Overview

This strategy is an advanced trading system that combines dynamic trailing stops, risk-reward ratios, and RSI extreme exits. It identifies specific patterns (parallel bar patterns and pin bar patterns) for trade entry, while utilizing ATR and recent lows for dynamic stop loss placement, and determines profit targets based on preset risk-reward ratios. The system also incorporates an RSI-based market overbought/oversold exit mechanism.

Strategy Principles

The core logic includes several key components: 1. Entry signals based on two patterns: parallel bar pattern (big bullish bar following a big bearish bar) and double pin bar pattern. 2. Dynamic trailing stops using ATR multiplier adjusted to recent N-bar lows, ensuring stop loss levels adapt to market volatility. 3. Profit targets set based on fixed risk-reward ratios, calculated using the risk value ® for each trade. 4. Position sizing dynamically calculated based on fixed risk amount and per-trade risk value. 5. RSI extreme exit mechanism triggers position closure at market extremes.

Strategy Advantages

- Dynamic Risk Management: Stop loss levels dynamically adjust to market volatility through ATR and recent lows combination.

- Precise Position Control: Position sizing based on fixed risk amount ensures consistent risk per trade.

- Multi-dimensional Exit Mechanism: Combines trailing stops, fixed profit targets, and RSI extremes.

- Flexible Trading Direction: Options for long-only, short-only, or bi-directional trading.

- Clear Risk-Reward Setup: Predetermined risk-reward ratios define clear profit targets for each trade.

Strategy Risks

- Pattern Recognition Accuracy Risk: Potential false identification of parallel bars and pin bars.

- Slippage Risk in Stop Loss: May face significant slippage in volatile markets.

- Premature RSI Exit: Could lead to early exits in strong trend markets.

- Fixed Risk-Reward Ratio Limitations: Optimal risk-reward ratios may vary across market conditions.

- Parameter Optimization Overfitting Risk: Multiple parameter combinations may lead to over-optimization.

Strategy Optimization Directions

- Entry Signal Enhancement: Add more pattern confirmation indicators like volume and trend indicators.

- Dynamic Risk-Reward Ratio: Adjust risk-reward ratios based on market volatility.

- Intelligent Parameter Adaptation: Introduce machine learning algorithms for dynamic parameter optimization.

- Multi-timeframe Confirmation: Add signal confirmation mechanisms across multiple timeframes.

- Market Environment Classification: Apply different parameter sets for different market conditions.

Summary

This is a well-designed trading strategy that combines multiple mature technical analysis concepts to build a complete trading system. The strategy’s strengths lie in its comprehensive risk management system and flexible trading rules, while attention needs to be paid to parameter optimization and market adaptability. Through the suggested optimization directions, there is room for further improvement of the strategy.

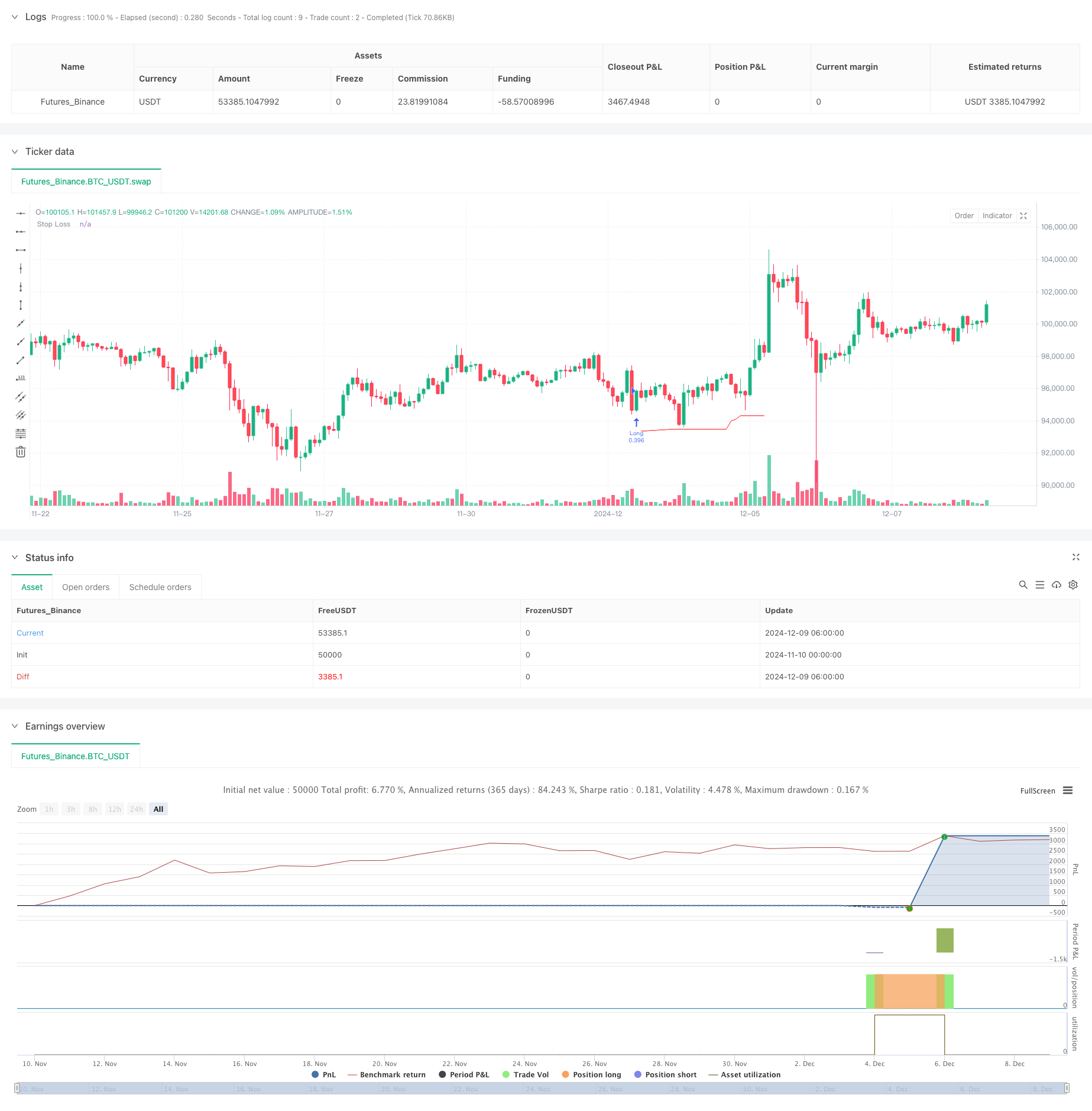

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading | www.TheArtOfTrading.com

// @version=5

strategy("Trailing stop 1", overlay=true)

// Get user input

int BAR_LOOKBACK = input.int(10, "Bar Lookback")

int ATR_LENGTH = input.int(14, "ATR Length")

float ATR_MULTIPLIER = input.float(1.0, "ATR Multiplier")

rr = input.float(title="Risk:Reward", defval=3)

// Basic definition

var float shares=na

risk = 1000

var float R=na

E = strategy.position_avg_price

// Input option to choose long, short, or both

side = input.string("Long", title="Side", options=["Long", "Short", "Both"])

// RSI exit option

RSIexit = input.string("Yes", title="Exit at RSI extreme?", options=["Yes", "No"])

RSIup = input(75)

RSIdown = input(25)

// Get indicator values

float atrValue = ta.atr(ATR_LENGTH)

// Calculate stop loss values

var float trailingStopLoss = na

float longStop = ta.lowest(low, BAR_LOOKBACK) - (atrValue * ATR_MULTIPLIER)

float shortStop = ta.highest(high, BAR_LOOKBACK) + (atrValue * ATR_MULTIPLIER)

// Check if we can take trades

bool canTakeTrades = not na(atrValue)

bgcolor(canTakeTrades ? na : color.red)

//Long pattern

//Two pin bar

onepinbar = (math.min(close,open)-low)/(high-low)>0.6 and math.min(close,open)-low>ta.sma(high-low,14)

twopinbar = onepinbar and onepinbar[1]

notatbottom = low>ta.lowest(low[1],10)

// Parallel

bigred = (open-close)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

biggreen = (close-open)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

parallel = bigred[1] and biggreen

atbottom = low==ta.lowest(low,10)

// Enter long trades (replace this entry condition)

longCondition = parallel

if (longCondition and canTakeTrades and strategy.position_size == 0 and (side == "Long" or side == "Both"))

R:= close-longStop

shares:= risk/R

strategy.entry("Long", strategy.long,qty=shares)

// Enter short trades (replace this entry condition)

shortCondition = parallel

if (shortCondition and canTakeTrades and strategy.position_size == 0 and (side == "Short" or side == "Both"))

R:= shortStop - close

shares:= risk/R

strategy.entry("Short", strategy.short,qty=shares)

// Update trailing stop

if (strategy.position_size > 0)

if (na(trailingStopLoss) or longStop > trailingStopLoss)

trailingStopLoss := longStop

else if (strategy.position_size < 0)

if (na(trailingStopLoss) or shortStop < trailingStopLoss)

trailingStopLoss := shortStop

else

trailingStopLoss := na

// Exit trades with trailing stop

strategy.exit("Long Exit", "Long", stop=trailingStopLoss, limit = E + rr*R )

strategy.exit("Short Exit", "Short", stop=trailingStopLoss, limit = E - rr*R)

//Close trades at RSI extreme

if ta.rsi(high,14)>RSIup and RSIexit == "Yes"

strategy.close("Long")

if ta.rsi(low,14)<RSIdown and RSIexit == "Yes"

strategy.close("Short")

// Draw stop loss

plot(trailingStopLoss, "Stop Loss", color.red, 1, plot.style_linebr)