Overview

This strategy is a trading system based on VWAP (Volume-Weighted Average Price) and standard deviation channels, which identifies reversal patterns at channel boundaries for trade execution. The strategy combines momentum and mean reversion trading concepts, capturing opportunities when prices break through key technical levels.

Strategy Principles

The core of the strategy uses VWAP as a price pivot, constructing upper and lower channels using 20-period standard deviation. It looks for long opportunities near the lower band and short opportunities near the upper band. Specifically: - Long entry: Price forms a bullish reversal pattern near the lower band, then breaks above the previous bullish candle’s high - Short entry: Price forms a bearish pattern near the upper band, then breaks below the previous bearish candle’s low - Take profit: VWAP and upper band for longs, lower band for shorts - Stop loss: Below the reversal bullish candle for longs, above the reversal bearish candle for shorts

Strategy Advantages

- Combines benefits of trend-following and reversal trading, capturing both trend continuation and reversal opportunities

- Uses VWAP as core indicator, better reflecting true market supply and demand

- Implements staged profit-taking, realizing gains at different price levels

- Reasonable stop-loss settings for effective risk control

- Clear strategy logic with simple parameter settings, easy to understand and execute

Strategy Risks

- May trigger frequent stop losses in highly volatile markets

- Can generate excessive false signals during consolidation phases

- Sensitive to VWAP calculation timeframe

- Standard deviation channel width may not suit all market conditions

- Might miss some significant trending opportunities

Strategy Optimization Directions

- Introduce volume filters to improve signal quality

- Add trend confirmation indicators, such as moving average systems

- Dynamically adjust standard deviation periods to adapt to different market environments

- Optimize staged profit-taking ratios to enhance overall returns

- Add time filters to avoid trading during unfavorable periods

- Consider adding volatility indicators to optimize position management

Summary

This is a complete trading system combining VWAP, standard deviation channels, and price patterns. The strategy trades by seeking reversal signals at key price levels, managing risk through staged profit-taking and reasonable stop losses. While it has certain limitations, the suggested optimization directions can further enhance the strategy’s stability and profitability. The strategy is suitable for markets with higher volatility and represents a worthy trading system for medium to long-term traders.

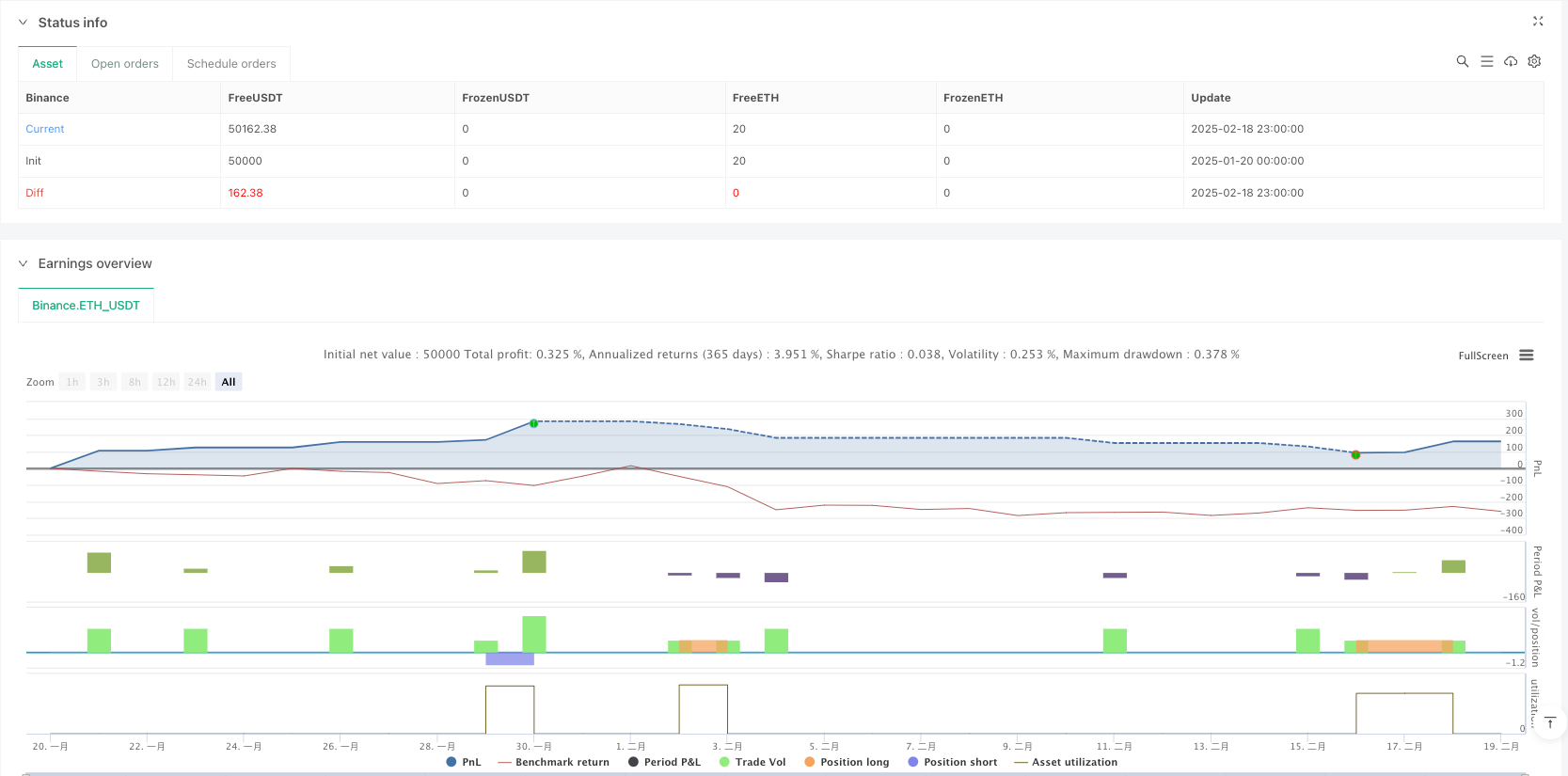

/*backtest

start: 2025-01-20 00:00:00

end: 2025-02-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("VRS Strategy", overlay=true)

// Calculate VWAP

vwapValue = ta.vwap(close)

// Calculate standard deviation for the bands

stdDev = ta.stdev(close, 20) // 20-period standard deviation for bands

upperBand = vwapValue + stdDev

lowerBand = vwapValue - stdDev

// Plot VWAP and its bands

plot(vwapValue, color=color.blue, title="VWAP", linewidth=2)

plot(upperBand, color=color.new(color.green, 0), title="Upper Band", linewidth=2)

plot(lowerBand, color=color.new(color.red, 0), title="Lower Band", linewidth=2)

// Signal Conditions

var float previousGreenCandleHigh = na

var float previousGreenCandleLow = na

var float previousRedCandleLow = na

// Detect bearish candle close below lower band

bearishCloseBelowLower = close[1] < lowerBand and close[1] < open[1]

// Detect bullish reversal candle after a bearish close below lower band

bullishCandle = close > open and low < lowerBand // Ensure it's near the lower band

candleReversalCondition = bearishCloseBelowLower and bullishCandle

if (candleReversalCondition)

previousGreenCandleHigh := high[1] // Capture the high of the previous green candle

previousGreenCandleLow := low[1] // Capture the low of the previous green candle

previousRedCandleLow := na // Reset previous red candle low

// Buy entry condition: next candle breaks the high of the previous green candle

buyEntryCondition = not na(previousGreenCandleHigh) and close > previousGreenCandleHigh

if (buyEntryCondition)

// Set stop loss below the previous green candle

stopLoss = previousGreenCandleLow

risk = close - stopLoss // Calculate risk for position sizing

// Target Levels

target1 = vwapValue // Target 1 is at VWAP

target2 = upperBand // Target 2 is at the upper band

// Ensure we only enter the trade near the lower band

if (close < lowerBand)

strategy.entry("Buy", strategy.long)

// Set exit conditions based on targets

strategy.exit("Take Profit 1", from_entry="Buy", limit=target1)

strategy.exit("Take Profit 2", from_entry="Buy", limit=target2)

strategy.exit("Stop Loss", from_entry="Buy", stop=stopLoss)

// Sell signal condition: Wait for a bearish candle near the upper band

bearishCandle = close < open and high > upperBand // A bearish candle should be formed near the upper band

sellSignalCondition = bearishCandle

if (sellSignalCondition)

previousRedCandleLow := low[1] // Capture the low of the current bearish candle

// Sell entry condition: next candle breaks the low of the previous bearish candle

sellEntryCondition = not na(previousRedCandleLow) and close < previousRedCandleLow

if (sellEntryCondition)

// Set stop loss above the previous bearish candle

stopLossSell = previousRedCandleLow + (high[1] - previousRedCandleLow) // Set stop loss above the bearish candle

targetSell = lowerBand // Target for sell is at the lower band

// Ensure we only enter the trade near the upper band

if (close > upperBand)

strategy.entry("Sell", strategy.short)

// Set exit conditions for sell

strategy.exit("Take Profit Sell", from_entry="Sell", limit=targetSell)

strategy.exit("Stop Loss Sell", from_entry="Sell", stop=stopLossSell)

// Reset previous values when a trade occurs

if (strategy.position_size > 0)

previousGreenCandleHigh := na

previousGreenCandleLow := na

previousRedCandleLow := na