Overview

This strategy is a multi-indicator trading system combining Bollinger Bands, Woodies CCI (Commodity Channel Index), Moving Averages (MA), and On-Balance Volume (OBV). It uses Bollinger Bands to provide market volatility ranges, CCI indicators for signal filtering, and combines MA systems with volume confirmation to execute trades when market trends are clear. Additionally, it employs ATR for dynamic stop-loss and take-profit placement to effectively control risk.

Strategy Principles

The core logic is based on the following key elements: 1. Uses two standard deviation Bollinger Bands (1x and 2x) to construct price volatility channels 2. Employs 6-period and 14-period CCI indicators as signal filters, requiring confirmation from both periods 3. Combines 50-period and 200-period moving averages to determine market trends 4. Confirms volume trends through 10-period smoothed OBV 5. Uses 14-period ATR for dynamic stop-loss and take-profit levels

Strategy Advantages

- Multiple indicator cross-validation significantly reduces false signals

- Bollinger Bands and CCI combination provides accurate market volatility judgment

- Long and short-term MA systems effectively capture major trends

- OBV confirms volume support, increasing signal reliability

- Dynamic stop-loss and take-profit settings adapt to different market conditions

- Clear trading signals with standardized execution, suitable for quantitative implementation

Strategy Risks

- Multiple indicators may lead to delayed signals

- Frequent stop-losses in ranging markets

- Risk of parameter optimization overfitting

- Stop-losses may not trigger quickly enough in volatile periods Mitigation measures:

- Dynamically adjust indicator parameters for different market cycles

- Monitor drawdown for position control

- Regular parameter validation

- Set maximum loss limits

Optimization Directions

- Introduce volatility indicators to adjust positions in high volatility periods

- Add trend strength filtering to avoid ranging market trades

- Optimize CCI period selection for improved signal sensitivity

- Enhance profit/loss management with partial profit-taking

- Implement volume anomaly warning system

Summary

This is a complete trading system based on technical indicator combinations that improves trading accuracy through multiple signal confirmations. The strategy design is reasonable with proper risk control and has good practical application value. It is recommended to test with conservative positions in live trading and continuously optimize parameters based on market conditions.

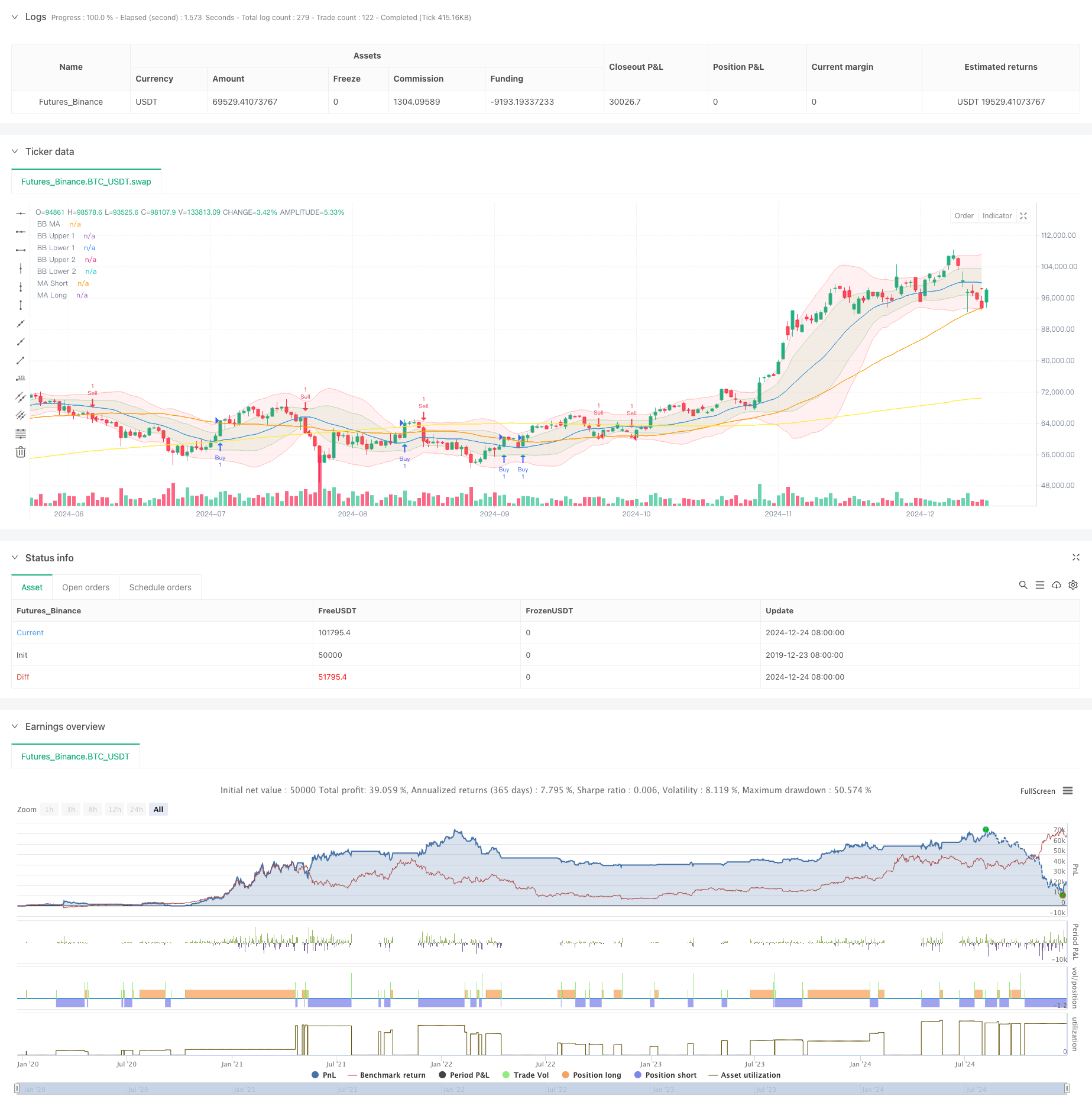

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(shorttitle="BB Debug + Woodies CCI Filter", title="Debug Buy/Sell Signals with Woodies CCI Filter", overlay=true)

// Input Parameters

length = input.int(20, minval=1, title="BB MA Length")

src = input.source(close, title="BB Source")

mult1 = input.float(1.0, minval=0.001, maxval=50, title="BB Multiplier 1 (Std Dev 1)")

mult2 = input.float(2.0, minval=0.001, maxval=50, title="BB Multiplier 2 (Std Dev 2)")

ma_length = input.int(50, minval=1, title="MA Length")

ma_long_length = input.int(200, minval=1, title="Long MA Length")

obv_smoothing = input.int(10, minval=1, title="OBV Smoothing Length")

atr_length = input.int(14, minval=1, title="ATR Length") // ATR Length for TP/SL

// Bollinger Bands

basis = ta.sma(src, length)

dev1 = mult1 * ta.stdev(src, length)

dev2 = mult2 * ta.stdev(src, length)

upper_1 = basis + dev1

lower_1 = basis - dev1

upper_2 = basis + dev2

lower_2 = basis - dev2

plot(basis, color=color.blue, title="BB MA")

p1 = plot(upper_1, color=color.new(color.green, 80), title="BB Upper 1")

p2 = plot(lower_1, color=color.new(color.green, 80), title="BB Lower 1")

p3 = plot(upper_2, color=color.new(color.red, 80), title="BB Upper 2")

p4 = plot(lower_2, color=color.new(color.red, 80), title="BB Lower 2")

fill(p1, p2, color=color.new(color.green, 90))

fill(p3, p4, color=color.new(color.red, 90))

// Moving Averages

ma_short = ta.sma(close, ma_length)

ma_long = ta.sma(close, ma_long_length)

plot(ma_short, color=color.orange, title="MA Short")

plot(ma_long, color=color.yellow, title="MA Long")

// OBV and Smoothing

obv = ta.cum(ta.change(close) > 0 ? volume : ta.change(close) < 0 ? -volume : 0)

obv_smooth = ta.sma(obv, obv_smoothing)

// Debugging: Buy/Sell Signals

debugBuy = ta.crossover(close, ma_short)

debugSell = ta.crossunder(close, ma_short)

// Woodies CCI

cciTurboLength = 6

cci14Length = 14

cciTurbo = ta.cci(src, cciTurboLength)

cci14 = ta.cci(src, cci14Length)

// Filter: Only allow trades when CCI confirms the signal

cciBuyFilter = cciTurbo > 0 and cci14 > 0

cciSellFilter = cciTurbo < 0 and cci14 < 0

finalBuySignal = debugBuy and cciBuyFilter

finalSellSignal = debugSell and cciSellFilter

// Plot Debug Buy/Sell Signals

plotshape(finalBuySignal, title="Filtered Buy", location=location.belowbar, color=color.lime, style=shape.triangleup, size=size.normal)

plotshape(finalSellSignal, title="Filtered Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.normal)

// Change candle color based on filtered signals

barcolor(finalBuySignal ? color.lime : finalSellSignal ? color.red : na)

// ATR for Stop Loss and Take Profit

atr = ta.atr(atr_length)

tp_long = close + 2 * atr // Take Profit for Long = 2x ATR

sl_long = close - 1 * atr // Stop Loss for Long = 1x ATR

tp_short = close - 2 * atr // Take Profit for Short = 2x ATR

sl_short = close + 1 * atr // Stop Loss for Short = 1x ATR

// Strategy Execution

if (finalBuySignal)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=tp_long, stop=sl_long)

if (finalSellSignal)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=tp_short, stop=sl_short)

// Check for BTC/USDT pair

isBTCUSDT = syminfo.ticker == "BTCUSDT"

// Add alerts only for BTC/USDT

alertcondition(isBTCUSDT and finalBuySignal, title="BTCUSDT Buy Signal", message="Buy signal detected for BTCUSDT!")

alertcondition(isBTCUSDT and finalSellSignal, title="BTCUSDT Sell Signal", message="Sell signal detected for BTCUSDT!")