Overview

This strategy is a high-frequency quantitative trading system that combines multiple timeframe trend analysis with volume-price relationships. It primarily uses Exponential Moving Averages (EMA) on 3-minute and 1-hour timeframes to determine market trends, while incorporating volume analysis to confirm trading signals, and implements a dual exit mechanism based on all-day highs and fixed time points.

Strategy Principles

The core logic consists of three main components: 1. Short-term trend determination: Uses a 50-period EMA on a 3-minute timeframe as a short-term trend indicator, considering an uptrend when price is above the EMA. 2. Volume confirmation: Compares current volume to the 20-period volume SMA, generating a volume spike signal when current volume exceeds 1.5 times the average. 3. Long-term trend filter: Incorporates a 50-period EMA on the 1-hour timeframe as a long-term trend filter, only allowing entries when price is above this EMA.

Entry signals require all three conditions to be met simultaneously. The exit strategy employs either reaching the day’s highest price or 3:00 PM, whichever comes first.

Strategy Advantages

- Multiple timeframe analysis reduces false signal risks

- Volume-price integration improves signal reliability

- Dual exit mechanism ensures both profit maximization and overnight risk avoidance

- Clear and easy-to-implement logic

- Suitable for highly volatile and liquid instruments

Strategy Risks

- Rapid oscillating markets may lead to frequent trading

- Volume indicators’ effectiveness may vary across different market conditions

- Fixed-time exits might miss important price breakouts

- EMA parameters need optimization for different trading instruments

- Lack of stop-loss could result in significant losses in extreme market conditions

Strategy Optimization Directions

- Introduce adaptive volume thresholds that dynamically adjust to market conditions

- Implement stop-loss and take-profit mechanisms to enhance risk control

- Optimize exit timing based on historical data analysis

- Add market environment filters to automatically stop trading in unfavorable conditions

- Consider incorporating volatility indicators to optimize entry timing

Summary

This strategy builds a relatively complete trading system by combining multiple timeframe analysis with volume-price relationships. Its strengths lie in clear logic and simple implementation, though risk control aspects still need optimization. Traders are advised to conduct thorough historical data testing and optimize parameters according to specific trading instrument characteristics before live implementation.

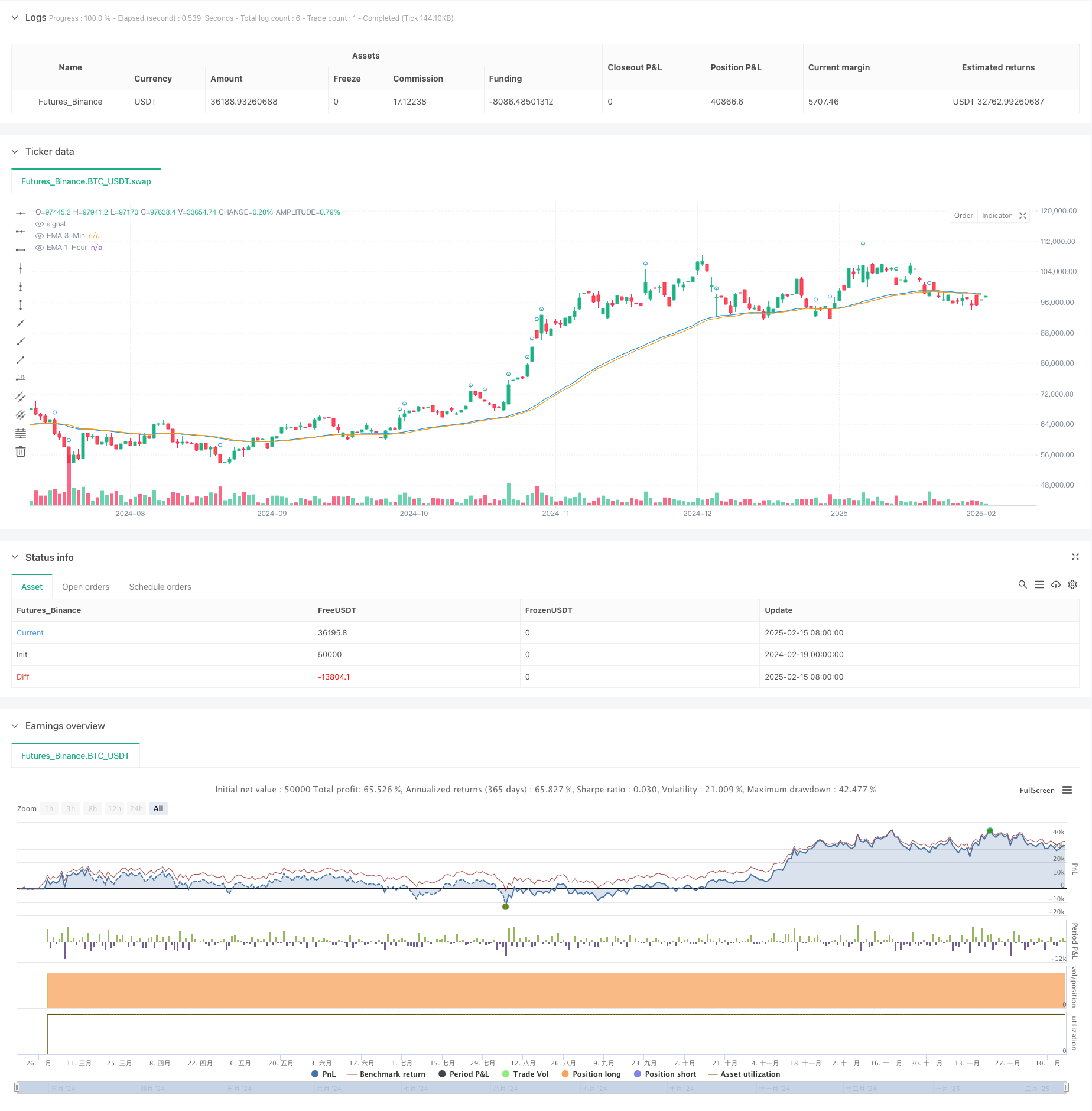

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Intraday + 1-Hour Trend Match", overlay=true)

// Inputs

emaLength3Min = input.int(50, title="EMA Length (3-Min)")

emaLength1Hr = input.int(50, title="EMA Length (1-Hour)")

volumeMultiplier = input.float(1.5, title="Volume Spike Multiplier")

// Intraday (3-Minute) EMA and Volume Spike

ema3Min = ta.ema(close, emaLength3Min)

volumeSMA = ta.sma(volume, 20)

isVolumeSpike = volume > (volumeSMA * volumeMultiplier)

// 1-Hour Trend (EMA)

ema1Hr = request.security(syminfo.tickerid, "60", ta.ema(close, emaLength1Hr))

is1HrUptrend = close > ema1Hr

// Intraday Signal

buyCondition3Min = close > ema3Min and isVolumeSpike

// Combined Signal: Match 3-Min Signal with 1-Hour Trend

finalBuyCondition = buyCondition3Min and is1HrUptrend

// All-Day High Tracking

var float allDayHigh = na

if (hour == 9 and minute == 0)

allDayHigh := high // Reset the all-day high at market open

else

allDayHigh := math.max(allDayHigh, high) // Update all-day high

// Debugging Plots

plot(ema3Min, color=color.blue, title="EMA 3-Min")

plot(ema1Hr, color=color.orange, title="EMA 1-Hour")

plotshape(isVolumeSpike, style=shape.circle, color=color.blue, title="Volume Spike (3-Min)")

plotshape(finalBuyCondition, style=shape.triangleup, color=color.green, title="Buy Signal")

plot(allDayHigh, color=color.red, title="All-Day High", linewidth=2)

// Strategy Execution

if (finalBuyCondition)

strategy.entry("Buy Signal", strategy.long)

// Exit Conditions

exitCondition = (close == allDayHigh) or (hour == 15 and minute >= 0)

if (exitCondition)

strategy.close("Buy Signal")