Overview

This strategy is a quantitative trading system based on the Gaussian Channel and Stochastic RSI indicator. It combines mean reversion and momentum principles from technical analysis, entering long positions when price touches the lower channel and Stochastic RSI shows oversold signals, and exiting when price touches the upper channel or Stochastic RSI shows overbought signals. The strategy is designed for long-only trading.

Strategy Principles

The core logic is based on the following key calculations: 1. Gaussian Channel construction: Using EMA as the middle line, with channel width calculated as 2 times the standard deviation. 2. Stochastic RSI calculation: First calculating 14-period RSI, then computing RSI’s highest and lowest values within 14 periods, finally determining current RSI’s relative position within this range. 3. Entry signals: Price breaks above the lower channel while Stochastic RSI breaks above 20. 4. Exit signals: Price breaks above the upper channel or Stochastic RSI breaks below 80.

Strategy Advantages

- Dual confirmation mechanism: Combining price channel and momentum indicators reduces false signals.

- Comprehensive risk control: Implements percentage-based position management and considers transaction costs and slippage.

- Mean reversion characteristics: Gaussian Channel effectively captures price volatility range, improving trading accuracy.

- Strong dynamic adaptability: Strategy parameters can be optimized for different market conditions.

Strategy Risks

- Trend market risk: May exit positions too early in strong trend markets, missing major moves.

- Parameter sensitivity: Channel multiplier and RSI parameters significantly impact strategy performance.

- Market environment dependency: Strategy performs better in ranging markets but may underperform in trending markets.

- Calculation delay risk: Technical indicators have inherent calculation delays that may affect trading timing.

Strategy Optimization Directions

- Introduce adaptive parameters: Dynamically adjust channel multiplier based on market volatility.

- Add market environment recognition: Include trend strength indicators to use different parameter settings in different market conditions.

- Optimize money management: Adjust position size dynamically based on signal strength.

- Improve stop-loss mechanism: Add trailing stop-loss functionality to better protect profits.

Summary

The strategy combines Gaussian Channel and Stochastic RSI indicators to create a relatively robust trading system. Its strengths lie in the dual confirmation mechanism and comprehensive risk control, though attention must be paid to adaptability in different market environments. Strategy performance can be further enhanced through the introduction of adaptive parameters and market environment recognition.

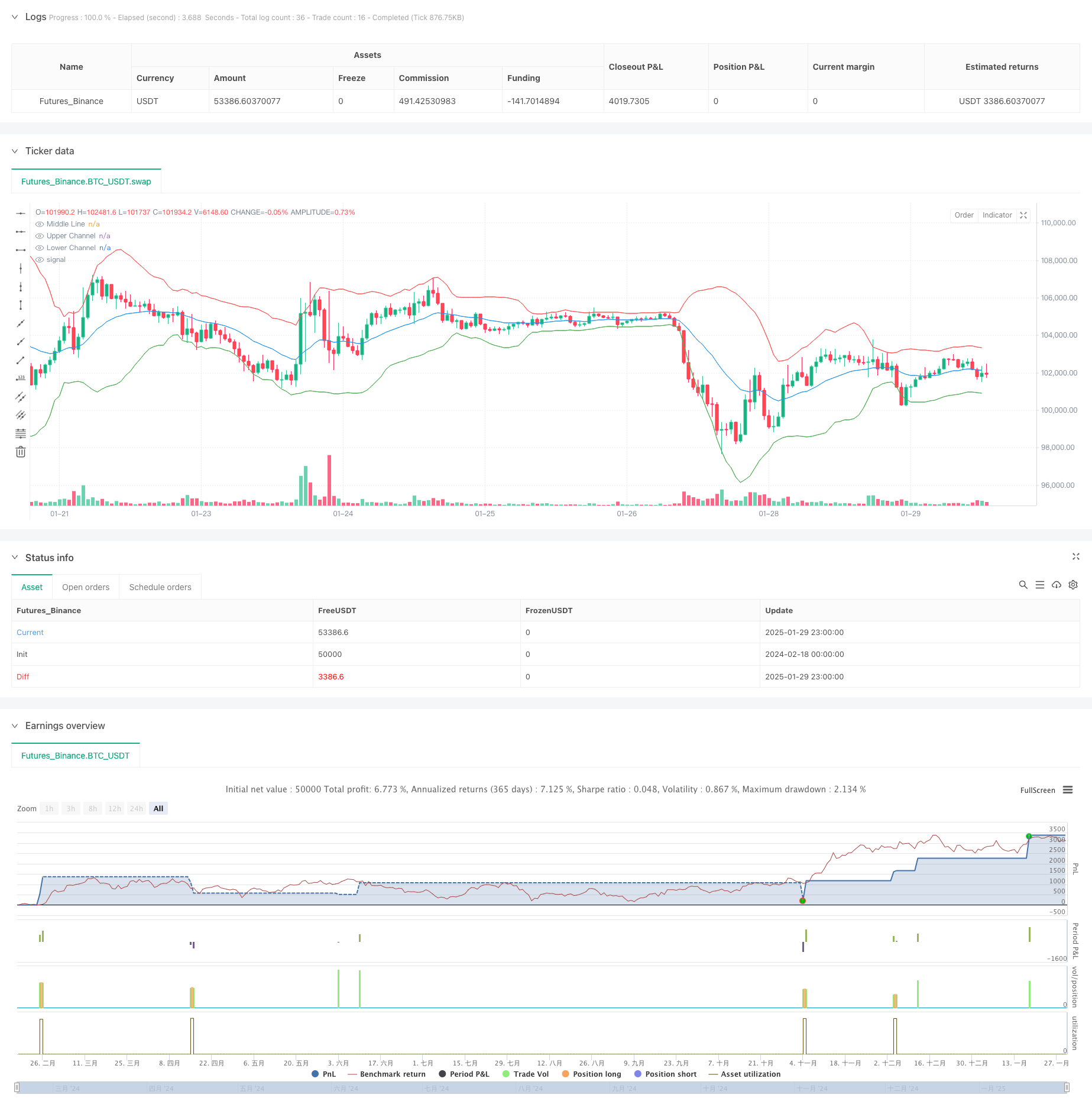

/*backtest

start: 2024-02-18 00:00:00

end: 2025-01-30 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gaussian Channel with Stochastic RSI", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=200, commission_type=strategy.commission.percent, commission_value=0.1, slippage=0)

// Gaussian Channel Parameters

gc_length = input.int(20, "Gaussian Channel Length", minval=1)

gc_mult = input.float(2.0, "Gaussian Channel Multiplier", minval=0.1)

middle = ta.ema(close, gc_length)

stdev = ta.stdev(close, gc_length)

upper = middle + gc_mult * stdev

lower = middle - gc_mult * stdev

// Plot Channels

plot(middle, "Middle Line", color=color.blue)

plot(upper, "Upper Channel", color=color.red)

plot(lower, "Lower Channel", color=color.green)

// Stochastic RSI Parameters

rsi_length = input.int(14, "RSI Length", minval=1)

stoch_length = input.int(14, "Stochastic Length", minval=1)

smooth_k = input.int(3, "Smooth %K", minval=1)

oversold = input.int(20, "Oversold Level", minval=0, maxval=100)

overbought = input.int(80, "Overbought Level", minval=0, maxval=100)

// Calculate Stochastic RSI

rsi = ta.rsi(close, rsi_length)

lowest_rsi = ta.lowest(rsi, stoch_length)

highest_rsi = ta.highest(rsi, stoch_length)

stoch_rsi = highest_rsi != lowest_rsi ? (rsi - lowest_rsi) / (highest_rsi - lowest_rsi) * 100 : 0

k = ta.sma(stoch_rsi, smooth_k)

// Entry/Exit Conditions

enterLong = ta.crossover(close, lower) and ta.crossover(k, oversold)

exitLong = ta.crossover(close, upper) or ta.crossunder(k, overbought)

// Strategy Execution

if (time >= timestamp(2018, 01, 01, 0, 0) and time < timestamp(2069, 01, 01, 0, 0))

if enterLong

strategy.entry("Long", strategy.long)

if exitLong

strategy.close("Long")