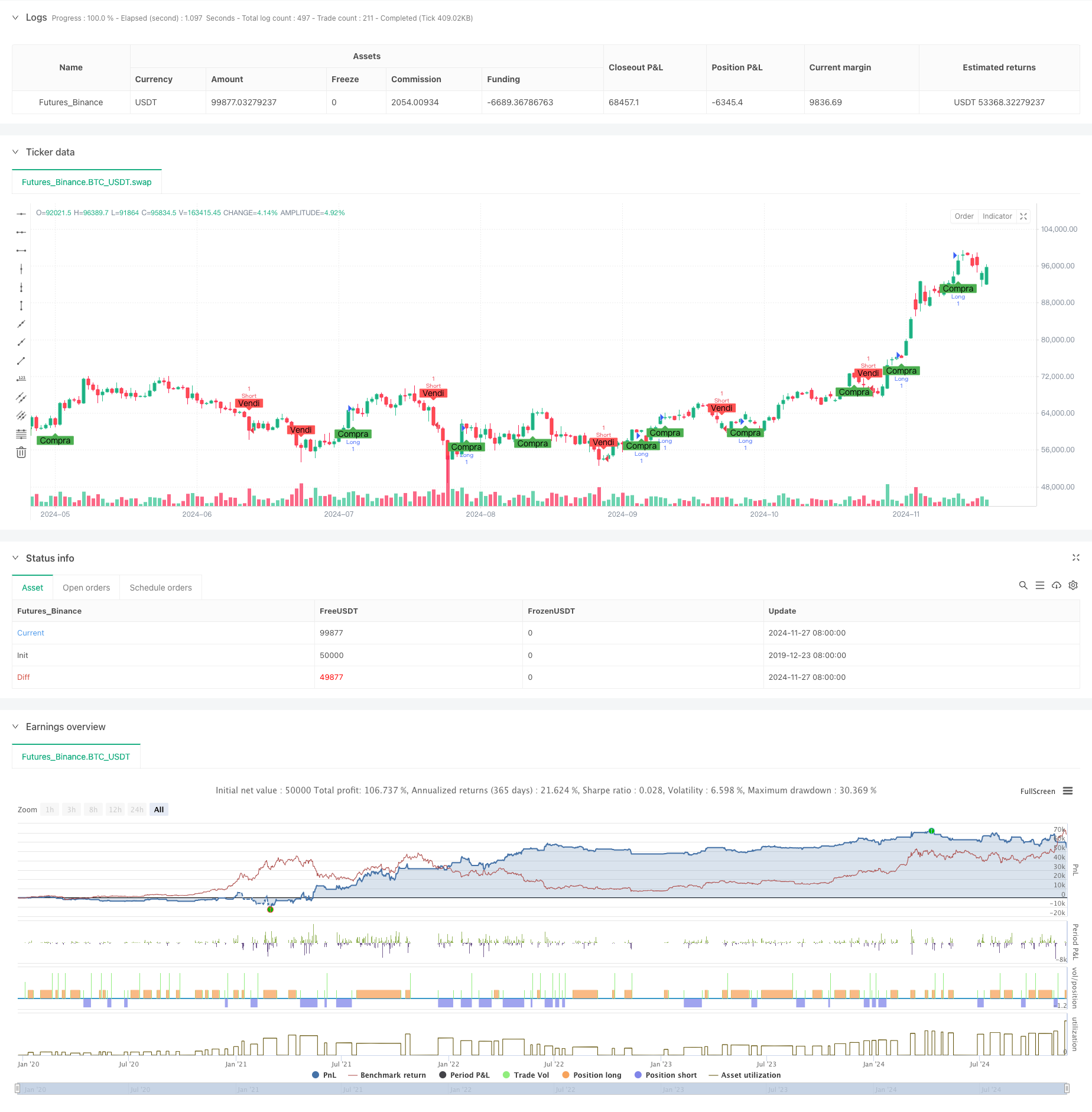

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Indicatore Minimi e Massimi", overlay=true)

// Parametri di input per stop loss e take profit

stopLossDistance = input(2, title="Distanza Stop Loss")

takeProfitDistance = input(6, title="Distanza Take Profit")

// Funzione per il conteggio dei massimi e minimi

var int countUp = 0

var int countDown = 0

// Calcola i massimi e minimi

if (low > low[1] and low[1] > low[2])

countUp := countUp + 1

countDown := 0

else if (high < high[1] and high[1] < high[2])

countDown := countDown + 1

countUp := 0

else

countUp := 0

countDown := 0

// Segnali di acquisto e vendita

longSignal = countUp == 3

shortSignal = countDown == 3

// Impostazione dello stop loss e take profit

longStopLoss = close - stopLossDistance

longTakeProfit = close + takeProfitDistance

shortStopLoss = close + stopLossDistance

shortTakeProfit = close - takeProfitDistance

// Esegui le operazioni

if (longSignal)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", "Long", limit=longTakeProfit, stop=longStopLoss)

if (shortSignal)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", "Short", limit=shortTakeProfit, stop=shortStopLoss)

// Visualizza segnali sul grafico

plotshape(series=longSignal, location=location.belowbar, color=color.green, style=shape.labelup, text="Compra")

plotshape(series=shortSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="Vendi")