Overview

This strategy is a low timeframe leveraged trend following system based on moving average breakouts, RSI indicator, and volume analysis. The strategy utilizes EMA as the primary trend indicator, combined with RSI and volume to confirm signal strength, while managing risk through defined stop-loss and profit targets. It is designed for low timeframes such as 3-minute, 5-minute, or 15-minute charts, with a maximum leverage of 40x.

Strategy Principles

The core logic of the strategy is based on the following key elements: 1. Trend Confirmation: Uses 9-period EMA as the main reference for trend direction. Price crossing above EMA indicates an uptrend, while crossing below suggests a downtrend. 2. Momentum Verification: Employs 14-period RSI to verify price momentum. RSI above 50 supports long positions, below 50 supports shorts. 3. Volume Confirmation: Requires current volume to exceed 1.5 times the 50-period volume average to ensure sufficient market liquidity for breakouts. 4. Risk Management: Implements a 1.3% stop-loss with a 2.0 risk-reward ratio for profit targets, ensuring controlled risk per trade.

Strategy Advantages

- Signal Reliability: Cross-validation through multiple technical indicators enhances trade signal reliability. EMA reflects trends, RSI confirms momentum, and volume validates market participation.

- Comprehensive Risk Control: Features clear stop-loss and profit targets, optimizing capital management through fixed risk-reward ratios.

- High Adaptability: Parameters can be adjusted for different market conditions, including EMA periods, RSI thresholds, and stop-loss percentages.

- High Execution Efficiency: Low timeframe strategy enables high capital turnover, facilitating quick capture of market opportunities.

Strategy Risks

- High Leverage Risk: 40x leverage significantly amplifies price volatility’s impact on account value, potentially leading to substantial drawdowns.

- False Breakout Risk: False breakouts are common in lower timeframes, potentially triggering incorrect trade signals.

- Slippage Impact: Slippage can significantly affect strategy performance under low timeframe and high leverage conditions.

- Market Environment Dependency: Strategy may generate frequent false signals in ranging markets, affecting profitability.

Strategy Optimization Directions

- Dynamic Parameter Adjustment: Recommend dynamically adjusting EMA periods and RSI thresholds based on market volatility to adapt to different market conditions.

- Trend Strength Filtering: Consider adding ADX indicator to filter weak trend environments, reducing false signals in ranging markets.

- Leverage Management Optimization: Suggest designing a dynamic leverage management system that automatically adjusts leverage based on market volatility and account risk levels.

- Exit Mechanism Improvement: Consider implementing trailing stops or volatility-based dynamic stops to enhance strategy profitability.

Summary

The strategy builds a complete trading system by combining moving average, momentum, and volume indicators, featuring clear entry, exit, and risk management mechanisms. While there are inherent risks under high leverage and low timeframe conditions, the strategy maintains good application value and development potential through parameter optimization and risk management improvements. Traders are advised to start with small capital when implementing the strategy in live trading, gradually validating performance and continuously adjusting based on market feedback.

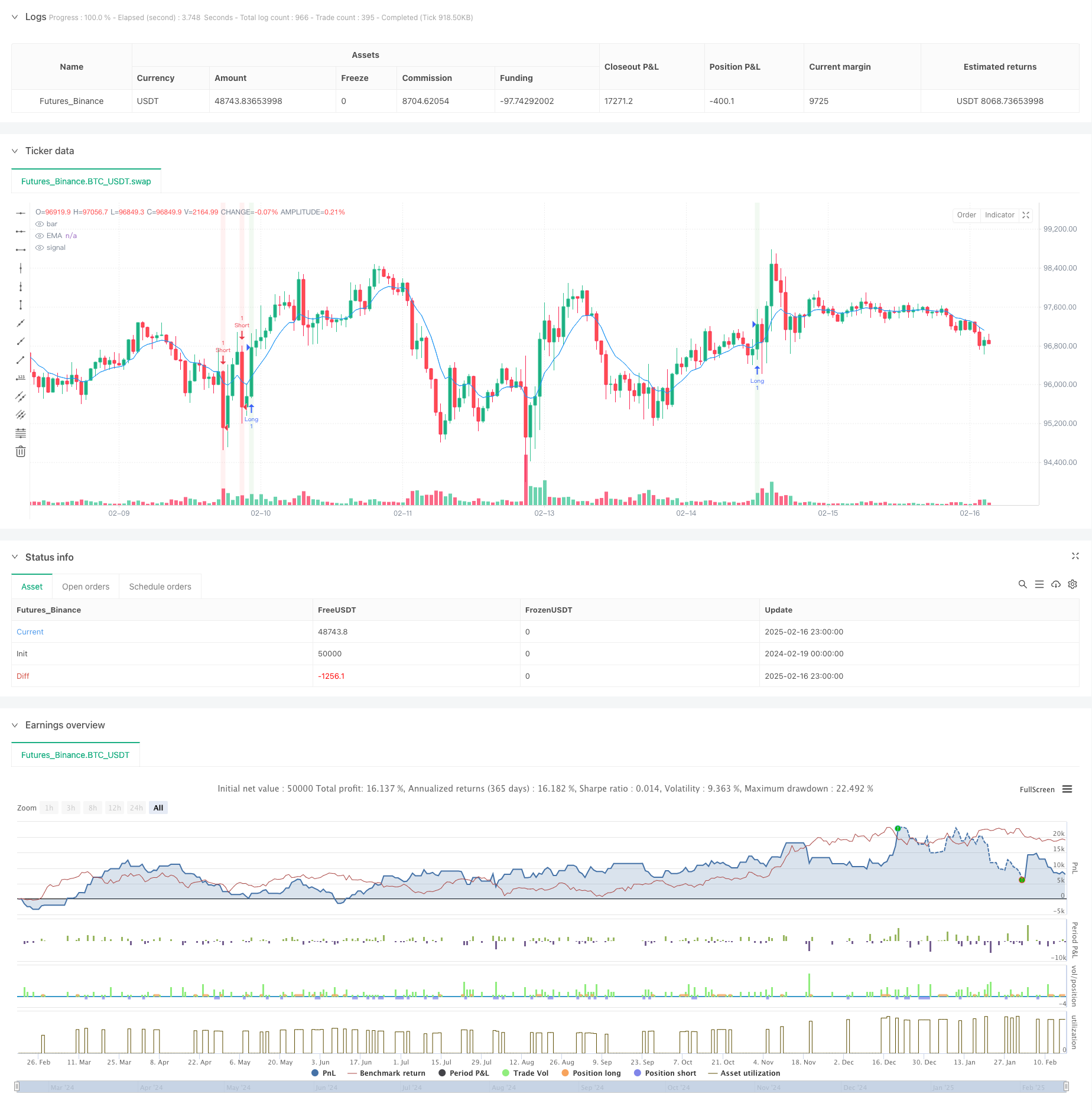

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-17 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Low Timeframe Leverage Strategy", overlay=true, shorttitle="LTF Lev 40x")

// Inputs

ema_len = input.int(9, title="EMA Length")

rsi_len = input.int(14, title="RSI Length")

rsi_threshold = input.int(50, title="RSI Threshold")

stop_loss_percent = input.float(1.3, title="Stop Loss %", minval=0.1, step=0.1)

risk_reward_ratio = input.float(2.0, title="Risk-Reward Ratio", minval=1.0)

vol_multiplier = input.float(1.5, title="Volume Multiplier", minval=1.0, step=0.1)

// Indicators

ema = ta.ema(close, ema_len)

rsi = ta.rsi(close, rsi_len)

avg_vol = ta.sma(volume, 50)

vol_spike = volume > avg_vol * vol_multiplier

// Entry Conditions

long_condition = ta.crossover(close, ema) and rsi > rsi_threshold and vol_spike

short_condition = ta.crossunder(close, ema) and rsi < 100 - rsi_threshold and vol_spike

// Stop Loss and Take Profit

stop_loss_long = close * (1 - stop_loss_percent / 100)

take_profit_long = close + (close - stop_loss_long) * risk_reward_ratio

stop_loss_short = close * (1 + stop_loss_percent / 100)

take_profit_short = close - (stop_loss_short - close) * risk_reward_ratio

// Execute Trades

if (long_condition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Long", limit=take_profit_long, stop=stop_loss_long)

if (short_condition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Short", limit=take_profit_short, stop=stop_loss_short)

// Plot EMA

plot(ema, color=color.blue, title="EMA")

// Background for Buy/Sell Conditions

bgcolor(long_condition ? color.new(color.green, 90) : na)

bgcolor(short_condition ? color.new(color.red, 90) : na)