Overview

This strategy is a trend following system that combines dual moving averages and MACD indicators. It uses 50-period and 200-period moving averages to determine trend direction while utilizing MACD indicator for specific entry timing. The strategy employs dynamic stop-loss and take-profit mechanisms, along with multiple filtering conditions to enhance trade quality. It is a complete trading system operating on a 15-minute timeframe with precise entry and exit rules.

Strategy Principles

The core logic is built on several key elements: 1. Trend Determination: Uses the relative position of 50MA and 200MA to judge overall trend, with uptrend confirmed when fast MA is above slow MA, and downtrend vice versa. 2. Entry Signals: After trend confirmation, uses MACD crossovers for specific entry signals. Enters long when MACD line crosses above signal line in uptrends; enters short when MACD line crosses below signal line in downtrends. 3. Trade Filtering: Incorporates multiple filtering mechanisms including minimum trade interval, trend strength, and MACD threshold to avoid overtrading in volatile market conditions. 4. Risk Control: Uses fixed-point stop-loss and adjustable take-profit mechanisms, combined with moving average and MACD reverse signals as dynamic exit conditions.

Strategy Advantages

- Trend Following and Momentum Combination: Combines moving averages and MACD indicators to capture both major trends and precise entry timing.

- Comprehensive Risk Management: Implements multiple stop-loss mechanisms, including fixed stops and technical indicator-triggered dynamic stops.

- Flexible Parameter Settings: Key parameters such as stop-loss/take-profit points and MA periods can be adjusted according to market conditions.

- Smart Filtering Mechanism: Reduces false signals through multiple filtering conditions to improve trade quality.

- Complete Performance Statistics: Built-in detailed trade statistics including win rate and average profit/loss calculations in real-time.

Strategy Risks

- Choppy Market Risk: May generate frequent false signals in sideways markets; consider adding trend confirmation indicators.

- Slippage Risk: Short-term trading is susceptible to slippage; consider widening stop-loss settings.

- Parameter Sensitivity: Strategy performance is sensitive to parameter settings, requiring thorough optimization.

- Market Environment Dependency: Strategy performs well in strong trend markets but may be unstable in other market conditions.

Strategy Optimization Directions

- Dynamic Stop-Loss Optimization: Can adjust stop-loss range dynamically based on ATR indicator to better adapt to market volatility.

- Entry Timing Optimization: Can add RSI or other auxiliary indicators to confirm entry timing and improve trade accuracy.

- Position Management Optimization: Introduce volatility-based dynamic position management system for better risk control.

- Market Environment Recognition: Add market environment recognition module to use different parameter combinations under different market conditions.

Summary

This is a well-designed trend following trading system with complete logic. By combining classic technical indicators with modern risk management methods, the strategy balances trend capture with risk control. While there are areas for optimization, it is overall a practically valuable trading strategy. Traders are advised to conduct thorough backtesting before live implementation and adjust parameters according to specific trading instruments and market environments.

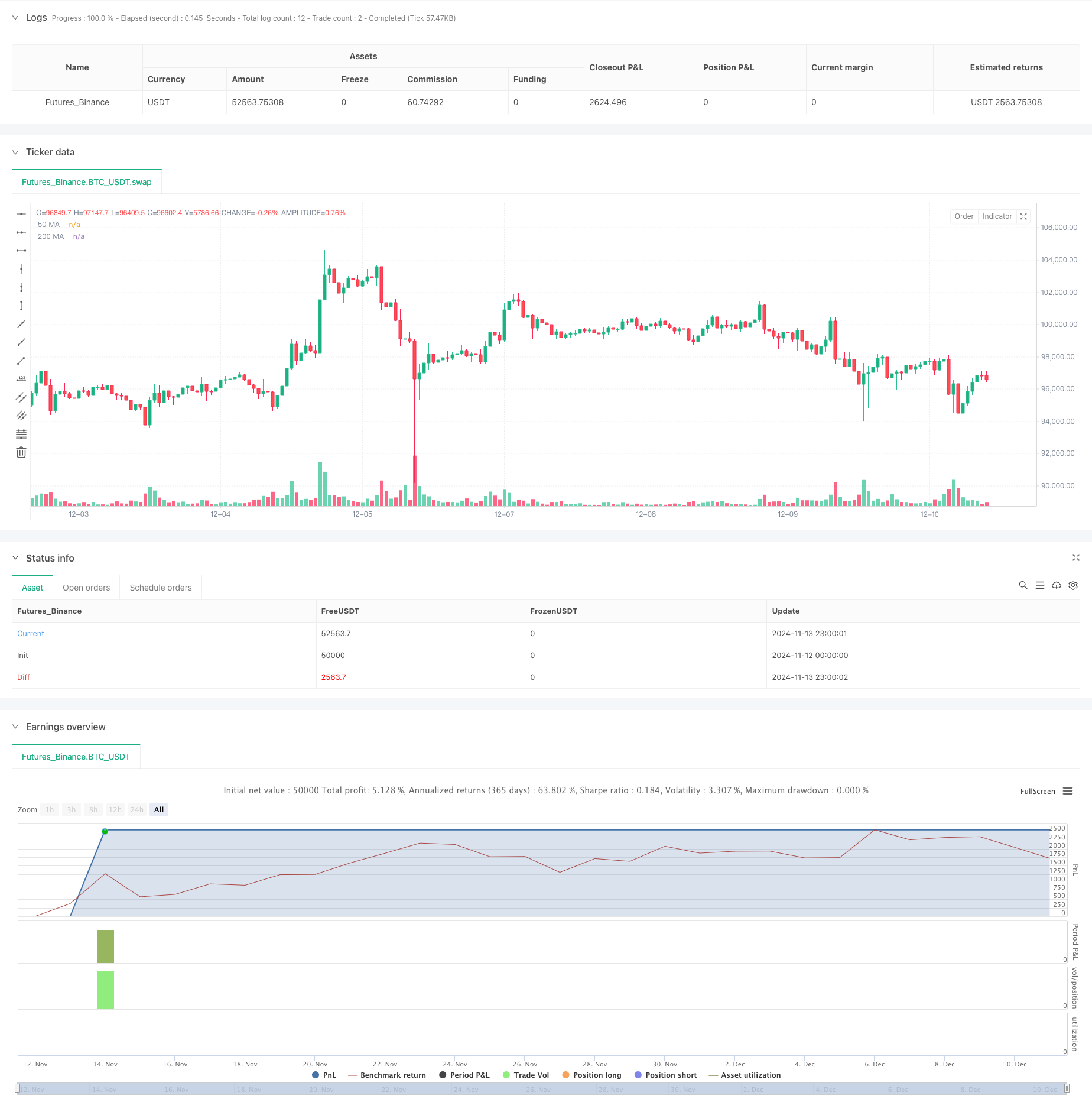

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WolfofAlgo

//@version=5

strategy("Trend Following Scalping Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Input Parameters

stopLossPips = input.float(5.0, "Stop Loss in Pips", minval=1.0)

takeProfitPips = input.float(10.0, "Take Profit in Pips", minval=1.0)

useFixedTakeProfit = input.bool(true, "Use Fixed Take Profit")

// Moving Average Parameters

fastMA = input.int(50, "Fast MA Period")

slowMA = input.int(200, "Slow MA Period")

// MACD Parameters

macdFastLength = input.int(12, "MACD Fast Length")

macdSlowLength = input.int(26, "MACD Slow Length")

macdSignalLength = input.int(9, "MACD Signal Length")

// Trade Filter Parameters (Adjusted to be less strict)

minBarsBetweenTrades = input.int(5, "Minimum Bars Between Trades", minval=1)

trendStrengthPeriod = input.int(10, "Trend Strength Period")

minTrendStrength = input.float(0.4, "Minimum Trend Strength", minval=0.1, maxval=1.0)

macdThreshold = input.float(0.00005, "MACD Threshold", minval=0.0)

// Variables for trade management

var int barsLastTrade = 0

barsLastTrade := nz(barsLastTrade[1]) + 1

// Calculate Moving Averages

ma50 = ta.sma(close, fastMA)

ma200 = ta.sma(close, slowMA)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

// Calculate trend strength (simplified)

trendDirection = ta.ema(close, trendStrengthPeriod) > ta.ema(close, trendStrengthPeriod * 2)

isUptrend = close > ma50 and ma50 > ma200

isDowntrend = close < ma50 and ma50 < ma200

// Calculate pip value

pointsPerPip = syminfo.mintick * 10

// Entry Conditions with Less Strict Filters

macdCrossUp = ta.crossover(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

macdCrossDown = ta.crossunder(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

// Long and Short Conditions

longCondition = close > ma50 and macdCrossUp and barsLastTrade >= minBarsBetweenTrades and isUptrend

shortCondition = close < ma50 and macdCrossDown and barsLastTrade >= minBarsBetweenTrades and isDowntrend

// Exit Conditions (made more lenient)

exitLongCondition = macdCrossDown or close < ma50

exitShortCondition = macdCrossUp or close > ma50

// Reset bars counter on new trade

if (longCondition or shortCondition)

barsLastTrade := 0

// Calculate stop loss and take profit levels

longStopPrice = strategy.position_avg_price - (stopLossPips * pointsPerPip)

longTakeProfitPrice = strategy.position_avg_price + (takeProfitPips * pointsPerPip)

shortStopPrice = strategy.position_avg_price + (stopLossPips * pointsPerPip)

shortTakeProfitPrice = strategy.position_avg_price - (takeProfitPips * pointsPerPip)

// Plot Moving Averages

plot(ma50, "50 MA", color=color.blue)

plot(ma200, "200 MA", color=color.red)

// Plot Entry Signals

plotshape(longCondition, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(shortCondition, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)

// Strategy Entry Rules

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short", strategy.short)

// Strategy Exit Rules

if (strategy.position_size > 0 and exitLongCondition)

strategy.close("Long")

if (strategy.position_size < 0 and exitShortCondition)

strategy.close("Short")

// Stop Loss and Take Profit Management

if (strategy.position_size > 0)

strategy.exit("Long TP/SL", "Long", stop=longStopPrice, limit=useFixedTakeProfit ? longTakeProfitPrice : na)

if (strategy.position_size < 0)

strategy.exit("Short TP/SL", "Short", stop=shortStopPrice, limit=useFixedTakeProfit ? shortTakeProfitPrice : na)

// Performance Metrics

var float totalTrades = 0

var float winningTrades = 0

var float totalProfitPips = 0

var float totalLossPips = 0

if (strategy.closedtrades > 0)

totalTrades := strategy.closedtrades

winningTrades := strategy.wintrades

totalProfitPips := strategy.grossprofit / pointsPerPip

totalLossPips := math.abs(strategy.grossloss) / pointsPerPip

// Display Stats

var label statsLabel = na

label.delete(statsLabel[1])

// Create performance stats text

var string stats = ""

if (strategy.closedtrades > 0)

winRate = (winningTrades / math.max(totalTrades, 1)) * 100

avgWin = totalProfitPips / math.max(winningTrades, 1)

avgLoss = totalLossPips / math.max(totalTrades - winningTrades, 1)

plRatio = avgWin / math.max(avgLoss, 1)

stats := "Win Rate: " + str.tostring(winRate, "#.##") + "%\n" +

"Avg Win: " + str.tostring(avgWin, "#.##") + " pips\n" +

"Avg Loss: " + str.tostring(avgLoss, "#.##") + " pips\n" +

"P/L Ratio: " + str.tostring(plRatio, "#.##") + "\n" +

"Total Trades: " + str.tostring(totalTrades, "#")

statsLabel := label.new(x=bar_index, y=high, text=stats, style=label.style_label_down, color=color.new(color.blue, 80))