Overview

This is a trend detection system that combines trading volume weighting and price movement. The system calculates the difference between opening and closing prices (Delta value), weighted by trading volume, to form a unique trend indicator. The system also integrates a Simple Moving Average (SMA) for signal confirmation, determining market trends by comparing the Delta value with its SMA. Additionally, the system incorporates EMA as an auxiliary indicator, forming a multi-dimensional analytical framework.

Strategy Principles

- Delta Value Calculation: Uses the difference between opening and closing prices within a specific period, weighted by trading volume

- Signal Generation Mechanism:

- When Delta crosses above its SMA, the system identifies a bearish signal

- When Delta crosses below its SMA, the system identifies a bullish signal

- EMA Integration:

- System uses 20-period EMA for trend confirmation

- EMA color changes based on Delta value’s position relative to its SMA

- Volume Filter: Sets volume threshold to ensure trading occurs under sufficient liquidity conditions

Strategy Advantages

- Multi-dimensional Analysis: Combines price, volume, and moving average systems for a more comprehensive market perspective

- Signal Reliability: Reduces random price fluctuation effects through volume weighting

- Strong Adaptability: Operates effectively across multiple timeframes, including 4-hour and daily

- Parameter Flexibility: Offers multiple adjustable parameters for optimization across different market characteristics

- Risk Control: Built-in volume filtering mechanism effectively avoids low liquidity environments

Strategy Risks

- Trend Reversal Risk: May generate false signals in volatile markets

- Parameter Sensitivity: Different parameter combinations may lead to significant strategy performance variations

- Time Lag Risk: Inherent lag in moving average systems may delay entry timing

- Market Environment Dependency: May generate frequent trading signals in sideways markets

Strategy Optimization Directions

- Introduce Dynamic Parameters:

- Automatically adjust Delta calculation period based on market volatility

- Dynamically adjust volume threshold based on volume changes

- Enhance Signal Filtering:

- Add trend strength confirmation indicators

- Integrate price pattern recognition systems

- Improve Risk Management:

- Establish dynamic stop-loss mechanism

- Introduce position management system

Summary

This is a systematic strategy that organically combines price momentum, trading volume, and trend indicators. Through multi-dimensional analysis and strict trading condition screening, the strategy maintains high reliability while demonstrating good adaptability and scalability. The core advantage lies in its three-dimensional judgment of market trends, while its greatest development potential lies in dynamic parameter optimization and risk management system improvement.

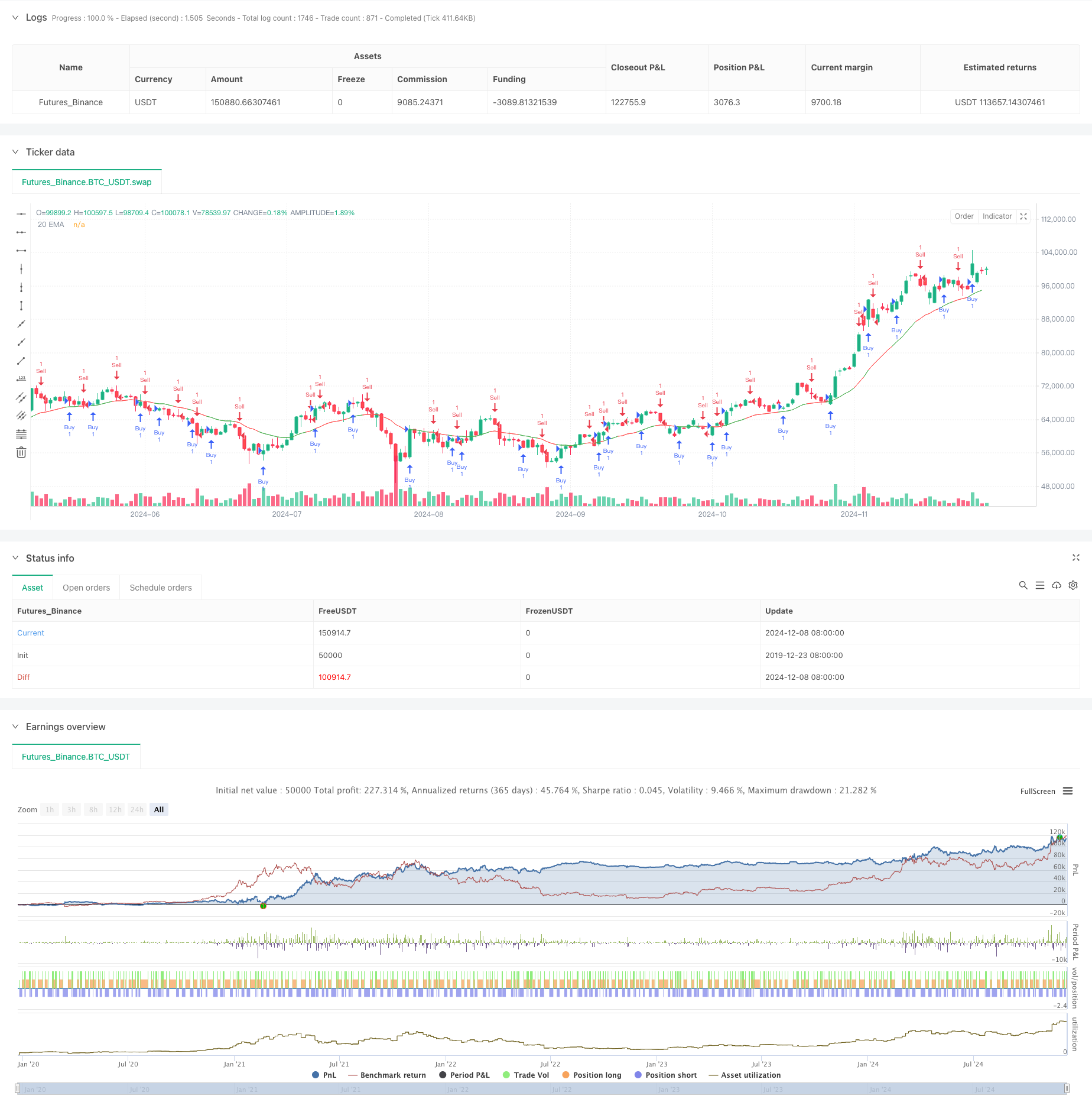

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Volume-Weighted Delta Strategy", overlay=true)

// Input-parametrit

length_delta = input.int(5, minval=1, title="Delta Length")

length_ma = input.int(5, minval=1, title="MA Length")

length_sma = input.int(5, minval=1, title="MA Length")

volume_threshold = input.float(100000, title="Volume Threshold")

// Funktio delta-arvojen laskemiseksi ja volyymin mukaan painottamiseksi

calculate_volume_weighted_delta(delta_length) =>

delta_sum = 0.0

for i = 0 to delta_length - 1

delta_sum := delta_sum + ((close[i] - open[i]) * volume[i])

delta_sum

// Laskenta

delta_value = calculate_volume_weighted_delta(length_delta)

ma_value = ta.sma(delta_value, length_sma)

ema20 = ta.ema(close, 20)

// EMA:n värin määrittely

ema_color = delta_value > ma_value ? color.green : color.red

positive = ta.crossover(delta_value, ma_value)

negative = ta.crossunder(delta_value, ma_value)

// Piirretään graafit

plot(ema20, color=ema_color, title="20 EMA")

BullishCond = ta.crossover(ma_value, delta_value)

BearishCond = ta.crossunder(ma_value, delta_value)

if (BullishCond)

strategy.entry("Sell", strategy.short)

if (BearishCond)

strategy.entry("Buy", strategy.long)