Overview

This strategy is an advanced quantitative trading system based on Bollinger Bands with dynamic stop-loss and take-profit mechanisms. The core idea is to capture market momentum through breakouts of Bollinger Bands while managing risk using pip-based SL/TP levels. The strategy is applicable to various trading instruments and can be adapted to different market conditions through parameter optimization.

Strategy Principles

The strategy is based on the following core principles: 1. Uses a 20-period Simple Moving Average (SMA) as the middle band, with 2 standard deviations for upper and lower bands. 2. Generates long signals when price breaks above the lower band and closes above it; generates short signals when price breaks below the upper band and closes below it. 3. Implements dynamic SL/TP based on pips, with default settings of 10 pips for stop-loss and 20 pips for take-profit. 4. Adapts to different trading instruments through the pipValue parameter, making the strategy universal.

Strategy Advantages

- Robust signal generation mechanism with confirmation through closing prices to reduce false signals.

- Comprehensive risk management system using dynamic SL/TP to protect profits and limit losses.

- Highly adjustable parameters to adapt to different market conditions.

- Complete visualization features for easy monitoring and analysis.

- Considers real trading costs with slippage parameters for more realistic backtesting.

Strategy Risks

- May generate frequent false breakout signals in ranging markets.

- Fixed pip-based SL/TP might not suit markets with varying volatility.

- Improper parameter settings may lead to overtrading or missing important opportunities. Solutions:

- Add trend filters to reduce false signals in ranging markets

- Implement ATR-based dynamic SL/TP

- Optimize parameters through backtesting

Optimization Directions

- Introduce volatility indicators (like ATR) to dynamically adjust SL/TP distances.

- Add trend confirmation indicators to filter trading signals.

- Incorporate volume analysis to support entry decisions.

- Implement position sizing system to optimize capital efficiency.

- Develop adaptive parameter system to adjust to changing market conditions.

Summary

This is a well-designed quantitative trading strategy that captures market opportunities through Bollinger Bands breakouts with scientific risk management. The strategy offers good scalability and adaptability, with potential for further performance enhancement through suggested optimizations. It is suitable for investors interested in medium to long-term trend trading.

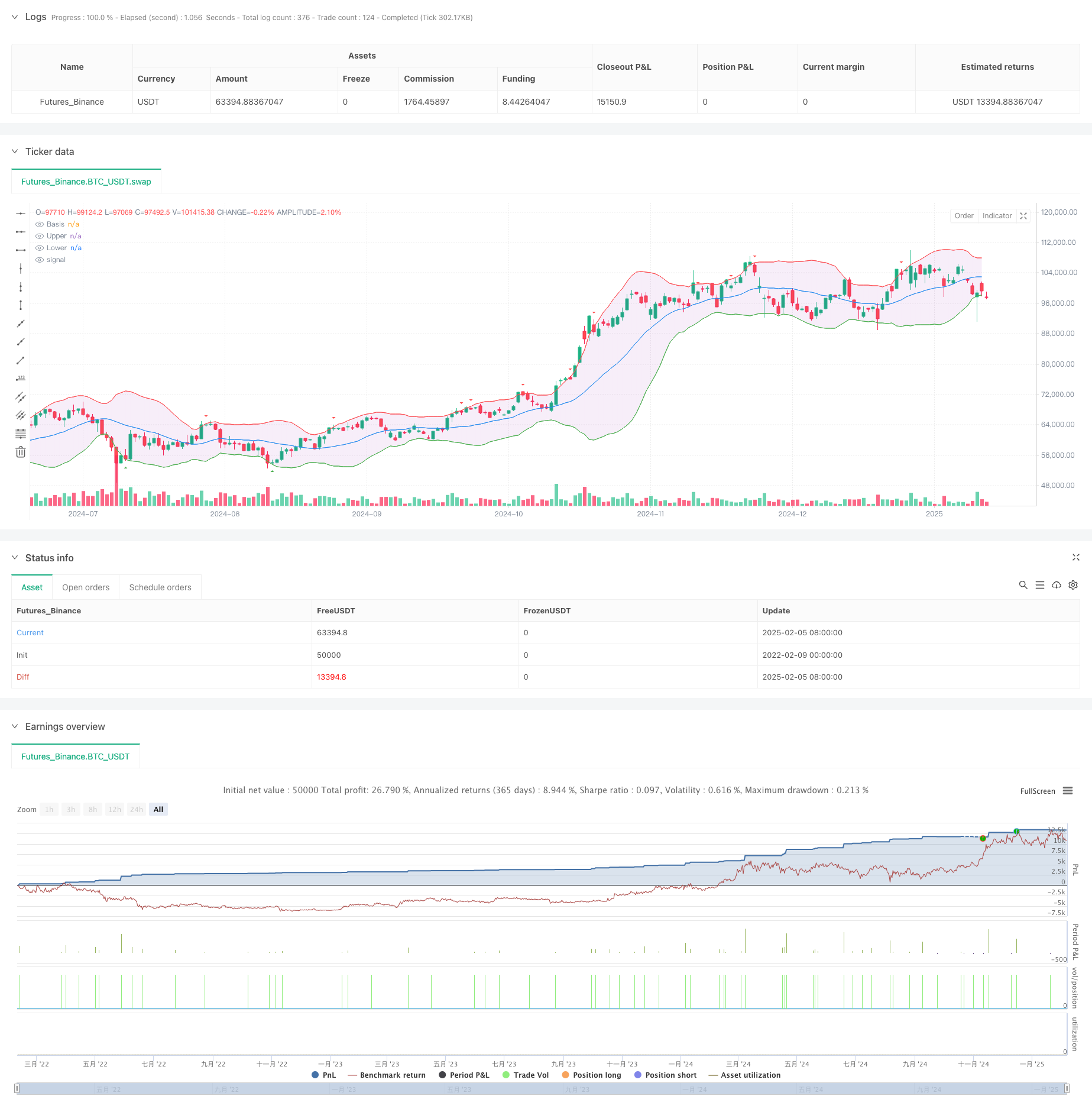

/*backtest

start: 2022-02-09 00:00:00

end: 2025-02-06 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced Bollinger Bands Strategy with SL/TP", overlay=true,

slippage=2)

// 入力パラメータの改善

length = input.int(20, "SMA Length", minval=1)

mult = input.float(2.0, "Standard Deviation Multiplier", minval=0.001, maxval=50)

enableLong = input.bool(true, "Enable Long Positions")

enableShort = input.bool(true, "Enable Short Positions")

pipValue = input.float(0.0001, "Pip Value", step=0.00001)

slPips = input.float(10, "Stop Loss (Pips)", minval=0)

tpPips = input.float(20, "Take Profit (Pips)", minval=0)

showBands = input.bool(true, "Show Bollinger Bands")

showSignals = input.bool(true, "Show Entry Signals")

// ボリンジャーバンド計算

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// 可視化

plot(showBands ? basis : na, "Basis", color=color.blue)

u = plot(showBands ? upper : na, "Upper", color=color.red)

l = plot(showBands ? lower : na, "Lower", color=color.green)

fill(u, l, color=color.new(color.purple, 90))

// エントリー条件の改善

longCondition = ta.crossover(close, lower) and close > lower and enableLong

shortCondition = ta.crossunder(close, upper) and close < upper and enableShort

// ポジション管理

calcSlPrice(price, isLong) => isLong ? price - slPips * pipValue : price + slPips * pipValue

calcTpPrice(price, isLong) => isLong ? price + tpPips * pipValue : price - tpPips * pipValue

// エントリー&エグジットロジック

if longCondition

strategy.entry("Long", strategy.long, limit=lower)

strategy.exit("Long Exit", "Long",

stop=calcSlPrice(lower, true),

limit=calcTpPrice(lower, true))

if shortCondition

strategy.entry("Short", strategy.short, limit=upper)

strategy.exit("Short Exit", "Short",

stop=calcSlPrice(upper, false),

limit=calcTpPrice(upper, false))

// シグナル可視化

plotshape(showSignals and longCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(showSignals and shortCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)