Overview

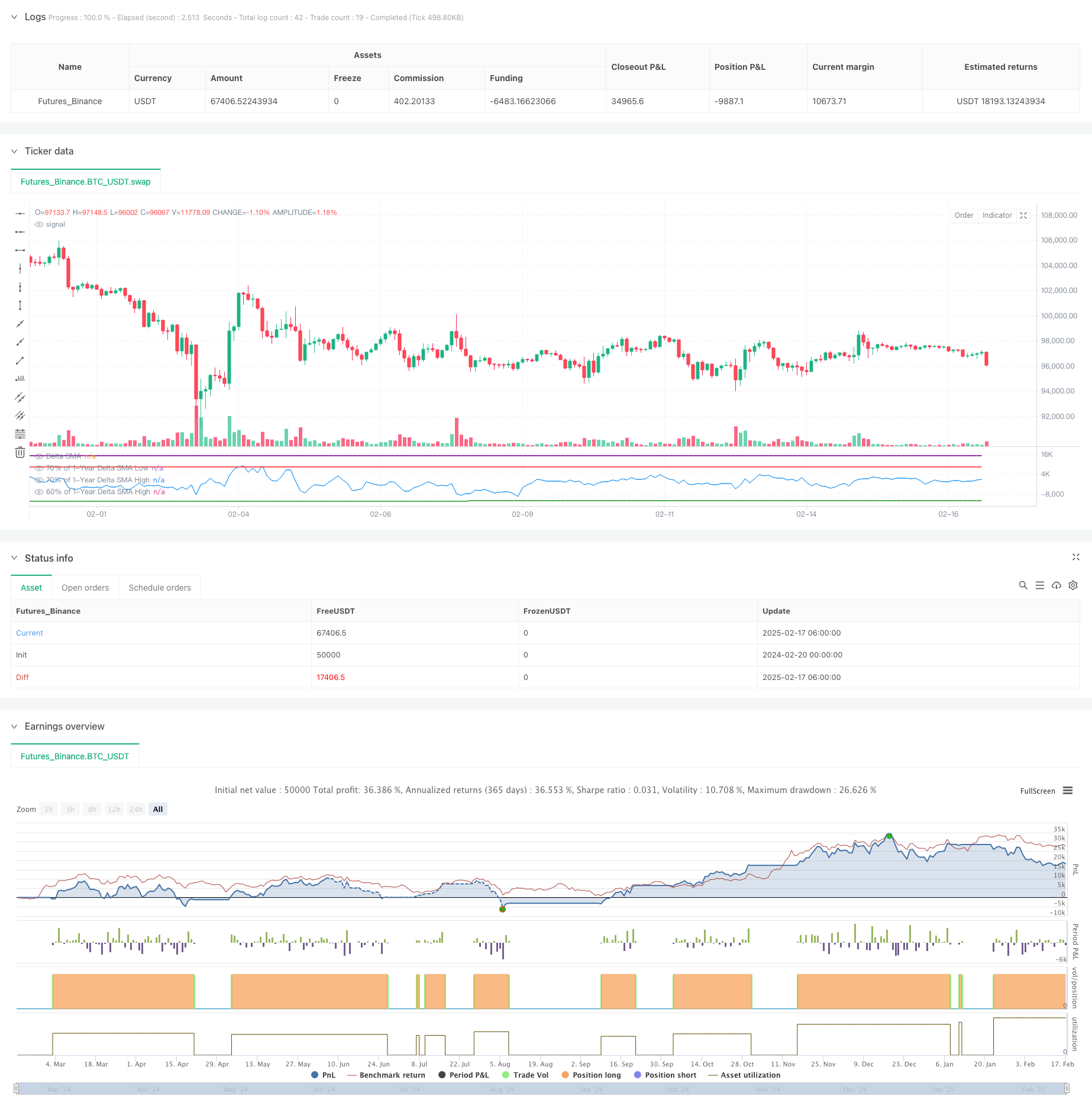

This is a trading strategy based on analyzing the historical highs and lows of the Delta SMA (Simple Moving Average) of buy/sell volumes over a one-year period. The strategy identifies potential trading signals by comparing the Delta SMA with historical threshold values. It employs a long-term lookback period, making it suitable for medium to long-term trend trading.

Strategy Principles

The core logic of the strategy is based on the following key steps: 1. Delta Calculation: Calculate the difference between buy and sell volumes based on price movement. Volume is recorded as buy volume when closing price is above opening price, and vice versa. 2. SMA Smoothing: Apply a 14-period moving average to the Delta value to reduce noise. 3. One-Year High/Low Determination: Calculate the highest and lowest values of Delta SMA over the past year. 4. Signal Trigger Conditions: - Buy Signal: Triggered when Delta SMA crosses above 0 after falling below 70% of the yearly low - Sell Signal: Triggered when Delta SMA falls below 60% after crossing above 90% of the yearly high

Strategy Advantages

- Strong Long-term Trend Capture: Effectively captures major trends through one-year historical data analysis.

- Excellent Noise Filtering: Uses SMA smoothing and multiple threshold conditions to effectively reduce false signals.

- Reasonable Risk Control: Sets clear entry and exit conditions to avoid overtrading.

- High Adaptability: Strategy parameters can be adjusted for different market conditions.

Strategy Risks

- Lag Risk: Use of SMA and long lookback period may lead to delayed signals.

- False Breakout Risk: May generate false signals in ranging markets.

- Market Environment Dependency: May underperform in markets without clear trends.

- Parameter Sensitivity: Threshold settings significantly impact strategy performance.

Strategy Optimization Directions

- Dynamic Threshold Adjustment: Dynamically adjust high/low thresholds based on market volatility.

- Additional Indicators: Incorporate other technical indicators to improve signal reliability.

- Stop-Loss Implementation: Implement dynamic stop-loss mechanisms for risk control.

- Market Environment Filtering: Add market environment assessment logic to run the strategy in suitable conditions.

Summary

This is a medium to long-term trend following strategy based on volume analysis, capturing market trends by analyzing historical highs and lows of buy/sell volume differences. The strategy is well-designed with proper risk control, but attention needs to be paid to market environment adaptability and parameter optimization. Through the proposed optimization directions, there is room for further strategy improvement.

/*backtest

start: 2024-02-20 00:00:00

end: 2025-02-17 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Delta SMA 1-Year High/Low Strategy", overlay = false, margin_long = 100, margin_short = 100)

// Inputs

delta_sma_length = input.int(14, title="Delta SMA Length", minval=1) // SMA length for Delta

lookback_days = 365 // Lookback period fixed to 1 year

// Function to calculate buy and sell volume

buy_volume = close > open ? volume : na

sell_volume = close < open ? volume : na

// Calculate the Delta

delta = nz(buy_volume, 0) - nz(sell_volume, 0)

// Calculate Delta SMA

delta_sma = ta.sma(delta, delta_sma_length)

// Lookback period in bars (1 bar = 1 day)

desired_lookback_bars = lookback_days

// Ensure lookback doesn't exceed available historical data

max_lookback_bars = math.min(desired_lookback_bars, 365) // Cap at 365 bars (1 year)

// Calculate Delta SMA low and high within the valid lookback period

delta_sma_low_1yr = ta.lowest(delta_sma, max_lookback_bars)

delta_sma_high_1yr = ta.highest(delta_sma, max_lookback_bars)

// Define thresholds for buy and sell conditions

very_low_threshold = delta_sma_low_1yr * 0.7

above_70_threshold = delta_sma_high_1yr * 0.9

below_60_threshold = delta_sma_high_1yr * 0.5

// Track if `delta_sma` was very low and persist the state

var bool was_very_low = false

if delta_sma < very_low_threshold

was_very_low := true

if ta.crossover(delta_sma, 10000)

was_very_low := false // Reset after crossing 0

// Track if `delta_sma` crossed above 70% of the high

var bool crossed_above_70 = false

if ta.crossover(delta_sma, above_70_threshold)

crossed_above_70 := true

if delta_sma < below_60_threshold*0.5 and crossed_above_70

crossed_above_70 := false // Reset after triggering sell

// Buy condition: `delta_sma` was very low and now crosses 0

buy_condition = was_very_low and ta.crossover(delta_sma, 0)

// Sell condition: `delta_sma` crossed above 70% of the high and now drops below 60%

sell_condition = crossed_above_70 and delta_sma < below_60_threshold

// Place a long order when buy condition is met

if buy_condition

strategy.entry("Buy", strategy.long)

// Place a short order when sell condition is met

if sell_condition

strategy.close("Buy")

// Plot Delta SMA and thresholds for visualization

plot(delta_sma, color=color.blue, title="Delta SMA")

plot(very_low_threshold, color=color.green, title="70% of 1-Year Delta SMA Low", linewidth=2)

plot(above_70_threshold, color=color.purple, title="70% of 1-Year Delta SMA High", linewidth=2)

plot(below_60_threshold, color=color.red, title="60% of 1-Year Delta SMA High", linewidth=2)

// Optional: Plot Buy and Sell signals on the chart

//plotshape(series=buy_condition, title="Buy Signal", location=location.belowbar, color=color.new(color.green, 0), style=shape.labelup, text="BUY")

//plotshape(series=sell_condition, title="Sell Signal", location=location.abovebar, color=color.new(color.red, 0), style=shape.labeldown, text="SELL")