Overview

This strategy is an adaptive trading system that combines Bollinger Bands and ATR trailing stop loss. It uses Bollinger Bands breakouts for entry signals while implementing an ATR-based dynamic trailing stop loss for risk management and exit timing. The strategy is designed to capture trending opportunities while providing protection in ranging markets.

Strategy Principles

The core logic consists of two main components: 1. Entry Signal System: Uses Bollinger Bands (BB) as the primary indicator, generating long signals when price breaks above the lower band and short signals when price breaks below the upper band. BB parameters are set to 20-period moving average as the middle band with a standard deviation multiplier of 2.0. 2. Stop Loss Management System: Employs a 14-period ATR with a multiplier of 3.0 for volatility reference. The stop loss line moves up with price increases during long positions and vice versa. This dynamic stop loss mechanism allows profits to grow naturally while effectively controlling drawdowns.

Strategy Advantages

- High Adaptability: Both Bollinger Bands and ATR are calculated based on actual market volatility, automatically adapting to different market conditions.

- Comprehensive Risk Control: The ATR dynamic stop loss enables timely exits while avoiding premature exits in strong trends.

- Clear Signals: Entry and exit signals are based on definitive price breakouts, requiring no subjective judgment.

- High Visualization: The strategy clearly marks all signal points on the chart, facilitating analysis and optimization.

Strategy Risks

- Ranging Market Risk: In markets without clear trends, frequent false breakouts may lead to consecutive stop losses.

- Slippage Risk: During high volatility periods, actual execution prices may significantly deviate from theoretical signal prices.

- Parameter Sensitivity: Strategy performance is sensitive to Bollinger Bands and ATR parameter settings, requiring optimization for different market environments.

Strategy Optimization Directions

- Add Trend Filters: Additional trend identification indicators can be incorporated to open positions only in clear trends, reducing false signals in ranging markets.

- Optimize Stop Loss Parameters: ATR multiplier can be dynamically adjusted based on different market conditions, using wider stops in high volatility periods.

- Implement Position Sizing: Design a dynamic position sizing system based on ATR to automatically adjust position size in different volatility environments.

- Include Time Filters: Avoid trading during high volatility periods such as major economic data releases.

Summary

The strategy combines Bollinger Bands and ATR trailing stop loss to create a trading system that balances trend capture and risk control capabilities. Its adaptive nature maintains stability across different market environments, while the clear signal system provides objective trading criteria. The suggested optimization directions offer room for further improvement. In practical application, investors should adjust parameters according to their risk preferences and specific trading instrument characteristics.

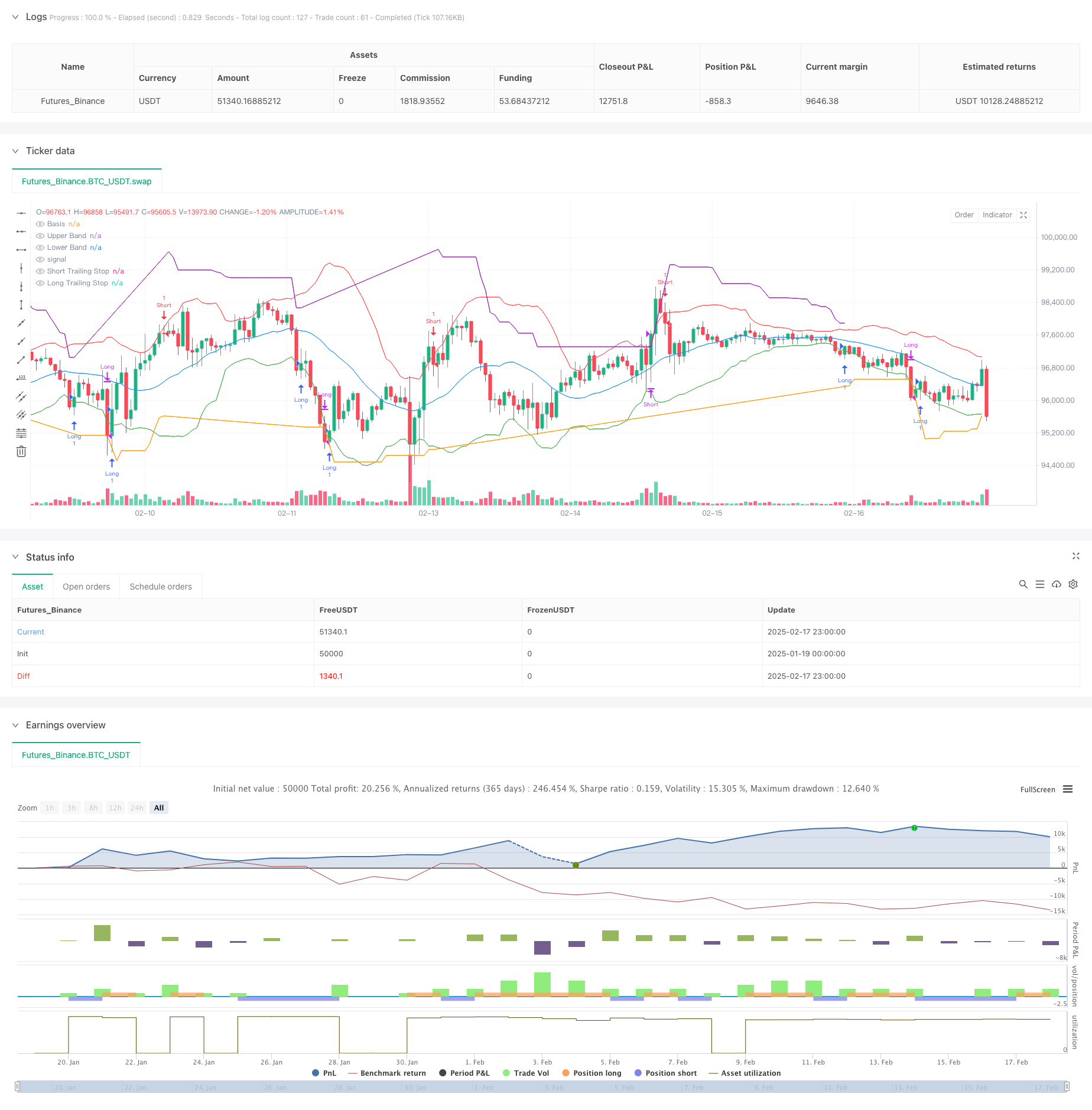

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ATR Trailing Stop Loss with Bollinger Bands", overlay=true)

// Input parameters for Bollinger Bands

bb_length = input.int(20, title="Bollinger Bands Length")

bb_stddev = input.float(2.0, title="Bollinger Bands Std Dev")

// Input parameters for ATR Trailing Stop Loss

atr_length = input.int(14, title="ATR Length")

atr_multiplier = input.float(3.0, title="ATR Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(close, bb_length)

upper_band = ta.sma(close, bb_length) + ta.stdev(close, bb_length) * bb_stddev

lower_band = ta.sma(close, bb_length) - ta.stdev(close, bb_length) * bb_stddev

// Calculate ATR

atr = ta.atr(atr_length)

// Trailing Stop Loss Calculation

var float long_stop = na // Explicitly define as float type

var float short_stop = na // Explicitly define as float type

if (strategy.position_size > 0)

long_stop := close - atr * atr_multiplier

long_stop := math.max(long_stop, nz(long_stop[1], long_stop))

else

long_stop := na

if (strategy.position_size < 0)

short_stop := close + atr * atr_multiplier

short_stop := math.min(short_stop, nz(short_stop[1], short_stop))

else

short_stop := na

// Entry and Exit Conditions

long_condition = ta.crossover(close, lower_band) // Enter long when price crosses above lower band

short_condition = ta.crossunder(close, upper_band) // Enter short when price crosses below upper band

exit_long_condition = ta.crossunder(close, long_stop) // Exit long when price crosses below trailing stop

exit_short_condition = ta.crossover(close, short_stop) // Exit short when price crosses above trailing stop

// Execute Trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (exit_long_condition)

strategy.close("Long")

if (exit_short_condition)

strategy.close("Short")

// Plot Bollinger Bands

plot(basis, color=color.blue, title="Basis")

plot(upper_band, color=color.red, title="Upper Band")

plot(lower_band, color=color.green, title="Lower Band")

// Plot Trailing Stop Loss

plot(strategy.position_size > 0 ? long_stop : na, color=color.orange, title="Long Trailing Stop")

plot(strategy.position_size < 0 ? short_stop : na, color=color.purple, title="Short Trailing Stop")

// Labels for Entry and Exit

if (long_condition)

label.new(bar_index, low, text="Entry Long", style=label.style_circle, color=color.green, textcolor=color.white, size=size.small)

if (short_condition)

label.new(bar_index, high, text="Entry Short", style=label.style_circle, color=color.red, textcolor=color.white, size=size.small)

if (exit_long_condition)

label.new(bar_index, low, text="Exit Long", style=label.style_circle, color=color.blue, textcolor=color.white, size=size.small)

if (exit_short_condition)

label.new(bar_index, high, text="Exit Short", style=label.style_circle, color=color.orange, textcolor=color.white, size=size.small)