5 EMA Instant Divergence Breakout Trading Strategy

EMA DIVERGENCE ALERTS

Overview

This strategy is a trading system based on the 5-day Exponential Moving Average (EMA), which identifies divergence patterns between price and the moving average and combines breakout signals for trading. The strategy employs instant execution without waiting for candle closure, enhancing trading timeliness. The system also incorporates a dynamic stop-loss and take-profit mechanism with a 3:1 risk-reward ratio.

Strategy Principles

The core logic is built on several key elements: 1. Uses a short-period 5-day EMA as the main trend reference line 2. Identifies divergence patterns by monitoring whether candles are completely above or below the EMA 3. Triggers long signals when price breaks above the high of divergence candles 4. Triggers short signals when price breaks below the low of divergence candles 5. Sets stop-loss and take-profit levels based on the divergence candle’s range with a 3:1 risk-reward ratio

Strategy Advantages

- Quick Response: Instant execution mechanism eliminates the need for candle closure confirmation

- Robust Risk Management: Integrates dynamic stop-loss and take-profit based on actual market volatility

- Clear Signals: Combination of divergence and breakout confirmation reduces false signals

- High Adaptability: 5-day EMA responds sensitively to market changes

- Simple Operation: Trading rules are clear and easy to understand and execute

Strategy Risks

- Choppy Market Risk: May generate frequent false signals in sideways markets

- Slippage Risk: Instant execution may face significant slippage during high volatility

- Overtrading Risk: Short-period EMA may lead to excessive trading

- Trend Reversal Risk: May experience large drawdowns during strong trend reversals Risk management recommendations:

- Incorporate longer-period trend indicators for trade filtering

- Set daily maximum trade limits

- Adjust stop-loss range during high volatility periods

- Regular backtesting and parameter optimization

Optimization Directions

- Add Trend Filter: Introduce longer-period trend indicators like 20 or 50-day moving averages

- Enhance Divergence Identification: Consider adding RSI or MACD divergence as confirmation signals

- Dynamic Parameter Adjustment: Automatically adjust EMA period and risk-reward ratio based on volatility

- Add Time Filters: Avoid trading during high-volatility periods like market open and close

- Improve Stop-Loss Mechanism: Add trailing stops to better protect profits

Summary

This is a comprehensive trading strategy combining short-term moving average, divergence patterns, and breakout signals. The instant execution mechanism improves strategy timeliness while employing dynamic risk management methods. Despite potential risks, the strategy holds practical value through appropriate optimization and risk management measures. Traders are advised to conduct thorough backtesting before live trading and adjust parameters according to specific market conditions.

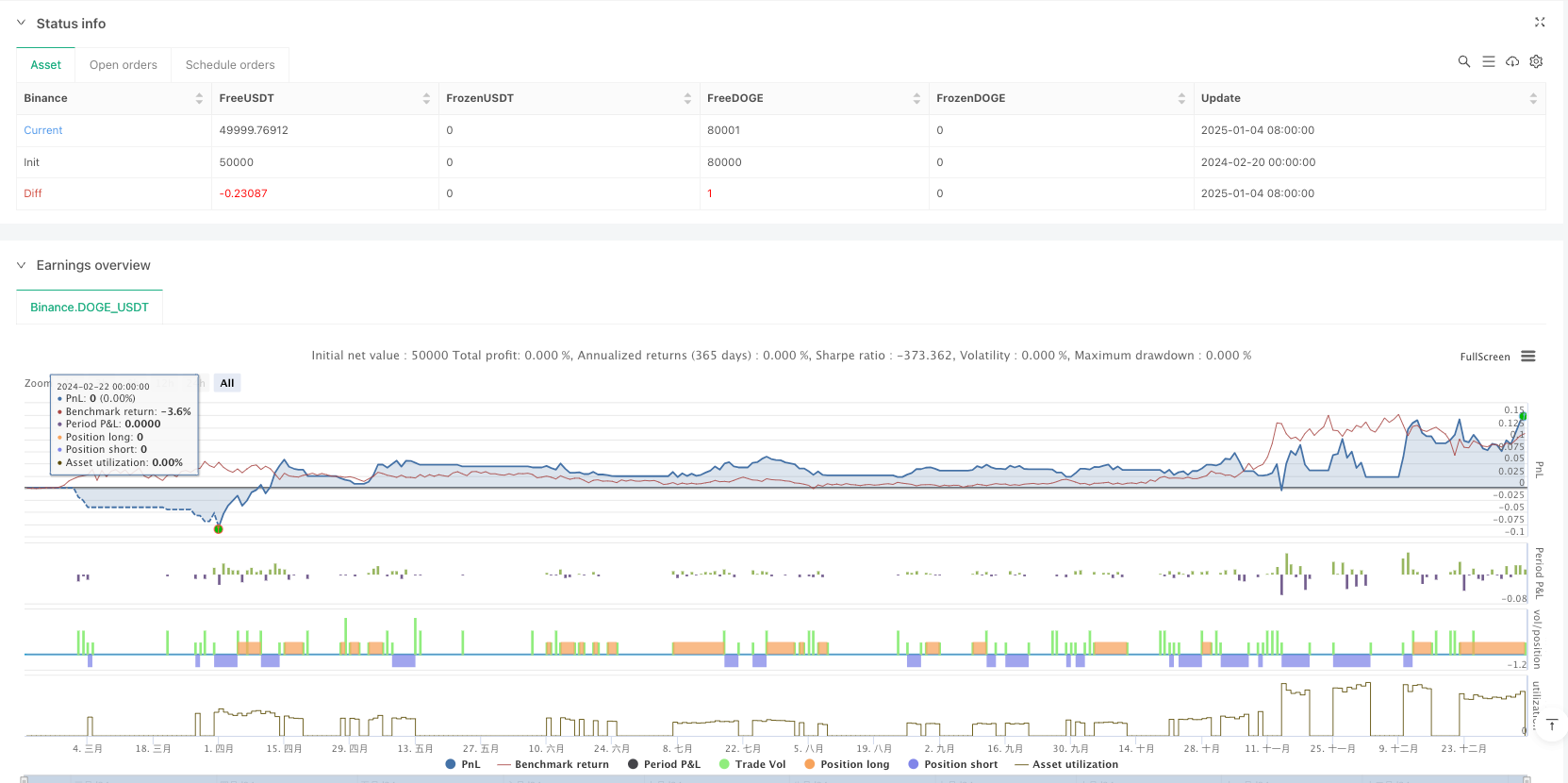

/*backtest

start: 2024-02-20 00:00:00

end: 2025-01-05 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("5 EMA (Instant Execution)", overlay=true, margin_long=100, margin_short=100)

// Input parameters

ema_length = input.int(5)

target_multiplier = input.float(3.0)

// Calculate 5 EMA

ema_5 = ta.ema(close, ema_length)

// Detect divergence candles

divergence_buy = (high < ema_5) and (low < ema_5) // Below 5 EMA for buy

divergence_sell = (high > ema_5) and (low > ema_5) // Above 5 EMA for sell

// Store trigger levels dynamically

var float trigger_high = na

var float trigger_low = na

// Set trigger levels when divergence occurs

if divergence_buy

trigger_high := high

if divergence_sell

trigger_low := low

// Check real-time price break (no candle close waiting)

buy_signal = not na(trigger_high) and high >= trigger_high

sell_signal = not na(trigger_low) and low <= trigger_low

// Execute trades instantly

if buy_signal

strategy.entry("Long", strategy.long)

candle_size = trigger_high - low

strategy.exit("Long Exit", "Long", limit=trigger_high + (candle_size * target_multiplier), stop=low)

trigger_high := na // Reset trigger

if sell_signal

strategy.entry("Short", strategy.short)

candle_size = high - trigger_low

strategy.exit("Short Exit", "Short", limit=trigger_low - (candle_size * target_multiplier), stop=high)

trigger_low := na // Reset trigger

// Plot signals

plotshape(buy_signal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sell_signal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Plot 5 EMA

plot(ema_5, color=color.blue, linewidth=2)

// Alert conditions

alertcondition(buy_signal, message="BUY triggered - High of divergence candle broken instantly")

alertcondition(sell_signal, message="SELL triggered - Low of divergence candle broken instantly")