Overview

This strategy is an innovative trading system combining Fibonacci sequence and Bollinger Bands. It replaces traditional Bollinger Bands’ standard deviation multipliers with Fibonacci ratios (1.618, 2.618, 4.236), creating a unique price volatility assessment system. The strategy includes comprehensive trade management features, including stop-loss/take-profit settings and trading time window filters, making it highly practical and flexible.

Strategy Principle

The core logic is based on price interactions with Fibonacci Bollinger Bands. It first calculates a Simple Moving Average (SMA) as the middle band, then uses ATR multiplied by different Fibonacci ratios to form upper and lower bands. Trading signals are generated when price breaks through user-selected Fibonacci bands. Specifically, a long signal is triggered when the low price is below and high price is above the target buy band; a short signal is triggered when the low price is below and high price is above the target sell band.

Strategy Advantages

- Strong Adaptability: Dynamically adjusts band width through ATR, better adapting to different market conditions

- High Flexibility: Users can choose different Fibonacci bands as trading signals based on their trading style

- Comprehensive Risk Management: Built-in take-profit/stop-loss and time filtering functions effectively control risk

- Visual Intuitiveness: Different transparency levels of band areas help traders understand market structure

- Clear Calculation Logic: Uses classic technical indicator combinations, easy to understand and maintain

Strategy Risks

- False Breakout Risk: Price may immediately retrace after breakout, generating false signals

- Parameter Sensitivity: Different Fibonacci ratio choices significantly affect strategy performance

- Time Dependency: When trading window is enabled, might miss important trading opportunities

- Market Environment Dependency: May generate excessive signals in ranging markets

Strategy Optimization Directions

- Signal Confirmation Mechanism: Suggest adding volume or momentum indicators for breakout confirmation

- Dynamic Parameter Optimization: Automatically adjust Fibonacci ratios based on market volatility

- Market Environment Filtering: Add trend identification functionality, use different parameters in different market conditions

- Signal Weighting System: Establish multi-timeframe analysis to improve signal reliability

- Position Management Optimization: Dynamically adjust position size based on market volatility and signal strength

Summary

This strategy innovatively combines classic technical analysis tools by optimizing traditional Bollinger Bands with Fibonacci sequence. Its main advantages lie in adaptability and flexibility, but attention must be paid to parameter selection and market environment compatibility. The strategy has significant improvement potential through adding additional confirmation indicators and optimizing signal generation mechanisms.

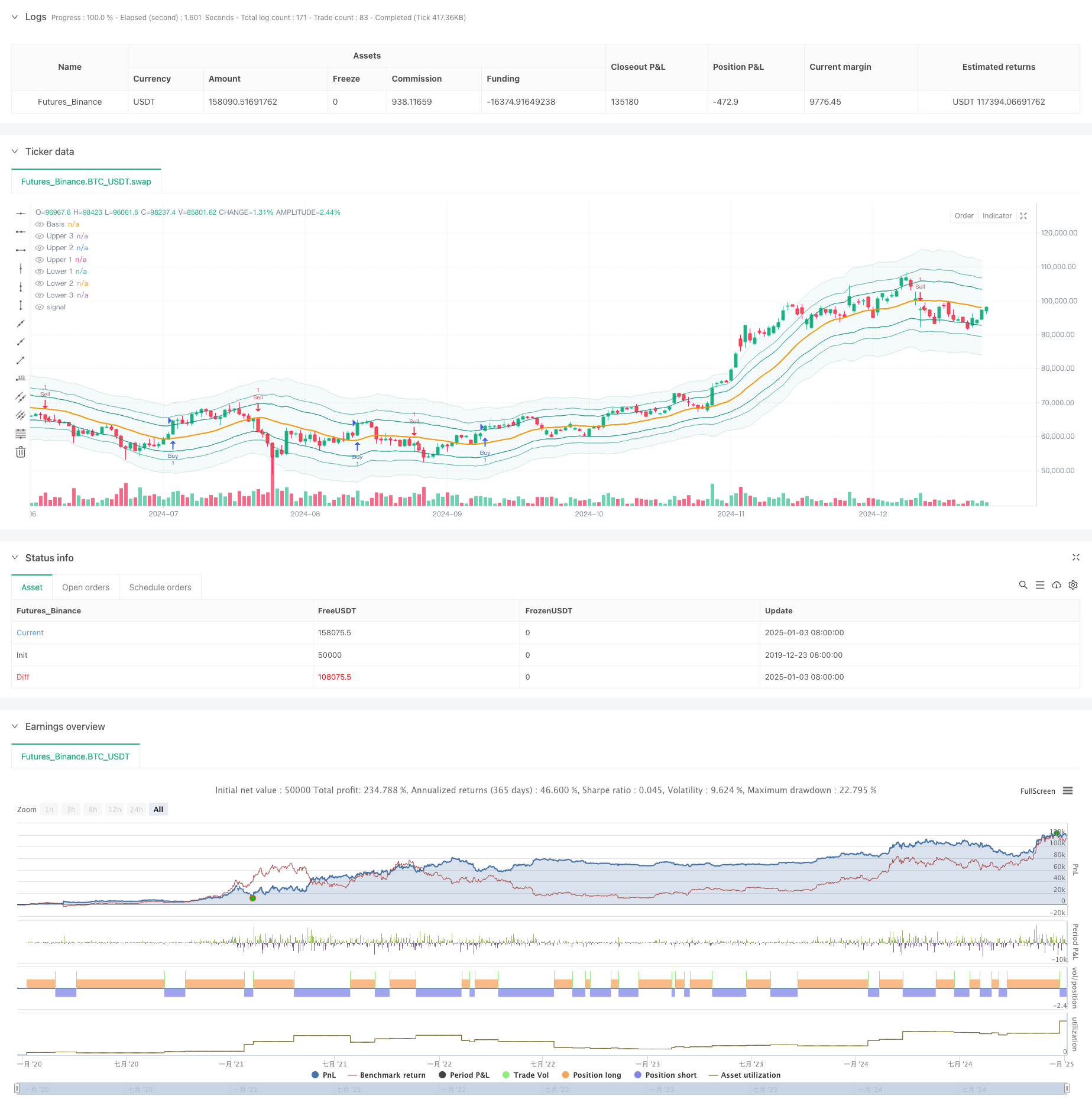

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sapphire_edge

// # ========================================================================= #

// #

// # _____ __ _ ______ __

// # / ___/____ _____ ____ / /_ (_)_______ / ____/___/ /___ ____

// # \__ \/ __ `/ __ \/ __ \/ __ \/ / ___/ _ \ / __/ / __ / __ `/ _ \

// # ___/ / /_/ / /_/ / /_/ / / / / / / / __/ / /___/ /_/ / /_/ / __/

// # /____/\__,_/ .___/ .___/_/ /_/_/_/ \___/ /_____/\__,_/\__, /\___/

// # /_/ /_/ /____/

// #

// # ========================================================================= #

strategy(shorttitle="⟡Sapphire⟡ FiboBands Strategy", title="[Sapphire] Fibonacci Bollinger Bands Strategy", initial_capital= 50000, currency= currency.USD,default_qty_value = 1,commission_type= strategy.commission.cash_per_contract,overlay= true )

// # ========================================================================= #

// # // Settings Menu //

// # ========================================================================= #

// -------------------- Main Settings -------------------- //

groupFiboBands = "FiboBands"

length = input.int(20, minval = 1, title = 'Length', group=groupFiboBands)

src = input(close, title = 'Source', group=groupFiboBands)

offset = input.int(0, 'Offset', minval = -500, maxval = 500, group=groupFiboBands)

fibo1 = input(defval = 1.618, title = 'Fibonacci Ratio 1', group=groupFiboBands)

fibo2 = input(defval = 2.618, title = 'Fibonacci Ratio 2', group=groupFiboBands)

fibo3 = input(defval = 4.236, title = 'Fibonacci Ratio 3', group=groupFiboBands)

fiboBuy = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Buy', group=groupFiboBands)

fiboSell = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Sell', group=groupFiboBands)

showSignals = input.bool(true, title="Show Signals", group=groupFiboBands)

signalOffset = input.int(5, title="Signal Vertical Offset", group=groupFiboBands)

// -------------------- Trade Management Inputs -------------------- //

groupTradeManagement = "Trade Management"

useProfitPerc = input.bool(false, title="Enable Profit Target", group=groupTradeManagement)

takeProfitPerc = input.float(1.0, title="Take Profit (%)", step=0.1, group=groupTradeManagement)

useStopLossPerc = input.bool(false, title="Enable Stop Loss", group=groupTradeManagement)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", step=0.1, group=groupTradeManagement)

// -------------------- Time Filter Inputs -------------------- //

groupTimeOfDayFilter = "Time of Day Filter"

useTimeFilter1 = input.bool(false, title="Enable Time Filter 1", group=groupTimeOfDayFilter)

startHour1 = input.int(0, title="Start Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

startMinute1 = input.int(0, title="Start Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

endHour1 = input.int(23, title="End Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

endMinute1 = input.int(45, title="End Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

closeAtEndTimeWindow = input.bool(false, title="Close Trades at End of Time Window", group=groupTimeOfDayFilter)

// -------------------- Trading Window -------------------- //

isWithinTradingWindow(startHour, startMinute, endHour, endMinute) =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

startInMinutes = startHour * 60 + startMinute

endInMinutes = endHour * 60 + endMinute

timeInMinutes >= startInMinutes and timeInMinutes <= endInMinutes

timeCondition = (useTimeFilter1 ? isWithinTradingWindow(startHour1, startMinute1, endHour1, endMinute1) : true)

// Check if the current bar is the last one within the specified time window

isEndOfTimeWindow() =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

endInMinutes = endHour1 * 60 + endMinute1

timeInMinutes == endInMinutes

// Logic to close trades if the time window ends

if timeCondition and closeAtEndTimeWindow and isEndOfTimeWindow()

strategy.close_all(comment="Closing trades at end of time window")

// # ========================================================================= #

// # // Calculations //

// # ========================================================================= #

sma = ta.sma(src, length)

atr = ta.atr(length)

ratio1 = atr * fibo1

ratio2 = atr * fibo2

ratio3 = atr * fibo3

upper3 = sma + ratio3

upper2 = sma + ratio2

upper1 = sma + ratio1

lower1 = sma - ratio1

lower2 = sma - ratio2

lower3 = sma - ratio3

// # ========================================================================= #

// # // Signal Logic //

// # ========================================================================= #

// -------------------- Entry Logic -------------------- //

targetBuy = fiboBuy == 'Fibo 1' ? upper1 : fiboBuy == 'Fibo 2' ? upper2 : upper3

buy = low < targetBuy and high > targetBuy

// -------------------- User-Defined Exit Logic -------------------- //

targetSell = fiboSell == 'Fibo 1' ? lower1 : fiboSell == 'Fibo 2' ? lower2 : lower3

sell = low < targetSell and high > targetSell

// # ========================================================================= #

// # // Strategy Management //

// # ========================================================================= #

// -------------------- Trade Execution Flags -------------------- //

var bool buyExecuted = false

var bool sellExecuted = false

float labelOffset = ta.atr(14) * signalOffset

// -------------------- Buy Logic -------------------- //

if buy and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Buy", strategy.long, stop=(useStopLossPerc ? close * (1 - stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 + takeProfitPerc / 100) : na))

else

strategy.entry("Buy", strategy.long)

if showSignals and not buyExecuted

buyExecuted := true

sellExecuted := false

label.new(bar_index, high - labelOffset, "◭", style=label.style_label_up, color = color.rgb(119, 0, 255, 20), textcolor=color.white)

// -------------------- Sell Logic -------------------- //

if sell and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Sell", strategy.short, stop=(useStopLossPerc ? close * (1 + stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 - takeProfitPerc / 100) : na))

else

strategy.entry("Sell", strategy.short)

if showSignals and not sellExecuted

sellExecuted := true

buyExecuted := false

label.new(bar_index, low + labelOffset, "⧩", style=label.style_label_down, color = color.rgb(255, 85, 0, 20), textcolor=color.white)

// # ========================================================================= #

// # // Plots and Charts //

// # ========================================================================= #

plot(sma, style = plot.style_line, title = 'Basis', color = color.new(color.orange, 0), linewidth = 2, offset = offset)

upp3 = plot(upper3, title = 'Upper 3', color = color.new(color.teal, 90), offset = offset)

upp2 = plot(upper2, title = 'Upper 2', color = color.new(color.teal, 60), offset = offset)

upp1 = plot(upper1, title = 'Upper 1', color = color.new(color.teal, 30), offset = offset)

low1 = plot(lower1, title = 'Lower 1', color = color.new(color.teal, 30), offset = offset)

low2 = plot(lower2, title = 'Lower 2', color = color.new(color.teal, 60), offset = offset)

low3 = plot(lower3, title = 'Lower 3', color = color.new(color.teal, 90), offset = offset)

fill(upp3, low3, title = 'Background', color = color.new(color.teal, 95))