Overview

This strategy is a trading system based on moving average crossover signals and trend filtering. It combines short-term SMA crossover signals (9-period and 15-period) with a long-term EMA (200-period) as a trend filter to capture market trends across different timeframes. The system also includes a re-entry mechanism that allows for position rebuilding during trend continuation.

Strategy Principles

The strategy employs a triple moving average system for trading decisions: 1. Uses 9-period and 15-period Simple Moving Averages (SMA) for generating trading signals 2. Employs 200-period Exponential Moving Average (EMA) as a trend filter 3. Generates long signals when the short-term SMA (9-period) crosses above the 15-period SMA and price is above the 200-period EMA 4. Generates short signals when the short-term SMA (9-period) crosses below the 15-period SMA and price is below the 200-period EMA 5. Includes re-entry logic allowing new positions after initial crossover signals as long as price maintains position relative to the 200 EMA

Strategy Advantages

- Multiple timeframe analysis: Combines short-term and long-term moving averages for a comprehensive market perspective

- Trend filtering: Uses 200 EMA to filter false signals and improve trade quality

- Re-entry mechanism: Allows multiple entries during strong trends to maximize profit potential

- Clear entry/exit rules: Based on objective technical indicators, reducing subjective judgment

- Bi-directional trading: Profits from both bullish and bearish markets

- Integrated risk management: Automatic risk control through the moving average system

Strategy Risks

- Choppy market risk: May generate frequent false signals in sideways markets

- Lag risk: Moving averages are inherently lagging indicators, potentially missing optimal entry points

- Trend reversal risk: May suffer significant losses during sharp market reversals

- Re-entry risk: Excessive position building may lead to overexposure Mitigation measures:

- Add additional volatility filters

- Set maximum position limits

- Implement dynamic stop-loss mechanisms

- Deploy position sizing system

Strategy Optimization Directions

- Dynamic Period Optimization:

- Automatically adjust moving average periods based on market volatility

- Introduce Adaptive Moving Averages (AMA) to replace fixed-period ones

- Entry Optimization:

- Add volume confirmation

- Include momentum indicator validation

- Implement price pattern confirmation

- Risk Management Optimization:

- Implement dynamic position sizing

- Add trailing stops

- Develop volatility-based stop-loss settings

- Re-entry Logic Optimization:

- Add trend strength confirmation

- Design graduated position building system

- Incorporate market environment recognition

Summary

This strategy builds a comprehensive trend-following trading system by combining multiple moving average systems with trend filters. Its main advantage lies in capturing significant profits in trending markets while improving stability through moving average filtering and re-entry mechanisms. Although inherent risks exist, implementing the optimization directions can further enhance strategy performance. The strategy is suitable for tracking medium to long-term market trends and serves as a reliable trading tool for patient traders.

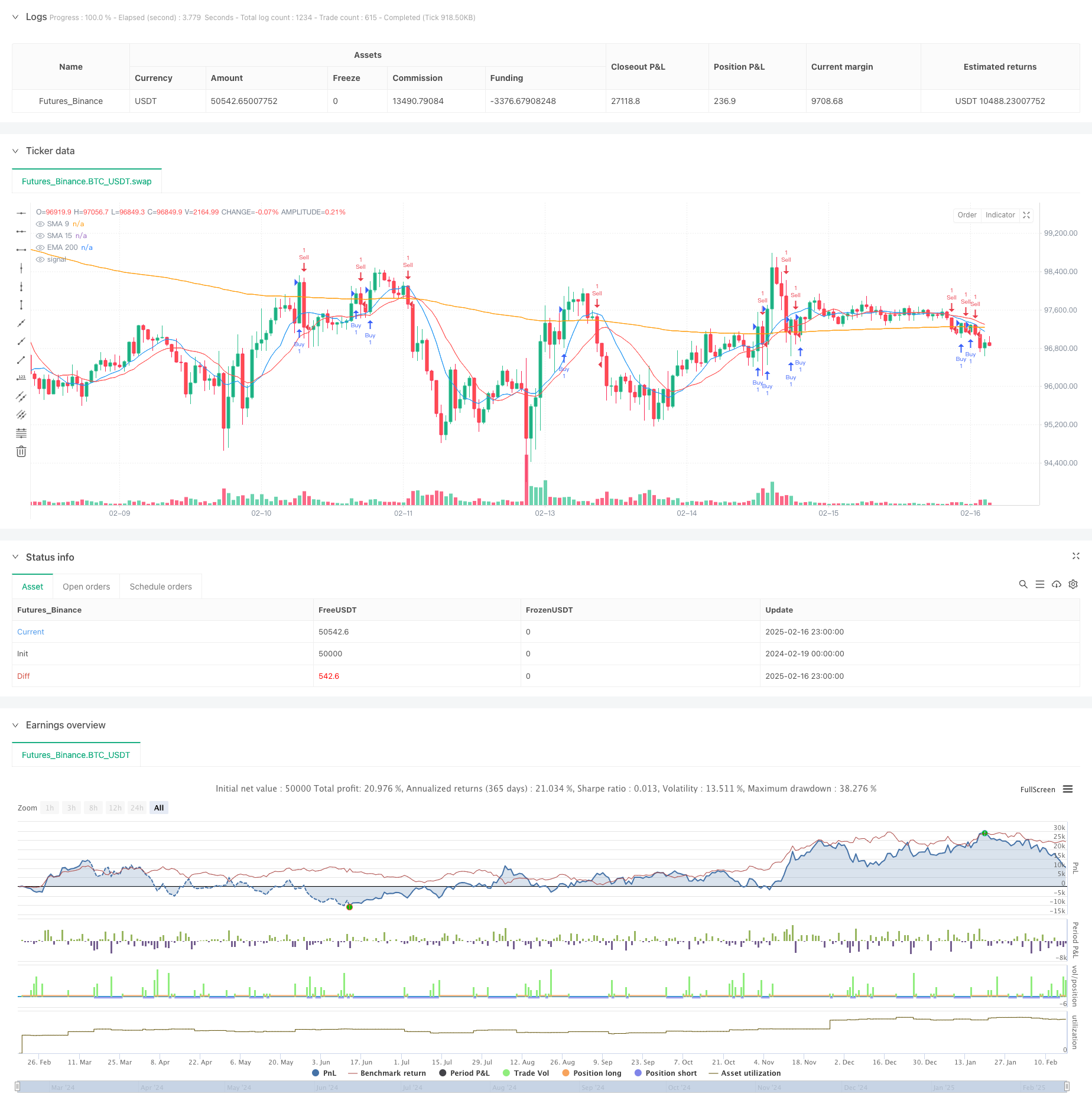

/*backtest

start: 2024-02-19 00:00:00

end: 2025-02-17 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMA Crossover with EMA Filter", overlay=true)

// Define indicators

sma9 = ta.sma(close, 9)

sma15 = ta.sma(close, 15)

ema200 = ta.ema(close, 200)

// Crossover conditions

bullish_crossover = ta.crossover(sma9, sma15) // Buy signal

bearish_crossover = ta.crossunder(sma9, sma15) // Sell signal

// Filters

above_ema200 = close > ema200

below_ema200 = close < ema200

// Buy condition (only above 200 EMA)

buy_signal = bullish_crossover and above_ema200

if buy_signal

strategy.entry("Buy", strategy.long)

// Sell condition (only below 200 EMA)

sell_signal = bearish_crossover and below_ema200

if sell_signal

strategy.entry("Sell", strategy.short)

// Exit condition if the signal reverses

exit_long = bearish_crossover

exit_short = bullish_crossover

if exit_long

strategy.close("Buy")

if exit_short

strategy.close("Sell")

// Re-entry condition when price crosses EMA 200 after a prior crossover

buy_reentry = ta.barssince(bullish_crossover) > 0 and above_ema200

sell_reentry = ta.barssince(bearish_crossover) > 0 and below_ema200

if buy_reentry

strategy.entry("Buy", strategy.long)

if sell_reentry

strategy.entry("Sell", strategy.short)

// Plot indicators

plot(sma9, color=color.blue, title="SMA 9")

plot(sma15, color=color.red, title="SMA 15")

plot(ema200, color=color.orange, title="EMA 200")