Overview

This strategy is a quantitative trading system based on two classic candlestick patterns: Hammer and Hanging Man. It predicts potential market turning points by identifying these reversal patterns. The system combines multiple technical indicators to confirm signal validity, including the relationship between candlestick body and shadows, trend direction, and other elements, achieving precise capture of market reversal points.

Strategy Principle

The core logic of the strategy is to identify two key candlestick patterns programmatically: 1. Hammer: Appears in downtrends, suggesting potential upward reversal. Characterized by a small body, long lower shadow (at least twice the body length), and minimal or no upper shadow. 2. Hanging Man: Appears in uptrends, suggesting potential downward reversal. Similar characteristics to Hammer but appears in different locations with opposite implications.

The strategy quantifies these patterns through strict parameters, including: - Minimum candle body length multiplier - Lower shadow to candle height ratio - Holding periods

Strategy Advantages

- Systematic Identification: Precisely identifies market reversal signals programmatically, avoiding subjective human judgment.

- Controlled Risk: Sets clear holding periods, avoiding risks from excessive position holding.

- Signal Visualization: Displays trading signals intuitively on charts for analysis and optimization.

- Flexible Parameters: Can adjust parameters based on different market conditions, improving strategy adaptability.

Strategy Risks

- False Breakout Risk: Reversal patterns may generate false signals, requiring confirmation from other technical indicators.

- Timing Risk: Fixed holding periods may not fully capture price movement potential.

- Market Environment Dependency: May generate excessive false signals in ranging markets.

Strategy Optimization Directions

- Introduce Trend Filters: Add indicators like moving averages to filter trends and improve signal quality.

- Dynamic Holding Periods: Adjust holding time based on market volatility.

- Multi-timeframe Confirmation: Implement higher timeframe trend confirmation mechanisms.

- Stop Loss Optimization: Add dynamic stop loss mechanisms to improve risk control.

Summary

This strategy implements classical technical analysis theory systematically through quantification, demonstrating strong practical value. Through parameter optimization and risk control mechanism refinement, the strategy can maintain stable performance in different market environments. The modular design also provides a solid foundation for subsequent optimization.

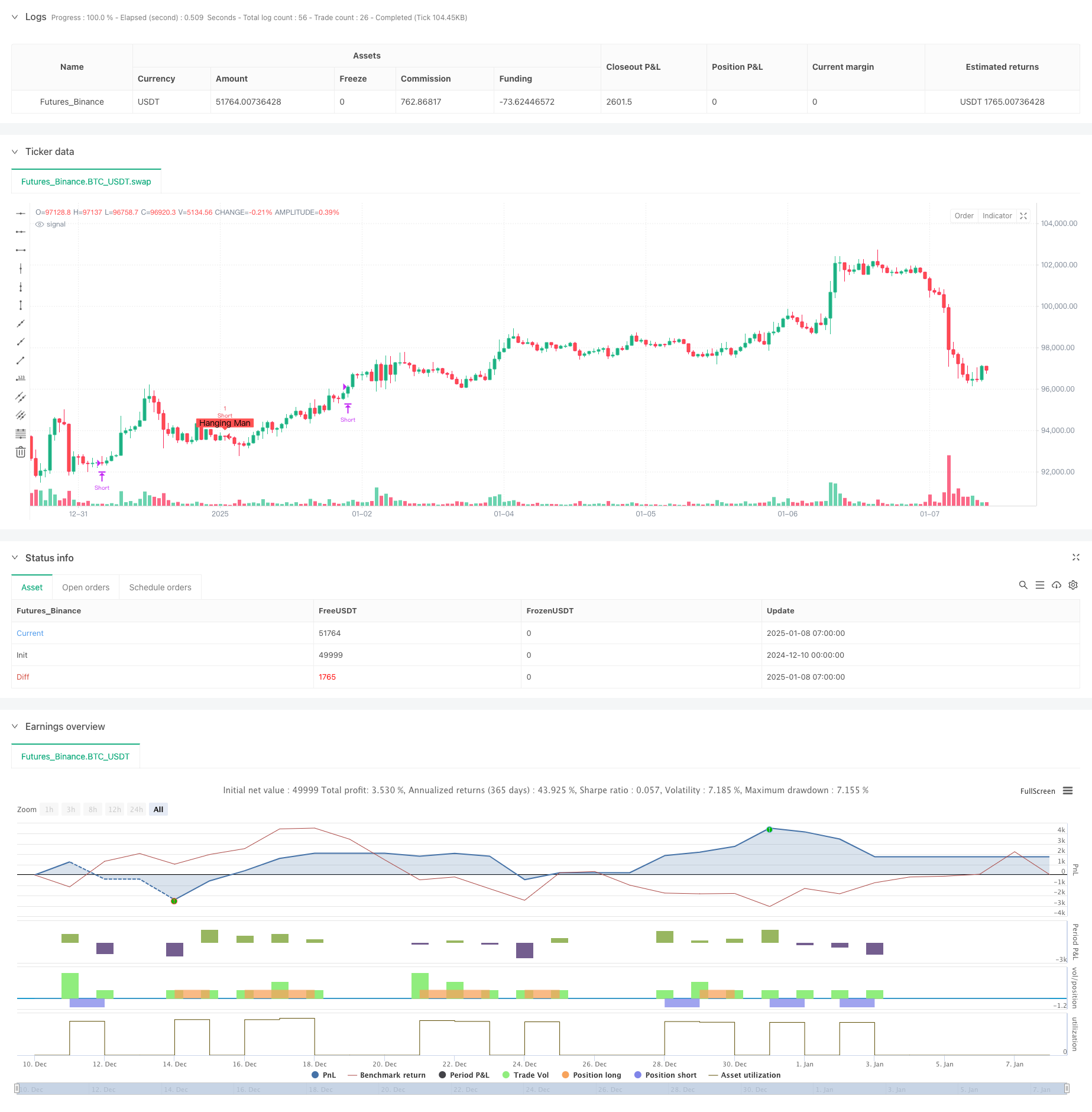

/*backtest

start: 2024-12-10 00:00:00

end: 2025-01-08 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("Hammer and Hanging Man Strategy", overlay=true)

// Input parameters

length = input.int(5, title="Minimum Candle Body Length (Multiplier)", minval=1)

shadowRatio = input.float(1, title="Lower Shadow to Candle Height Ratio", minval=1.0)

holdPeriods = input.int(26, title="Hold Periods (Bars)", minval=1) // Holding period in bars

// Function to calculate the absolute value

absValue(x) =>

x >= 0 ? x : -x

// Function to check if it is a Hammer

isHammer() =>

bodyLength = absValue(close - open)

candleHeight = high - low

lowerShadow = math.min(open, close) - low

upperShadow = high - math.max(open, close)

smallBody = bodyLength <= candleHeight / length

longLowerShadow = lowerShadow >= bodyLength * shadowRatio

shortUpperShadow = upperShadow <= bodyLength

smallBody and longLowerShadow and shortUpperShadow and close > open

// Function to check if it is a Hanging Man

isHangingMan() =>

bodyLength = absValue(close - open)

candleHeight = high - low

lowerShadow = math.min(open, close) - low

upperShadow = high - math.max(open, close)

smallBody = bodyLength <= candleHeight / length

longLowerShadow = lowerShadow >= bodyLength * shadowRatio

shortUpperShadow = upperShadow <= bodyLength

smallBody and longLowerShadow and shortUpperShadow and close < open

// Detect the candles

hammer = isHammer()

hangingMan = isHangingMan()

// Trading logic: Long on Hammer, Short on Hanging Man

if hammer

strategy.entry("Long", strategy.long) // Long entry on Hammer

if hangingMan

strategy.entry("Short", strategy.short) // Short entry on Hanging Man

// Exit after X bars

if strategy.position_size > 0 and bar_index - strategy.opentrades.entry_bar_index(0) >= holdPeriods

strategy.close("Long")

if strategy.position_size < 0 and bar_index - strategy.opentrades.entry_bar_index(0) >= holdPeriods

strategy.close("Short")

// Visualization of signals

plotshape(hammer, title="Hammer", location=location.belowbar, color=color.green, style=shape.labelup, text="Hammer")

plotshape(hangingMan, title="Hanging Man", location=location.abovebar, color=color.red, style=shape.labeldown, text="Hanging Man")