Overview

This strategy is a high-frequency trading system based on short-period Exponential Moving Average (EMA) crossover signals. It combines adaptive volatility tracking mechanisms with dynamic position management and strict risk control to quickly capture short-term market fluctuations. The strategy operates on short timeframes such as 1-minute or 5-minute charts, suitable for active traders seeking frequent trading opportunities.

Strategy Principles

The core logic is based on crossover signals between a fast EMA (3-period) and a slow EMA (8-period). Long signals are generated when the fast line crosses above the slow line, and short signals when the fast line crosses below. The strategy uses the ATR indicator to measure market volatility and dynamically set stop-loss and profit targets. The system supports both fixed contract quantity trading and dynamic position management based on account equity. In dynamic position mode, risk is controlled within 0.5% of account equity per trade. The strategy employs a 1.2 risk-reward ratio and uses 1.5 times ATR as the trailing stop distance.

Strategy Advantages

- Quick Response: Short-period EMAs enable rapid capture of price trend changes, improving trading timeliness

- Comprehensive Risk Management: Dynamic stop-loss adjustment through ATR provides both profit protection and sufficient price movement space

- Flexible Position Management: Supports both fixed contract and dynamic position modes, adapting to different trading preferences

- Optimized Trailing Stops: Implements trailing stop mechanism to protect profits while seeking larger gains

- High Adaptability: Strategy parameters can be optimized for different market conditions

Strategy Risks

- False Breakout Risk: Short-period EMAs can generate false crossover signals, leading to frequent trading

- Slippage Impact: High-frequency trading may face significant slippage, affecting actual returns

- Volatility Shifts: Sudden market volatility changes may make ATR-based stops less timely

- Trading Costs: Frequent trading will incur higher commission expenses Mitigation measures include: adding signal filters, optimizing ATR parameters, adjusting risk-reward ratios, and setting daily maximum trade limits.

Strategy Optimization Directions

- Signal Enhancement: Incorporate volume and volatility indicators to improve signal reliability

- Time Filtering: Add trading time window settings to avoid low liquidity periods

- Dynamic Parameters: Adjust EMA periods and risk-reward ratios based on market conditions

- Drawdown Control: Add dynamic drawdown limits and daily stop-loss levels

- Cost Optimization: Optimize entry/exit rules to reduce unnecessary trades

Summary

The strategy builds a complete high-frequency trading system by combining short-period EMA crossover signals with dynamic risk management. Its strengths lie in quick response and strict risk control, but attention must be paid to false signals and trading costs. Through continuous optimization and parameter adjustment, the strategy can better adapt to different market environments, improving trading efficiency and stability.

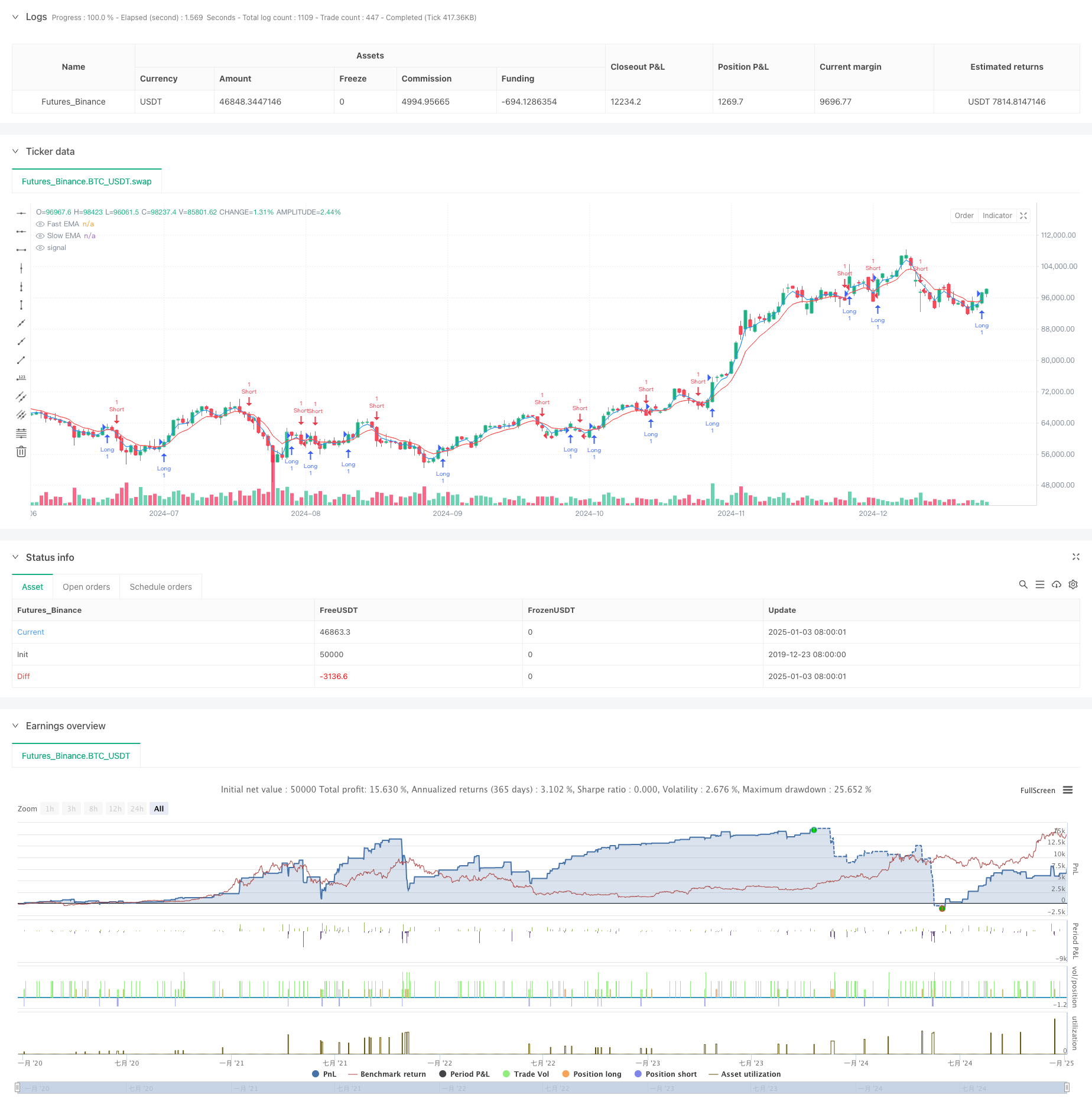

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High-Frequency EMA Scalping Strategy - Adjustable Contracts", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Input parameters

fastEmaLength = input.int(3, title="Fast EMA Length", minval=1)

slowEmaLength = input.int(8, title="Slow EMA Length", minval=1)

atrLength = input.int(10, title="ATR Length", minval=1)

riskRewardRatio = input.float(1.2, title="Risk/Reward Ratio", minval=1)

useDynamicPositionSizing = input.bool(false, title="Use Dynamic Position Sizing?")

fixedContracts = input.int(1, title="Number of Contracts (if Fixed)", minval=1) // Fixed number of contracts

// Calculate EMA values

fastEma = ta.ema(close, fastEmaLength)

slowEma = ta.ema(close, slowEmaLength)

// Calculate ATR for dynamic stop-loss and take-profit

atr = ta.atr(atrLength)

// Dynamic position sizing (if enabled)

capital = strategy.equity

riskPerTrade = capital * 0.005 // Risk 0.5% per trade

dynamicTradeQty = riskPerTrade / (atr * 1.5)

// Use fixed or dynamic position sizing

tradeQty = useDynamicPositionSizing ? dynamicTradeQty : fixedContracts

// Entry conditions

longCondition = ta.crossover(fastEma, slowEma)

shortCondition = ta.crossunder(fastEma, slowEma)

// Long trade execution

if longCondition

risk = atr * 1.0

reward = risk * riskRewardRatio

strategy.entry("Long", strategy.long, qty=tradeQty)

strategy.exit("Trailing Stop Long", from_entry="Long", trail_points=atr * 1.5, trail_offset=atr * 1.0)

strategy.exit("Take Profit", from_entry="Long", limit=close + reward, stop=close - risk)

// Short trade execution

if shortCondition

risk = atr * 1.0

reward = risk * riskRewardRatio

strategy.entry("Short", strategy.short, qty=tradeQty)

strategy.exit("Trailing Stop Short", from_entry="Short", trail_points=atr * 1.5, trail_offset=atr * 1.0)

strategy.exit("Take Profit", from_entry="Short", limit=close - reward, stop=close + risk)

// Plot EMA lines for reference

plot(fastEma, color=color.blue, title="Fast EMA")

plot(slowEma, color=color.red, title="Slow EMA")