Overview

This strategy is a trend following system based on the Tillson T3 indicator and Twin Optimized Trend Tracker (TOTT). It optimizes trade signal generation by incorporating the Williams %R momentum oscillator. The strategy employs separate buy and sell parameter settings, enabling flexible sensitivity adjustment for different market conditions.

Strategy Principles

The strategy consists of three core components: 1. Tillson T3 Indicator - An optimized variant of the Exponential Moving Average (EMA) that produces a smoother trend line through multiple weighted EMA calculations. 2. Twin Optimized Trend Tracker (TOTT) - An adaptive trend following tool that adjusts based on price action and volatility coefficient, calculating upper and lower bands for buy and sell conditions. 3. Williams %R Indicator - A momentum oscillator used to identify overbought and oversold conditions.

Signal generation logic: - Buy condition: When T3 line crosses above TOTT upper band and Williams %R is above -20 (oversold) - Sell condition: When T3 line crosses below TOTT lower band and Williams %R is above -70

Strategy Advantages

- Strong signal stability - Effectively reduces false breakout risks through T3’s multiple smoothing

- Good adaptability - Separate buy/sell parameters allow independent optimization for different market conditions

- Comprehensive risk control - Integrates Williams %R as secondary confirmation

- Clear visualization - Provides comprehensive chart visualization support

Strategy Risks

- Trend reversal lag - T3’s multiple smoothing may cause signal delays

- Unsuitable for ranging markets - May generate excessive signals during consolidation

- High parameter sensitivity - Requires frequent adjustment for different market environments

Risk control suggestions: - Implement stop-loss mechanisms - Set trading volume limits - Add trend confirmation filters

Optimization Directions

- Dynamic parameter optimization - Develop adaptive parameter adjustment mechanisms

- Enhanced market environment recognition - Introduce trend strength indicators

- Improved risk management - Add dynamic stop-loss and take-profit

- Enhanced signal filtering - Integrate additional technical indicators

Summary

This is a well-structured trend following strategy with clear logic. Through the combination of T3 indicator and TOTT, coupled with Williams %R filtering, it performs excellently in trending markets. While there is some inherent lag, the strategy shows good practical value and room for expansion through parameter optimization and risk management improvements.

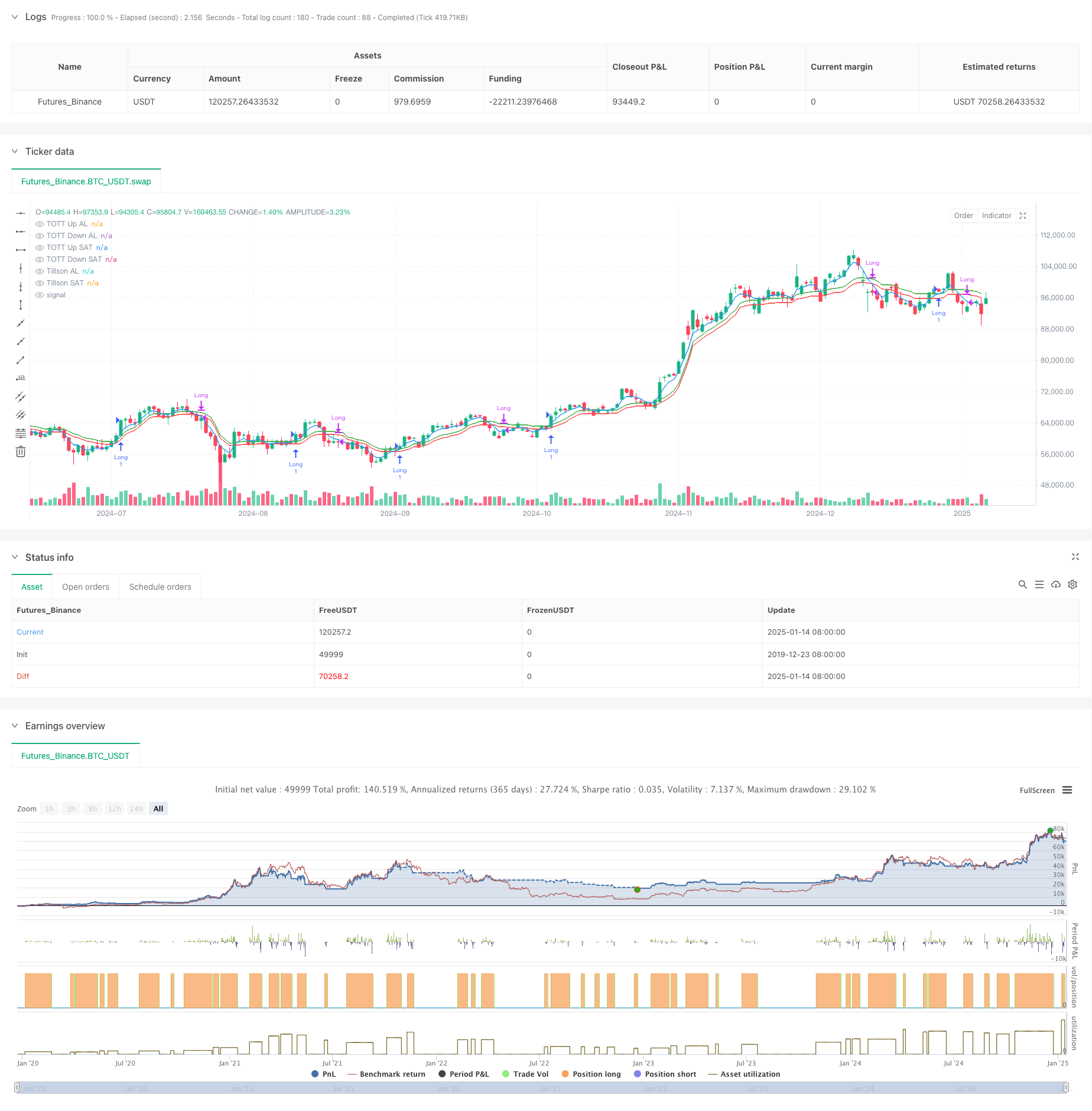

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("FON60DK by leventsah", overlay=true)

// Girdi AL

t3_length = input.int(5, title="Tillson Per AL", minval=1)

t3_opt = input.float(0.1, title="Tillson Opt AL", step=0.1, minval=0)

tott_length = input.int(5, title="TOTT Per AL", minval=1)

tott_opt = input.float(0.1, title="TOTT Opt AL", step=0.1, minval=0)

tott_coeff = input.float(0.006, title="TOTT Coeff AL", step=0.001, minval=0)

//GİRDİ SAT

t3_lengthSAT = input.int(5, title="Tillson Per SAT", minval=1)

t3_optSAT = input.float(0.1, title="Tillson Opt SAT", step=0.1, minval=0)

tott_lengthSAT = input.int(5, title="TOTT Per SAT", minval=1)

tott_opt_SAT = input.float(0.1, title="TOTT Opt SAT", step=0.1, minval=0)

tott_coeff_SAT = input.float(0.006, title="TOTT Coeff SAT", step=0.001, minval=0)

william_length = input.int(3, title="William %R Periyodu", minval=1)

// Tillson T3 AL

t3(src, length, opt) =>

k = 2 / (length + 1)

ema1 = ta.ema(src, length)

ema2 = ta.ema(ema1, length)

ema3 = ta.ema(ema2, length)

ema4 = ta.ema(ema3, length)

c1 = -opt * opt * opt

c2 = 3 * opt * opt + 3 * opt * opt * opt

c3 = -6 * opt * opt - 3 * opt - 3 * opt * opt * opt

c4 = 1 + 3 * opt + opt * opt * opt + 3 * opt * opt

t3_val = c1 * ema4 + c2 * ema3 + c3 * ema2 + c4 * ema1

t3_val

t3_value = t3(close, t3_length, t3_opt)

t3_valueSAT = t3(close, t3_lengthSAT, t3_optSAT)

// TOTT hesaplaması (Twin Optimized Trend Tracker)

Var_Func(src, length) =>

valpha = 2 / (length + 1)

vud1 = math.max(src - src[1], 0)

vdd1 = math.max(src[1] - src, 0)

vUD = math.sum(vud1, 9)

vDD = math.sum(vdd1, 9)

vCMO = (vUD - vDD) / (vUD + vDD)

var float VAR = na

VAR := valpha * math.abs(vCMO) * src + (1 - valpha * math.abs(vCMO)) * nz(VAR[1], src)

VAR

VAR = Var_Func(close, tott_length)

VAR_SAT = Var_Func(close, tott_lengthSAT)

//LONG

MAvg = VAR

fark = MAvg * tott_opt * 0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir == 1 ? longStop : shortStop

OTT = MAvg > MT ? MT * (200 + tott_opt) / 200 : MT * (200 - tott_opt) / 200

OTTup = OTT * (1 + tott_coeff)

OTTdn = OTT * (1 - tott_coeff)

//CLOSE

MAvgS = VAR_SAT

farkS = MAvgS * tott_opt_SAT * 0.01

longStopS = MAvgS - farkS

longStopPrevS = nz(longStopS[1], longStopS)

longStopS := MAvgS > longStopPrevS ? math.max(longStopS, longStopPrevS) : longStopS

shortStopS = MAvgS + farkS

shortStopPrevS = nz(shortStopS[1], shortStopS)

shortStopS := MAvgS < shortStopPrevS ? math.min(shortStopS, shortStopPrevS) : shortStopS

dirS = 1

dirS := nz(dirS[1], dirS)

dirS := dirS == -1 and MAvgS > shortStopPrevS ? 1 : dirS == 1 and MAvgS < longStopPrevS ? -1 : dirS

MTS = dirS == 1 ? longStopS : shortStopS

OTTS = MAvgS > MTS ? MTS * (200 + tott_opt_SAT) / 200 : MTS * (200 - tott_opt_SAT) / 200

OTTupS = OTTS * (1 + tott_coeff_SAT)

OTTdnS = OTTS * (1 - tott_coeff_SAT)

// Calculation of Williams %R

williamsR = -100 * (ta.highest(high, william_length) - close) / (ta.highest(high, william_length) - ta.lowest(low, william_length))

// Alım koşulu

longCondition = (t3_value > OTTup) and (williamsR > -20)

// Short koşulu (long pozisyonunu kapatmak için)

shortCondition = (t3_valueSAT < OTTdnS) and (williamsR > -70)

// Alım pozisyonu açma

if (longCondition)

strategy.entry("Long", strategy.long)

// Short koşulu sağlandığında long pozisyonunu kapama

if (shortCondition)

strategy.close("Long")

// Alım pozisyonu boyunca barları yeşil yapma

barcolor(strategy.position_size > 0 ? color.green : na)

// Grafikte göstergeleri çizme

plot(t3_value, color=color.blue, linewidth=1, title="Tillson AL")

plot(OTTup, color=color.green, linewidth=1, title="TOTT Up AL")

plot(OTTdn, color=color.red, linewidth=1, title="TOTT Down AL")

// Grafikte göstergeleri çizme

plot(t3_valueSAT, color=color.blue, linewidth=1, title="Tillson SAT")

plot(OTTupS, color=color.green, linewidth=1, title="TOTT Up SAT")

plot(OTTdnS, color=color.red, linewidth=1, title="TOTT Down SAT")