Overview

This strategy is a trend-following trading system that combines Moving Average (SMA), Bollinger Bands (BB), and candlestick patterns. It primarily identifies trading signals through engulfing patterns, confirmed by the 200-day moving average and Bollinger Bands middle line, while implementing a 1:2 risk-reward ratio for risk management.

Strategy Principles

The core logic relies on the combination of multiple technical indicators to confirm trading signals. Specifically: 1. Uses 200-day SMA to determine the overall trend direction 2. Employs Bollinger Bands middle line as secondary trend confirmation 3. Identifies specific entry points through engulfing patterns 4. Implements a fixed 1:2 risk-reward ratio for stop-loss and take-profit levels

The system enters long positions when bullish engulfing patterns appear above both the 200-day SMA and Bollinger Bands middle line. Conversely, it enters short positions when bearish engulfing patterns form below these levels.

Strategy Advantages

- Multiple technical indicators increase signal reliability

- Uses classic trend-following indicators that are easy to understand and implement

- Fixed risk-reward ratio promotes long-term profitable trading

- Clear entry and exit rules minimize subjective judgment

- Combines trend and momentum analysis for improved success rate

Strategy Risks

- May generate frequent false signals in ranging markets

- SMA and Bollinger Bands are lagging indicators, potentially missing opportunities

- Fixed risk-reward ratio might not suit all market conditions

- Stop-loss levels may be wide in highly volatile markets

- Requires a large sample size to demonstrate strategy effectiveness

Strategy Optimization

- Consider implementing dynamic risk-reward ratios based on market volatility

- Add volume indicators for additional confirmation

- Incorporate additional technical indicators to filter false signals

- Optimize entry timing through multi-timeframe signal coordination

- Introduce adaptive indicator parameters to improve strategy flexibility

Summary

This is a well-structured trend-following strategy with clear logic. The combination of moving averages, Bollinger Bands, and engulfing patterns ensures reliable trading signals while providing explicit risk management methods. Despite some inherent lag, it represents a highly operable trading system with controllable risk.

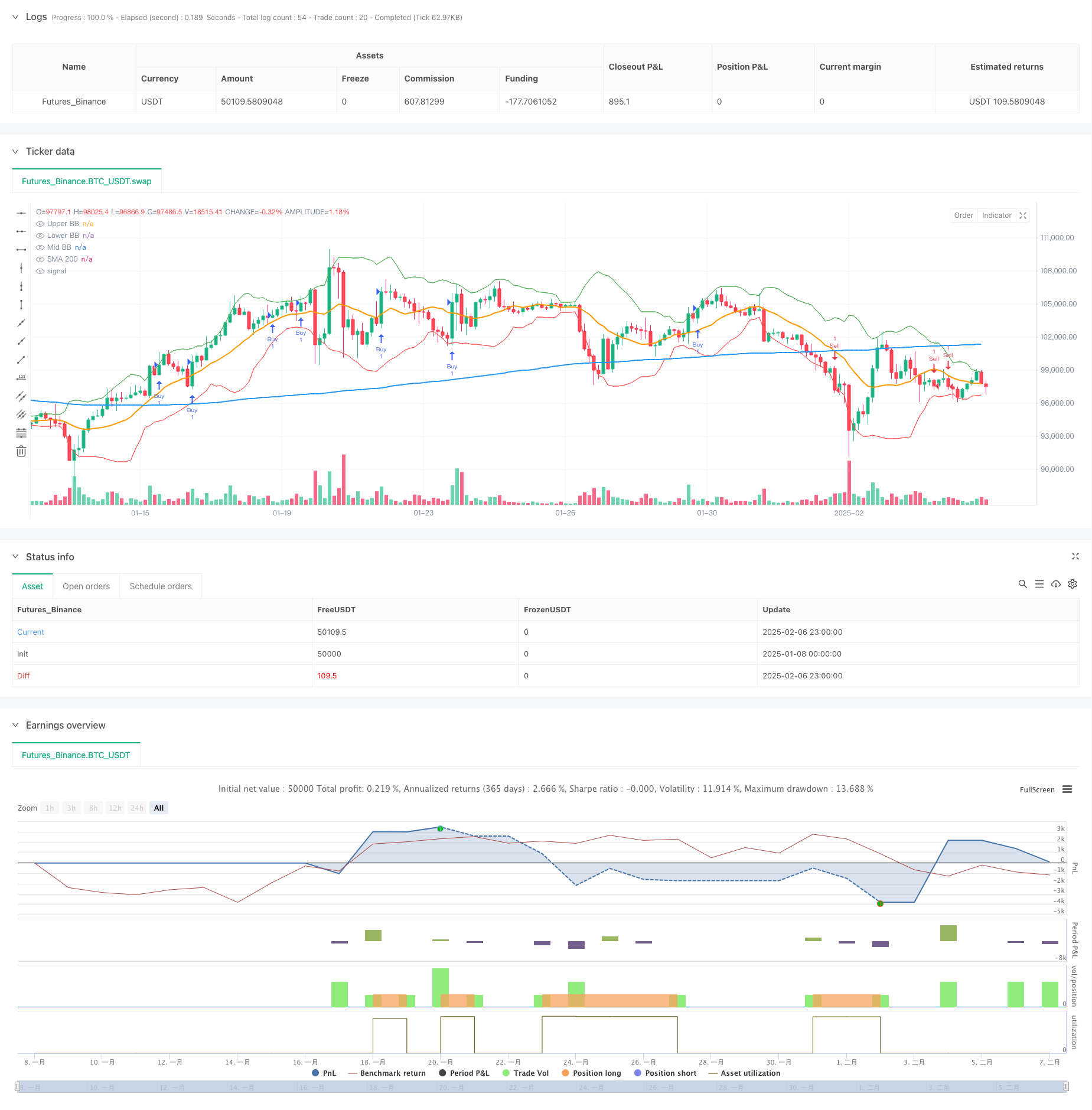

/*backtest

start: 2025-01-08 00:00:00

end: 2025-02-07 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ardhankurniawan

//@version=5

//@version=5

strategy("Engulfing Candles Strategy with Risk-Reward 1:2 by ardhankurniawan", overlay = true)

// Menyimpan harga pembukaan dan penutupan dari candle sebelumnya dan saat ini

openBarPrevious = open[1]

closeBarPrevious = close[1]

openBarCurrent = open

closeBarCurrent = close

// Menghitung SMA 200

sma200 = ta.sma(close, 200)

// Menghitung Bollinger Bands (BB) dengan periode 14 dan standar deviasi 2

length = 14

src = close

mult = 2.0

basis = ta.sma(src, length) // Mid Bollinger Band (SMA)

dev = mult * ta.stdev(src, length) // Standard deviation

upperBB = basis + dev

lowerBB = basis - dev

midBB = basis // Mid Bollinger Band adalah SMA

// Kondisi Bullish Engulfing: harga pembukaan saat ini lebih rendah dari harga penutupan sebelumnya,

// harga pembukaan saat ini lebih rendah dari harga pembukaan sebelumnya, dan harga penutupan saat ini lebih tinggi dari harga pembukaan sebelumnya.

bullishEngulfing = (openBarCurrent <= closeBarPrevious) and (openBarCurrent < openBarPrevious) and (closeBarCurrent > openBarPrevious)

// Kondisi Bearish Engulfing: harga pembukaan saat ini lebih tinggi dari harga penutupan sebelumnya,

// harga pembukaan saat ini lebih tinggi dari harga pembukaan sebelumnya, dan harga penutupan saat ini lebih rendah dari harga pembukaan sebelumnya.

bearishEngulfing = (openBarCurrent >= closeBarPrevious) and (openBarCurrent > openBarPrevious) and (closeBarCurrent < openBarPrevious)

// Kondisi untuk membeli (buy) hanya jika Bullish Engulfing terjadi di atas SMA 200 dan Mid Bollinger Band

buyCondition = bullishEngulfing and close > sma200 and close > midBB

// Kondisi untuk menjual (sell) hanya jika Bearish Engulfing terjadi di bawah SMA 200 dan Mid Bollinger Band

sellCondition = bearishEngulfing and close < sma200 and close < midBB

// Menghitung Stop Loss dan Take Profit dengan Risk-Reward Ratio 1:2

longSL = low // SL di low candle bullish engulfing (prev low)

longRR = (close - low) * 2 // TP dengan Risk-Reward 1:2

longTP = close + longRR // TP untuk posisi long

shortSL = high // SL di high candle bearish engulfing (prev high)

shortRR = (high - close) * 2 // TP dengan Risk-Reward 1:2

shortTP = close - shortRR // TP untuk posisi short

// Strategi Buy ketika kondisi beli terpenuhi dengan SL dan TP

if buyCondition

strategy.entry("Buy", strategy.long) // Perintah beli ketika Bullish Engulfing terjadi di atas SMA 200 dan Mid Bollinger Band

strategy.exit("Sell Exit", from_entry = "Buy", stop = longSL, limit = longTP) // SL dan TP untuk posisi long

// Strategi Sell ketika kondisi jual terpenuhi dengan SL dan TP

if sellCondition

strategy.entry("Sell", strategy.short) // Perintah jual ketika Bearish Engulfing terjadi di bawah SMA 200 dan Mid Bollinger Band

strategy.exit("Buy Exit", from_entry = "Sell", stop = shortSL, limit = shortTP) // SL dan TP untuk posisi short

// Menambahkan kondisi untuk keluar dari posisi

if sellCondition

strategy.close("Buy") // Menutup posisi beli jika Bearish Engulfing terjadi di bawah SMA 200 dan Mid Bollinger Band

if buyCondition

strategy.close("Sell") // Menutup posisi jual jika Bullish Engulfing terjadi di atas SMA 200 dan Mid Bollinger Band

// Plotting SMA 200 dan Bollinger Bands

plot(sma200, color = color.blue, linewidth = 2, title = "SMA 200")

plot(upperBB, color = color.green, linewidth = 1, title = "Upper BB")

plot(lowerBB, color = color.red, linewidth = 1, title = "Lower BB")

plot(midBB, color = color.orange, linewidth = 2, title = "Mid BB")

// Alert condition

alertcondition(buyCondition, title = "Bullish Engulfing Above SMA 200 and Mid BB", message = "[CurrencyPair] [TimeFrame], Bullish Engulfing above SMA 200 and Mid Bollinger Band")

alertcondition(sellCondition, title = "Bearish Engulfing Below SMA 200 and Mid BB", message = "[CurrencyPair] [TimeFrame], Bearish Engulfing below SMA 200 and Mid Bollinger Band")