Overview

This strategy is a multi-timeframe trend following trading system that combines Exponential Moving Average (EMA) and Stochastic Oscillator to determine trading direction and entry timing. It confirms trends on the 15-minute timeframe and seeks specific entry opportunities on the 1-5 minute timeframe, optimizing trading performance through strict risk management and scaled profit-taking.

Strategy Principles

The strategy employs a multi-level trade validation mechanism: 1. Trend Confirmation: Uses 50-period EMA as a trend direction benchmark, with price above EMA indicating uptrend and below indicating downtrend 2. Entry Conditions: After trend confirmation, uses Stochastic Oscillator (14,3,3) to identify oversold/overbought opportunities, entering longs below 30 and shorts above 70 3. Position Management: Uses fixed position size of 0.02 units per trade 4. Risk Control: Sets stop-loss at 1.5x ATR and moves it to breakeven when price reaches 50% of target 5. Profit Taking: Implements two-stage profit-taking, first at 1:1 risk-reward ratio and second at 1.5x target

Strategy Advantages

- Multi-timeframe Analysis Accuracy: Combines higher and lower timeframes to ensure both trend direction accuracy and precise entry timing

- Comprehensive Risk Management: Uses volatility-based dynamic stop-loss to avoid the limitations of fixed stops

- Flexible Profit-taking: Scaled exit strategy allows for both profit protection and participation in larger moves

- Moving Stop-loss Protection: Protects accumulated profits by moving stops to breakeven as price moves favorably

Strategy Risks

- Choppy Market Risk: May generate false signals leading to consecutive losses in range-bound markets

- Slippage Risk: Actual execution prices may significantly deviate from theoretical prices during volatile periods

- Money Management Risk: Fixed position sizing may not suit all account sizes

- Parameter Sensitivity: Strategy performance heavily depends on EMA and Stochastic parameter settings

Strategy Optimization Directions

- Market Environment Filtering: Introduce volatility or trend strength indicators to adjust parameters or suspend trading in different market conditions

- Dynamic Position Sizing: Adjust trade size based on account equity and market volatility

- Entry Condition Enhancement: Add price pattern or additional technical indicator confirmation to improve signal reliability

- Stop/Target Optimization: Implement dynamic risk-reward ratios based on market conditions for more flexible capital management

Summary

This strategy constructs a comprehensive trend following system through multi-timeframe analysis and multiple technical indicators. Its core strengths lie in strict risk management and flexible profit-taking, though practical application requires parameter optimization based on market conditions and account size. Through the suggested optimization directions, the strategy has potential for more stable performance across various market environments.

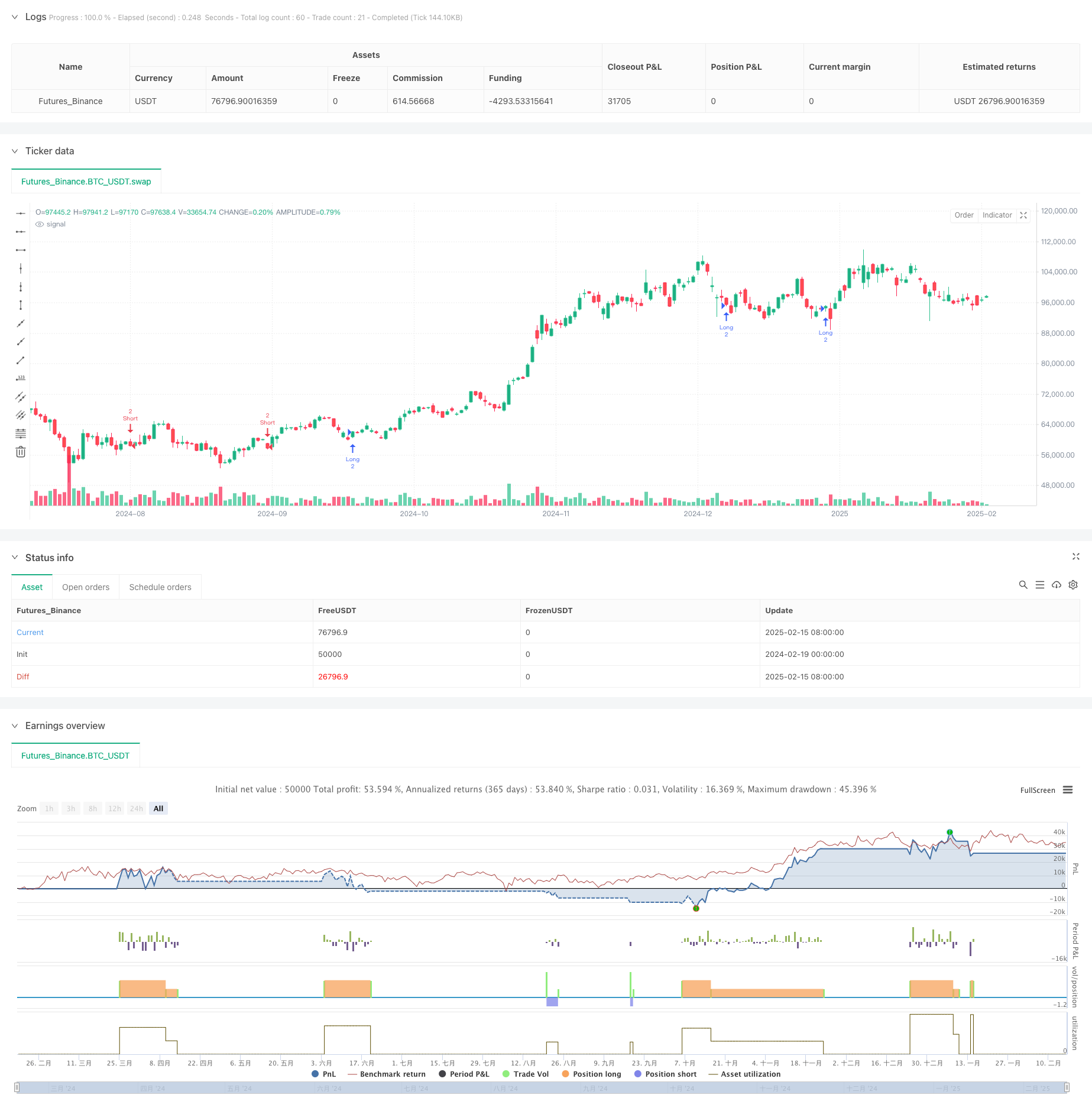

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-16 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("15-Min Trend Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Define EMA for trend confirmation

ema50 = ta.ema(close, 50)

trendLong = close > ema50

trendShort = close < ema50

// Stochastic settings

length = 14

smoothK = 3

smoothD = 3

stochK = ta.sma(ta.stoch(close, high, low, length), smoothK)

stochD = ta.sma(stochK, smoothD)

// Entry conditions

longCondition = stochK < 30 and trendLong

shortCondition = stochK > 70 and trendShort

// ATR-based stop-loss calculation

atrValue = ta.atr(14)

stopLossLong = close - (1.5 * atrValue)

stopLossShort = close + (1.5 * atrValue)

takeProfitLong = close + (2 * atrValue)

takeProfitShort = close - (2 * atrValue)

// Execute trades

if longCondition

strategy.entry("Long", strategy.long, qty=2)

strategy.exit("TP Long 1", from_entry="Long", qty=1, stop=stopLossLong, limit=takeProfitLong)

strategy.exit("TP Long 2", from_entry="Long", qty=1, stop=stopLossLong, limit=takeProfitLong * 1.5)

if shortCondition

strategy.entry("Short", strategy.short, qty=2)

strategy.exit("TP Short 1", from_entry="Short", qty=1, stop=stopLossShort, limit=takeProfitShort)

strategy.exit("TP Short 2", from_entry="Short", qty=1, stop=stopLossShort, limit=takeProfitShort * 1.5)

// Move SL to breakeven after 50% move to target

if strategy.position_size > 0

if strategy.position_avg_price != 0

moveToBELong = close >= (strategy.position_avg_price + (takeProfitLong - strategy.position_avg_price) * 0.5)

if moveToBELong

strategy.exit("BE Long", from_entry="Long", qty=1, stop=strategy.position_avg_price)

moveToBEShort = close <= (strategy.position_avg_price - (strategy.position_avg_price - takeProfitShort) * 0.5)

if moveToBEShort

strategy.exit("BE Short", from_entry="Short", qty=1, stop=strategy.position_avg_price)