Overview

This strategy is a dynamic trend following system that combines Exponential Moving Averages (EMA) with Relative Strength Index (RSI). It identifies trend direction through 9-period and 21-period EMA crossovers, using RSI as trend confirmation. The strategy includes a comprehensive money management system with dynamic stop-loss and profit target settings.

Strategy Principles

The core logic is based on several key elements: 1. Using short-term (9-period) and long-term (21-period) EMA crossovers to capture trend changes 2. Confirming trends with 14-period RSI, requiring RSI>50 for longs and RSI<50 for shorts 3. Implementing fixed-point stop-losses (default 30 points) with dynamic position sizing based on risk amount 4. Calculating profit targets dynamically using money management parameters 5. Displaying real-time entry markers, target prices, and stop-loss levels on the chart

Strategy Advantages

- Combines trend and momentum indicators for improved signal reliability

- Complete money management system adaptable to account size

- Clear visual feedback system including trade failure markers

- Fully customizable parameters to suit different trading styles

- Automated entry and exit execution reducing manual intervention

Strategy Risks

- EMA as a lagging indicator may generate delayed signals in volatile markets

- Frequent false breakout signals possible in ranging markets

- Fixed-point stop-losses may lack flexibility during volatility changes

- Careful parameter adjustment needed for different market conditions

- Potential slippage risks in low liquidity environments

Strategy Optimization Directions

- Introduce adaptive stop-loss mechanisms, such as ATR-based dynamic stops

- Add market volatility filters to adjust strategy parameters during high volatility

- Implement trading time filters to avoid unfavorable periods

- Develop smarter position sizing system considering market volatility

- Incorporate additional indicators to filter false signals

Summary

This strategy establishes a complete trend following system by combining EMA crossovers with RSI confirmation. Its main strength lies in the organic integration of technical analysis and risk management, offering good scalability and adaptability. While inherent risks exist, through continuous optimization and parameter adjustment, the strategy can provide traders with a robust trading framework.

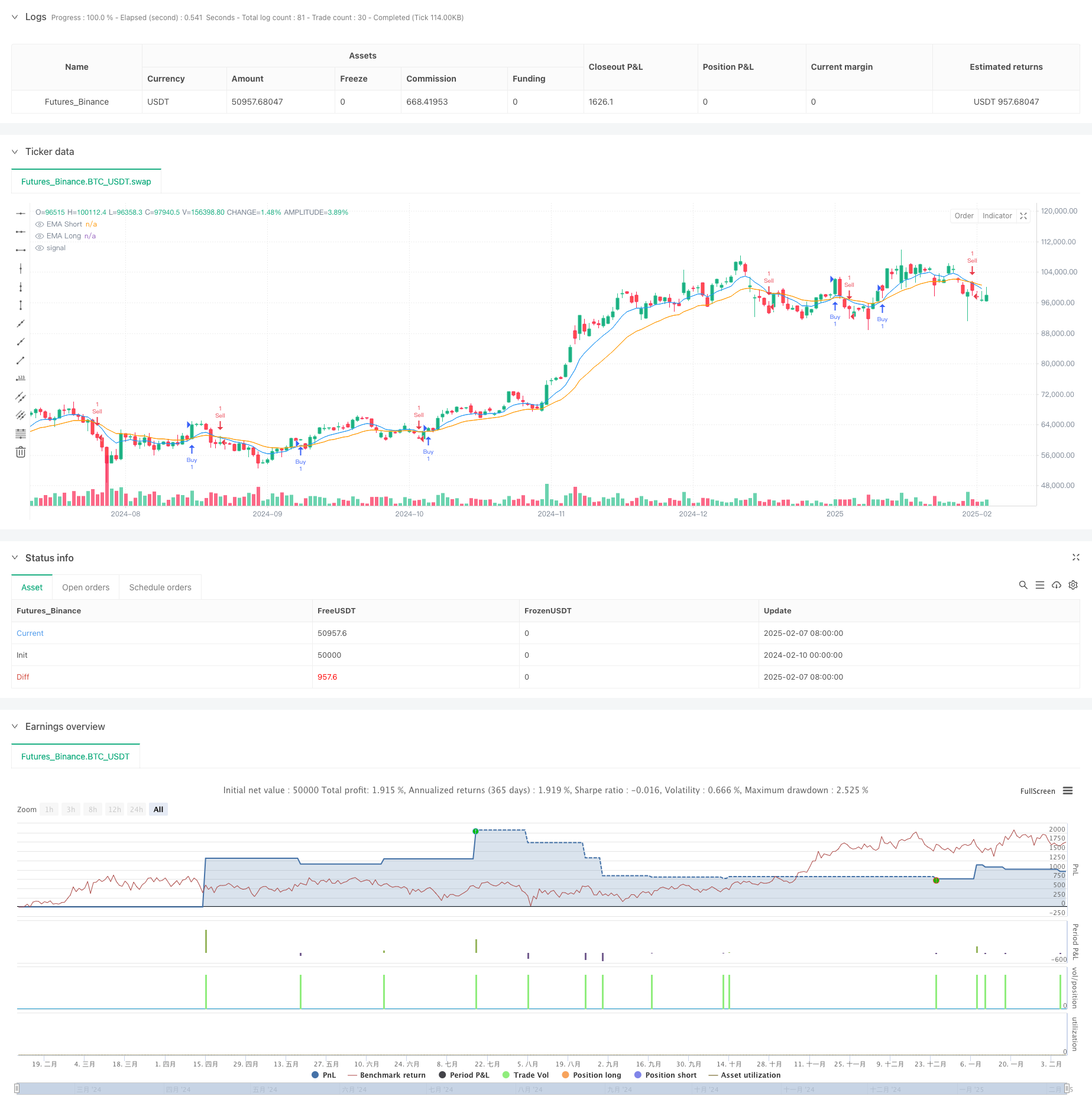

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Lukhi24

//@version=6

strategy("Lukhi EMA Crossover_TWL educational strategy", overlay=true)

// Input Parameters

capital = input.float(15000, title="Capital (₹)", tooltip="Total capital")

risk_per_trade = input.float(1000, title="Risk per Trade (₹)", tooltip="Risk per trade amount")

target_per_trade = input.float(5000, title="Take Profit per Trade (₹)", tooltip="Target profit per trade")

lot_size = input.int(1, title="Lot Size", tooltip="Nifty option lot size")

stop_loss_distance = input.float(30, title="Stop Loss Distance (Points)", tooltip="Fixed stop-loss in points")

// EMA Parameters

short_ema_length = input.int(9, title="Short EMA Length")

long_ema_length = input.int(21, title="Long EMA Length")

// RSI Parameters

rsi_length = input.int(14, title="RSI Length")

rsi_overbought = input.float(70, title="RSI Overbought Level")

rsi_oversold = input.float(30, title="RSI Oversold Level")

// Calculate EMAs and RSI

ema_short = ta.ema(close, short_ema_length)

ema_long = ta.ema(close, long_ema_length)

rsi = ta.rsi(close, rsi_length)

// Buy and Sell Signals

buy_signal = ta.crossover(ema_short, ema_long) and rsi > 50

sell_signal = ta.crossunder(ema_short, ema_long) and rsi < 50

// Plot EMAs

plot(ema_short, color=color.blue, title="EMA Short")

plot(ema_long, color=color.orange, title="EMA Long")

// Position Size Calculation

position_size = risk_per_trade / stop_loss_distance

// Stop Loss and Take Profit Levels

long_stop_loss = close - stop_loss_distance

long_take_profit = close + (target_per_trade / position_size)

short_stop_loss = close + stop_loss_distance

short_take_profit = close - (target_per_trade / position_size)

// Entry and Exit Logic

if buy_signal

strategy.entry("Buy", strategy.long, qty=lot_size)

strategy.exit("Exit Buy", "Buy", stop=long_stop_loss, limit=long_take_profit)

if sell_signal

strategy.entry("Sell", strategy.short, qty=lot_size)

strategy.exit("Exit Sell", "Sell", stop=short_stop_loss, limit=short_take_profit)

// Add Entry Signal Labels

var label long_label = na

var label short_label = na

if buy_signal

label.delete(long_label)

long_label := label.new(bar_index,close,text="BUY\nEntry: " + str.tostring(close, "#.##") + "\nTarget: " + str.tostring(long_take_profit, "#.##") + "\nSL: " + str.tostring(long_stop_loss, "#.##"),style=label.style_label_up,color=color.rgb(12, 90, 90, 73),textcolor=#010000)

if sell_signal

label.delete(short_label)

short_label := label.new(bar_index,close,text="SELL\nEntry: " + str.tostring(close, "#.##") + "\nTarget: " + str.tostring(short_take_profit, "#.##") + "\nSL: " + str.tostring(short_stop_loss, "#.##"),style=label.style_label_down,color=#5d371752,textcolor=#000000)

// Trade Failure Indicators

long_trade_loss = strategy.position_size > 0 and close <= long_stop_loss

short_trade_loss = strategy.position_size < 0 and close >= short_stop_loss

plotshape(long_trade_loss, location=location.belowbar, color=color.red, style=shape.cross, title="Long Trade Failed", text="SL Hit")

plotshape(short_trade_loss, location=location.abovebar, color=color.red, style=shape.cross, title="Short Trade Failed", text="SL Hit")