Overview

This strategy is a quantitative trading system based on candlestick technical analysis, primarily identifying potential trading opportunities by analyzing the total length of candlestick upper and lower wicks. The core mechanism compares real-time calculated total wick length with an offset-adjusted moving average, generating long signals when the wick length breaks through the moving average. The strategy integrates multiple types of moving averages, including Simple Moving Average (SMA), Exponential Moving Average (EMA), Weighted Moving Average (WMA), and Volume Weighted Moving Average (VWMA), providing traders with flexible parameter selection options.

Strategy Principles

The core logic includes the following key steps: 1. Calculate upper and lower wick lengths for each candlestick: upper wick is the difference between high and the greater of close/open, lower wick is the difference between the lesser of close/open and low 2. Calculate total wick length by adding upper and lower wick lengths 3. Compute moving average of wick lengths based on user-selected type (SMA/EMA/WMA/VWMA) 4. Add user-defined offset to the moving average 5. Generate long signal when real-time total wick length breaks through the offset-adjusted moving average 6. Automatically close positions after preset holding period

Strategy Advantages

- Rational technical indicator selection: wick length effectively reflects market volatility and price movement strength, crucial for trend reversal identification

- Flexible parameter settings: multiple moving average options and customizable parameters adapt to different market conditions

- Comprehensive risk control: fixed holding period prevents overexposure risks

- Outstanding visualization: histogram displays wick length, line chart shows moving average, intuitively presenting trading signals

- Clear calculation logic: concise code structure, easy to understand and maintain

Strategy Risks

- Market environment dependency: signals may be less effective in low volatility environments

- Parameter sensitivity: moving average period, offset value significantly impact strategy performance

- False breakout risk: potential short-term wick length breakouts with quick reversals leading to false signals

- Fixed holding period limitations: inability to dynamically adjust holding time based on market conditions

- Unidirectional trading: only supports long positions, cannot profit in downtrends

Strategy Optimization Directions

- Incorporate volatility filtering: combine ATR or historical volatility indicators to trade in suitable volatility environments

- Add trend filtering conditions: integrate long-term moving averages or trend indicators to trade with main trend

- Optimize position management: introduce dynamic stop-loss/profit mechanisms, adjust holding periods based on market volatility

- Add short trading functionality: include short positions under appropriate conditions to diversify revenue sources

- Enhance signal filtering: consider volume, market sentiment, and other multi-dimensional indicators to improve signal quality

Summary

This strategy combines classic technical indicators of candlestick wick analysis with modern quantitative trading methods, creating a trading system with clear logic and strong practicality. The core advantages lie in parameter flexibility and comprehensive risk control, though limitations include strong market environment dependency and parameter sensitivity. Significant improvement potential exists through multi-dimensional indicator integration and position management optimization. Overall, it represents a fundamentally sound and logically coherent quantitative trading strategy suitable for further development and optimization.

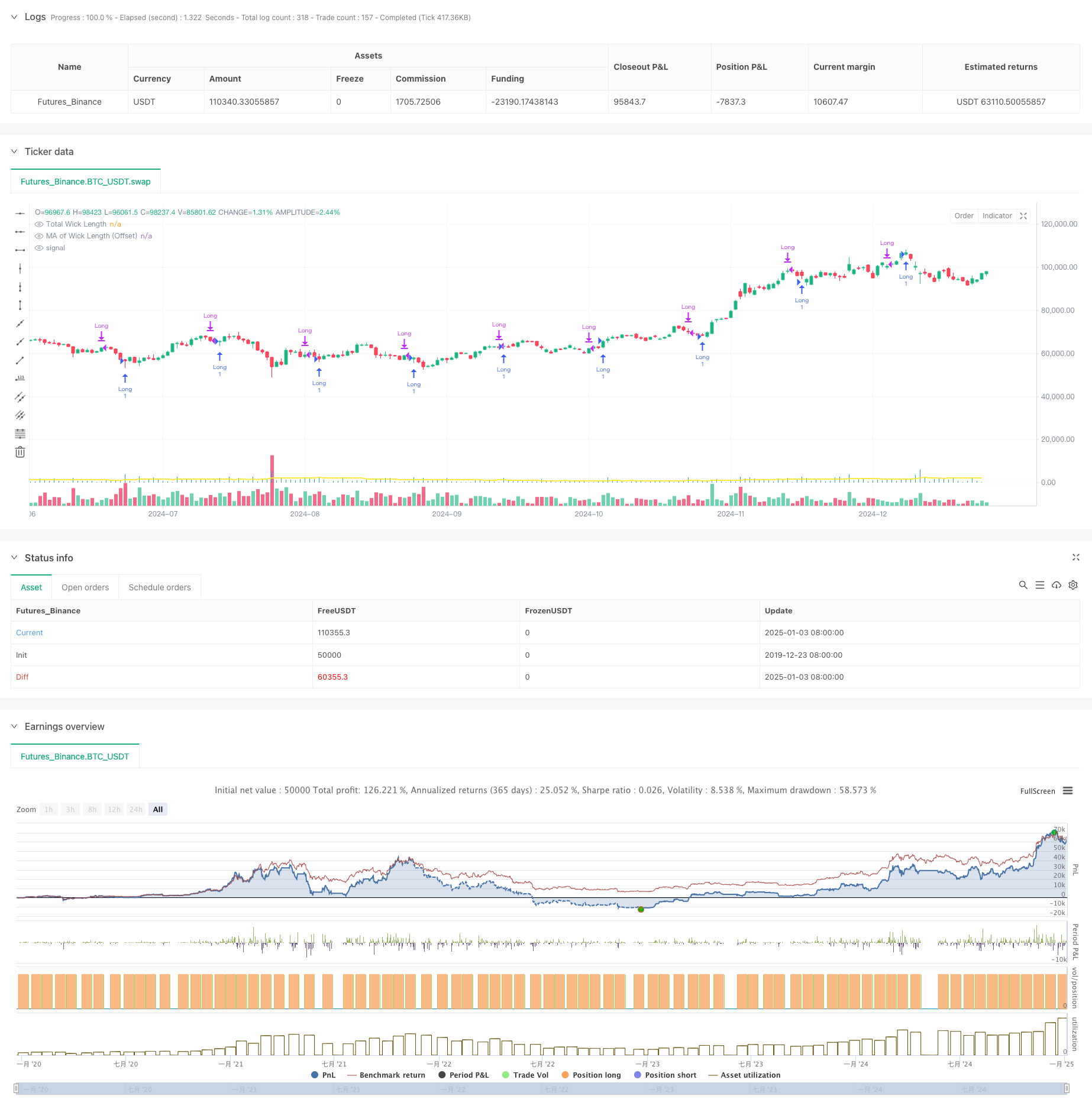

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Daytrading ES Wick Length Strategy", overlay=true)

// Input parameters

ma_length = input.int(20, title="Moving Average Length", minval=1)

ma_type = input.string("VWMA", title="Type of Moving Average", options=["SMA", "EMA", "WMA", "VWMA"])

ma_offset = input.float(10, title="MA Offset (Points)", step=1)

hold_periods = input.int(18, title="Holding Period (Bars)", minval=1)

// Calculating upper and lower wick lengths

upper_wick_length = high - math.max(close, open)

lower_wick_length = math.min(close, open) - low

// Total wick length (upper + lower)

total_wick_length = upper_wick_length + lower_wick_length

// Calculate the moving average based on the selected method

ma = switch ma_type

"SMA" => ta.sma(total_wick_length, ma_length)

"EMA" => ta.ema(total_wick_length, ma_length)

"WMA" => ta.wma(total_wick_length, ma_length)

"VWMA" => ta.vwma(total_wick_length, ma_length)

// Add the offset to the moving average

ma_with_offset = ma + ma_offset

// Entry condition: wick length exceeds MA with offset

long_entry_condition = total_wick_length > ma_with_offset

// Long entry

if (long_entry_condition)

strategy.entry("Long", strategy.long)

// Automatic exit after holding period

if strategy.position_size > 0 and bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= hold_periods

strategy.close("Long")

// Plot the total wick length as a histogram

plot(total_wick_length, color=color.blue, style=plot.style_histogram, linewidth=2, title="Total Wick Length")

// Plot the moving average with offset

plot(ma_with_offset, color=color.yellow, linewidth=2, title="MA of Wick Length (Offset)")