Overview

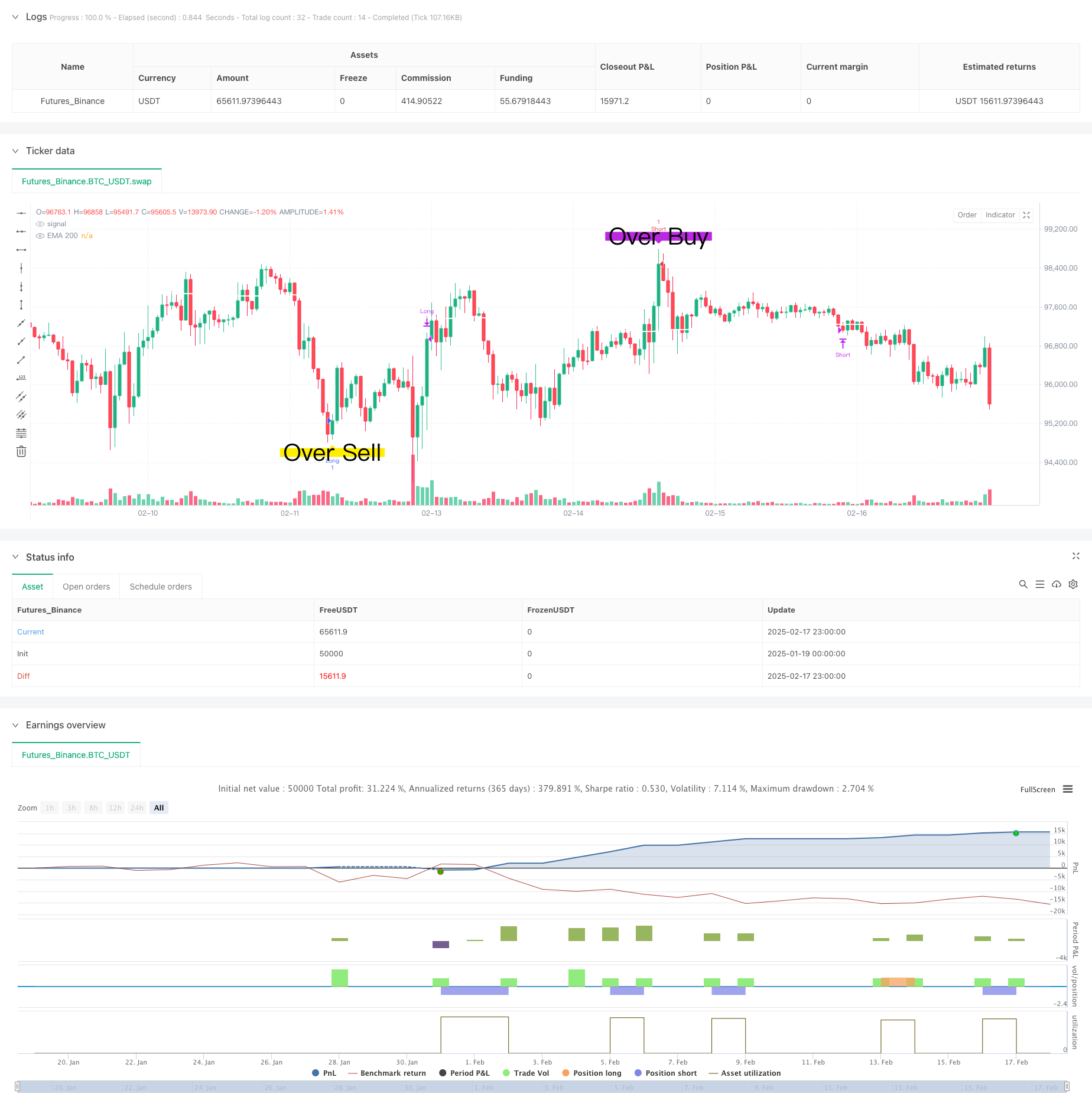

This is an adaptive trading strategy based on dual technical indicators RSI and CCI. The strategy monitors the cross-state of RSI and CCI indicators under different time periods, combined with EMA trend, to build a complete trading system. The strategy features strong adaptability and stable signals, effectively capturing market overbought and oversold opportunities.

Strategy Principle

The core logic includes: 1. Time period adaptation: Dynamically adjusts RSI and CCI parameters based on different time periods (1 minute to 4 hours). 2. Dual indicator confirmation: Uses combination of RSI (Relative Strength Index) and CCI (Commodity Channel Index) to filter trading signals. Trading signals are generated only when both RSI and CCI meet specific conditions. 3. Signal persistence verification: Ensures signal stability through minimum duration settings (stayTimeFrames). 4. Dynamic profit/loss limits: Sets dynamic take-profit and stop-loss levels based on entry RSI and CCI levels. 5. Trend confirmation: Uses 200-period EMA as trend reference.

Strategy Advantages

- Strong adaptability: Strategy automatically adjusts parameters for different time periods.

- High signal reliability: Cross-confirmation through dual technical indicators significantly improves signal reliability.

- Comprehensive risk control: Dynamic profit/loss mechanism effectively controls risk.

- Clear operation rules: Entry and exit conditions are clear for practical operation.

- Good extensibility: Flexible strategy framework allows addition of new filtering conditions.

Strategy Risks

- Parameter sensitivity: Optimal parameters may vary in different market environments.

- Range-bound market risk: False signals may occur during market consolidation.

- Slippage impact: High-frequency trading may face slippage effects.

- Signal delay: Multiple confirmation mechanisms may cause slight delays in entry timing.

- Market environment dependence: May perform better in trending markets than ranging markets.

Strategy Optimization

- Parameter adaptation: Introduce adaptive parameter optimization mechanism for dynamic adjustment based on market conditions.

- Market environment recognition: Add market state identification module for different trading strategies in various market conditions.

- Volatility adaptation: Introduce volatility indicators to adjust profit/loss parameters based on volatility levels.

- Signal filtering: Add more technical indicators and pattern recognition to filter false signals.

- Risk management: Improve money management plan, enhance position time and size control.

Summary

The strategy builds a robust trading system by combining the advantages of RSI and CCI indicators. Its adaptive features and comprehensive risk control mechanisms provide good practicality. Through continuous optimization and improvement, the strategy shows promise for better performance in actual trading. Traders are advised to conduct thorough backtesting and parameter optimization before live implementation.

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI & CCI Strategy with Alerts", overlay=true)

// Detect current chart timeframe

tf = timeframe.period

// Define settings for different timeframes

rsiLength = tf == "1" ? 30 : tf == "5" ? 30 : tf == "15" ? 30 : tf == "30" ? 30 : 30 // Default

cciLength = tf == "1" ? 15 : tf == "5" ? 20 : tf == "15" ? 20 : tf == "30" ? 20 : 20 // Default

cciBuyThreshold = tf == "1" ? -100 : tf == "5" ? -100 : tf == "15" ? -100 : tf == "30" ? -100 : -100

cciSellThreshold = tf == "1" ? 100 : tf == "5" ? 100 : tf == "15" ? 100 : tf == "30" ? 100 : 100 // Default

stayTimeFrames = tf == "1" ? 1 : tf == "5" ? 1 : tf == "15" ? 1 : tf == "30" ? 1 : tf == "240" ? 1 : 2 // Default

stayTimeFramesOver =tf == "1" ? 1 : tf == "5" ? 2 : tf == "15" ? 2 : tf == "30" ? 3 : 2 // Default

// Calculate RSI & CCI

rsi = ta.rsi(close, rsiLength)

rsiOver = ta.rsi(close, 14)

cci = ta.cci(close, cciLength)

// EMA 50

ema200 = ta.ema(close, 200)

plot(ema200, color=color.rgb(255, 255, 255), linewidth=2, title="EMA 200")

// CCI candle threshold tracking

var int cciEntryTimeLong = na

var int cciEntryTimeShort = na

// Store entry time when CCI enters the zone

if (cci < cciBuyThreshold)

if na(cciEntryTimeLong)

cciEntryTimeLong := bar_index

else

cciEntryTimeLong := na

if (cci > cciSellThreshold)

if na(cciEntryTimeShort)

cciEntryTimeShort := bar_index

else

cciEntryTimeShort := na

// Confirming CCI has stayed in the threshold for required bars

cciStayedBelowNeg100 = not na(cciEntryTimeLong) and (bar_index - cciEntryTimeLong >= stayTimeFrames) and rsi >= 53

cciStayedAbove100 = not na(cciEntryTimeShort) and (bar_index - cciEntryTimeShort >= stayTimeFrames) and rsi <= 47

// CCI & RSI candle threshold tracking for Buy Over and Sell Over signals

var int buyOverEntryTime = na

var int sellOverEntryTime = na

// Track entry time when RSI and CCI conditions are met

if (rsiOver <= 31 and cci <= -120)

if na(buyOverEntryTime)

buyOverEntryTime := bar_index

else

buyOverEntryTime := na

if (rsiOver >= 69 and cci >= 120)

if na(sellOverEntryTime)

sellOverEntryTime := bar_index

else

sellOverEntryTime := na

// Confirm that conditions are met for the required stayTimeFrames

buyOverCondition = not na(buyOverEntryTime) and (bar_index - buyOverEntryTime >= stayTimeFramesOver)

sellOverCondition = not na(sellOverEntryTime) and (bar_index - sellOverEntryTime <= stayTimeFramesOver)

//Buy and sell for over bought or sell

conditionOverBuy = buyOverCondition

conditionOverSell = sellOverCondition

// Buy and sell conditions

buyCondition = cciStayedBelowNeg100

sellCondition = cciStayedAbove100

// // Track open positions

var bool isLongOpen = false

var bool isShortOpen = false

// // Strategy logic for backtesting

// if (buyCondition and not isLongOpen)

// strategy.entry("Long", strategy.long)

// isLongOpen := true

// isShortOpen := false

// if (sellCondition and not isShortOpen)

// strategy.entry("Short", strategy.short)

// isShortOpen := true

// isLongOpen := false

// // Close positions based on EMA 50

// if (isLongOpen and exitLongCondition)

// strategy.close("Long")

// isLongOpen := false

// if (isShortOpen and exitShortCondition)

// strategy.close("Short")

// isShortOpen := false

// Track RSI at position entry

var float entryRSILong = na

var float entryRSIShort = na

// Track CCI at position entry

var float entryCCILong = na

var float entryCCIShort = na

if (buyOverCondition and not isLongOpen)

strategy.entry("Long", strategy.long)

entryRSILong := rsi // Store RSI at entry

entryCCILong := cci

isLongOpen := true

isShortOpen := false

if (sellOverCondition and not isShortOpen)

strategy.entry("Short", strategy.short)

entryRSIShort := rsi // Store RSI at entry

entryCCIShort := cci // Stpre CCI at entry

isShortOpen := true

isLongOpen := false

exitLongRSICondition = isLongOpen and not na(entryRSILong) and rsi >= (entryRSILong + 12) or rsi <= (entryRSILong -8)

exitShortRSICondition = isShortOpen and not na(entryRSIShort) and rsi <= (entryRSIShort - 12) or rsi >= (entryRSIShort +8)

exitLongCCICondition = isLongOpen and not na(entryCCILong) and cci <= (entryCCILong -100)

exitShortCCICondition = isShortOpen and not na(entryCCIShort) and cci >= (entryCCIShort +100)

// Close positions based on EMA 50 or RSI change

if (isLongOpen and (exitLongRSICondition) or (exitLongCCICondition))

strategy.close("Long")

isLongOpen := false

entryRSILong := na

entryCCILong := na

isLongOpen := false

if (isShortOpen and (exitShortRSICondition) or (exitShortCCICondition))

strategy.close("Short")

isShortOpen := false

entryRSIShort := na

entryCCIShort := na

isShortOpen := false

// Plot buy and sell signals

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.large, title="Buy Signal", text="BUY")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.large, title="Sell Signal", text="SELL")

//Plot buy and sell OverBought

plotshape(conditionOverBuy, style=shape.labelup, location=location.belowbar, color=color.rgb(255, 238, 0), size=size.large, title="OverBuy Signal", text="Over Sell")

plotshape(conditionOverSell, style=shape.labeldown, location=location.abovebar, color=color.rgb(186, 40, 223), size=size.large, title="OverSell Signal", text="Over Buy")

// Alerts

alertcondition(buyCondition, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell Signal Triggered")