Overview

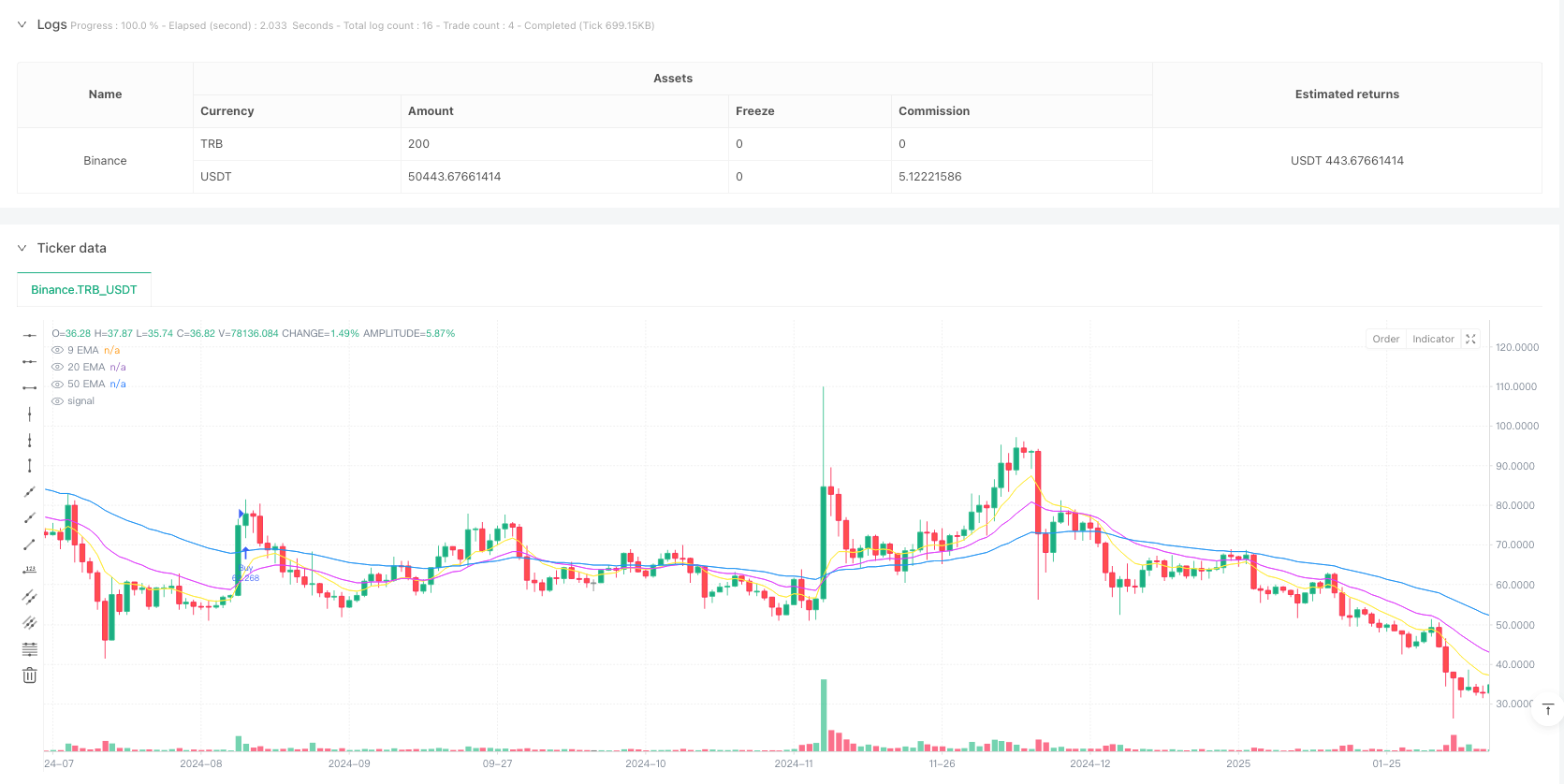

This is a cryptocurrency trading strategy based on a multiple EMA trend following system, incorporating RSI and ATR indicators for trade filtering and risk management. The strategy focuses on major cryptocurrencies, implementing daily trade frequency limits and dynamic stop-loss/take-profit levels for risk control. It uses three exponential moving averages (9, 20, and 50 periods) to determine trend direction, with Relative Strength Index (RSI) and Average True Range (ATR) as supplementary indicators for trade filtering.

Strategy Principles

The core trading logic includes the following key components: 1. Trend Determination: Uses three EMAs (9/20/50) for trend direction identification, with bullish trends confirmed when the short-term EMA crosses above the medium-term EMA and price is above the long-term EMA; bearish trends are confirmed by the opposite conditions. 2. Trade Filtering: Employs RSI(14) for overbought/oversold filtering, requiring RSI between 45-70 for buy signals and 30-55 for sell signals. 3. Trend Strength Confirmation: Requires price distance from 50-period EMA to exceed 1.1 times ATR to ensure sufficient trend strength. 4. Risk Management: Sets stop-loss at 2.5-3.2 times ATR and take-profit at 3.5-5.0 times ATR, customized for different cryptocurrencies. 5. Trade Frequency Control: Limits trading to one trade per day maximum to prevent overtrading.

Strategy Advantages

- Dynamic Risk Management: Adjusts stop-loss and take-profit levels dynamically using ATR to adapt to high cryptocurrency market volatility.

- Differentiated Handling: Sets different risk parameters for different cryptocurrencies.

- Multiple Filtering Mechanisms: Combines trend, momentum, and volatility indicators to improve trade quality.

- Trade Frequency Limitation: Reduces overtrading risk through daily trade limits, particularly suitable for volatile crypto markets.

- Rational Money Management: Calculates trade size dynamically based on account size and risk level to protect capital.

Strategy Risks

- Trend Reversal Risk: May incur significant losses during violent cryptocurrency market movements.

- Slippage Risk: May face substantial slippage during low liquidity periods.

- Trading Opportunity Limitation: Daily trade limits may cause missed opportunities in fast-moving markets.

- Parameter Sensitivity: Strategy performance depends on multiple indicator parameters requiring periodic optimization.

- Market Environment Dependency: Performs well in trending markets but may generate false signals in ranging markets.

Strategy Optimization Directions

- Incorporate Market Cycle Analysis: Dynamically adjust parameters based on different cryptocurrency market cycles.

- Optimize Time-Based Filtering: Add filters based on major global trading sessions.

- Enhance Exit Mechanisms: Add trailing stops or dynamic exits based on market sentiment.

- Improve Position Sizing: Dynamically adjust trade size based on market volatility.

- Include Market Sentiment Indicators: Incorporate on-chain data or social media sentiment indicators for enhanced filtering.

Summary

The strategy achieves a relatively robust cryptocurrency trading system through the comprehensive use of multiple technical indicators. It balances returns and risks well through differentiated risk parameters and strict trade frequency control. The core advantages lie in its dynamic risk management mechanism and comprehensive filtering system, while attention must be paid to the unique high volatility and liquidity risks of cryptocurrency markets. Through continuous optimization and improvement, the strategy has the potential to maintain stable performance across different market environments.

/*backtest

start: 2015-02-22 00:00:00

end: 2025-02-18 17:23:25

period: 1h

basePeriod: 1h

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © buffalobillcody

//@version=6

strategy("Backtest Last 2880 Baars Filers and Exits", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2, backtest_fill_limits_assumption=0)

// Define EMAs

shortEMA = ta.ema(close, 9)

longEMA = ta.ema(close, 20)

refEMA = ta.ema(close, 50)

// **Force Strategy to Trade on Historical Bars**

barLimit = bar_index > 10 // Allow trading on past bars

allowTrade = strategy.opentrades == 0 or barLimit // Enable first trade on history

// **Define ATR for Stop-Loss & Take-Profit**

atrLength = 14

atrValue = ta.atr(atrLength)

atr50 = ta.sma(atrValue, 50) // 50-period ATR average

// **Relaxed RSI Filters (More Trades Allowed)**

rsi = ta.rsi(close, 14)

rsiFilterBuy = rsi > 45 and rsi < 70

rsiFilterSell = rsi < 55 and rsi > 30

// **Reduce Trend Filter - Allow Smaller Price Movement**

minDistance = atrValue * 1.1

isTrending = math.abs(close - refEMA) > minDistance

// **Allow Trading in All Conditions (No ATR Filter)**

atrFilter = true

// **Allow Flat EMA Slopes - Increase Trade Frequency**

emaSlope = ta.linreg(refEMA, 5, 0) > -0.2

emaSlopeSell = ta.linreg(refEMA, 5, 0) < 0.2

// **Trade Counter: Allow 1 Trade Per Day**

var int dailyTradeCount = 0

if dayofweek != dayofweek[1]

dailyTradeCount := 0

// **ATR-Based Stop-Loss & Take-Profit Per Pair**

atrSL = switch syminfo.ticker

"EURUSD" => 3.0 * atrValue,

"USDJPY" => 2.5 * atrValue,

"GBPUSD" => 3.0 * atrValue,

"AUDUSD" => 3.2 * atrValue,

"GBPJPY" => 3.0 * atrValue,

=> 2.5 * atrValue

atrTP = switch syminfo.ticker

"EURUSD" => 3.8 * atrValue,

"USDJPY" => 3.5 * atrValue,

"GBPUSD" => 4.0 * atrValue,

"AUDUSD" => 4.0 * atrValue,

"GBPJPY" => 5.0 * atrValue,

=> 3.5 * atrValue

// **Ensure Trade Size is Not Zero**

riskPerTrade = 2

accountSize = strategy.equity

tradeSize = (accountSize * (riskPerTrade / 100)) / atrSL

tradeSize := tradeSize < 1 ? 1 : tradeSize // Minimum lot size of 1

// **Buy/Sell Conditions (Now More Trades Will Trigger)**

buyCondition = ta.crossover(shortEMA, longEMA) and rsiFilterBuy and close > refEMA and close > longEMA and isTrending and emaSlope and allowTrade and dailyTradeCount < 1

sellCondition = ta.crossunder(shortEMA, longEMA) and rsiFilterSell and close < refEMA and close < longEMA and isTrending and emaSlopeSell and allowTrade and dailyTradeCount < 1

// **Execute Trades**

if buyCondition

strategy.entry("Buy", strategy.long, qty=tradeSize)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", limit=close + atrTP, stop=close - atrSL)

label.new(x=bar_index, y=low, text="BUY", color=color.green, textcolor=color.white, size=size.small, style=label.style_label_down)

alert("BUY", alert.freq_once_per_bar_close)

dailyTradeCount := dailyTradeCount + 1

if sellCondition

strategy.entry("Sell", strategy.short, qty=tradeSize)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", limit=close - atrTP, stop=close + atrSL)

label.new(x=bar_index, y=high, text="SELL", color=color.red, textcolor=color.white, size=size.small, style=label.style_label_up)

alert("SELL", alert.freq_once_per_bar_close)

dailyTradeCount := dailyTradeCount + 1

// **Plot Indicators**

plot(shortEMA, color=color.yellow, title="9 EMA")

plot(longEMA, color=color.fuchsia, title="20 EMA")

plot(refEMA, color=color.blue, title="50 EMA")