Overview

This strategy is a comprehensive trading system that combines multiple technical indicators to capture trading opportunities by dynamically monitoring market momentum and trend changes. The strategy integrates multiple indicators including Moving Averages (EMA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands (BB), and implements a dynamic stop-loss mechanism based on Average True Range (ATR), achieving multi-dimensional market analysis and risk control.

Strategy Principle

The strategy employs a multi-level signal confirmation mechanism, including: 1. Trend Determination: Uses 7-period and 14-period EMA crossovers to determine market trend direction 2. Momentum Analysis: Monitors market overbought/oversold conditions using RSI with 30⁄70 dynamic thresholds 3. Trend Strength Confirmation: Incorporates ADX indicator to judge trend strength, confirming strong trends when ADX>25 4. Volatility Range Assessment: Utilizes Bollinger Bands to define price volatility ranges and generates trading signals 5. Volume Verification: Employs dynamic volume moving average filtering to ensure sufficient market activity 6. Risk Control: Dynamic stop-loss strategy based on ATR indicator, with stop-loss distance set at 1.5 times ATR

Strategy Advantages

- Multi-dimensional signal verification reduces false signals

- Dynamic stop-loss mechanism enhances risk adaptation capability

- Combination of volume and trend strength analysis improves trading reliability

- Adjustable indicator parameters provide good adaptability

- Complete entry and exit mechanisms with clear trading logic

- Uses standard technical indicators, easy to understand and maintain

Strategy Risks

- Multiple indicators may lead to signal lag

- Parameter optimization may result in overfitting

- May generate frequent trades in ranging markets

- Complex signal system might increase computational load

- Requires large sample size for strategy validation

Strategy Optimization Directions

- Introduce market volatility adaptive mechanism for dynamic parameter adjustment

- Add time filters to avoid trading during unfavorable periods

- Optimize profit-taking strategy, consider implementing trailing stops

- Include transaction cost considerations in entry/exit conditions

- Implement position management mechanism for dynamic position sizing

Summary

The strategy constructs a comprehensive trading system through the coordination of multiple indicators. Its core advantages lie in multi-dimensional signal confirmation and dynamic risk control systems, while attention needs to be paid to parameter optimization and market adaptability. Through continuous optimization and adjustment, the strategy has the potential to maintain stable performance across different market conditions.

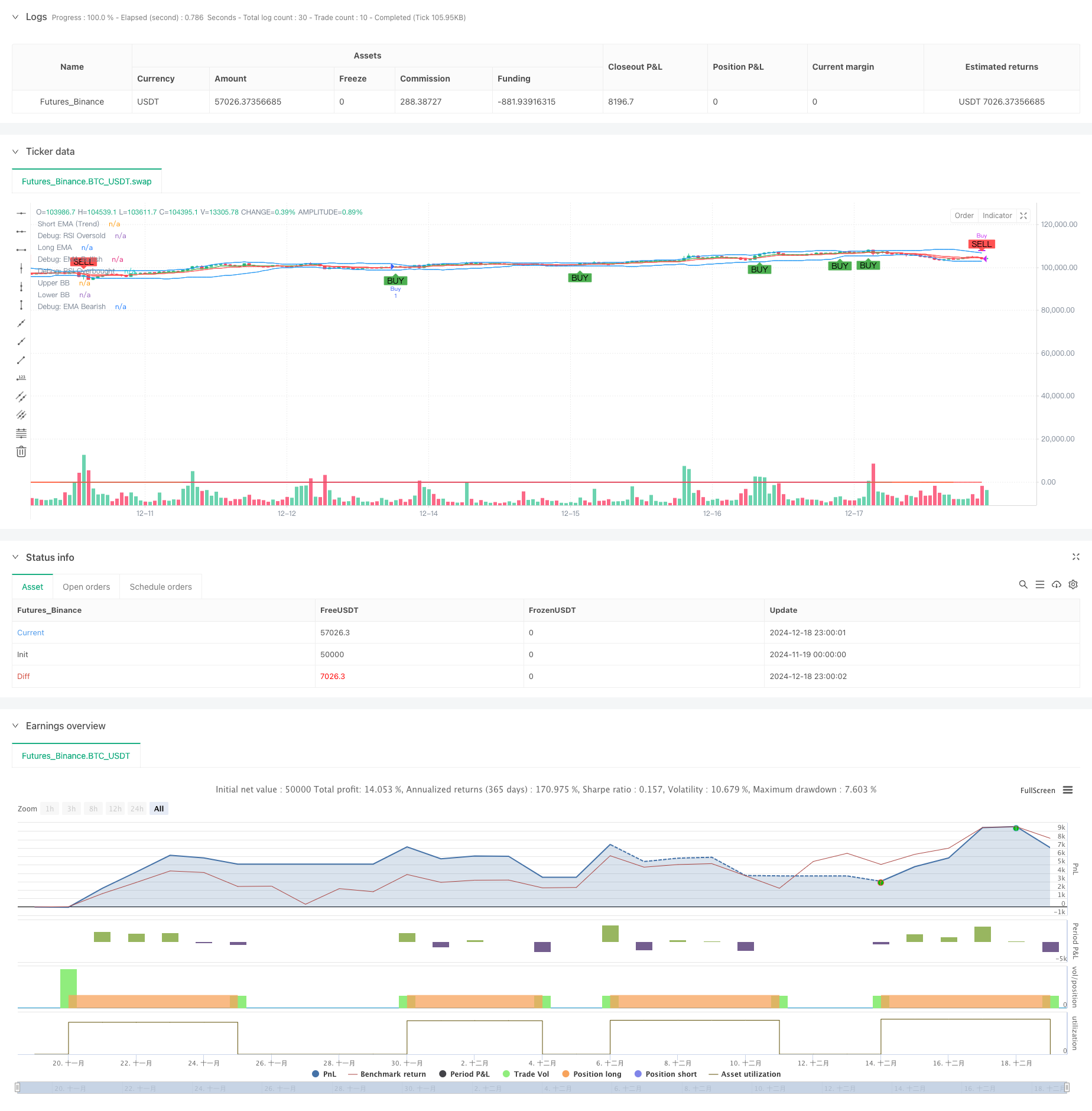

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USDT Scalping Strategy", overlay=true)

// Input Parameters

emaShortLength = input.int(7, title="Short EMA Length")

emaLongLength = input.int(14, title="Long EMA Length")

rsiLength = input.int(7, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level") // Adjusted to 70 for broader range

rsiOversold = input.int(30, title="RSI Oversold Level") // Adjusted to 30 for broader range

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Standard Deviation") // Adjusted to 2.0 for better signal detection

// EMA Calculation

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdHistogram = macdLine - signalLine

// Bollinger Bands Calculation

basis = ta.sma(close, bbLength)

deviation = ta.stdev(close, bbLength)

bbUpper = basis + (bbStdDev * (deviation > 1e-5 ? deviation : 1e-5)) // Ensure robust Bollinger Band calculation

bbLower = basis - bbStdDev * deviation

// Volume Condition

volCondition = volume > ta.sma(volume, input.int(20, title="Volume SMA Period")) // Dynamic volume filter

// Trend Strength (ADX)

// True Range Calculation

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

// Directional Movement

plusDM = high - high[1] > low[1] - low ? math.max(high - high[1], 0) : 0

minusDM = low[1] - low > high - high[1] ? math.max(low[1] - low, 0) : 0

// Smooth Moving Averages

atr_custom = ta.rma(tr, 14)

plusDI = 100 * ta.rma(plusDM, 14) / atr_custom // Correct reference to atr_custom

minusDI = 100 * ta.rma(minusDM, 14) / atr_custom // Correct reference to atr_custom

// ADX Calculation

adx = plusDI + minusDI > 0 ? 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), 14) : na // Simplified ternary logic for ADX calculation // Prevent division by zero // Prevent division by zero // Final ADX

strongTrend = adx > 25

// Conditions for Buy Signal

emaBullish = emaShort > emaLong

rsiOversoldCondition = rsi < rsiOversold

macdBullishCrossover = ta.crossover(macdLine, signalLine)

priceAtLowerBB = close <= bbLower

buySignal = emaBullish and (rsiOversoldCondition or macdBullishCrossover or priceAtLowerBB) // Relaxed conditions by removing volCondition and strongTrend

// Conditions for Sell Signal

emaBearish = emaShort < emaLong

rsiOverboughtCondition = rsi > rsiOverbought

macdBearishCrossover = ta.crossunder(macdLine, signalLine)

priceAtUpperBB = close >= bbUpper

sellSignal = emaBearish and (rsiOverboughtCondition or macdBearishCrossover or priceAtUpperBB) // Relaxed conditions by removing volCondition and strongTrend

// Plot EMA Lines

trendColor = emaShort > emaLong ? color.green : color.red

plot(emaShort, color=trendColor, title="Short EMA (Trend)") // Simplified color logic

plot(emaLong, color=color.red, title="Long EMA")

// Plot Bollinger Bands

plot(bbUpper, color=color.blue, title="Upper BB")

plot(bbLower, color=color.blue, title="Lower BB")

// Plot Buy and Sell Signals

plot(emaBullish ? 1 : na, color=color.green, linewidth=1, title="Debug: EMA Bullish")

plot(emaBearish ? 1 : na, color=color.red, linewidth=1, title="Debug: EMA Bearish")

plot(rsiOversoldCondition ? 1 : na, color=color.orange, linewidth=1, title="Debug: RSI Oversold")

plot(rsiOverboughtCondition ? 1 : na, color=color.purple, linewidth=1, title="Debug: RSI Overbought")

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small) // Dynamic size for signals

// Strategy Execution with ATR-based Stop Loss and Take Profit

// Reuse atr_custom from earlier calculation

stopLoss = low - (input.float(1.5, title="Stop Loss Multiplier") * atr_custom) // Consider dynamic adjustment based on market conditions // Adjustable stop-loss multiplier

takeProfit = close + (2 * atr_custom)

if (buySignal)

strategy.entry("Buy", strategy.long, stop=stopLoss) // Removed limit to simplify trade execution

if (sellSignal)

strategy.close("Buy")