Overview

This strategy is a comprehensive trading system that combines multi-period trend following, volume analysis, and dynamic risk management. It integrates multiple technical indicators including Exponential Moving Average (EMA), Average Directional Index (ADX), Relative Strength Index (RSI), and Volume Weighted Average Price (VWAP) to construct an adaptive trading framework. The strategy emphasizes market pattern recognition across different time periods and optimizes entry timing through volume characteristics.

Strategy Principles

The strategy employs a layered architecture design with the following core components: 1. Trend Identification System: Uses a combination of EMA and ADX to determine market trend direction and strength, with ADX above 25 indicating a trending market. 2. Multi-Period Analysis: Achieves more accurate market positioning by comparing current timeframe with 4-hour chart technical indicators. 3. Dynamic Volatility Adjustment: Uses ATR indicator to adaptively adjust stop-loss positions and target prices. 4. Volume Analysis: Screens for low volatility entry opportunities by comparing current volume with average volume. 5. Risk Control: Implements a percentage risk model based on account equity to limit risk exposure per trade.

Strategy Advantages

- Multi-dimensional Verification: Improves signal reliability through cross-validation of technical indicators across multiple time periods.

- Precise Risk Control: Dynamic stop-loss setting based on ATR adapts to market volatility.

- Comprehensive Position Management: Achieves precise position control through percentage risk model based on account equity.

- Flexible Profit Targets: Sets multiple profit targets combining VWAP and Fibonacci extension levels.

- Low-Risk Entry: Reduces trading costs by screening for low volatility environments through volume analysis.

Strategy Risks

- Trend Reversal Risk: False breakouts may trigger stop-losses in strong trend markets.

- Parameter Optimization Risk: Multiple technical indicator parameters require periodic optimization, risking overfitting.

- Liquidity Risk: May face increased slippage in low liquidity environments.

- Systemic Risk: Stop-loss positions may be insufficient to control risk during extreme market volatility.

Strategy Optimization Directions

- Introduce Machine Learning: Optimize parameter adaptive capability through deep learning.

- Add Market Sentiment Indicators: Integrate options market volatility indicators to enhance market prediction capability.

- Improve Volume Analysis: Introduce more volume pattern recognition algorithms.

- Optimize Stop-Loss Mechanism: Develop dynamic stop-loss system based on market microstructure.

- Enhance Risk Control: Introduce correlation analysis to optimize portfolio risk management.

Summary

The strategy achieves comprehensive analysis of market trends, volatility, and volume through multi-layered technical indicator combinations. Its core advantage lies in combining multi-period analysis with strict risk control, maintaining stable performance across different market environments. Future improvements can further enhance strategy adaptability and robustness through advanced technologies like machine learning.

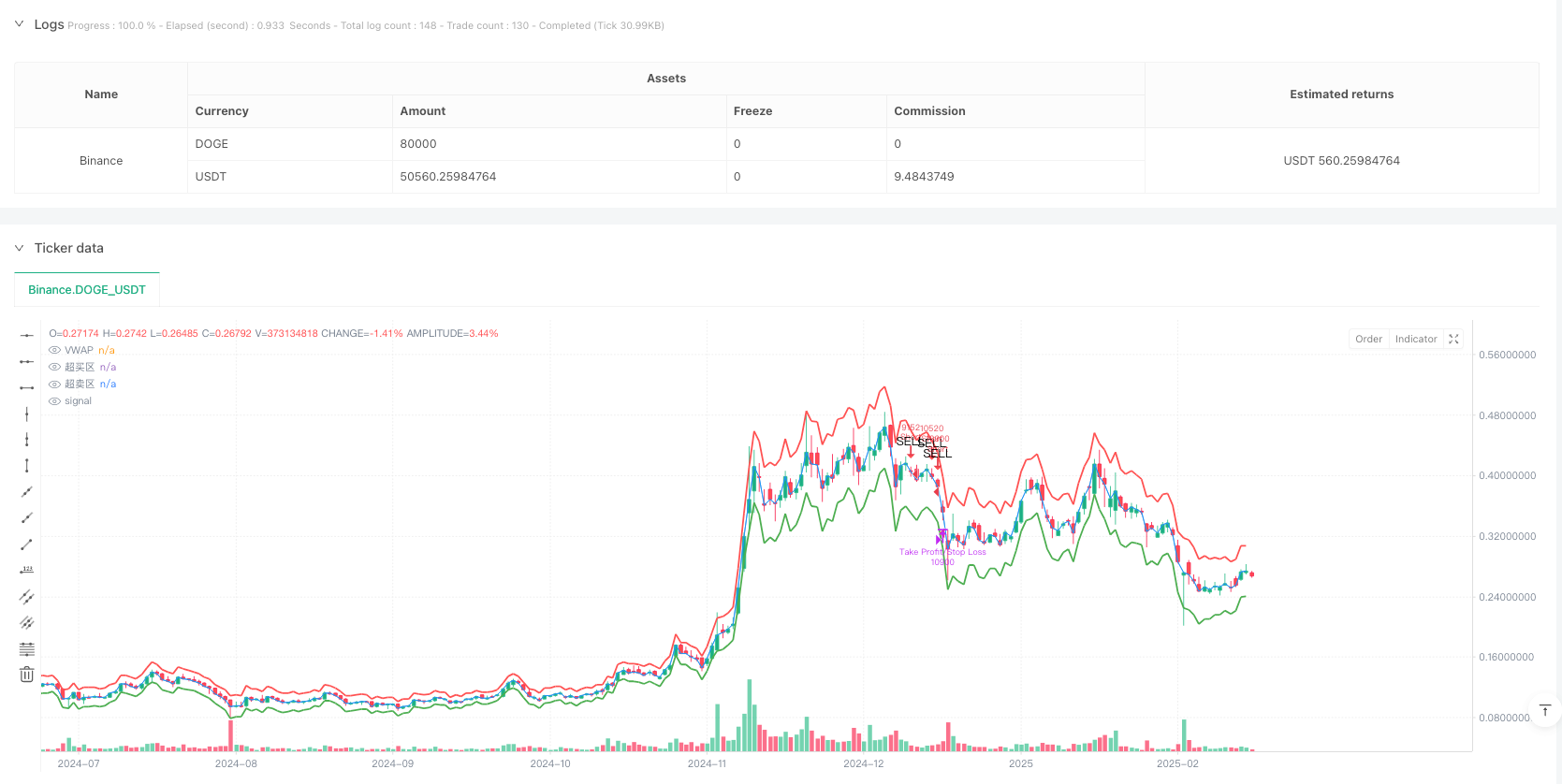

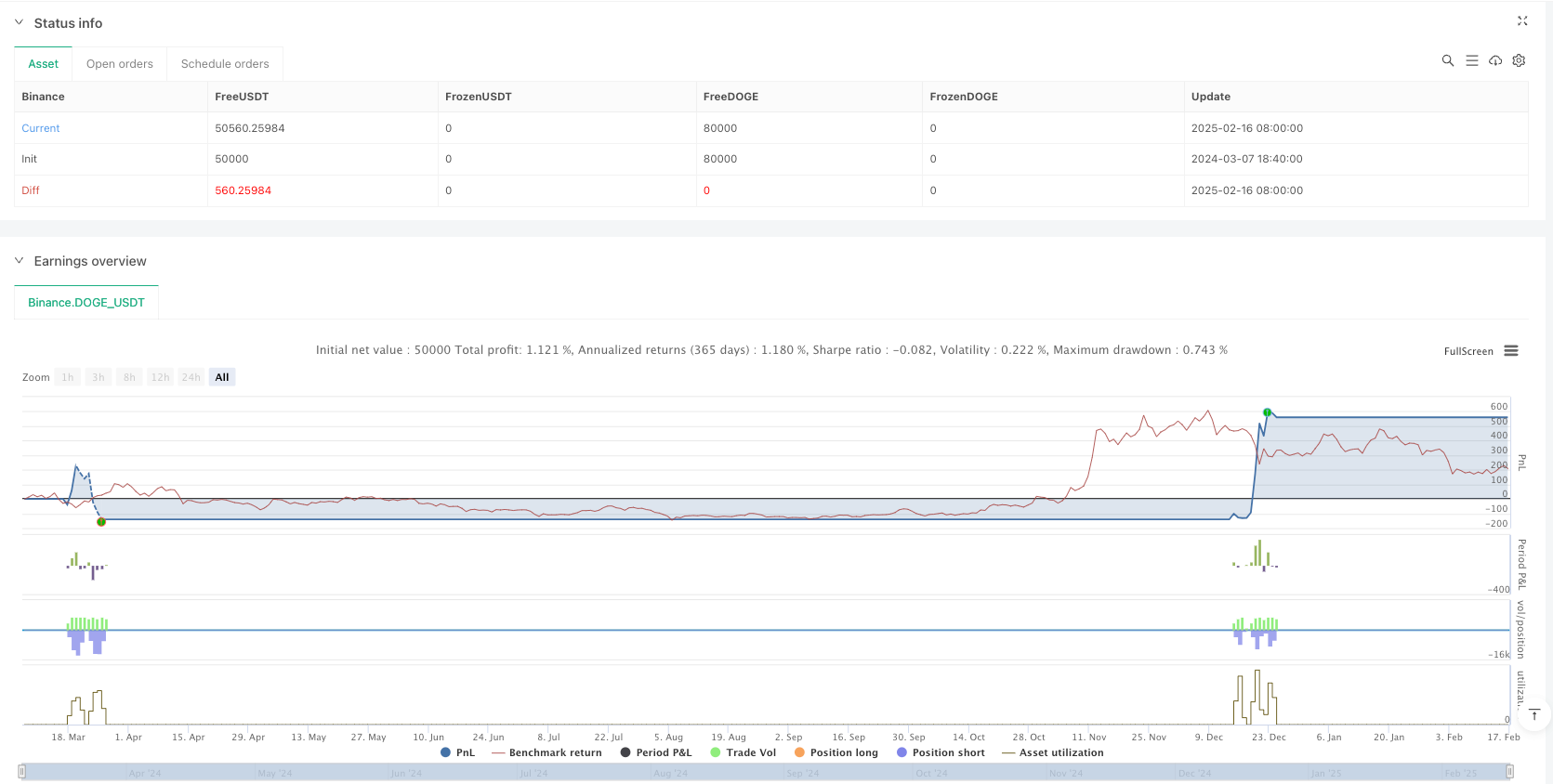

/*backtest

start: 2024-03-07 18:40:00

end: 2025-02-17 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("优化后策略框架", overlay=true)

// 输入参数

ema_length = input.int(20, title="EMA周期")

adx_length = input.int(14, title="ADX周期")

rsi_length = input.int(21, title="RSI周期")

atr_length = input.int(14, title="ATR周期")

volume_length = input.int(20, title="成交量均值周期")

fibonacci_level = 1.618 // 斐波那契扩展位161.8%

// 计算技术指标

ema = ta.ema(close, ema_length)

// 使用ta.dmi()来获取+DI, -DI 和 ADX

[dm_plus, dm_minus, adx] = ta.dmi(adx_length, adx_length)

// 计算RSI和ATR

rsi = ta.rsi(close, rsi_length)

atr = ta.atr(atr_length)

vwap = ta.vwap(close)

avg_volume = ta.sma(volume, volume_length)

// 定义趋势

bull_trend = close > ema and adx > 25

bear_trend = close < ema and adx > 25

range_market = adx < 25

// VWAP分层定位

upper_bound = vwap + 1.5 * atr

lower_bound = vwap - 1.5 * atr

// 计算4小时图的信号

four_hour_ema = request.security(syminfo.tickerid, "240", ta.ema(close, ema_length))

four_hour_vwap = request.security(syminfo.tickerid, "240", ta.vwap(close))

four_hour_rsi = request.security(syminfo.tickerid, "240", ta.rsi(close, rsi_length))

four_hour_volume = request.security(syminfo.tickerid, "240", ta.sma(volume, volume_length))

// 多头入场条件

long_condition = bull_trend and (close[1] < four_hour_ema or close[1] < four_hour_vwap) and rsi[1] < 45 and rsi[0] > 40 and volume < avg_volume * 0.7

// 空头入场条件

short_condition = bear_trend and (close[1] > four_hour_ema or close[1] > four_hour_vwap) and rsi[1] > 55 and rsi[0] < 60 and volume < avg_volume * 0.8

// 计算止损和止盈

long_stop = close - 1.5 * atr

short_stop = close + 1.5 * atr

long_target = vwap + atr // 第一目标,VWAP+1×ATR

short_target = vwap - atr // 第一目标,VWAP-1×ATR

fibonacci_target = close + (fibonacci_level * (high - low)) // 斐波那契161.8%目标

// 计算头寸规模(仓位控制)

risk_per_trade = 0.01 // 单笔风险为账户净值的1%

account_balance = strategy.equity

position_size = (account_balance * risk_per_trade) / (1.5 * atr)

// 绘制买卖信号

plotshape(series=long_condition, title="多头入场", location=location.belowbar, color=color.green, style=shape.triangleup, text="BUY")

plotshape(series=short_condition, title="空头入场", location=location.abovebar, color=color.red, style=shape.triangledown, text="SELL")

// 执行策略

if (long_condition)

strategy.entry("Long", strategy.long, qty=position_size)

if (short_condition)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Long", stop=long_stop, limit=long_target)

strategy.exit("Take Profit/Stop Loss", "Long", stop=long_stop, limit=fibonacci_target)

strategy.exit("Take Profit/Stop Loss", "Short", stop=short_stop, limit=short_target)

strategy.exit("Take Profit/Stop Loss", "Short", stop=short_stop, limit=fibonacci_target)

// 绘制VWAP和超买超卖区

plot(vwap, title="VWAP", color=color.blue)

plot(upper_bound, title="超买区", color=color.red, linewidth=2, style=plot.style_line)

plot(lower_bound, title="超卖区", color=color.green, linewidth=2, style=plot.style_line)