Overview

This strategy is a machine learning-based adaptive SuperTrend trading system that enhances the reliability of the traditional SuperTrend indicator by integrating volatility clustering, adaptive ATR trend detection, and structured entry/exit mechanisms. The core concept lies in classifying market volatility through machine learning methods, executing trend-following trades in suitable market conditions, while employing dynamic stop-loss and take-profit levels for risk control.

Strategy Principles

The strategy consists of three key components: 1) Adaptive SuperTrend calculation based on ATR for determining trend direction and turning points; 2) K-means-based volatility clustering that categorizes market states into high, medium, and low volatility environments; 3) Differentiated trading rules based on volatility environments. It seeks trending opportunities in low volatility environments while maintaining caution in high volatility conditions. The system captures trend reversal signals using ta.crossunder and ta.crossover functions, combined with price position relative to the SuperTrend line.

Strategy Advantages

- Strong adaptability: Dynamically adjusts market volatility assessment through machine learning methods to adapt to different market environments.

- Comprehensive risk control: Dynamic stop-loss and take-profit mechanism based on ATR automatically adjusts risk control parameters according to market volatility.

- False signal filtering: Effectively filters out false signals during high volatility periods through volatility clustering.

- Wide application range: Strategy can be applied to multiple markets including forex, cryptocurrency, stocks, and commodities.

- Multi-timeframe compatibility: Works well across different timeframes from 15-minute to monthly charts.

Strategy Risks

- Parameter sensitivity: Selection of ATR length, SuperTrend factor, and other parameters significantly affects strategy performance.

- Trend reversal risk: May experience significant drawdowns during sudden trend reversals.

- Market environment dependency: May generate frequent trades and accumulate trading costs in ranging markets.

- Computational complexity: Machine learning components increase strategy computational complexity, potentially affecting real-time execution efficiency.

Strategy Optimization Directions

- Optimize volatility clustering algorithm: Consider using more advanced clustering methods like DBSCAN or GMM to improve market state classification accuracy.

- Incorporate multiple timeframe analysis: Combine longer-term trend analysis to improve trade direction accuracy.

- Dynamic parameter adjustment: Develop adaptive parameter adjustment mechanisms to automatically optimize ATR length and SuperTrend factor based on market performance.

- Add market sentiment indicators: Integrate market sentiment indicators based on volume and price momentum to improve signal quality.

- Enhance money management: Introduce more sophisticated position sizing algorithms to optimize capital utilization efficiency.

Summary

This strategy creates an intelligent trend-following system by combining machine learning techniques with traditional technical analysis methods. Its core advantages lie in its adaptability and risk control capabilities, achieving intelligent market state identification through volatility clustering. While risks such as parameter sensitivity exist, continuous optimization and refinement can help maintain stable performance across various market environments. Traders are advised to thoroughly test parameter sensitivity and optimize based on specific market characteristics when implementing the strategy in live trading.

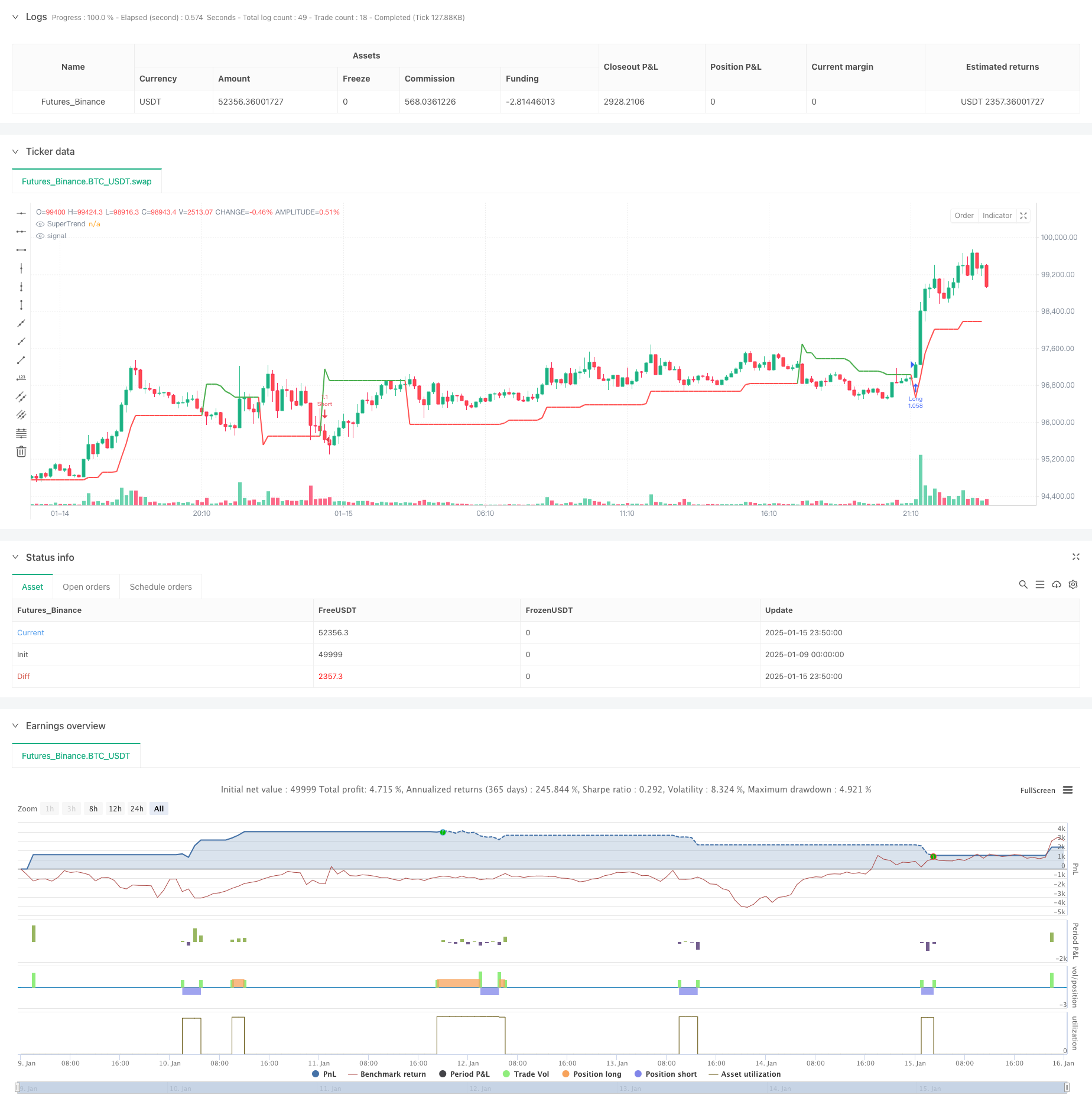

/*backtest

start: 2025-01-09 00:00:00

end: 2025-01-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Adaptive SuperTrend Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Import Indicator Components

atr_len = input.int(10, "ATR Length", group="SuperTrend Settings")

fact = input.float(3, "SuperTrend Factor", group="SuperTrend Settings")

training_data_period = input.int(100, "Training Data Length", group="K-Means Settings")

// Volatility Clustering

volatility = ta.atr(atr_len)

upper = ta.highest(volatility, training_data_period)

lower = ta.lowest(volatility, training_data_period)

high_volatility = lower + (upper-lower) * 0.75

medium_volatility = lower + (upper-lower) * 0.5

low_volatility = lower + (upper-lower) * 0.25

cluster = volatility >= high_volatility ? 0 : volatility >= medium_volatility ? 1 : 2

// SuperTrend Calculation

pine_supertrend(factor, atr) =>

src = hl2

upperBand = src + factor * atr

lowerBand = src - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

lowerBand := lowerBand > prevLowerBand or close[1] < prevLowerBand ? lowerBand : prevLowerBand

upperBand := upperBand < prevUpperBand or close[1] > prevUpperBand ? upperBand : prevUpperBand

int _direction = na

float superTrend = na

prevSuperTrend = superTrend[1]

if na(atr[1])

_direction := 1

else if prevSuperTrend == prevUpperBand

_direction := close > upperBand ? -1 : 1

else

_direction := close < lowerBand ? 1 : -1

superTrend := _direction == -1 ? lowerBand : upperBand

[superTrend, _direction]

[ST, dir] = pine_supertrend(fact, volatility)

// Entry Conditions

longEntry = ta.crossunder(dir, 0) and cluster > 1 and close > ST

shortEntry = ta.crossover(dir, 0) and cluster == 0 and close < ST

// Stop Loss & Take Profit

atr_mult = input.float(2, "ATR Multiplier for SL/TP", group="Risk Management")

sl = atr_mult * ta.atr(atr_len)

longStopLoss = close - sl

longTakeProfit = close + (sl * 1.5)

shortStopLoss = close + sl

shortTakeProfit = close - (sl * 1.5)

// Execute Trades

if longEntry

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

if shortEntry

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// Plot SuperTrend

plot(ST, title="SuperTrend", color=dir > 0 ? color.green : color.red, linewidth=2)

// Alerts

alertcondition(longEntry, title="Long Entry Signal", message="Buy Signal - Trend Shift Up")

alertcondition(shortEntry, title="Short Entry Signal", message="Sell Signal - Trend Shift Down")