Overview

This strategy is a trend reversal trading system that combines momentum indicators (MACD, RSI) with a volume filter. By introducing a Range Filter to monitor price fluctuations, it achieves precise capture of market tops and bottoms. The strategy incorporates a volume confirmation mechanism on top of traditional technical indicators, effectively improving the reliability of trading signals.

Strategy Principle

The strategy employs multiple indicator verification for trading: 1. MACD indicator captures momentum changes in price, confirming trend reversal points through crossovers 2. RSI monitors market overbought/oversold conditions, seeking potential reversals at extreme values 3. Range Filter calculates smoothed price bands to ensure trades occur at significant trend deviations 4. Volume Filter requires trading signals to be confirmed by increased volume, enhancing signal reliability

Multiple condition trigger mechanism works as follows: - Long conditions: MACD golden cross + RSI in oversold zone + Price below lower band + Volume above average - Short conditions: MACD death cross + RSI in overbought zone + Price above upper band + Volume above average

Strategy Advantages

- Cross-validation of multiple indicators improves signal accuracy, effectively reducing false signal interference

- Range Filter ensures trades occur at significant price deviations, increasing potential profit margins

- Volume confirmation mechanism prevents misjudgments in low liquidity environments, enhancing trade reliability

- Strategy parameters can be flexibly adjusted to adapt to different market conditions and trading instruments

- Clear signal generation logic facilitates real-time monitoring and backtesting analysis

Strategy Risks

- Strict multiple conditions may cause missed trading opportunities

- May generate frequent trading signals in ranging markets, increasing transaction costs

- Parameter selection requires substantial market experience and historical data support

- Technical indicators’ effectiveness may be affected in extreme market conditions

Risk control suggestions: - Recommend thorough parameter optimization and backtesting verification - Consider implementing stop-loss and take-profit mechanisms - Monitor market environment changes and adjust strategy parameters accordingly

Strategy Optimization Directions

- Introduce adaptive parameter mechanisms to dynamically adjust indicator parameters based on market volatility

- Add market environment recognition module to apply different signal filtering rules in different market states

- Optimize volume filter by considering volume pattern analysis

- Add price pattern recognition functionality to provide additional reversal confirmation signals

- Develop intelligent money management module to optimize position sizing and risk control

Summary

The strategy establishes a relatively comprehensive trend reversal trading system through the coordination of multiple technical indicators. Its core advantages lie in its strict signal filtering mechanism and flexible parameter adjustment space. Through continuous optimization and improvement, the strategy shows promise in maintaining stable performance across various market conditions. In practical application, investors are advised to adjust strategy parameters according to their risk preferences and market experience.

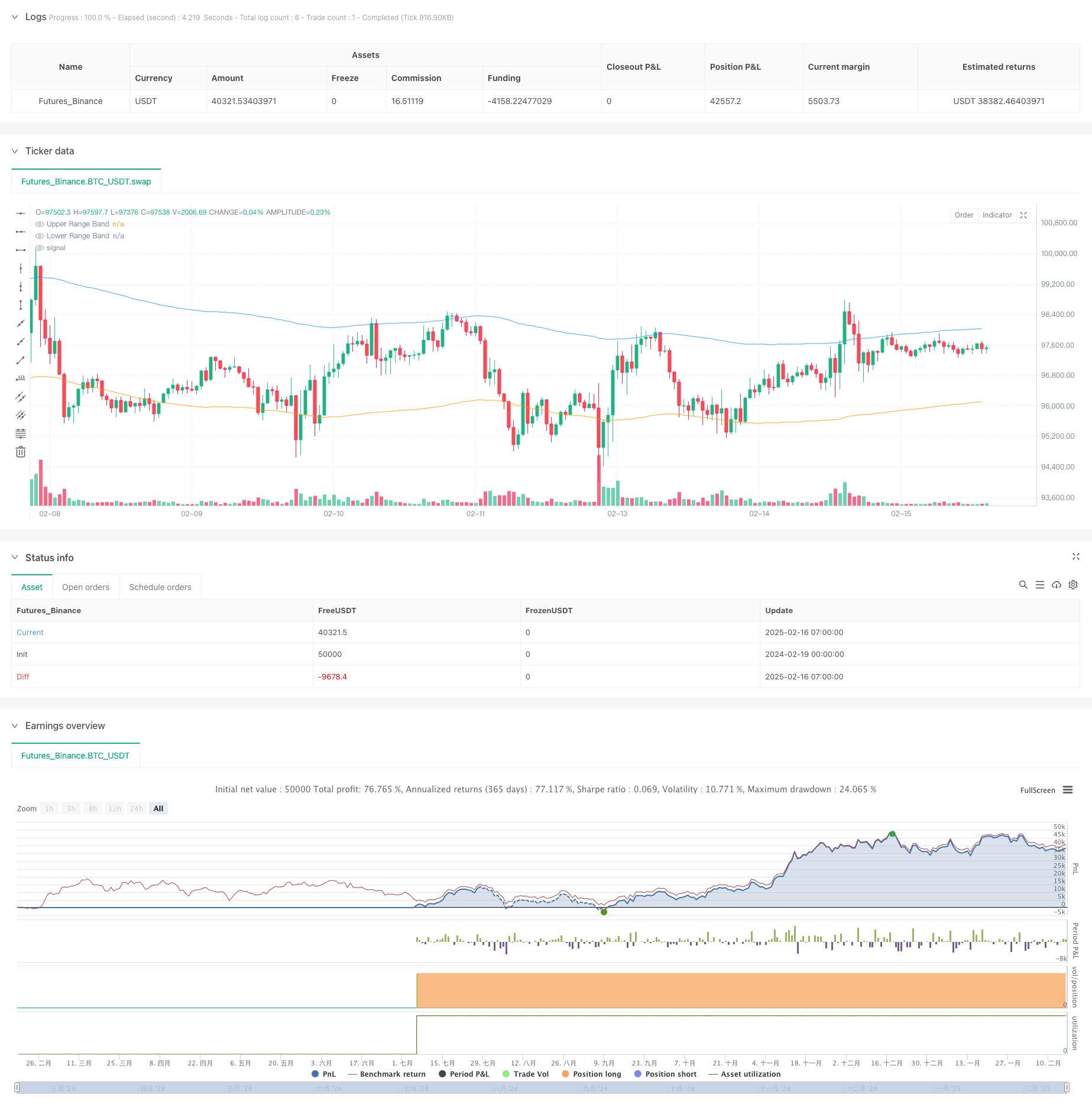

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("MACD & RSI with Range and Volume Filter", overlay=true)

// Inputs for MACD

fastLength = input.int(12, title="MACD Fast Length")

slowLength = input.int(26, title="MACD Slow Length")

signalLength = input.int(9, title="MACD Signal Length")

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(80, title="RSI Overbought Level")

rsiOversold = input.int(40, title="RSI Oversold Level")

// Inputs for Range Filter

rangePeriod = input.int(100, minval=1, title="Range Filter Period")

rangeMultiplier = input.float(3.0, minval=0.1, title="Range Filter Multiplier")

// Inputs for Volume Filter

volumeMA_Period = input.int(20, minval=1, title="Volume MA Period")

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Smooth Average Range

smoothRange(src, period, multiplier) =>

avgRange = ta.ema(math.abs(src - src[1]), period)

ta.ema(avgRange, period * 2 - 1) * multiplier

smoothedRange = smoothRange(close, rangePeriod, rangeMultiplier)

rangeFilter = ta.ema(close, rangePeriod)

upperBand = rangeFilter + smoothedRange

lowerBand = rangeFilter - smoothedRange

// Range Filter Conditions

priceAboveRange = close > upperBand

priceBelowRange = close < lowerBand

// Volume Filter

volumeMA = ta.sma(volume, volumeMA_Period)

highVolume = volume > volumeMA

// Buy and Sell Conditions with Range and Volume Filter

buyCondition = ta.crossover(macdLine, signalLine) and rsi < rsiOversold and priceBelowRange and highVolume

sellCondition = ta.crossunder(macdLine, signalLine) and rsi > rsiOverbought and priceAboveRange and highVolume

// Strategy Execution

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Alerts for Buy and Sell Signals

alertcondition(buyCondition, title="Buy Signal", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Signal", message="Sell Signal Triggered")

// Plot Buy and Sell Signals

plotshape(buyCondition, title="Buy Signal", text="Buy", style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0))

plotshape(sellCondition, title="Sell Signal", text="Sell", style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0))

// Plot Range Filter Bands

plot(upperBand, color=color.new(color.blue, 50), title="Upper Range Band")

plot(lowerBand, color=color.new(color.orange, 50), title="Lower Range Band")