Overview

This strategy is a trend following trading system that combines the Average Directional Index (ADX) with the Parabolic Stop and Reverse (SAR) indicator. The system measures trend strength using ADX and confirms trend direction using SAR to capture trading opportunities in strong trending markets. It employs a dual confirmation mechanism to ensure both the existence and reliability of trends.

Strategy Principle

The core logic is based on the following key components: 1. ADX indicator measures trend strength, with values above 25 indicating a significant trend. 2. DI+ and DI- crossovers determine trend direction, with DI+ > DI- indicating uptrend and vice versa. 3. Parabolic SAR tracks price movement by dynamically adjusting stop points, providing additional trend confirmation.

Trade signal triggers are as follows: - Long entry: ADX>25, DI+>DI-, and price above SAR - Short entry: ADX>25, DI->DI+, and price below SAR - Exit: When opposite trading signals appear

Strategy Advantages

- Dual confirmation mechanism significantly improves signal reliability

- Dynamic stop-loss helps protect existing profits

- High parameter adaptability for different market conditions

- Clear strategy logic, easy to understand and execute

- Excellent performance in strong trending markets

Strategy Risks

- May generate frequent false signals in oscillating markets

- Entry points may lag behind trend initiation

- Potential for significant drawdowns during quick reversals

- Parameter settings can significantly impact strategy performance

Risk control suggestions: - Set maximum drawdown limits - Adjust parameters based on market volatility - Incorporate additional technical indicators for trade confirmation - Implement position management strategies

Strategy Optimization Directions

Introduce volatility indicators for parameter adjustment

- Increase ADX threshold during high volatility periods

- Reduce SAR sensitivity during low volatility periods

Optimize exit mechanism

- Add profit targets

- Design dynamic stop-loss strategy

Add market environment filters

- Incorporate trendline analysis

- Consider volume factors

Improve position management

- Design position sizing based on ATR

- Implement staged entry/exit

Summary

This strategy constructs a robust trend following system by combining ADX and SAR indicators. Its main advantages lie in the dual confirmation mechanism and dynamic stop-loss settings, although performance may be suboptimal in oscillating markets. Through appropriate parameter optimization and risk control, the strategy can achieve good performance in clearly trending market environments. Traders are advised to conduct thorough backtesting before live implementation and adjust parameters according to specific market characteristics.

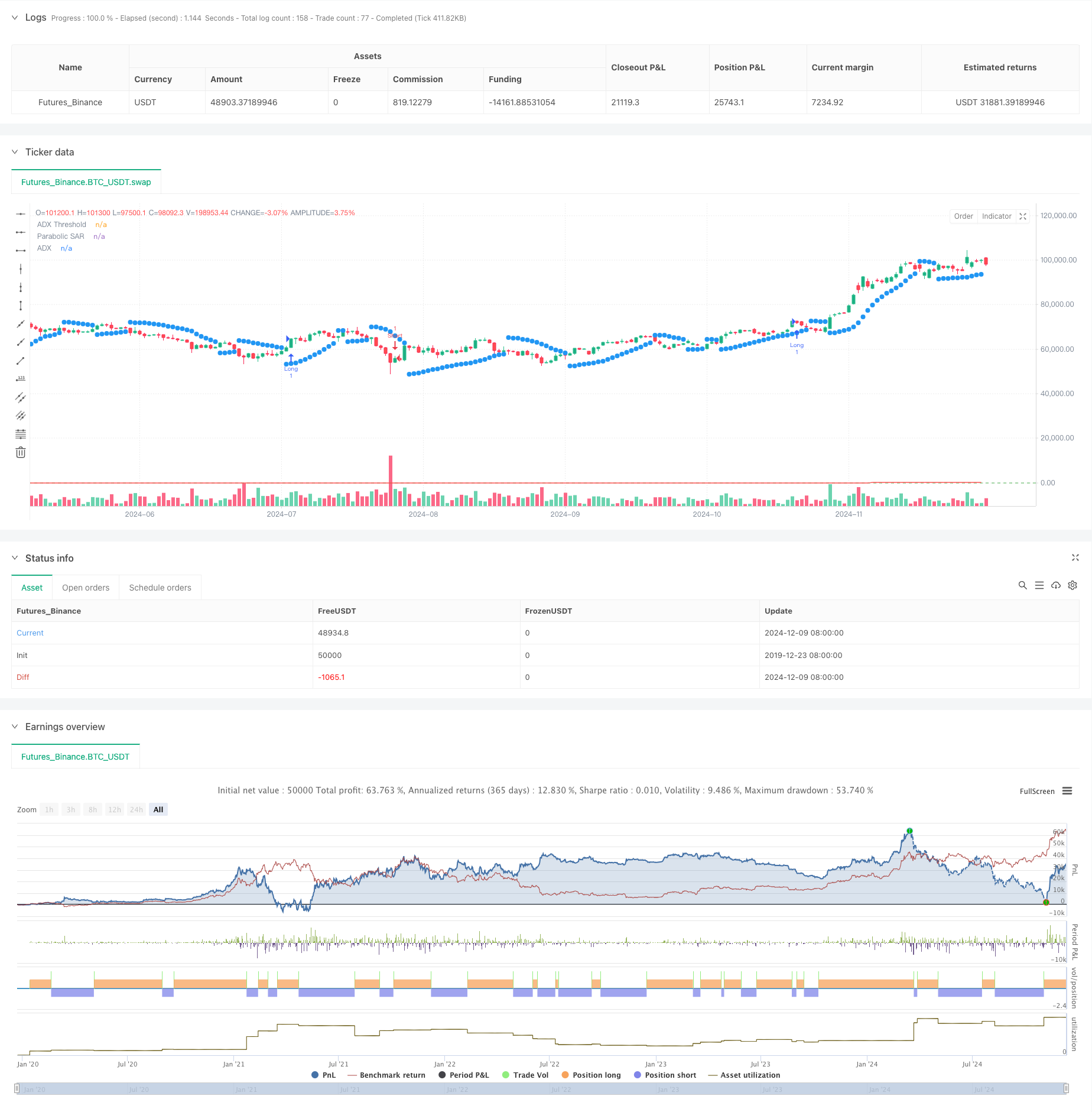

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © traderhub

//@version=5

strategy("Trend Following ADX + Parabolic SAR", overlay=true)

// Strategy parameters

adxLength = input(14, title="ADX Period")

adxThreshold = input(25, title="ADX Threshold")

adxSmoothing = input(14, title="ADX Smoothing")

sarStart = input(0.02, title="Parabolic SAR Start") // Starting acceleration factor

sarIncrement = input(0.02, title="Parabolic SAR Increment") // Increment step

sarMax = input(0.2, title="Parabolic SAR Max") // Maximum acceleration factor

// Calculate ADX, DI+, and DI-

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxSmoothing)

// Parabolic SAR calculation

sar = ta.sar(sarStart, sarIncrement, sarMax)

// Conditions for a long position

longCondition = adx > adxThreshold and diPlus > diMinus and close > sar

// Conditions for a short position

shortCondition = adx > adxThreshold and diMinus > diPlus and close < sar

// Enter a long position

if (longCondition)

strategy.entry("Long", strategy.long)

// Enter a short position

if (shortCondition)

strategy.entry("Short", strategy.short)

// Close position on reverse signal

if (strategy.position_size > 0 and shortCondition)

strategy.close("Long")

if (strategy.position_size < 0 and longCondition)

strategy.close("Short")

// Plot indicators on the chart

plot(sar, color=color.blue, style=plot.style_circles, linewidth=2, title="Parabolic SAR")

plot(adx, color=color.red, title="ADX")

hline(adxThreshold, "ADX Threshold", color=color.green)