Overview

The Multi-Factor Counter-Trend Trading Strategy is a sophisticated algorithmic trading system designed to identify potential reversal points after consecutive price rises or falls in the market. The strategy analyzes price movements in conjunction with volume confirmation and channel bands (Bollinger Bands or Keltner Channels) to capture reversal opportunities in overbought or oversold conditions. The core strength lies in its multi-factor approach to enhance signal reliability and accuracy.

Strategy Principles

The strategy generates trading signals based on three core elements: 1. Consecutive Price Movement Detection - Identifies strong trends through threshold settings for consecutive rising or falling bars 2. Volume Confirmation Mechanism - Optional volume analysis requiring increasing volume during consecutive price movements 3. Channel Breakout Verification - Supports both Bollinger Bands and Keltner Channels to confirm overbought/oversold conditions

Trade signals trigger when set conditions are met. The system plots triangle markers and executes corresponding long/short positions after bar confirmation. The strategy uses 80% of account equity for position sizing and factors in a 0.01% trading commission.

Strategy Advantages

- Multi-dimensional Signal Confirmation - Reduces false signals through comprehensive analysis of price, volume, and channel lines

- Flexible Parameter Configuration - Customizable bar count, optional volume and channel confirmation for different market conditions

- Clear Visual Feedback - Intuitive entry point visualization through triangle markers for monitoring and backtesting

- Rational Money Management - Dynamic position sizing based on account proportion for effective risk control

Strategy Risks

- Failed Reversal Risk - Counter-trend signals may lead to losses in strong trends

- Capital Efficiency Issues - Fixed 80% equity usage may be too aggressive in certain market conditions

- Time Lag Risk - Waiting for bar confirmation may result in suboptimal entry points

- Parameter Sensitivity - Performance varies significantly with different parameter combinations

Strategy Optimization Directions

- Implement Dynamic Stop-Loss - Consider adaptive stop-loss based on ATR or volatility

- Optimize Position Management - Consider dynamic position sizing based on market volatility

- Add Trend Filters - Incorporate trend indicators like moving averages to avoid counter-trend trades in strong trends

- Enhance Exit Mechanism - Design technical indicator-based profit-taking rules

- Market Environment Adaptation - Dynamically adjust strategy parameters based on market conditions

Summary

The Multi-Factor Counter-Trend Trading Strategy provides a systematic approach to reversal trading through comprehensive analysis of price patterns, volume changes, and channel breakouts. While the strategy excels in its flexible configuration and multi-dimensional signal confirmation, attention must be paid to market environment adaptation and risk control. The suggested optimization directions offer potential improvements for live trading performance.

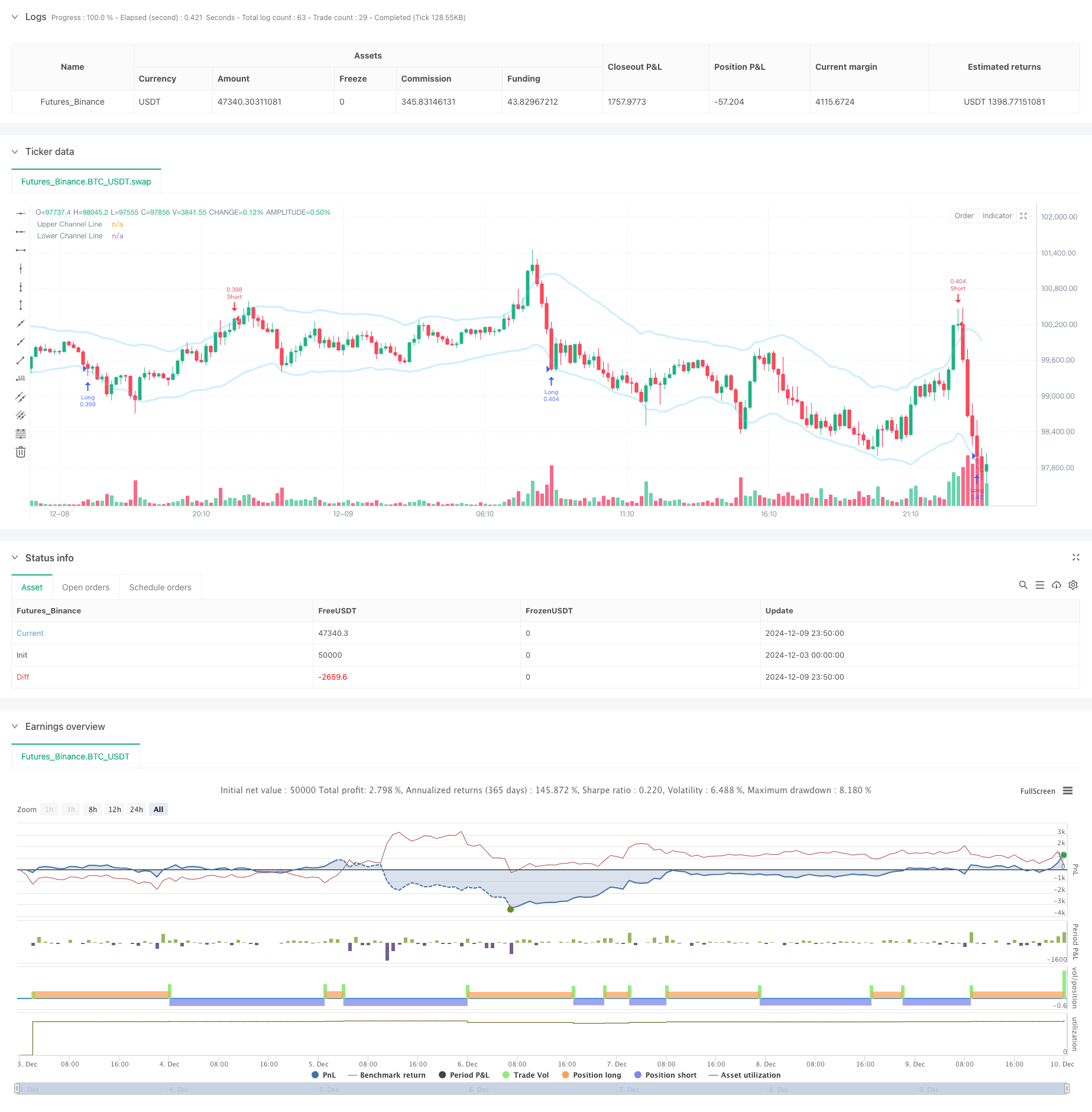

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="The Bar Counter Trend Reversal Strategy [TradeDots]", overlay=true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 80, commission_type = strategy.commission.percent, commission_value = 0.01)

// Initialize variables

var bool rise_triangle_ready = false

var bool fall_triangle_ready = false

var bool rise_triangle_plotted = false

var bool fall_triangle_plotted = false

//Strategy condition setup

noOfRises = input.int(3, "No. of Rises", minval=1, group="STRATEGY")

noOfFalls = input.int(3, "No. of Falls", minval=1, group="STRATEGY")

volume_confirm = input.bool(false, "Volume Confirmation", group="STRATEGY")

channel_confirm = input.bool(true, "", inline="CHANNEL", group="STRATEGY")

channel_type = input.string("KC", "", inline="CHANNEL", options=["BB", "KC"],group="STRATEGY")

channel_source = input(close, "", inline="CHANNEL", group="STRATEGY")

channel_length = input.int(20, "", inline="CHANNEL", minval=1,group="STRATEGY")

channel_mult = input.int(2, "", inline="CHANNEL", minval=1,group="STRATEGY")

//Get channel line information

[_, upper, lower] = if channel_type == "KC"

ta.kc(channel_source, channel_length,channel_mult)

else

ta.bb(channel_source, channel_length,channel_mult)

//Entry Condition Check

if channel_confirm and volume_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and ta.rising(volume, noOfFalls) and high > upper

fall_triangle_ready := ta.rising(close, noOfRises) and ta.rising(volume, noOfRises) and low < lower

else if channel_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and low < lower

fall_triangle_ready := ta.rising(close, noOfRises) and high > upper

else if volume_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and ta.rising(volume, noOfFalls)

fall_triangle_ready := ta.rising(close, noOfRises) and ta.rising(volume, noOfRises)

else

rise_triangle_ready := ta.falling(close, noOfFalls)

fall_triangle_ready := ta.rising(close, noOfRises)

// Check if trend is reversed

if close > close[1]

rise_triangle_plotted := false // Reset triangle plotted flag

if close < close[1]

fall_triangle_plotted := false

//Wait for bar close and enter trades

if barstate.isconfirmed

// Plot triangle when ready and counts exceed threshold

if rise_triangle_ready and not rise_triangle_plotted

label.new(bar_index, low, yloc = yloc.belowbar, style=label.style_triangleup, color=color.new(#9CFF87,10))

strategy.entry("Long", strategy.long)

rise_triangle_plotted := true

rise_triangle_ready := false // Prevent plotting again until reset

if fall_triangle_ready and not fall_triangle_plotted

label.new(bar_index, low, yloc = yloc.abovebar, style=label.style_triangledown, color=color.new(#F9396A,10))

strategy.entry("Short", strategy.short)

fall_triangle_plotted := true

fall_triangle_ready := false

// plot channel bands

plot(upper, color = color.new(#56CBF9, 70), linewidth = 3, title = "Upper Channel Line")

plot(lower, color = color.new(#56CBF9, 70), linewidth = 3, title = "Lower Channel Line")