Overview

This is a dynamic wave trading strategy based on multiple technical indicators, combining trend following and wave operation characteristics. The strategy seeks high-probability trading opportunities through the coordination of multiple technical indicators including EMA, ADX, RSI, and MACD. The system manages risk and profit through dynamic stop-loss and batch profit-taking methods.

Strategy Principle

The core logic of the strategy is based on the following key elements: 1. Trend Judgment: Uses EMA55 and EMA144 crossover relationships to determine market trend direction, combined with ADX indicator strength (threshold 30) for trend confirmation. 2. Entry Timing: Identifies oversold and overbought areas through RSI indicator (oversold 45, overbought 55) to judge pullback buying and rebound shorting opportunities. 3. Stop-Loss Mechanism: Adopts ATR-based dynamic stop-loss, with a stop-loss distance of 1.5 times ATR, which can adaptively adjust according to market volatility. 4. Profit Strategy: Uses 50-period high/low prices as profit targets, adopting a 50% position batch profit-taking approach.

Strategy Advantages

- Multiple Indicator Verification: Improves trading signal reliability through the combined use of multiple indicators including EMA, ADX, and RSI.

- Dynamic Risk Management: ATR-based dynamic stop-loss can adapt to different market environments, providing better risk control.

- Progressive Profit-Taking: The batch profit-taking approach allows both securing partial profits and maintaining positions in strong trends.

- Trend Confirmation: Inclusion of ADX indicator filtering helps avoid frequent trading in sideways markets.

Strategy Risks

- False Breakout Risk: Misjudgments may occur during increased market volatility, suggesting the addition of volume confirmation.

- Slippage Loss: Dynamic stop-loss may face significant slippage during rapid market movements.

- Sideways Market Losses: Despite ADX filtering, consecutive small losses may still occur in oscillating markets.

- Signal Lag: Multiple indicator combinations may lead to delayed entry signals, missing optimal position-building opportunities.

Strategy Optimization Directions

- Indicator Parameter Optimization: Recommend historical backtesting optimization for parameters like EMA periods and RSI thresholds.

- Stop-Loss Optimization: Consider adding trailing stop-loss for better profit protection.

- Position Management: Suggest introducing a volatility-adaptive position management system.

- Market Adaptability: Can add market environment classification to use different parameter combinations under different market conditions.

Summary

The strategy constructs a complete trading system through the coordination of multiple technical indicators. It emphasizes both trend capture and risk control, balancing risk and return through dynamic stop-loss and batch profit-taking methods. While there is room for optimization, it is overall a logically rigorous and practical trading strategy.

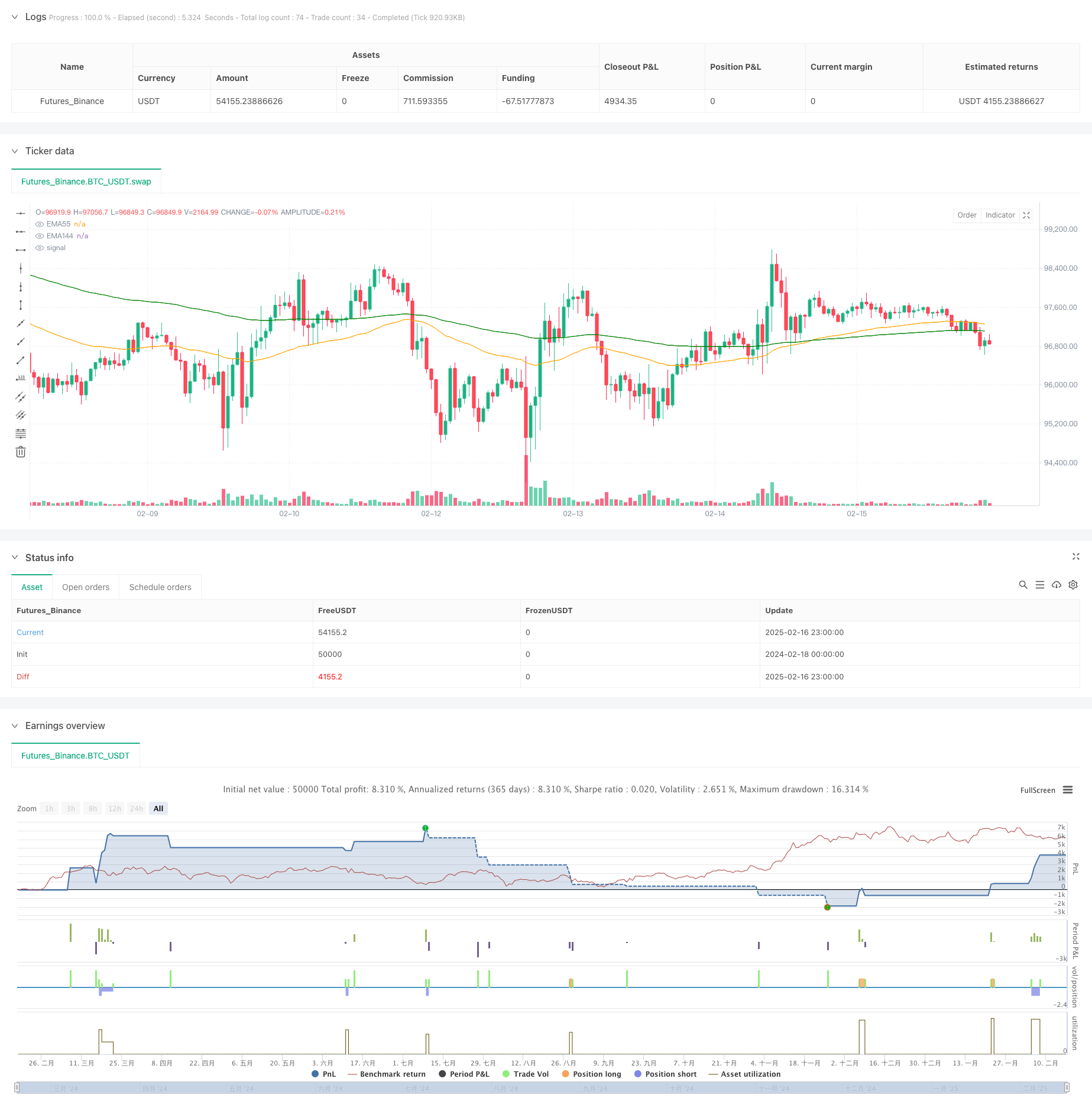

/*backtest

start: 2024-02-18 00:00:00

end: 2025-02-17 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("专业级交易系统", overlay=true, max_labels_count=500)

// ===== 参数设置 =====

x1 = input.float(1.5,"atr倍数",step=0.1)

x2 = input.int(50,"k线数量",step=1)

// EMA参数

ema55_len = input.int(55, "EMA55长度")

ema144_len = input.int(144, "EMA144长度")

// ADX参数

adx_len = input.int(14, "ADX长度")

adx_threshold = input.float(30.0, "ADX趋势过滤")

// RSI参数

rsi_len = input.int(14, "RSI长度")

rsi_oversold = input.float(45.0, "RSI超卖阈值")

rsi_overbuy = input.float(55.0, "RSI超买阈值")

// MACD参数

macd_fast = input.int(12, "MACD快线")

macd_slow = input.int(26, "MACD慢线")

macd_signal = input.int(9, "MACD信号线")

// ===== 指标计算 =====

// EMA计算

ema55 = ta.ema(close, ema55_len)

ema144 = ta.ema(close, ema144_len)

// ADX计算(使用标准函数)

[di_plus, di_minus, adx] = ta.dmi(adx_len, adx_len)

// RSI计算

rsi = ta.rsi(close, rsi_len)

// MACD计算(修正参数顺序)

[macdLine, signalLine, histLine] = ta.macd(close, macd_fast, macd_slow, macd_signal)

// ===== 信号逻辑 =====

// 趋势条件:EMA55 > EMA144 且 ADX > 30

trendCondition = ema55 > ema144 and adx > adx_threshold

trendConditions = ema55 < ema144 and adx > adx_threshold

// 回调条件:RSI < 45 且 MACD柱状线 > -0.002

pullbackCondition = rsi < rsi_oversold

pullbackConditions = rsi > rsi_overbuy

// 综合信号

entrySignal = trendCondition and pullbackCondition

entrySignals = trendConditions and pullbackConditions

// ===== 可视化 =====

// 绘制EMA

plot(ema55, "EMA55", color=color.new(#FFA500, 0))

plot(ema144, "EMA144", color=color.new(#008000, 0))

//plotshape(series=entrySignal,title="买入信号",location=location.belowbar,color=color.new(color.green, 0),style=shape.labelup,text="BUY",textcolor=color.new(color.white, 0))

s = strategy.position_avg_price ,s1 = strategy.position_size

le = false

le := low < ema144 and low[1] > ema144 and ema55 > ema144 ? true : s1 > 0 ? false : le[1]

se = false

se := high > ema144 and high[1] < ema144 and ema55 < ema144 ? true : s1 < 0 ? false : se[1]

if entrySignal and low < ema144 and close > ema144

strategy.entry("l",strategy.long)

strategy.exit("止盈一半","l",limit= ta.highest(x2),qty_percent = 50)

if s1 > 0 and low < (close - x1*ta.atr(12))[1]

strategy.close_all("动态止损")

if entrySignals and high > ema144 and close < ema144

strategy.entry("s",strategy.short)

strategy.exit("止盈一半","s",limit = ta.lowest(x2),qty_percent = 50)

if s1 < 0 and high > (close + x1*ta.atr(12))[1]

strategy.close_all("动态止损")

//plotshape(series=entrySignal,title="买入信号",location=location.belowbar,color=color.new(color.green, 0),style=shape.labelup,text="BUY",textcolor=color.new(color.white, 0))

//plot(close+x1*ta.atr(12))

//plot(close-x1*ta.atr(12))

//bgcolor(le ? color.red:na)