Overview

This strategy is an innovative quantitative trading system that integrates principles from quantum mechanics, statistics, and economics. It constructs a comprehensive market analysis framework by combining Simple Moving Average (SMA), Z-Score statistical analysis, quantum oscillation component, economic momentum indicators, and the Lyapunov stability index. The strategy’s core generates a Composite Outlook Index (COI) through weighted combinations of these multi-dimensional indicators to guide trading decisions.

Strategy Principles

The strategy is built on five main technical pillars: 1. Statistical analysis module uses SMA and standard deviation to calculate Z-Score, evaluating relative price positions. 2. Quantum component transforms Z-Score into an oscillator, simulating quantum state fluctuations through exponential and sine functions. 3. Economic component measures market momentum using the logarithmic ratio of fast and slow EMAs. 4. Lyapunov index assesses market stability by analyzing the combined stability of quantum and economic components. 5. Composite Outlook Index (COI) integrates all components with different weights to form final trading signals.

Strategy Advantages

- Multi-dimensional analysis provides more comprehensive market insights, reducing bias from single indicators.

- Introduction of quantum component brings unique market oscillation perspective, helping capture short-term opportunities.

- Application of Lyapunov index effectively evaluates market stability, enhancing risk management capabilities.

- Adjustable weights design allows strategy adaptation to different market environments.

- Neutral line design in composite index provides clear trading signal boundaries.

Strategy Risks

- Multiple indicators may lead to signal lag, affecting entry timing.

- Parameter optimization may result in overfitting risk.

- Quantum component may generate too frequent signals in high volatility markets.

- Economic component may produce misleading signals in ranging markets.

- Proper stop-loss settings are necessary for risk control.

Strategy Optimization Directions

- Introduce adaptive weight system to dynamically adjust component weights based on market conditions.

- Add volatility filters to adjust signal sensitivity during high volatility periods.

- Integrate market sentiment indicators to provide additional confirmation signals.

- Develop dynamic stop-loss mechanisms to adjust stop-loss levels based on market conditions.

- Add time filters to avoid opening positions during unfavorable trading periods.

Summary

This is an innovative quantitative trading strategy that builds a comprehensive market analysis framework by integrating multi-disciplinary theories. While there are areas for optimization, its multi-dimensional analysis approach provides unique perspectives for trading decisions. Through continuous optimization and risk management improvements, the strategy shows promise for maintaining stable performance across different market environments.

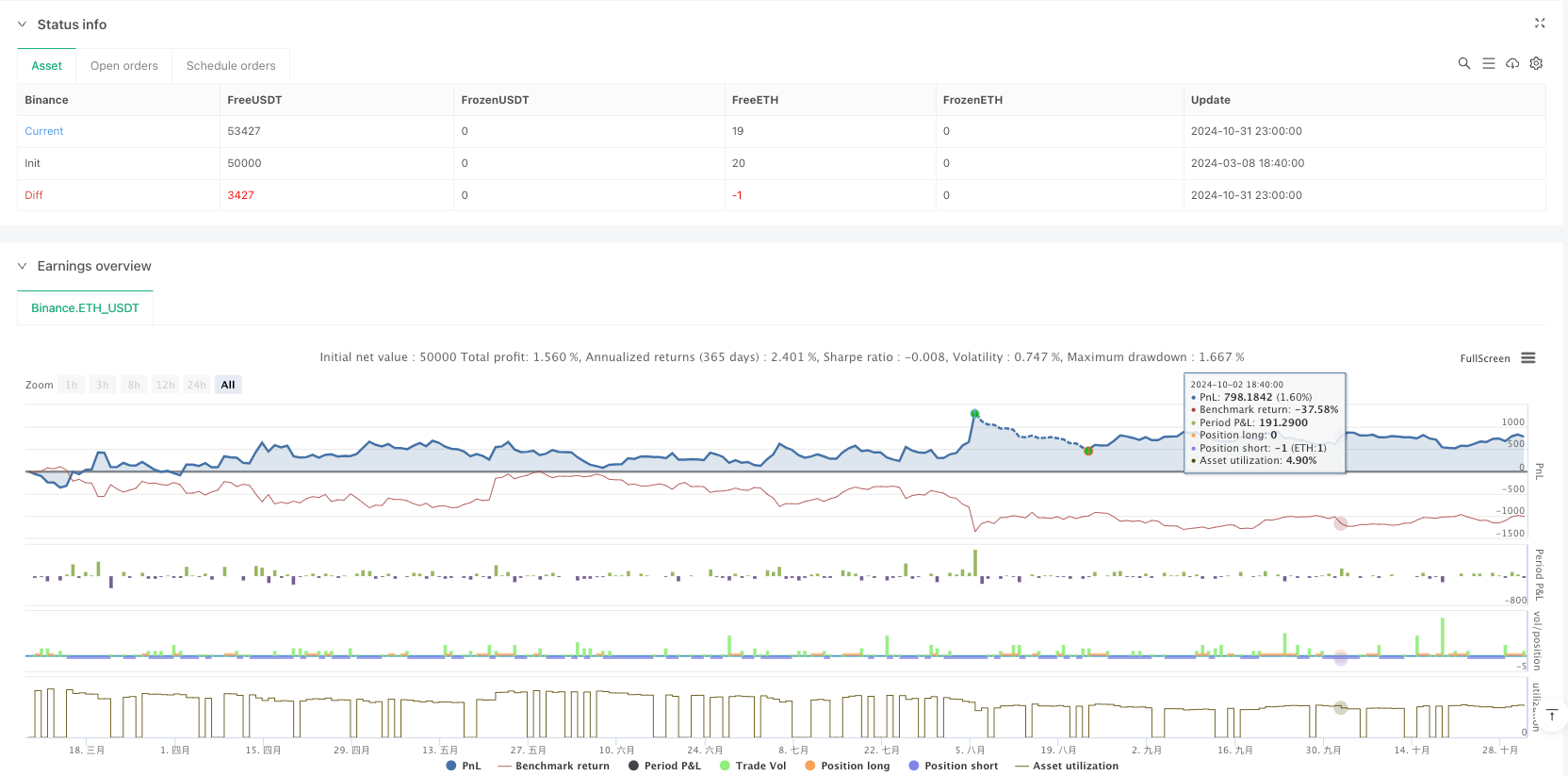

/*backtest

start: 2024-03-08 18:40:00

end: 2024-11-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Quantum-Lukas 2.0

//@version=6

strategy("Quantum Spectral Crypto Trading", shorttitle="QSCT", overlay=true, precision=2)

// ──────────────────────────────────────────────────────────────

// Input Parameters

// ──────────────────────────────────────────────────────────────

smaLength = input.int(50, title="SMA Length (Quantum & Statistical Component)", minval=1)

emaFastLength = input.int(20, title="EMA Fast Length (Economic Component)", minval=1)

emaSlowLength = input.int(50, title="EMA Slow Length (Economic Component)", minval=1)

quantumWeight = input.float(20.0, title="Quantum Component Weight", step=0.1)

economicWeight = input.float(30.0, title="Economic Component Weight", step=0.1)

statisticalWeight = input.float(20.0, title="Statistical Component Weight", step=0.1)

lyapunovWeight = input.float(10.0, title="Lyapunov Stability Weight", step=0.1)

// ──────────────────────────────────────────────────────────────

// Price Averages and Volatility Calculation

// ──────────────────────────────────────────────────────────────

smaPrice = ta.sma(close, smaLength)

stdevPrice = ta.stdev(close, smaLength)

// ──────────────────────────────────────────────────────────────

// Statistical Component: z-score Calculation

// ──────────────────────────────────────────────────────────────

z = (close - smaPrice) / stdevPrice

// ──────────────────────────────────────────────────────────────

// Quantum Component: Inspired by Quantum Mechanics

// ──────────────────────────────────────────────────────────────

quantum_component = math.exp(-0.5 * z * z) * (1 + math.sin((math.pi / 2) * z))

// ──────────────────────────────────────────────────────────────

// Economic Component: EMA Ratio as a Proxy for Market Momentum

// ──────────────────────────────────────────────────────────────

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

economic_component = math.log(emaFast / emaSlow)

// ──────────────────────────────────────────────────────────────

// Lyapunov Exponent for Market Stability (Prevents Log(0) Error)

// ──────────────────────────────────────────────────────────────

lyapunov_index = ta.sma(math.log(math.max(1e-10, math.abs(economic_component + quantum_component))), smaLength)

// ──────────────────────────────────────────────────────────────

// Composite Crypto Outlook Index Calculation (Fixed Indentation)

// ──────────────────────────────────────────────────────────────

crypto_outlook_index =

50 + quantumWeight * (quantum_component - 1) +

economicWeight * economic_component +

statisticalWeight * z +

lyapunovWeight * lyapunov_index

// ──────────────────────────────────────────────────────────────

// Plotting and Visual Enhancements

// ──────────────────────────────────────────────────────────────

// Normalized for better visibility in the BTC/USD chart range

normalized_outlook_index = (crypto_outlook_index - 50) * close / 100

plot(normalized_outlook_index, title="Scaled Crypto Outlook Index", color=color.blue, linewidth=2)

// Debugging: Plot each component separately

plot(quantum_component, title="Quantum Component", color=color.purple, linewidth=1)

plot(economic_component, title="Economic Component", color=color.orange, linewidth=1)

plot(z, title="Statistical Component (Z-Score)", color=color.yellow, linewidth=1)

plot(lyapunov_index, title="Lyapunov Stability Index", color=color.aqua, linewidth=1)

hline(50, title="Neutral Level", color=color.gray)

hline(70, title="Bullish Threshold", color=color.green, linestyle=hline.style_dotted)

hline(30, title="Bearish Threshold", color=color.red, linestyle=hline.style_dotted)

// Background color for bullish/bearish conditions

bgcolor(crypto_outlook_index > 50 ? color.new(color.green, 90) : color.new(color.red, 90), title="Outlook Background")

// ──────────────────────────────────────────────────────────────

// Trading Strategy: Entry and Exit Conditions (Fixed Errors)

// ──────────────────────────────────────────────────────────────

// Define entry conditions

longCondition = crypto_outlook_index > 70

shortCondition = crypto_outlook_index < 30

// Execute long entry

if (longCondition)

strategy.entry("Long", strategy.long)

// Execute short entry

if (shortCondition)

strategy.entry("Short", strategy.short)

// Define exit conditions (Added Stop Losses)

if (crypto_outlook_index < 50)

strategy.exit("Exit Long", from_entry="Long", stop=low)

if (crypto_outlook_index > 50)

strategy.exit("Exit Short", from_entry="Short", stop=high)