Overview

This is a long-only breakout trading strategy based on dynamic trendlines and volume confirmation. The strategy identifies key swing highs by tracking price movements in real-time and dynamically constructs trendlines. When price breaks above the upper trendline with significant volume, the strategy enters a long position while managing risk through percentage-based take-profit, stop-loss, and trailing stop mechanisms.

Strategy Principles

The core logic is built on three main pillars: dynamic trendline construction, volume confirmation, and risk management system. First, the strategy uses the ta.pivothigh function to dynamically identify price swing highs and constructs upper trendlines based on the slope and intercept calculated from the two most recent swing highs. Second, entry signals must be accompanied by volume 1.5 times higher than the 20-period average to ensure breakout validity. Finally, the strategy employs fixed percentage take-profit (2%) and stop-loss (1%), with a 1% trailing stop to lock in profits.

Strategy Advantages

- Strong Dynamic Adaptability: Trendlines automatically update with new swing highs, allowing the strategy to adapt to different market conditions.

- Multiple Confirmation Mechanisms: Combines price breakout and volume confirmation to significantly reduce false signals.

- Comprehensive Risk Management: Uses a combination of fixed and trailing stops to control risk while capturing trends.

- Clear Code Logic: Modular design makes the strategy easy to understand and maintain.

- High Computational Efficiency: Uses basic technical indicators with low computational overhead.

Strategy Risks

- Market Volatility Risk: May trigger frequent stops in highly volatile markets.

- Trend Dependency: Strategy may underperform in ranging markets.

- Slippage Risk: Actual execution prices may significantly deviate from signal prices in less liquid markets.

- Parameter Sensitivity: Trendline parameters and volume thresholds significantly impact strategy performance.

Strategy Optimization Directions

- Market Environment Filtering: Introduce volatility indicators (like ATR) to adjust parameters or filter trading signals.

- Dynamic Parameter Optimization: Adjust profit/loss ratios based on market conditions.

- Multi-timeframe Confirmation: Add longer timeframe trend confirmation to improve accuracy.

- Intelligent Position Sizing: Dynamically adjust position size based on market volatility and signal strength.

- Market Sentiment Integration: Incorporate indicators like RSI or MACD to enhance signal reliability.

Summary

This is a well-designed trend-following strategy with robust logic. Through the combination of dynamic trendlines and volume confirmation, along with a comprehensive risk management system, the strategy demonstrates good adaptability and reliability. While it has some market dependency, there is significant room for improvement through the suggested optimization directions. Traders are advised to conduct thorough parameter optimization and backtesting before live implementation.

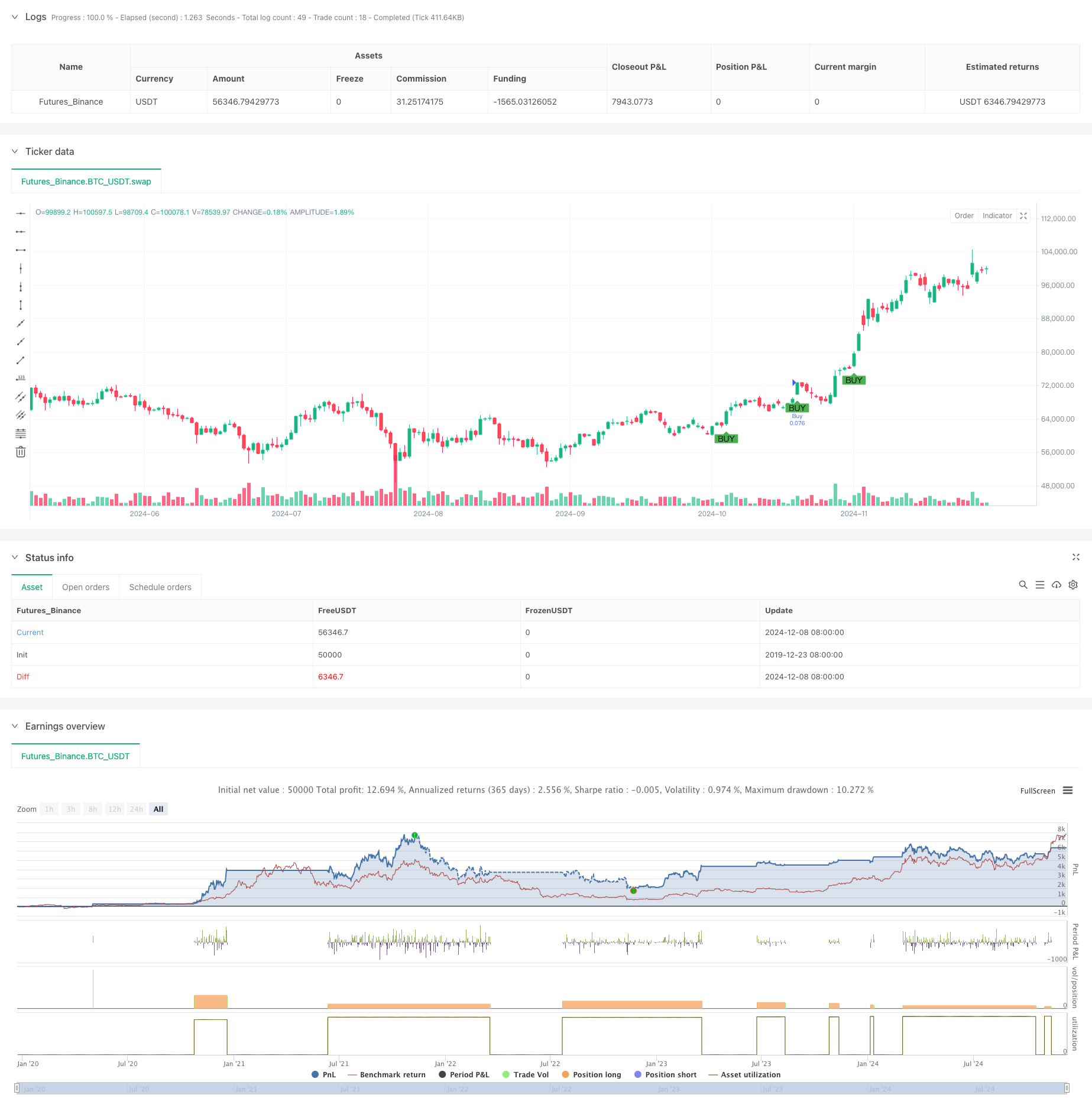

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Long Only Strategy with Dynamic Trend Lines, Fixed TP/SL, and Trailing SL+", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=10,

pyramiding=0, // Prevent multiple entries

calc_on_order_fills=true,

calc_on_every_tick=true)

// === Parameters ===

swingThreshold = input.int(5, title="Swing Detection Threshold")

tpPercent = input.float(2.0, title="Take Profit (%)")

slPercent = input.float(1.0, title="Stop Loss (%)")

trailPercent = input.float(1.0, title="Trailing Stop (%)")

volumeThresholdMultiplier = input.float(1.5, title="Volume Spike Threshold (x MA)")

// === Volume Indicator ===

avgVolume = ta.sma(volume, 20)

volumeSpike = volume > (avgVolume * volumeThresholdMultiplier)

// === Detect Swing High ===

isSwingHigh = ta.pivothigh(high, swingThreshold, swingThreshold)

// Variables to store swing highs

var float swingHigh1 = na

var float swingHigh2 = na

var int swingHighBar1 = na

var int swingHighBar2 = na

// Update swing highs

if (isSwingHigh)

swingHigh2 := swingHigh1

swingHighBar2 := swingHighBar1

swingHigh1 := high[swingThreshold]

swingHighBar1 := bar_index - swingThreshold

// === Calculate Upper Trend Line ===

var float upperSlope = na

var float upperIntercept = na

// Calculate slope and intercept for upper trend line if there are two swing highs

if (not na(swingHigh1) and not na(swingHigh2))

deltaX = swingHighBar1 - swingHighBar2

if (deltaX != 0)

upperSlope := (swingHigh1 - swingHigh2) / deltaX

upperIntercept := swingHigh1 - (upperSlope * swingHighBar1)

else

upperSlope := 0

upperIntercept := swingHigh1

// Calculate trend line price for the current bar

var float upperTrendPrice = na

if (not na(upperSlope) and not na(upperIntercept))

upperTrendPrice := upperSlope * bar_index + upperIntercept

// Calculate trend line price for the previous bar

var float upperTrendPrice_prev = na

if (not na(upperSlope) and not na(upperIntercept))

upperTrendPrice_prev := upperSlope * (bar_index - 1) + upperIntercept

// === Buy Condition Based on Trend Line Breakout ===

// Buy Signal: Price breaks above Upper Trend Line with volume spike

breakoutBuyCondition = (not na(upperTrendPrice)) and

(close > upperTrendPrice) and

(not na(upperTrendPrice_prev)) and

(close[1] <= upperTrendPrice_prev) and

volumeSpike

// === Manage Single Position ===

// Calculate Take Profit and Stop Loss levels based on percentage

longTakeProfit = close * (1 + tpPercent / 100)

longStopLoss = close * (1 - slPercent / 100)

// Calculate Trailing Stop as trail_offset (in price)

trail_offset = close * (trailPercent / 100)

// Execute Trade with Single Position Management

if (breakoutBuyCondition)

// Close existing short position if any

if (strategy.position_size < 0)

strategy.close("Sell")

// Open long position

strategy.entry("Buy", strategy.long)

// Set Take Profit, Stop Loss, and Trailing Stop Loss for long position

strategy.exit("Take Profit Buy", from_entry="Buy", limit=longTakeProfit, stop=longStopLoss, trail_offset=trail_offset)

// Plot Buy Signal

plotshape(breakoutBuyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")