Overview

This strategy is an adaptive trading system based on moving averages and volatility, constructing dynamic trading channels by combining Exponential Moving Average (EMA) and Average True Range (ATR). The core idea is to capture natural market volatility, performing excellently in sideways markets.

Strategy Principle

The strategy utilizes three key technical indicators: 1. Short-term EMA (default 10 periods): Serves as price center, used as baseline for trading channel 2. Long-term EMA (default 30 periods): Acts as trend filter, helping determine market conditions 3. ATR (default 14 periods): Measures market volatility, used for dynamic channel width adjustment

Trading channel calculation method: - Upper Band = EMA + ATR × Multiplier (default 0.5) - Lower Band = EMA - ATR × Multiplier (default 0.5)

The system initiates short positions when price touches the upper band and long positions at the lower band, with a recommended risk-reward ratio of 2:1.

Strategy Advantages

- Strong Adaptability: Dynamically adjusts channel width through ATR, adapting to different market environments

- Controlled Risk: Clear entry points and stop-loss positions facilitate risk management

- Objective Operation: Mechanical trading system based on technical indicators, avoiding subjective judgment bias

- Adjustable Parameters: Multiple configurable parameters allow traders to optimize for different market characteristics

Strategy Risks

- Trend Market Risk: May generate frequent false signals in strong trend markets

- Parameter Sensitivity: Different parameter combinations may lead to significantly different trading results

- Slippage Impact: Limit order execution may be affected by liquidity and slippage

- Turnover Cost: Frequent trading may incur high transaction costs

Strategy Optimization Directions

- Trend Adaptability Optimization:

- Add trend strength indicator (such as ADX)

- Adjust channel parameters or pause trading during strong trends

- Signal Quality Enhancement:

- Incorporate volume indicators for signal confirmation

- Add volatility filters to avoid false breakouts

- Risk Management Optimization:

- Implement dynamic position sizing

- Adjust stop-loss levels based on market volatility

- Execution Mechanism Improvement:

- Optimize order type selection

- Implement intelligent slippage management

Summary

This is a well-designed mean reversion trading system that captures market volatility opportunities through technical indicator combinations. The strategy’s strengths lie in its adaptability and objectivity, but attention must be paid to trend environment effects and parameter optimization during application. Through the suggested optimization directions, the strategy’s stability and profitability can be further enhanced. The strategy is suitable for markets with high volatility but unclear trends, and it is recommended to conduct thorough backtesting and parameter optimization before live trading.

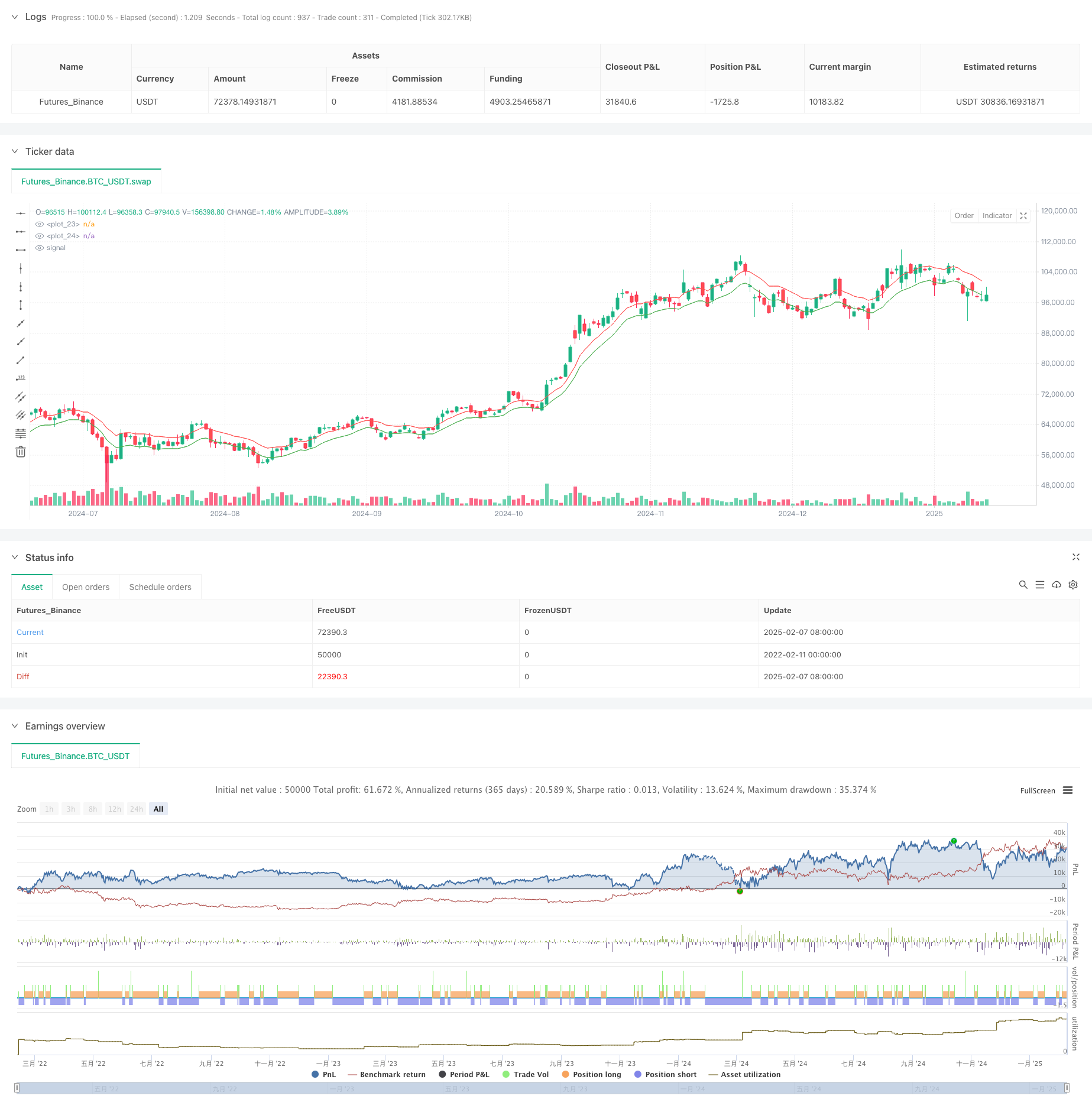

/*backtest

start: 2022-02-11 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rolguergf34585

//@version=5

strategy("Grupo ROG - Cash Bands", overlay=true)

PeriodoATR = input.int(defval=14,title="Período ATR")

PeriodoMedia = input.int(defval=10,title="Período Média Móvel")

PeriodoFiltro = input.int(defval=30,title="Período Média Filtro")

Mult = input.float(defval=0.5,title="Multiplicador",step=0.1)

Casas_Decimais = input.int(defval=5,title="Casas Decimais")

ema = ta.ema(close,PeriodoMedia)

filtro = ta.ema(close,PeriodoFiltro)

atr = ta.atr(PeriodoATR)

upper = math.round(ema+atr*Mult,Casas_Decimais)

basis = ema

lower = math.round(ema-atr*Mult,Casas_Decimais)

tendencia = lower>filtro?1:upper<filtro?-1:0

plot(upper,color=color.red)

plot(lower,color=color.green)

//plot(filtro,color=color.white)

barcolor(tendencia==1?color.green:tendencia==-1?color.red:color.white)

longCondition = true//tendencia==1 //and close < lower[1]

shortCondition = true//tendencia==-1 //and close > upper[1]

// if (strategy.position_size>0)

// strategy.exit("Long", limit=upper[0])

// if (strategy.position_size<0)

// strategy.exit("Short", limit=lower[0])

if (longCondition)

strategy.entry("Long", strategy.long, limit=lower[0])

if (shortCondition)

strategy.entry("Short", strategy.short, limit=upper[0])