Overview

This strategy is a trend-following trading system that combines Exponential Moving Averages (EMA) with a stop-loss mechanism based on the Average True Range (ATR). The strategy uses 9-period and 21-period EMAs to identify market trends while utilizing ATR to dynamically adjust stop-loss positions, achieving an organic combination of trend following and risk control.

Strategy Principle

The core logic of the strategy consists of two main components: trend determination and risk control. For trend determination, market trends are identified by monitoring the crossover between the fast EMA (9-period) and slow EMA (21-period). A long signal is triggered when the fast line crosses above the slow line, and a short signal is triggered when the fast line crosses below the slow line. For risk control, the strategy uses the ATR indicator to calculate dynamic stop-loss positions. Specifically, the stop-loss point for long positions is set at the entry price minus 1.5 times the ATR value, while the stop-loss point for short positions is set at the entry price plus 1.5 times the ATR value.

Strategy Advantages

- High trend identification accuracy: By using two EMAs with different periods, the strategy effectively filters market noise and improves trend judgment accuracy.

- Flexible risk control: The ATR-based dynamic stop-loss mechanism can adaptively adjust according to market volatility, providing wider stop-loss space during increased volatility and tighter stops during reduced volatility.

- Strong parameter adaptability: Key parameters (EMA periods, ATR period, ATR multiplier) can be optimized for different market characteristics and trading timeframes.

- Simple and understandable implementation: The strategy logic is clear, and the code structure is concise, making it easy to understand and maintain.

Strategy Risks

- Sideways market risk: In ranging markets, frequent EMA crossover signals may lead to overtrading and consecutive stop-losses.

- Lag risk: EMAs inherently have some lag, which may result in delayed reactions to rapid market reversals.

- Stop-loss setting risk: The choice of ATR multiplier requires balancing between stop-loss space and profit opportunity; improper settings may lead to premature stops or excessive risk exposure.

Strategy Optimization Directions

- Introduce trend strength confirmation: Add trend strength indicators (such as ADX) as trading filters to enter only during clear trends.

- Dynamic adjustment of ATR multiplier: Automatically adjust the ATR multiplier based on market volatility cycles to improve stop-loss adaptability.

- Add profit targets: Set dynamic profit targets based on ATR to achieve dynamic risk-reward ratio management.

- Include volume confirmation: Add volume analysis for entry signal confirmation to improve trading signal reliability.

Summary

This strategy builds a complete trend-following trading system by combining EMA crossover trend determination with ATR dynamic stop-loss. The strategy’s strengths lie in its objective judgment criteria and flexible risk control, but attention must be paid to sideways market risks and signal lag issues. There is significant room for improvement through adding trend strength confirmation, optimizing stop-loss settings, and other enhancements. Overall, this is a trend-following strategy with solid foundations and clear logic, suitable as a basis for building more complex trading systems.

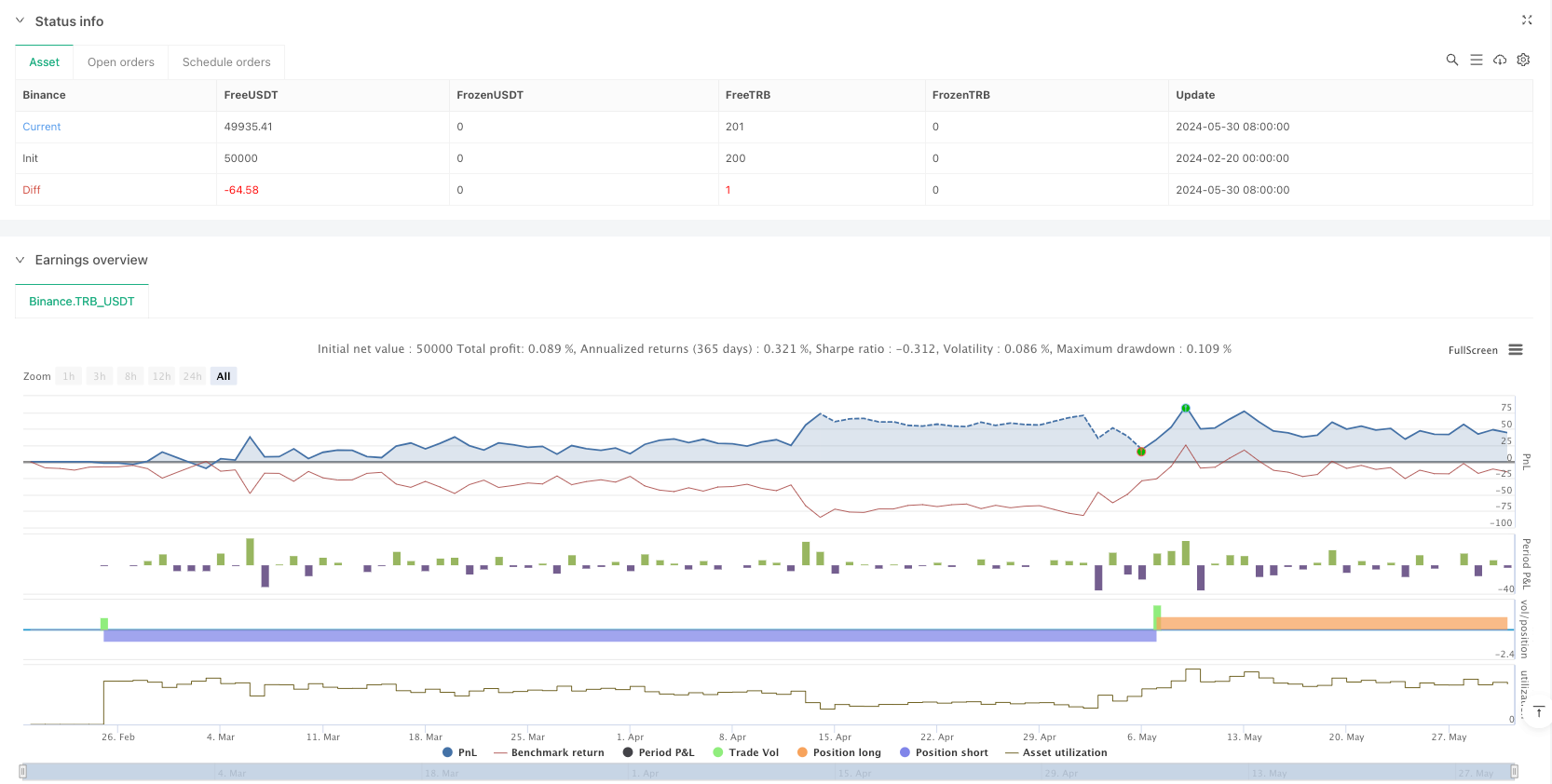

/*backtest

start: 2024-02-20 00:00:00

end: 2024-05-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

strategy("EMA 9/21 + ATR SL Strategy", shorttitle="EMA+ATR", overlay=true)

// ===== Input Parameters ===== //

emaFastLen = input.int(9, "Fast EMA")

emaSlowLen = input.int(21, "Slow EMA")

atrLen = input.int(14, "ATR Length")

atrMult = input.float(1.5, "ATR Multiplier")

// ===== EMA Calculation ===== //

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

// ===== ATR Calculation ===== //

atrValue = ta.atr(atrLen)

// ===== Conditions for Entry ===== //

longCondition = ta.crossover(emaFast, emaSlow) // Long when 9 EMA crosses above 21 EMA

shortCondition = ta.crossunder(emaFast, emaSlow) // Short when 9 EMA crosses below 21 EMA

// ===== Entry Commands ===== //

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// ===== Set Stop-Loss Using ATR ===== //

//

// For LONG: stop-loss = entry price - (atrMult * ATR)

// For SHORT: stop-loss = entry price + (atrMult * ATR)

//

// Note: You can adjust the atrMult values based on market volatility

//

if strategy.position_size > 0

// If holding LONG, define stop-loss below the entry price

strategy.exit("Exit Long", "Long", stop = strategy.position_avg_price - atrMult * atrValue)

if strategy.position_size < 0

// If holding SHORT, define stop-loss above the entry price

strategy.exit("Exit Short", "Short", stop = strategy.position_avg_price + atrMult * atrValue)