Overview

This strategy is a quantitative trading system that combines dual Exponential Moving Averages (EMA) with the Stochastic Oscillator. It utilizes 20-period and 50-period EMAs to determine market trends while using the Stochastic Oscillator to identify trading opportunities in overbought and oversold zones, achieving a perfect blend of trend and momentum. The strategy implements strict risk management measures, including fixed stop-loss and profit targets.

Strategy Principles

The core logic consists of three components: trend identification, entry timing, and risk control. Trend identification primarily relies on the relative position of fast EMA (20-period) and slow EMA (50-period), where an uptrend is confirmed when the fast line is above the slow line, and vice versa. Entry signals are confirmed by Stochastic Oscillator crossovers, seeking high-probability trades in overbought and oversold zones. Risk control employs fixed percentage stop-losses and 2:1 profit targets, ensuring clear risk-reward ratios for each trade.

Strategy Advantages

- Combines trend following and momentum indicators for consistent profits in trending markets

- Implements scientific money management through fixed risk percentages

- Indicator parameters can be flexibly adjusted for different markets

- Clear and easy-to-understand strategy logic

- Applicable across multiple timeframes

Strategy Risks

- May generate frequent false signals in ranging markets

- EMA parameter selection significantly impacts strategy performance

- Stochastic overbought/oversold levels need market-specific adjustment

- Stop-loss levels may be too wide in volatile markets

- Trading costs need to be considered for strategy profitability

Optimization Directions

- Add volume indicators for additional confirmation

- Incorporate ATR for dynamic stop-loss adjustment

- Develop adaptive parameter adjustment based on market volatility

- Implement trend strength filters to reduce false signals

- Develop adaptive profit target calculation methods

Summary

This strategy establishes a complete trading system by combining trend and momentum indicators. Its core strengths lie in its clear logical framework and strict risk control, though practical application requires parameter optimization based on specific market conditions. Through continuous improvement and optimization, the strategy has the potential to maintain stable performance across various market environments.

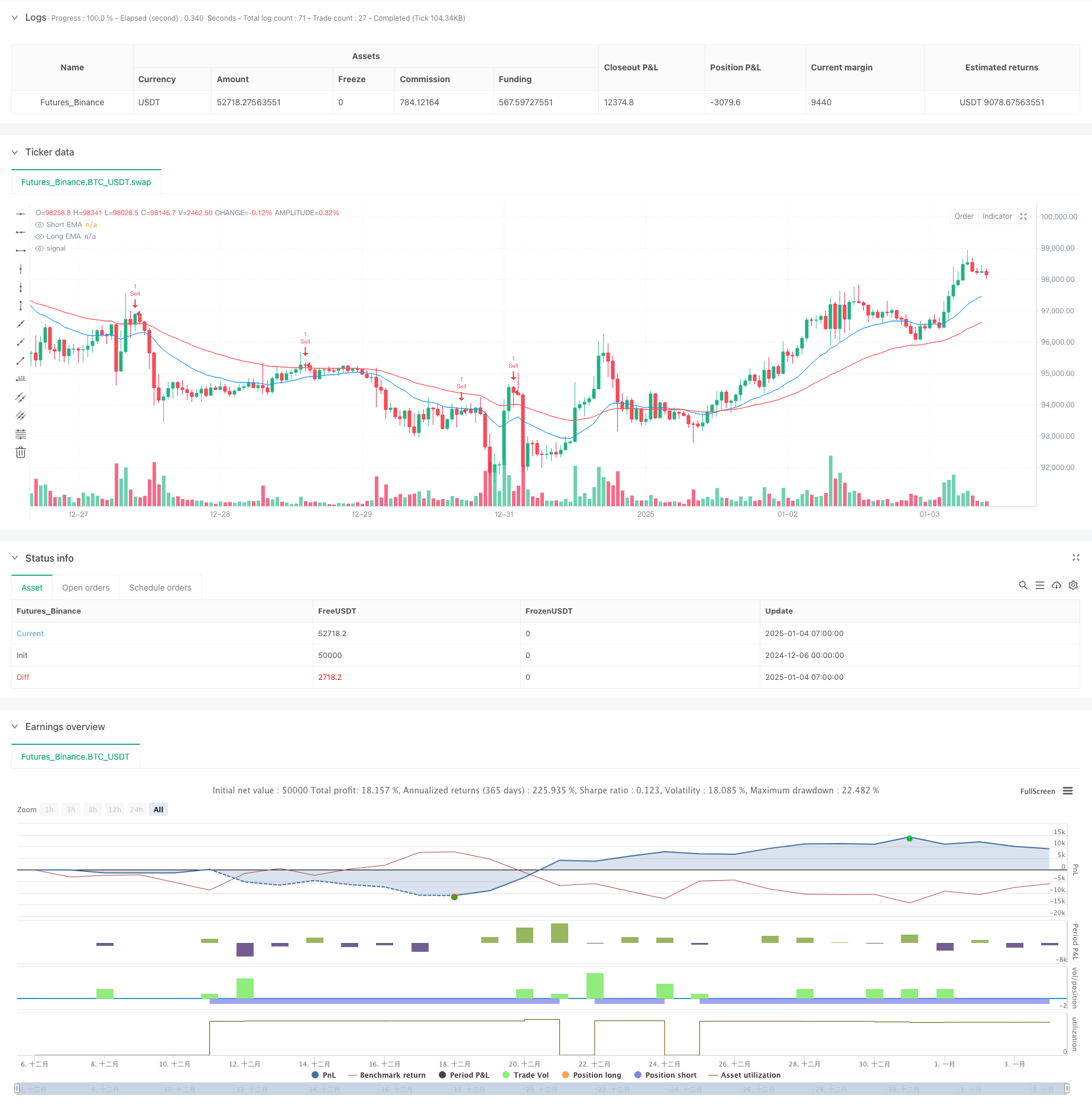

/*backtest

start: 2024-12-06 00:00:00

end: 2025-01-04 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("EMA + Stochastic Strategy", overlay=true)

// Inputs for EMA

emaShortLength = input.int(20, title="Short EMA Length")

emaLongLength = input.int(50, title="Long EMA Length")

// Inputs for Stochastic

stochK = input.int(14, title="Stochastic %K Length")

stochD = input.int(3, title="Stochastic %D Smoothing")

stochOverbought = input.int(85, title="Stochastic Overbought Level")

stochOversold = input.int(15, title="Stochastic Oversold Level")

// Inputs for Risk Management

riskRewardRatio = input.float(2.0, title="Risk-Reward Ratio")

stopLossPercent = input.float(1.0, title="Stop Loss (%)")

// EMA Calculation

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// Stochastic Calculation

k = ta.stoch(high, low, close, stochK)

d = ta.sma(k, stochD)

// Trend Condition

isUptrend = emaShort > emaLong

isDowntrend = emaShort < emaLong

// Stochastic Signals

stochBuyCrossover = ta.crossover(k, d)

stochBuySignal = k < stochOversold and stochBuyCrossover

stochSellCrossunder = ta.crossunder(k, d)

stochSellSignal = k > stochOverbought and stochSellCrossunder

// Entry Signals

buySignal = isUptrend and stochBuySignal

sellSignal = isDowntrend and stochSellSignal

// Strategy Execution

if buySignal

strategy.entry("Buy", strategy.long)

stopLoss = close * (1 - stopLossPercent / 100)

takeProfit = close * (1 + stopLossPercent * riskRewardRatio / 100)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", stop=stopLoss, limit=takeProfit)

if sellSignal

strategy.entry("Sell", strategy.short)

stopLoss = close * (1 + stopLossPercent / 100)

takeProfit = close * (1 - stopLossPercent * riskRewardRatio / 100)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", stop=stopLoss, limit=takeProfit)

// Plotting

plot(emaShort, color=color.blue, title="Short EMA")

plot(emaLong, color=color.red, title="Long EMA")