Overview

This strategy is a trend-following system that combines Bollinger Bands and EMA indicators with a multi-layer risk control mechanism to optimize trading performance. The core strategy utilizes Bollinger Bands breakout-reversion patterns to capture market trends while incorporating an EMA trend filter to enhance trading accuracy. The system includes a comprehensive risk management framework with trailing stops, fixed stop losses, profit targets, and time-based position closure.

Strategy Principles

The trading logic is based on the following core elements: 1. Uses Bollinger Bands with 1.5 standard deviation and 14-period length as the primary trading signal indicator 2. Triggers short signals when the previous candle closes above the upper band and current candle reverses 3. Triggers long signals when the previous candle closes below the lower band and current candle turns bullish 4. Optionally applies an 80-period EMA as a trend filter, only entering positions when trend direction aligns 5. Activates trailing stops when price crosses the Bollinger Bands middle line 6. Allows setting fixed stop loss and take profit amounts 7. Supports automatic position closure based on bar count

Strategy Advantages

- Combines trend-following and reversal trading characteristics for stable performance across different market conditions

- Multi-layered risk control system provides comprehensive money management

- Flexible parameter settings allow strategy adaptation to different market conditions

- EMA filter effectively reduces false breakout risks

- Trailing stop mechanism effectively locks in profits

- Time-dimensional closure mechanism prevents long-term position trapping

Strategy Risks

- May generate frequent false breakout signals in ranging markets

- Fixed monetary stop losses may not suit all market conditions

- EMA filtering might cause missing important trading opportunities

- Trailing stops may close positions prematurely in highly volatile markets

- Parameter optimization may lead to overfitting historical data

Strategy Optimization Directions

- Introduce adaptive Bollinger Bands periods based on market volatility

- Develop dynamic stop-loss system based on money management

- Add volume analysis to confirm breakout validity

- Implement intelligent parameter optimization system

- Add market environment recognition module for different parameter settings in different market conditions

Summary

This is a well-designed trend-following system that provides reliable trading signals through the combination of Bollinger Bands and EMA, while ensuring trading safety through multi-layered risk control. The strategy offers strong configurability to adapt to different trading styles and market environments. While there are some inherent risks, the suggested optimization directions can further enhance the strategy’s stability and profitability.

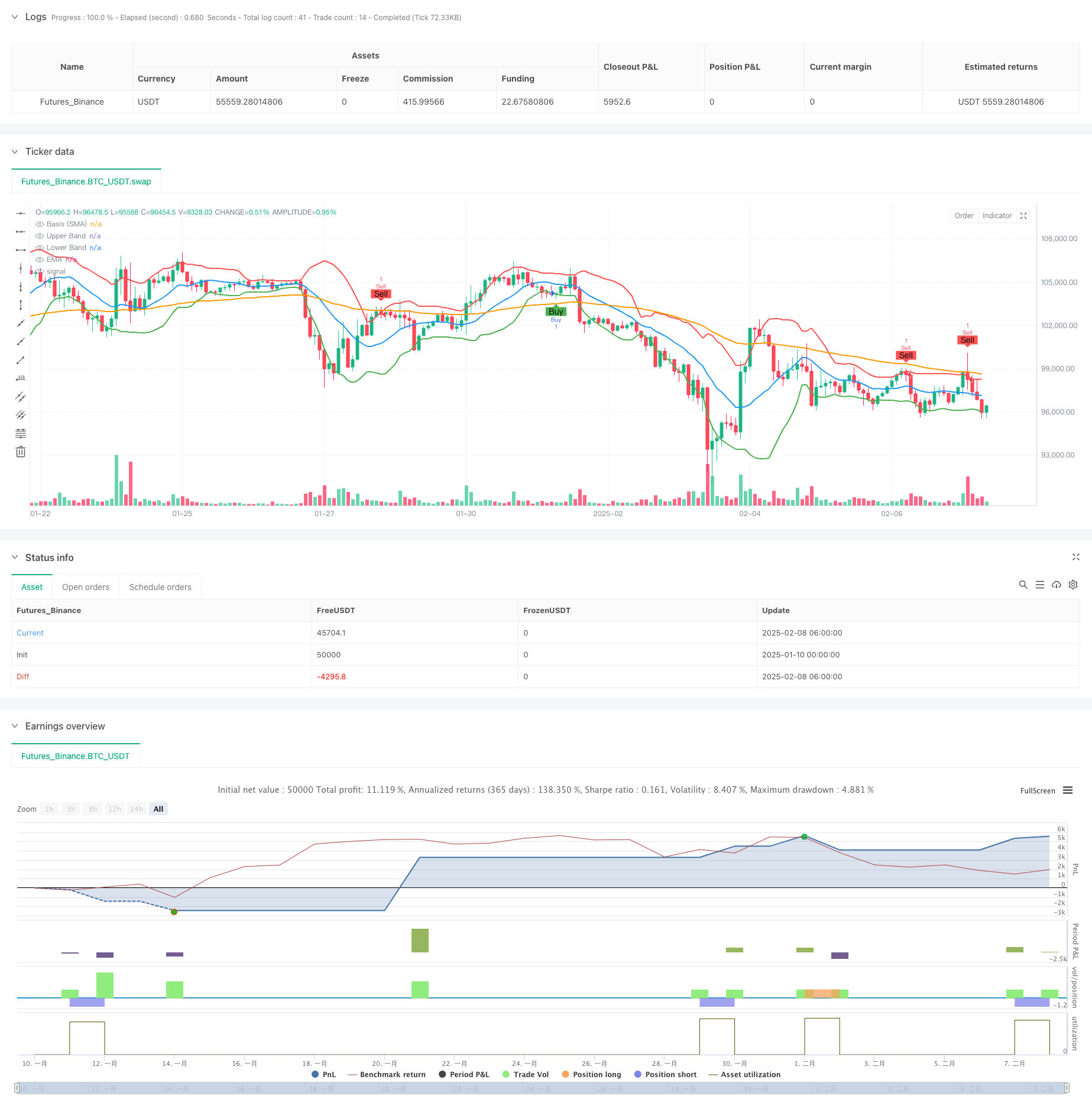

/*backtest

start: 2025-01-10 00:00:00

end: 2025-02-08 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("AI Bollinger Bands Strategy with SL, TP, and Bars Till Close", overlay=true)

// Input parameters

bb_length = input.int(14, title="Bollinger Bands Length", minval=1)

bb_stddev = input.float(1.5, title="Bollinger Bands Standard Deviation", minval=0.1)

use_ema = input.bool(true, title="Use EMA Filter")

ema_length = input.int(80, title="EMA Length", minval=1)

use_trailing_stop = input.bool(true, title="Use Trailing Stop")

use_sl = input.bool(true, title="Use Stop Loss")

use_tp = input.bool(false, title="Use Take Profit")

sl_dollars = input.float(300.0, title="Stop Loss (\$)", minval=0.0)

tp_dollars = input.float(1000.0, title="Take Profit (\$)", minval=0.0)

use_bars_till_close = input.bool(true, title="Use Bars Till Close")

bars_till_close = input.int(10, title="Bars Till Close", minval=1)

// New input to toggle indicator plotting

plot_indicators = input.bool(true, title="Plot Bollinger Bands and EMA on Chart")

// Calculate Bollinger Bands and EMA

basis = ta.sma(close, bb_length)

upper_band = basis + bb_stddev * ta.stdev(close, bb_length)

lower_band = basis - bb_stddev * ta.stdev(close, bb_length)

ema = ta.ema(close, ema_length)

// Plot Bollinger Bands and EMA conditionally

plot(plot_indicators ? basis : na, color=color.blue, linewidth=2, title="Basis (SMA)")

plot(plot_indicators ? upper_band : na, color=color.red, linewidth=2, title="Upper Band")

plot(plot_indicators ? lower_band : na, color=color.green, linewidth=2, title="Lower Band")

plot(plot_indicators ? ema : na, color=color.orange, linewidth=2, title="EMA")

// EMA conditions

ema_long_condition = ema > ema[1]

ema_short_condition = ema < ema[1]

// Entry conditions

sell_condition = close[1] > upper_band[1] and close[1] > open[1] and close < open

if sell_condition and (not use_ema or ema_short_condition)

strategy.entry("Sell", strategy.short)

buy_condition = close[1] < lower_band[1] and close > open

if buy_condition and (not use_ema or ema_long_condition)

strategy.entry("Buy", strategy.long)

// Trailing stop logic

if use_trailing_stop

if strategy.position_size > 0 and close >= basis

strategy.exit("Trailing Stop Long", from_entry="Buy", stop=low)

if strategy.position_size < 0 and close <= basis

strategy.exit("Trailing Stop Short", from_entry="Sell", stop=high)

// Stop Loss and Take Profit logic

if use_sl or use_tp

if strategy.position_size > 0

long_entry = strategy.position_avg_price

long_sl = long_entry - sl_dollars

long_tp = long_entry + tp_dollars

if use_sl and close <= long_sl

strategy.close("Buy", comment="Long SL Hit")

if use_tp and close >= long_tp

strategy.close("Buy", comment="Long TP Hit")

if strategy.position_size < 0

short_entry = strategy.position_avg_price

short_sl = short_entry + sl_dollars

short_tp = short_entry - tp_dollars

if use_sl and close >= short_sl

strategy.close("Sell", comment="Short SL Hit")

if use_tp and close <= short_tp

strategy.close("Sell", comment="Short TP Hit")

// Bars Till Close logic

var int bars_since_entry = na

if strategy.position_size != 0

bars_since_entry := na(bars_since_entry) ? 0 : bars_since_entry + 1

else

bars_since_entry := na

if use_bars_till_close and not na(bars_since_entry) and bars_since_entry >= bars_till_close

strategy.close("Buy", comment="Bars Till Close Hit")

strategy.close("Sell", comment="Bars Till Close Hit")

// Plot buy/sell signals

plotshape(sell_condition and (not use_ema or ema_short_condition), title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

plotshape(buy_condition and (not use_ema or ema_long_condition), title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")