Overview

This strategy is a trend following trading system that combines the Coral Trend indicator with the Donchian Channel. By precisely capturing market momentum and providing multiple confirmations of trend breakouts, it effectively filters out false signals in oscillating markets and improves trading accuracy. The strategy employs adaptive moving average techniques that can dynamically adjust parameters to maintain stable performance across different market conditions.

Strategy Principles

The core logic is built on the synergistic effect of two main indicators: 1. Coral Trend Indicator: Calculates a smoothed value of (high + low + close)/3 and compares it with the current closing price to determine trend direction. 2. Donchian Channel: Determines whether price breaks key levels by calculating the highest and lowest prices within a user-defined period.

The system generates long signals when both indicators confirm an uptrend (coralTrendVal == 1 and donchianTrendVal == 1), and short signals when both confirm a downtrend (coralTrendVal == -1 and donchianTrendVal == -1). The strategy uses a state machine (trendState) to track the current trend state and avoid duplicate signals.

Strategy Advantages

- Multiple Confirmation Mechanism: Combining two independent trend indicators significantly reduces the probability of false signals.

- Strong Adaptability: The smoothing calculation method of the Coral Trend indicator enables it to adapt to different market volatility states.

- Parameter Adjustability: The strategy offers flexible parameter settings that can be optimized for different trading instruments and timeframes.

- Trend Persistence Recognition: The system effectively identifies strong trend conditions and maintains positions during trends.

- Clear Visual Feedback: Traders can intuitively understand market conditions through chart markers and trend lines.

Strategy Risks

- Trend Reversal Risk: May experience lag at trend turning points, leading to drawdowns. Solution: Add volatility filters to reduce positions when market volatility increases.

- Sideways Market Performance: May generate excessive trading signals in range-bound markets. Solution: Add trend strength confirmation indicators to open positions only when trends are clear.

- Parameter Sensitivity: Different parameter settings may lead to significant variations in strategy performance. Solution: Recommend finding optimal parameter combinations through historical data backtesting.

Strategy Optimization Directions

- Dynamic Parameter Adjustment: Automatically adjust Donchian Channel period and Coral Trend smoothing period based on market volatility.

- Add Stop Loss Mechanism: Recommend adding dynamic ATR-based stop losses to improve risk control.

- Add Volume Confirmation: Include volume filtering conditions when generating signals to increase trend confirmation reliability.

- Optimize Position Management: Implement a dynamic position management system based on trend strength.

- Market Environment Classification: Add market environment recognition module to use different parameter combinations in different market states.

Summary

This strategy achieves a robust trend following system through multiple trend confirmation mechanisms and flexible parameter settings. Its adaptive features and clear signal logic make it suitable for various trading timeframes and market environments. Through the suggested optimization directions, there is room for further improvement in strategy performance. When applying to live trading, it is recommended to incorporate risk management measures and optimize parameters according to the characteristics of specific trading instruments.

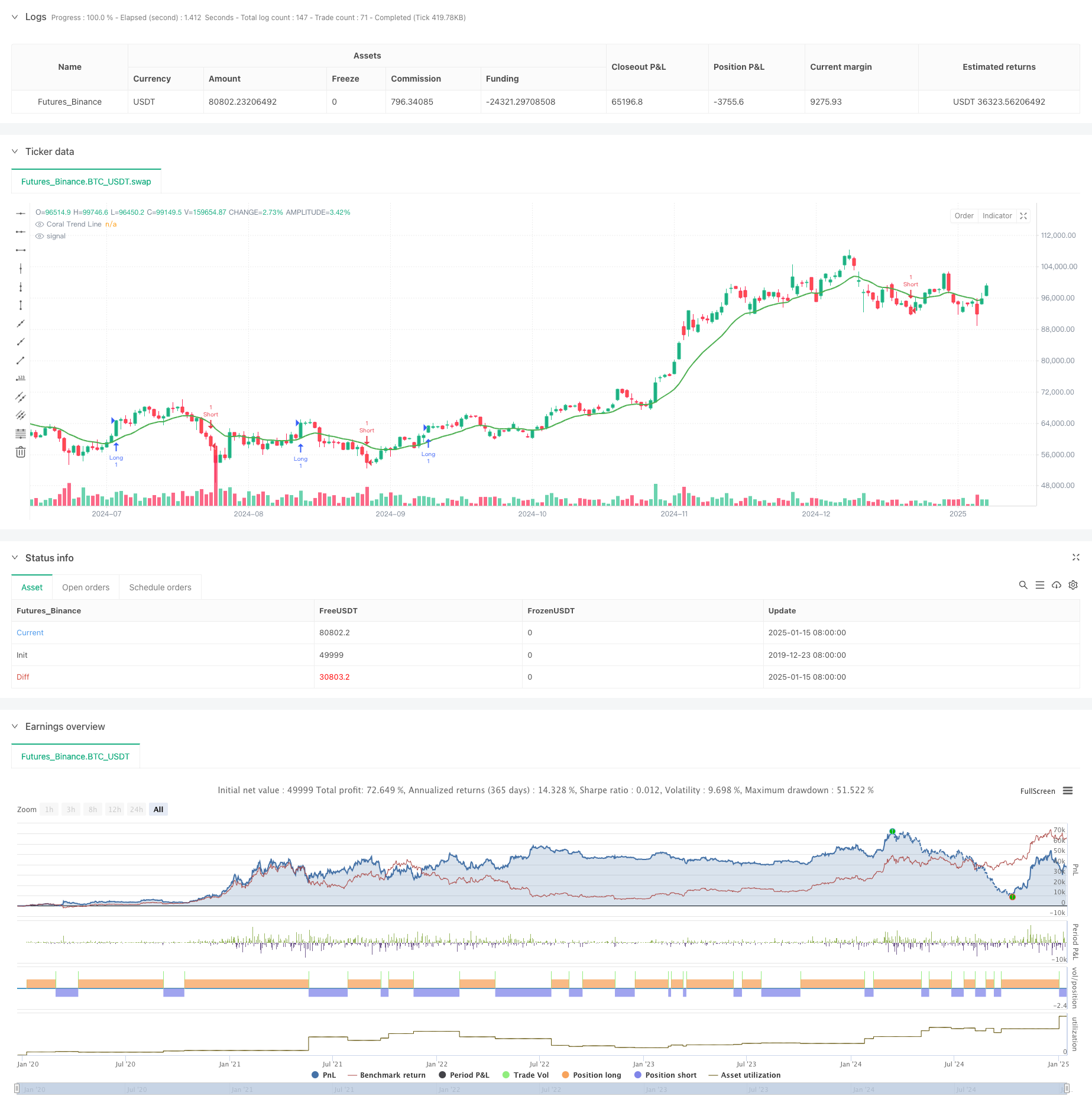

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-16 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Coral Tides Strategy", shorttitle="CoralTidesStrat", overlay=true)

// === Inputs ===

dlen = input.int(defval=20, title="Donchian Channel Period", minval=10)

coralPeriod = input.int(defval=14, title="Coral Trend Period")

// === Functions ===

// Coral Trend Calculation

coralTrend(period) =>

smooth = (high + low + close) / 3

coral = ta.ema(smooth, period)

trend = 0

trend := close > coral ? 1 : close < coral ? -1 : trend[1]

[trend, coral]

// Donchian Trend Calculation

donchianTrend(len) =>

hh = ta.highest(high, len)

ll = ta.lowest(low, len)

trend = 0

trend := close > hh[1] ? 1 : close < ll[1] ? -1 : trend[1]

trend

// === Trend Calculation ===

[coralTrendVal, coralLine] = coralTrend(coralPeriod)

donchianTrendVal = donchianTrend(dlen)

// === Signal Logic ===

var int trendState = 0

buySignal = false

sellSignal = false

if (coralTrendVal == 1 and donchianTrendVal == 1 and trendState != 1)

buySignal := true

sellSignal := false

trendState := 1

else if (coralTrendVal == -1 and donchianTrendVal == -1 and trendState != -1)

sellSignal := true

buySignal := false

trendState := -1

else

buySignal := false

sellSignal := false

// === Strategy Execution ===

// Entry Signals

if (buySignal)

strategy.entry("Long", strategy.long)

if (sellSignal)

strategy.entry("Short", strategy.short)

// === Plots ===

// Coral Trend Line

plot(coralLine, color=color.green, linewidth=2, title="Coral Trend Line")

// Buy/Sell Signal Labels

if buySignal

label.new(bar_index, low, "BUY", color=color.green, textcolor=color.white, style=label.style_label_down, size=size.normal)

if sellSignal

label.new(bar_index, high, "SELL", color=color.red, textcolor=color.white, style=label.style_label_up, size=size.normal)