Overview

This strategy is a short-term trading system that combines multiple technical indicators, primarily based on the Parabolic SAR (PSAR) as the core signal generator, while incorporating moving averages and momentum indicators for trade filtering, along with a combination of dynamic stop-loss and fixed take-profit risk management methods. The strategy is designed to consider market trends and volatility, making it suitable for short-term trading in volatile market conditions.

Strategy Principles

The strategy uses the PSAR indicator as its primary trend determination tool, generating trading signals when price crosses the PSAR. To enhance signal reliability, the following filters are added: 1. 50-period Exponential Moving Average (EMA50) as a trend filter to ensure trade direction aligns with medium-term trends 2. Relative Strength Index (RSI) to filter out ranging markets, requiring RSI>40 for long positions and RSI<60 for short positions 3. Average True Range (ATR) for dynamic stop-loss calculation, providing more flexible risk control 4. Fixed 0.7% take-profit target to secure gains promptly 5. Position check mechanism to avoid duplicate entries

Strategy Advantages

- Comprehensive signal system: Combines trend following and momentum indicators for more reliable trading signals

- Flexible risk control: Dynamic stop-loss adapts to market volatility

- False breakout prevention: Multiple filtering conditions effectively reduce the impact of false signals

- Clear profit targets: Fixed take-profit ratio helps control holding time and improve capital efficiency

- Clear trading logic: Well-defined component responsibilities facilitate subsequent optimization and adjustment

Strategy Risks

- Over-filtering risk: Multiple conditions may cause missed trading opportunities

- Fixed take-profit limitations: 0.7% fixed take-profit may exit strong trends too early

- Parameter sensitivity: PSAR, EMA, RSI parameter settings significantly impact strategy performance

- Market environment dependence: May underperform in low volatility or highly volatile markets

- Slippage impact: Frequent trading may lead to higher transaction costs

Strategy Optimization Directions

- Dynamic take-profit mechanism: Adjust profit targets based on market volatility

- Position management optimization: Introduce volatility-based dynamic position sizing system

- Market environment recognition: Add market state identification module to adjust strategy parameters accordingly

- Indicator parameter optimization: Implement adaptive parameter adjustment mechanism

- Transaction cost control: Optimize entry/exit frequency to reduce trading costs

Summary

The strategy builds a complete trading system by combining multiple technical indicators, with solid considerations in trend identification, risk control, and trade execution. Its core strengths lie in its flexible risk control mechanism and comprehensive signal system, while attention needs to be paid to parameter optimization and market adaptability. Through continuous optimization and improvement, the strategy has the potential to maintain stable performance across different market conditions.

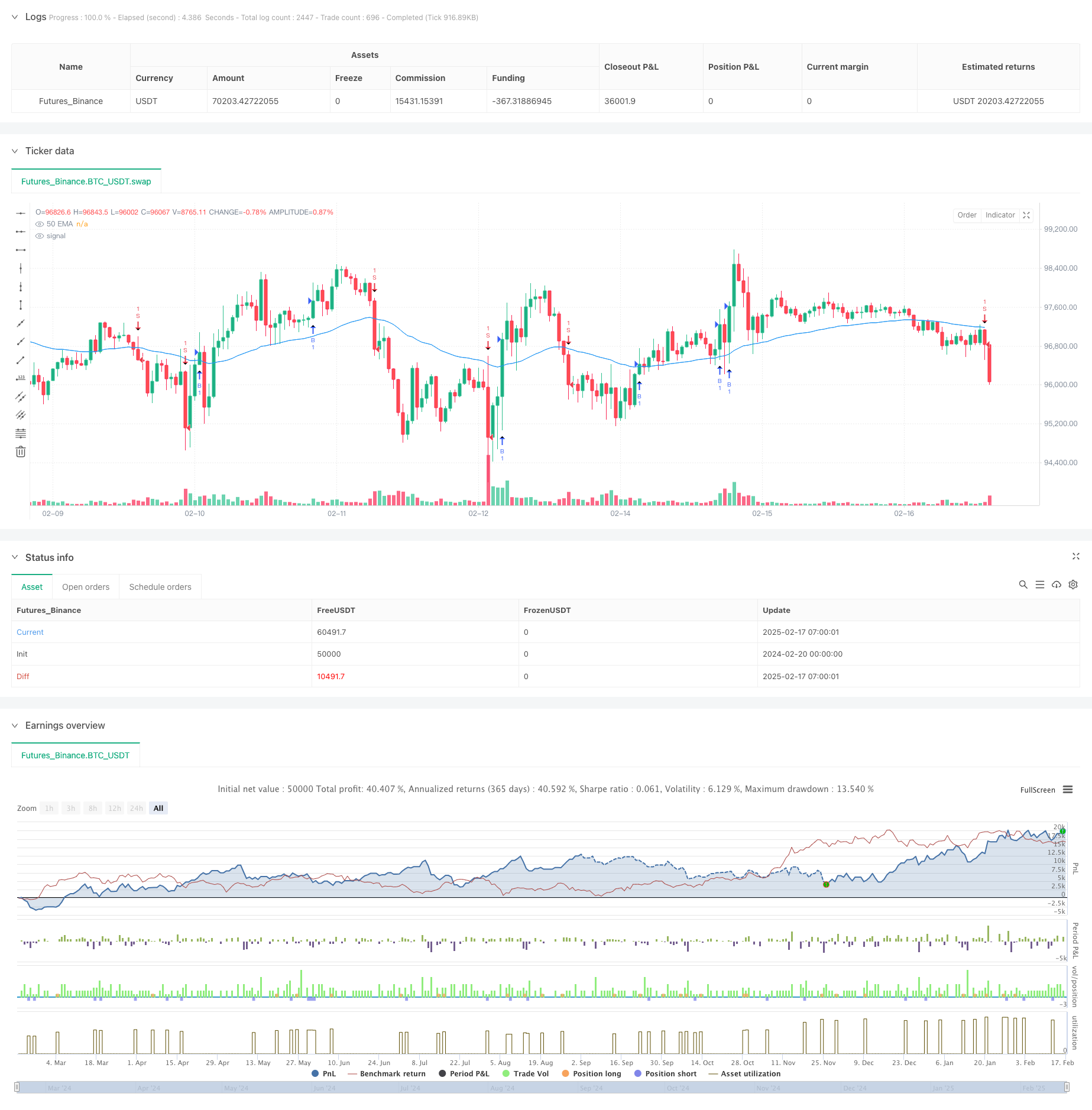

/*backtest

start: 2024-02-20 00:00:00

end: 2025-02-17 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("妮可百分百", overlay=true)

// 📌 設定 Parabolic SAR 參數

start = input.float(0.02, "起始 AF")

increment = input.float(0.02, "加速因子")

maximum = input.float(0.2, "最大 AF")

// 📌 計算 Parabolic SAR

SAR = ta.sar(start, increment, maximum)

// 📌 ATR 計算(用於動態止損)

atrLength = input.int(14, "ATR 計算週期")

atrMultiplier = input.float(1.3, "ATR 係數") // 2倍 ATR 作為止損範圍

ATR = ta.atr(atrLength)

// 📌 固定 0.5% 止盈計算

takeProfitPercent = 0.007 // 0.7% 固定止盈

takeProfitLong = close * (1 + takeProfitPercent) // 多單止盈

takeProfitShort = close * (1 - takeProfitPercent) // 空單止盈

// 📌 **50 EMA 過濾**

ema50 = ta.ema(close, 50)

// 📌 **RSI 過濾(防止震盪進場)**

rsiLength = input.int(14, "RSI 週期")

rsi = ta.rsi(close, rsiLength)

longFilter = rsi > 40 // 只在 RSI > 31 時做多

shortFilter = rsi < 60 // 只在 RSI < 69 時做空

// 📌 **檢查是否已經有持倉**

isFlat = strategy.position_size == 0 // **無持倉時,才能開新單**

// 🔼 **多頭進場條件**

longCondition = ta.crossover(close, SAR) and close > ema50 and longFilter and isFlat

// 🔽 **空頭進場條件**

shortCondition = ta.crossunder(close, SAR) and close < ema50 and shortFilter and isFlat

// 📌 **進場策略**

if (longCondition)

strategy.entry("B", strategy.long, comment="B")

if (shortCondition)

strategy.entry("S", strategy.short, comment="S")

// 📌 **止盈 & 止損**

stopLossLong = close - (ATR * atrMultiplier) // 多單 ATR 止損

stopLossShort = close + (ATR * atrMultiplier) // 空單 ATR 止損

strategy.exit("Exit Long", from_entry="B", stop=stopLossLong, limit=takeProfitLong, comment="TP Long")

strategy.exit("Exit Short", from_entry="S", stop=stopLossShort, limit=takeProfitShort, comment="TP Short")

// 📌 **標記進出場點**

plotshape(series=longCondition, location=location.belowbar, style=shape.triangleup, size=size.small, title="B")

plotshape(series=shortCondition, location=location.abovebar, style=shape.triangledown, size=size.small, title="S")

// 📌 **繪製 50 EMA**

plot(ema50, color=color.blue, title="50 EMA")