Overview

This strategy is a quantitative trading system based on multiple Exponential Moving Average (EMA) crossovers. It constructs a complete trend-following trading framework using three EMAs: 9-day, 21-day, and 200-day. The strategy identifies market trends and executes trades by analyzing the crossovers between fast and slow EMAs and their positions relative to the long-term EMA.

Strategy Principles

The core logic revolves around triple EMA crossovers to capture market trends. Specifically: 1. Uses 9-day EMA as the fast line to reflect short-term price movements 2. Uses 21-day EMA as the medium-term line to filter short-term noise 3. Uses 200-day EMA as the long-term line to determine major trend direction The system generates long signals when the fast EMA crosses above the slow EMA while both are above the 200-day EMA, and short signals when the fast EMA crosses below the slow EMA while both are below the 200-day EMA. This design captures trend reversal points while avoiding frequent trades in ranging markets.

Strategy Advantages

- High trend confirmation: Multiple EMA combinations provide more accurate trend confirmation

- Robust risk control: Long-term EMA serves as a trend filter to reduce false breakout risks

- Clear operational rules: Entry and exit conditions are well-defined, easy to implement and backtest

- High adaptability: Parameters can be adjusted for different market characteristics

- Simple computation: Uses common technical indicators, efficient for real-time trading

Strategy Risks

- Lag risk: EMA indicators have inherent lag, potentially causing delayed entries or exits

- Consolidation risk: May generate frequent false signals in ranging markets

- Trend reversal risk: May experience significant drawdowns during sudden trend reversals

- Parameter sensitivity: Different parameter combinations may lead to varying performance It’s recommended to manage these risks through stop-loss placement and position sizing.

Optimization Directions

- Incorporate volume indicators: Confirm trend strength with volume changes

- Add volatility filters: Adjust trading frequency in high volatility environments

- Optimize parameter selection: Dynamically adjust EMA parameters for different market cycles

- Include trend strength indicators: Use ADX to evaluate trend reliability

- Enhance risk management: Design more flexible stop-loss and take-profit rules

Summary

This is a well-designed trend-following strategy with clear logic. Through the coordination of multiple EMAs, it effectively captures market trends while maintaining good risk control. The strategy has significant optimization potential, and its stability and profitability can be further enhanced through continuous improvements.

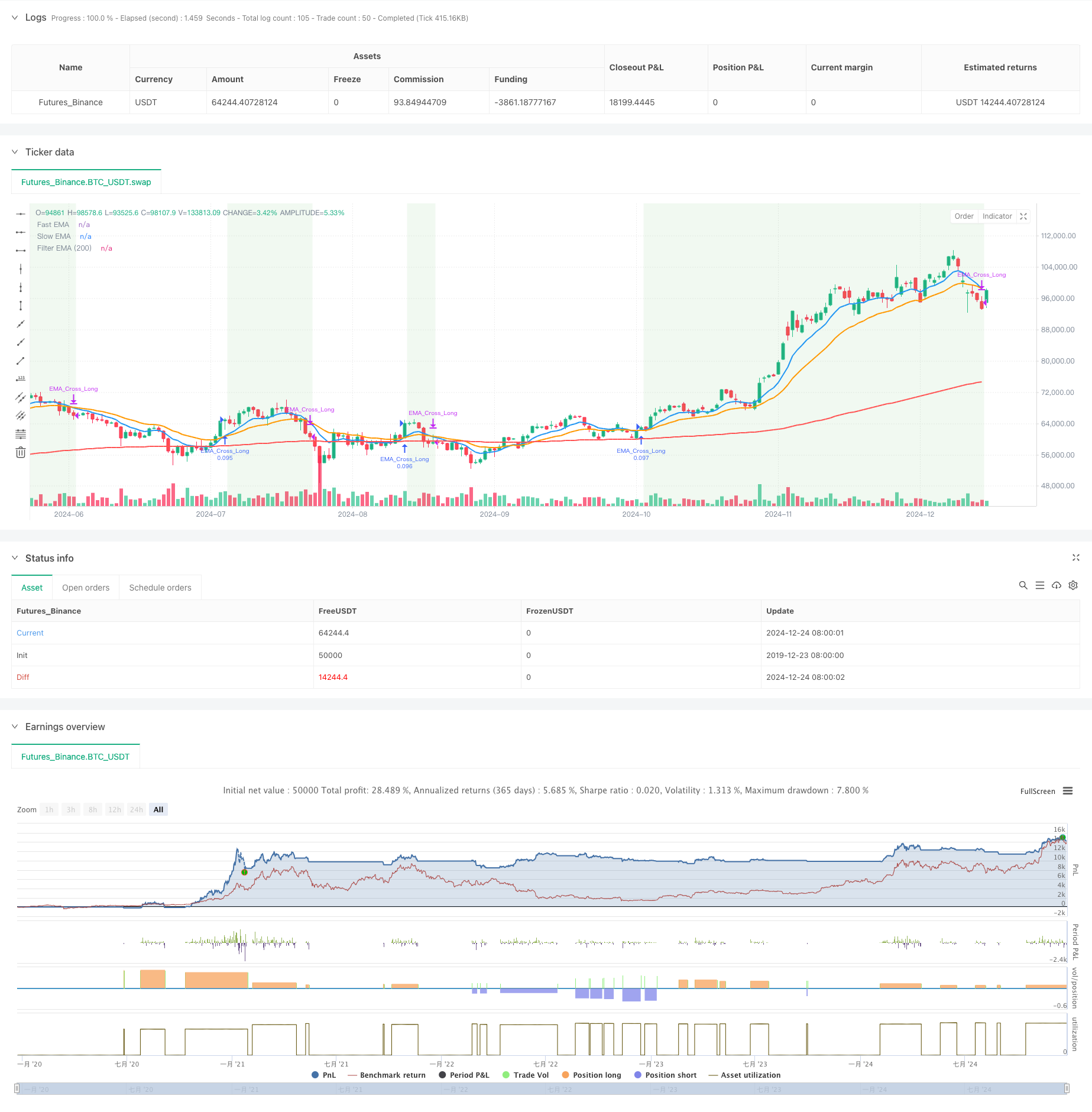

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("EMA Cross with both MinhTuan", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Tham số EMA

fastLength = input.int(9, title="Fast EMA Length", minval=1)

slowLength = input.int(21, title="Slow EMA Length", minval=1)

filterLength = input.int(200, title="EMA Filter Length", minval=1)

// Tùy chọn chế độ giao dịch

tradeMode = input.string("Both", options=["Long", "Short", "Both"], title="Trade Mode")

// Tính toán EMA

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

filterEMA = ta.ema(close, filterLength)

// Điều kiện vào lệnh Long: EMA nhanh cắt lên EMA chậm và cả hai nằm trên EMA 200

longCondition = ta.crossover(fastEMA, slowEMA) and fastEMA > filterEMA and slowEMA > filterEMA

// Điều kiện vào lệnh Short: EMA nhanh cắt xuống EMA chậm và cả hai nằm dưới EMA 200

shortCondition = ta.crossunder(fastEMA, slowEMA) and fastEMA < filterEMA and slowEMA < filterEMA

// Điều kiện thoát lệnh: EMA nhanh cắt ngược lại EMA chậm

closeLongCondition = ta.crossunder(fastEMA, slowEMA) // Thoát lệnh Long

closeShortCondition = ta.crossover(fastEMA, slowEMA) // Thoát lệnh Short

// Thực hiện lệnh Long

if (longCondition and (tradeMode == "Long" or tradeMode == "Both"))

strategy.entry("EMA_Cross_Long", strategy.long)

label.new(x=bar_index, y=low, text="Long", color=color.green, textcolor=color.white, size=size.small)

// Thực hiện lệnh Short

if (shortCondition and (tradeMode == "Short" or tradeMode == "Both"))

strategy.entry("EMA_Cross_Short", strategy.short)

label.new(x=bar_index, y=high, text="Short", color=color.red, textcolor=color.white, size=size.small)

// Thoát lệnh Long

if (closeLongCondition)

strategy.close("EMA_Cross_Long")

label.new(x=bar_index, y=high, text="Close Long", color=color.orange, textcolor=color.white, size=size.small)

// Thoát lệnh Short

if (closeShortCondition)

strategy.close("EMA_Cross_Short")

label.new(x=bar_index, y=low, text="Close Short", color=color.blue, textcolor=color.white, size=size.small)

// Vẽ đường EMA nhanh, EMA chậm, và EMA 200

plot(fastEMA, title="Fast EMA", color=color.blue, linewidth=2)

plot(slowEMA, title="Slow EMA", color=color.orange, linewidth=2)

plot(filterEMA, title="Filter EMA (200)", color=color.red, linewidth=2)

// Hiển thị nền khi đang giữ lệnh

bgcolor(strategy.position_size > 0 ? color.new(color.green, 90) : strategy.position_size < 0 ? color.new(color.red, 90) : na)