Overview

This strategy is a multi-level trading system based on market exhaustion analysis, designed to identify potential market turning points through in-depth price dynamics analysis. It incorporates dynamic risk management mechanisms, including money management, stop-loss optimization, and drawdown control, forming a comprehensive trading decision framework.

Strategy Principles

The core mechanism analyzes market exhaustion through continuous price movement monitoring. Specifically: 1. Determines trend direction by comparing current closing price with the 4th previous candle 2. Implements three different signal strength levels (9/12/14) 3. Accumulates signal counts when price moves consistently in one direction 4. Triggers corresponding level signals when preset thresholds are reached 5. Integrates ATR-based dynamic stop-loss and position sizing based on risk-reward ratio

Strategy Advantages

- Multi-level signal system provides varied trading opportunity identification

- Protects capital through money management and risk control mechanisms

- Uses ATR-based dynamic stop-loss for better market adaptation

- Incorporates trailing stop mechanism for better profit protection

- Implements maximum drawdown protection to prevent excessive losses

- System offers good extensibility and parameter optimization potential

Strategy Risks

- May generate false signals in ranging markets

- Fixed signal thresholds might not suit all market conditions

- Potential larger stops in quick reversal scenarios

- Requires significant parameter optimization work

- Money management system may limit profit potential in certain situations

Optimization Directions

- Introduce volatility filtering to adjust signal thresholds in different market conditions

- Add volume analysis dimension to improve signal reliability

- Develop adaptive parameter optimization system

- Incorporate additional market environment indicators

- Optimize money management system for greater flexibility

Summary

The strategy provides a systematic trading framework through multi-level exhaustion analysis and comprehensive risk management. While there are areas for optimization, the overall design is complete and practically applicable. It is recommended to use conservative money management in live trading while continuously optimizing parameters and improving the system.

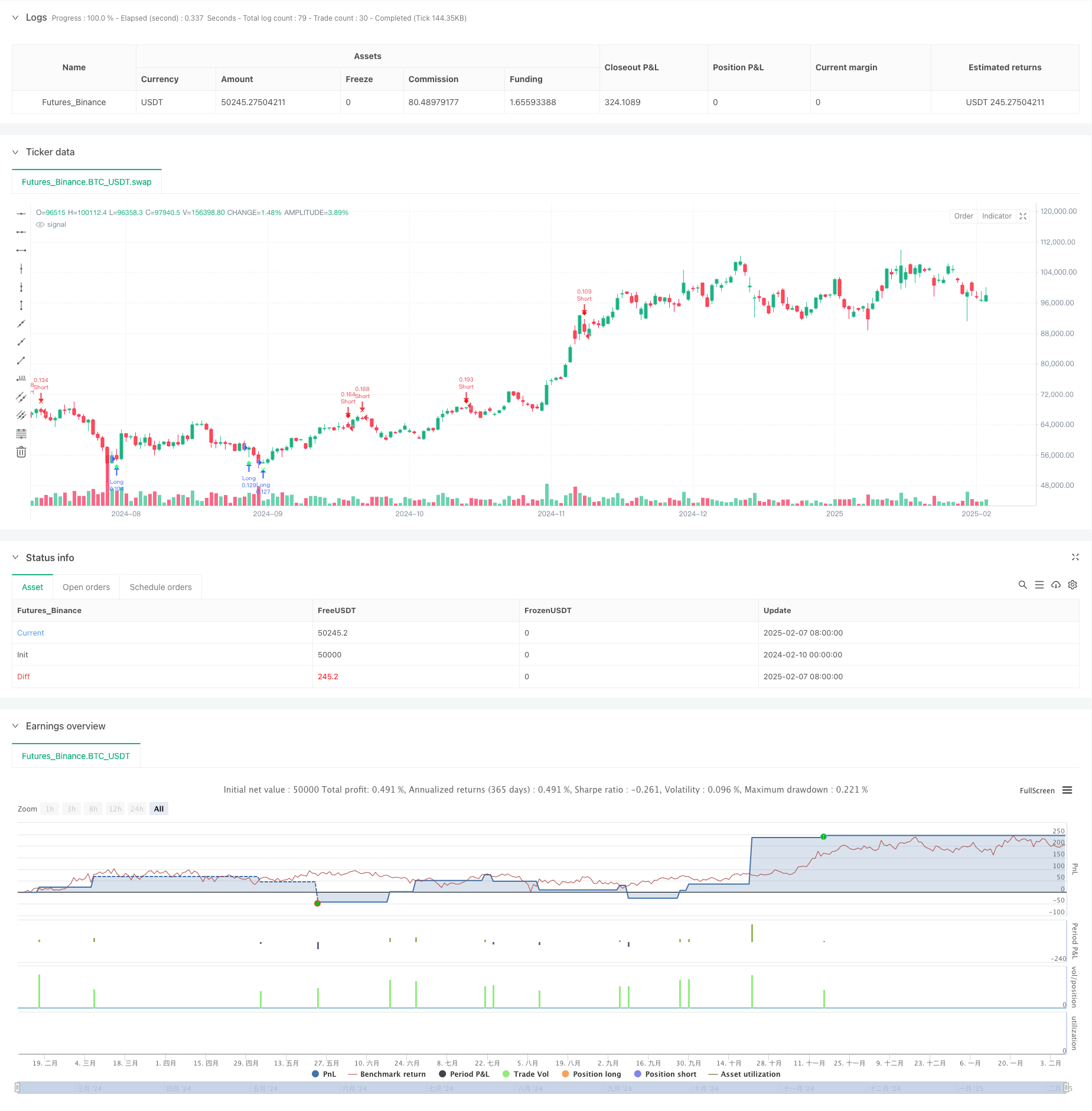

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(title="Improved Exhaustion Signal with Risk Management and Drawdown Control", shorttitle="Exhaustion Signal", overlay=true)

// ———————————————— INPUT SETTINGS ————————————————

showLevel1 = input.bool(true, 'Show Level 1 Signals')

showLevel2 = input.bool(true, 'Show Level 2 Signals')

showLevel3 = input.bool(true, 'Show Level 3 Signals')

// Thresholds for signal strength levels

level1 = 9

level2 = 12

level3 = 14

// Risk management inputs

riskPercentage = input.float(1.0, title="Risk Percentage per Trade", minval=0.1, maxval=5.0) // Risk per trade in percentage

riskRewardRatio = input.float(2.0, title="Risk-to-Reward Ratio", minval=1.0, maxval=5.0) // Reward-to-risk ratio

trailingStop = input.bool(true, title="Enable Trailing Stop") // Enable/Disable trailing stop

trailingStopDistance = input.int(50, title="Trailing Stop Distance (in points)", minval=1) // Distance for trailing stop

// Drawdown protection settings

maxDrawdown = input.float(10.0, title="Max Drawdown Percentage", minval=0.1, maxval=50.0) // Max allowable drawdown before stopping trading

// ———————————————— GLOBAL VARIABLES ————————————————

var int cycle = 0

var int bullishSignals = 0

var int bearishSignals = 0

var float equityHigh = na // Initialize as undefined

// Track equity drawdown

if (na(equityHigh) or strategy.equity > equityHigh)

equityHigh := strategy.equity

drawdownPercent = 100 * (equityHigh - strategy.equity) / equityHigh

// Stop trading if drawdown exceeds the limit

if drawdownPercent >= maxDrawdown

strategy.close_all()

// ———————————————— FUNCTION: RESET & IMMEDIATE RECHECK USING AN ARRAY RETURN ————————————————

f_resetAndRecheck(_bullish, _bearish, _cycle, _close, _close4) =>

newBullish = _bullish

newBearish = _bearish

newCycle = _cycle

// Reset cycle if necessary based on price action

newBullish := 0

newBearish := 0

newCycle := 0

if _close < _close4

newBullish := 1

newCycle := newBullish

else if _close > _close4

newBearish := 1

newCycle := newBearish

resultArray = array.new_int(3, 0)

array.set(resultArray, 0, newBullish)

array.set(resultArray, 1, newBearish)

array.set(resultArray, 2, newCycle)

resultArray

// ———————————————— EXHAUSTION LOGIC ————————————————

if cycle < 9

// Bullish cycle: close < close[4]

if close < close[4]

bullishSignals += 1

bearishSignals := 0

cycle := bullishSignals

// Bearish cycle: close > close[4]

else if close > close[4]

bearishSignals += 1

bullishSignals := 0

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

// ——— BULLISH checks ———

if bullishSignals > 0

if bullishSignals < (level3 - 1)

if close < close[3]

bullishSignals += 1

bearishSignals := 0

cycle := bullishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else if bullishSignals == (level3 - 1)

if close < close[2]

bullishSignals := level3

cycle := bullishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

// ——— BEARISH checks ———

else if bearishSignals > 0

if bearishSignals < (level3 - 1)

if close > close[3]

bearishSignals += 1

bullishSignals := 0

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else if bearishSignals == (level3 - 1)

if close > close[2]

bearishSignals := level3

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

// ———————————————— SIGNAL FLAGS ————————————————

bullishLevel1 = showLevel1 and (bullishSignals == level1)

bearishLevel1 = showLevel1 and (bearishSignals == level1)

bullishLevel2 = showLevel2 and (bullishSignals == level2)

bearishLevel2 = showLevel2 and (bearishSignals == level2)

bullishLevel3 = showLevel3 and (bullishSignals == level3)

bearishLevel3 = showLevel3 and (bearishSignals == level3)

// ———————————————— PLOT SIGNALS ————————————————

plotshape(bullishLevel1, style=shape.diamond, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 1 Bullish Signal")

plotshape(bearishLevel1, style=shape.diamond, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 1 Bearish Signal")

plotshape(bullishLevel2, style=shape.xcross, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 2 Bullish Signal")

plotshape(bearishLevel2, style=shape.xcross, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 2 Bearish Signal")

plotshape(bullishLevel3, style=shape.flag, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 3 Bullish Signal")

plotshape(bearishLevel3, style=shape.flag, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 3 Bearish Signal")

// ———————————————— RESET AFTER LEVEL 3 ————————————————

if bullishSignals == level3 or bearishSignals == level3

bullishSignals := 0

bearishSignals := 0

cycle := 0

// ———————————————— BACKTEST LOGIC ————————————————

// Set up basic long and short entry conditions based on signal levels

longCondition = bullishLevel1 or bullishLevel2 or bullishLevel3

shortCondition = bearishLevel1 or bearishLevel2 or bearishLevel3

// Calculate position size based on risk percentage

equity = strategy.equity

riskAmount = equity * riskPercentage / 100

atr = ta.atr(14)

stopLossLevel = atr * 1.5 // Using ATR for dynamic stop-loss

positionSize = riskAmount / stopLossLevel

// Initialize strategy logic

if longCondition

strategy.entry("Long", strategy.long, qty=positionSize)

if shortCondition

strategy.entry("Short", strategy.short, qty=positionSize)

// ———————————————— CONCRETE STOP LOSS AND TAKE PROFIT ————————————————

stopLoss = stopLossLevel

takeProfit = stopLoss * riskRewardRatio

// Apply stop loss and take profit to the strategy based on concrete price levels

strategy.exit("Exit Long", from_entry="Long", stop=close - stopLoss, limit=close + takeProfit)

strategy.exit("Exit Short", from_entry="Short", stop=close + stopLoss, limit=close - takeProfit)

// ———————————————— TRAILING STOP ————————————————

if trailingStop

strategy.exit("Exit Long Trailing", from_entry="Long", trail_price=close - trailingStopDistance, trail_offset=trailingStopDistance)

strategy.exit("Exit Short Trailing", from_entry="Short", trail_price=close + trailingStopDistance, trail_offset=trailingStopDistance)