Overview

This strategy is a trend-following trading system based on Exponential Moving Average (EMA) and Impulse Correction Model (ICM). It captures market trend changes by identifying price-EMA crossovers and subsequent impulse-correction-impulse patterns, executing trades when specific conditions are met. The system employs a fixed risk-reward ratio to manage stop-loss and take-profit levels for each trade.

Strategy Principles

The core logic of the strategy is based on the following key components: 1. Uses 10-period EMA as a reference indicator for trend direction 2. Looks for impulse-correction-impulse patterns within 3 periods after price-EMA crossover 3. Long entry conditions: - Price crosses above EMA - First candle is a bullish impulse (rise exceeds preset value) - Second candle is a bearish correction (close below open) - Third candle is a bullish impulse breaking above previous two candles’ highs 4. Short entry conditions are opposite to long conditions 5. Uses fixed risk-reward ratio (default 3x) to automatically set stop-loss and take-profit levels

Strategy Advantages

- Combines technical indicators and price patterns for more reliable trading signals

- Confirms trend continuation through impulse-correction-impulse pattern

- Uses fixed risk-reward ratio for position management, promoting long-term stable returns

- Clear entry logic, easy to understand and execute

- Applicable to different trading instruments and timeframes

Strategy Risks

- May generate frequent false breakout signals in ranging markets

- Fixed risk-reward ratio may not suit all market conditions

- EMA parameters and impulse threshold selection affect strategy performance

- Continuous violent fluctuations may lead to inappropriate stop-loss placement

- Rapid market reversals may cause significant drawdowns

Strategy Optimization Directions

- Introduce volatility indicators to dynamically adjust impulse threshold

- Add trend strength filters to reduce false breakouts

- Dynamically adjust risk-reward ratio based on market characteristics

- Add time filters to avoid trading during unfavorable periods

- Incorporate volume indicators to improve signal reliability

Summary

The strategy constructs a logically clear trend-following system by combining EMA and impulse correction model. Its advantages lie in clear signals and controllable risk, but optimization based on specific market characteristics is still needed. Through adding appropriate filtering conditions and dynamic parameter adjustment mechanisms, the strategy’s stability and profitability can be further improved.

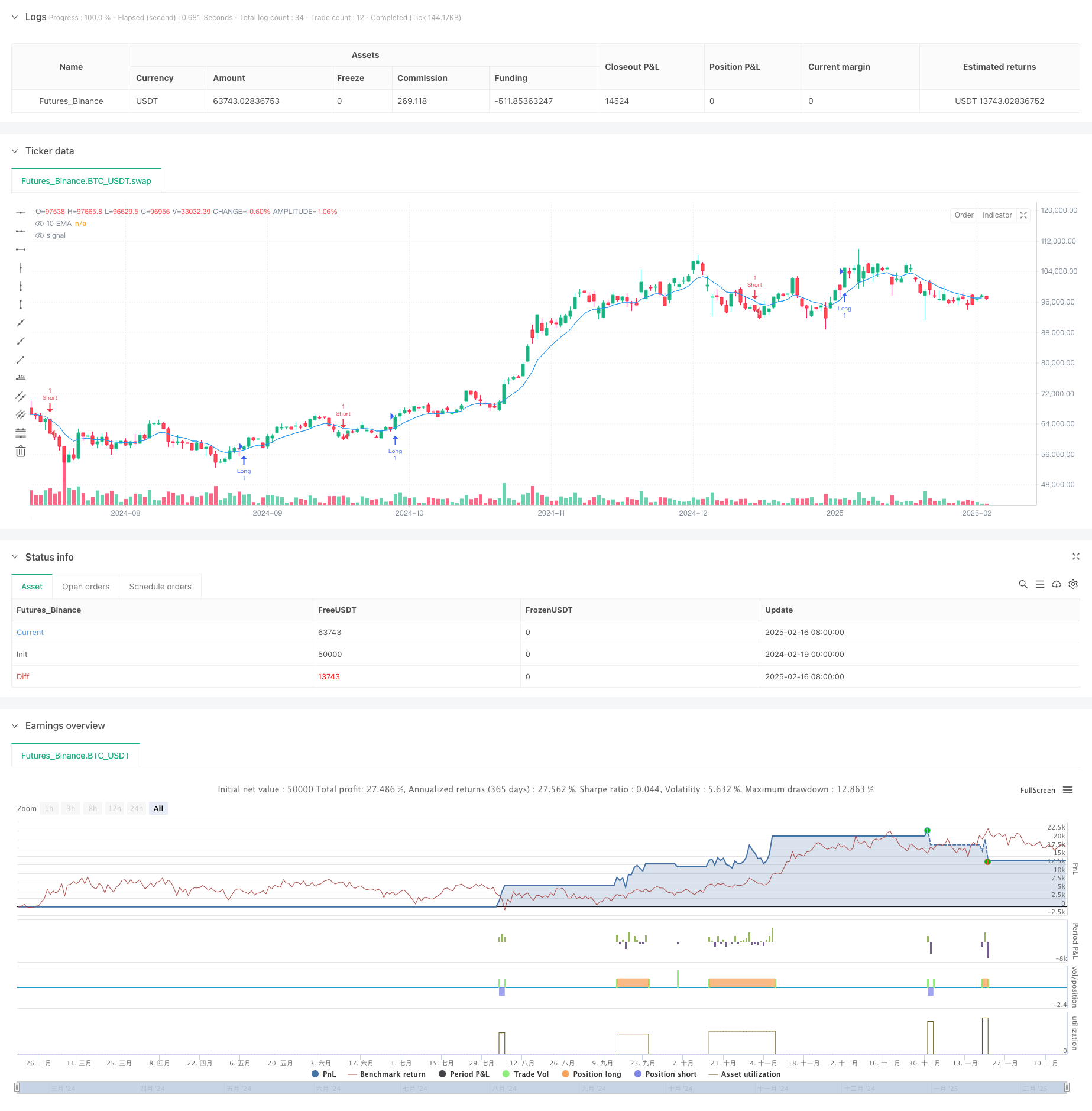

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-17 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Cross Impulsive Strategy", overlay=true, margin_long=100, margin_short=100)

// Parameters

emaLength = input.int(10, title="EMA Length")

impulsiveBodyTicks = input.int(10, title="Minimum Impulsive Candle Body (Ticks)")

rMultiplier = input.int(3, title="Risk Reward Multiplier")

// Calculate EMA

ema10 = ta.ema(close, emaLength)

// Cross conditions

crossUp = ta.crossover(close, ema10)

crossDown = ta.crossunder(close, ema10)

// Impulsive and correction conditions

tickSize = syminfo.mintick

impulsiveBodyMin = impulsiveBodyTicks * tickSize

isImpulsiveBullish = (close > open) and (close - open >= impulsiveBodyMin)

isImpulsiveBearish = (close < open) and (open - close >= impulsiveBodyMin)

isCorrectionBearish = (close < open)

isCorrectionBullish = (close > open)

// Long setup tracking

var int barsSinceLongCross = 0

var bool impulsive1Long = false

var bool correctionLong = false

var bool impulsive2Long = false

if crossUp

barsSinceLongCross := 0

impulsive1Long := false

correctionLong := false

impulsive2Long := false

else

barsSinceLongCross := barsSinceLongCross + 1

if barsSinceLongCross == 1

impulsive1Long := isImpulsiveBullish

if barsSinceLongCross == 2

correctionLong := isCorrectionBearish

if barsSinceLongCross == 3

impulsive2Long := isImpulsiveBullish and (close > math.max(high[1], high[2]))

// Short setup tracking

var int barsSinceShortCross = 0

var bool impulsive1Short = false

var bool correctionShort = false

var bool impulsive2Short = false

if crossDown

barsSinceShortCross := 0

impulsive1Short := false

correctionShort := false

impulsive2Short := false

else

barsSinceShortCross := barsSinceShortCross + 1

if barsSinceShortCross == 1

impulsive1Short := isImpulsiveBearish

if barsSinceShortCross == 2

correctionShort := isCorrectionBullish

if barsSinceShortCross == 3

impulsive2Short := isImpulsiveBearish and (close < math.min(low[1], low[2]))

// Execute trades

if barsSinceLongCross == 3 and impulsive1Long and correctionLong and impulsive2Long

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=low, profit=close + (close - low) * rMultiplier)

if barsSinceShortCross == 3 and impulsive1Short and correctionShort and impulsive2Short

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=high, profit=close - (high - close) * rMultiplier)

// Plot EMA

plot(ema10, color=color.blue, title="10 EMA")