Overview

This is a multi-timeframe trading strategy based on candlestick range theory. The strategy identifies potential trading opportunities by analyzing candlestick patterns and price ranges in higher timeframes. It incorporates a volume filter and dynamic stop-loss mechanism, capturing trend opportunities through breakouts of previous high and low points.

Strategy Principles

The core of the strategy is monitoring price breakouts from previous ranges in a higher timeframe (default 4-hour). Specifically: 1. The strategy continuously tracks and stores high and low data from the previous two higher timeframe candles 2. A short signal forms when the previous candle closes below the prior high and the current candle makes a new high 3. A long signal forms when the previous candle closes above the prior low and the current candle makes a new low 4. Entry prices are set at the trigger candle’s high/low points 5. Profit targets are set at previous corresponding high/low points 6. Stop-loss distances are dynamically adjusted based on range size

Strategy Advantages

- Multi-timeframe analysis provides more reliable signals

- Dynamic stop-loss settings adapt to market volatility

- Optional volume filter increases trade confirmation

- Clear visualization interface with marked trigger, target, and stop levels

- Simple and clear strategy logic, easy to understand and execute

- Applicable to various trading instruments and market conditions

Strategy Risks

- May generate frequent false breakout signals in ranging markets

- Larger stop-loss multipliers can lead to significant individual losses

- Reliance on historical price data may result in delayed reactions to rapidly changing markets

- Does not consider fundamental factors

- May be difficult to execute effectively in low-liquidity markets

Strategy Optimization Directions

- Introduce trend filters like moving averages or ADX indicator

- Add more market condition judgment criteria

- Optimize stop-loss strategy, consider implementing trailing stops

- Add position sizing module

- Consider incorporating more timeframe analyses

- Introduce volatility indicators to optimize range judgment

Summary

This is a well-structured, logically sound multi-timeframe trading strategy. It seeks trend opportunities by analyzing price action in higher timeframes while integrating risk management and filtering mechanisms. The strategy’s core strength lies in its adaptability and scalability, allowing adjustment to different market conditions through simple parameter modifications. While inherent risks exist, the suggested optimization directions can further enhance the strategy’s stability and reliability.

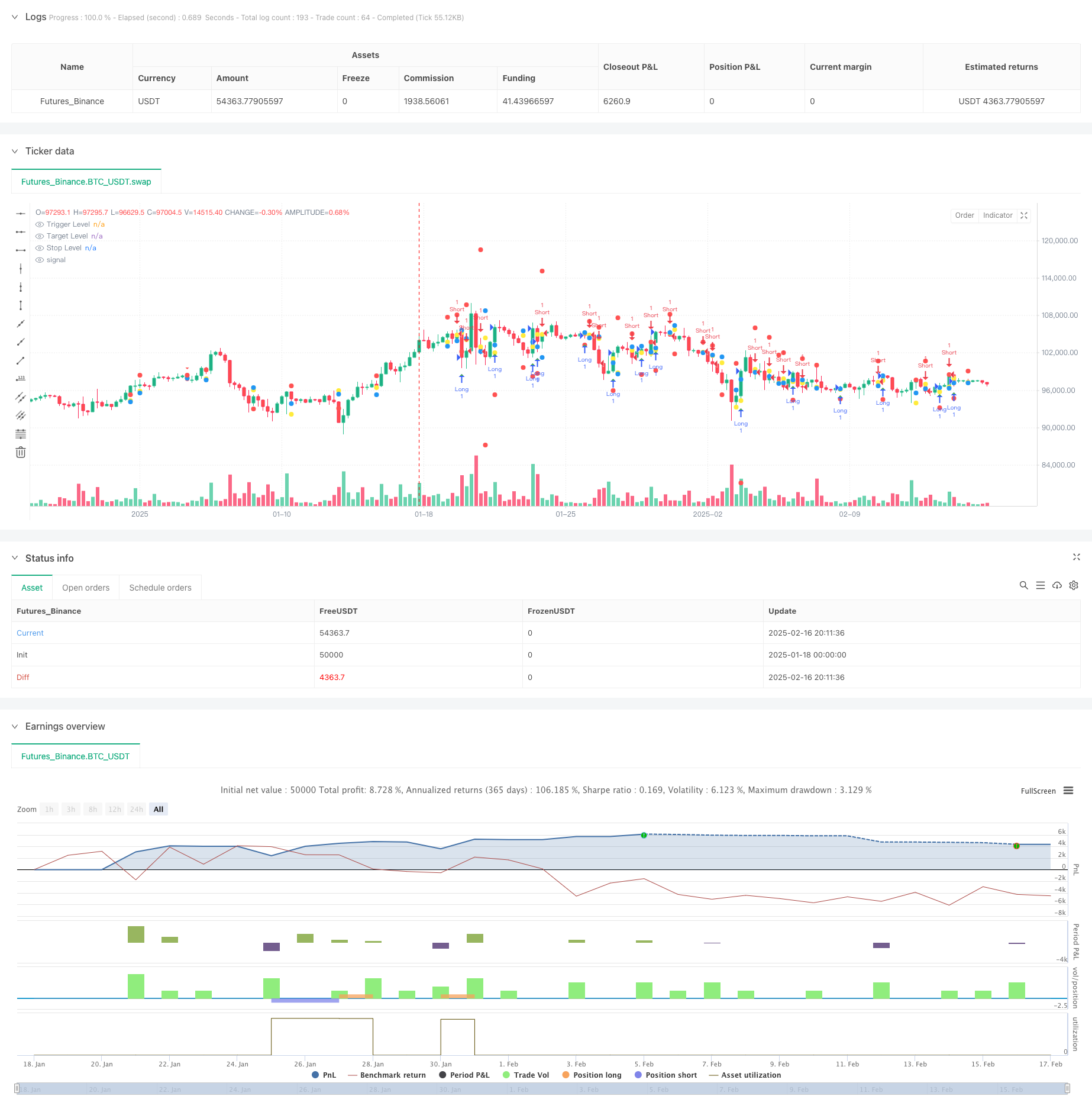

/*backtest

start: 2025-01-18 00:00:00

end: 2025-02-17 00:00:00

period: 6h

basePeriod: 6h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Candle Range Theory Strategy", overlay=true)

// Input parameters

var string HTF = input.timeframe("240", "Higher Timeframe (Minutes)") // 4H default

var float stopLossMultiplier = input.float(1.5, "Stop Loss Multiplier", minval=0.5)

var bool useVolFilter = input.bool(false, "Use Volume Filter")

var float volThreshold = input.float(1.5, "Volume Threshold Multiplier", minval=1.0)

// Function to get higher timeframe data

getHtfData(src) =>

request.security(syminfo.tickerid, HTF, src)

// Calculate volume condition once per bar

var bool volCondition = true

if useVolFilter

float vol = getHtfData(volume)

float avgVol = ta.sma(vol, 20)

volCondition := vol > avgVol * volThreshold

// Get HTF candle data

htf_open = getHtfData(open)

htf_high = getHtfData(high)

htf_low = getHtfData(low)

htf_close = getHtfData(close)

// Store previous candle data

var float h1 = na // High of Candle 1

var float l1 = na // Low of Candle 1

var float h2 = na // High of Candle 2

var float l2 = na // Low of Candle 2

var float prevClose = na

// Track setup conditions

var string setupType = na

var float triggerLevel = na

var float targetLevel = na

var float stopLevel = na

// Update candle data - fixed time function usage

var bool isNewBar = false

isNewBar := ta.change(request.security(syminfo.tickerid, HTF, time)) != 0

if isNewBar

h1 := h2

l1 := l2

h2 := htf_high[1]

l2 := htf_low[1]

prevClose := htf_close[1]

// Identify setup conditions

if not na(h1) and not na(h2) and not na(prevClose)

if (h2 > h1 and prevClose < h1) // Short setup

setupType := "short"

triggerLevel := l2

targetLevel := l1

stopLevel := h2 + (h2 - l1) * stopLossMultiplier

else if (l2 < l1 and prevClose > l1) // Long setup

setupType := "long"

triggerLevel := h2

targetLevel := h1

stopLevel := l2 - (h1 - l2) * stopLossMultiplier

else

setupType := na

triggerLevel := na

targetLevel := na

stopLevel := na

// Entry conditions using pre-calculated volume condition - fixed line breaks

bool longCondition = setupType == "long" and high > triggerLevel and not na(triggerLevel) and volCondition

bool shortCondition = setupType == "short" and low < triggerLevel and not na(triggerLevel) and volCondition

// Execute trades

if longCondition

strategy.entry("Long", strategy.long, comment="Long Entry")

strategy.exit("Long Exit", "Long", limit=targetLevel, stop=stopLevel)

if shortCondition

strategy.entry("Short", strategy.short, comment="Short Entry")

strategy.exit("Short Exit", "Short", limit=targetLevel, stop=stopLevel)

// Plot signals - fixed plotshape parameters

plotshape(series=longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup)

plotshape(series=shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown)

plot(triggerLevel, "Trigger Level", color=color.yellow, style=plot.style_circles)

plot(targetLevel, "Target Level", color=color.blue, style=plot.style_circles)

plot(stopLevel, "Stop Level", color=color.red, style=plot.style_circles)